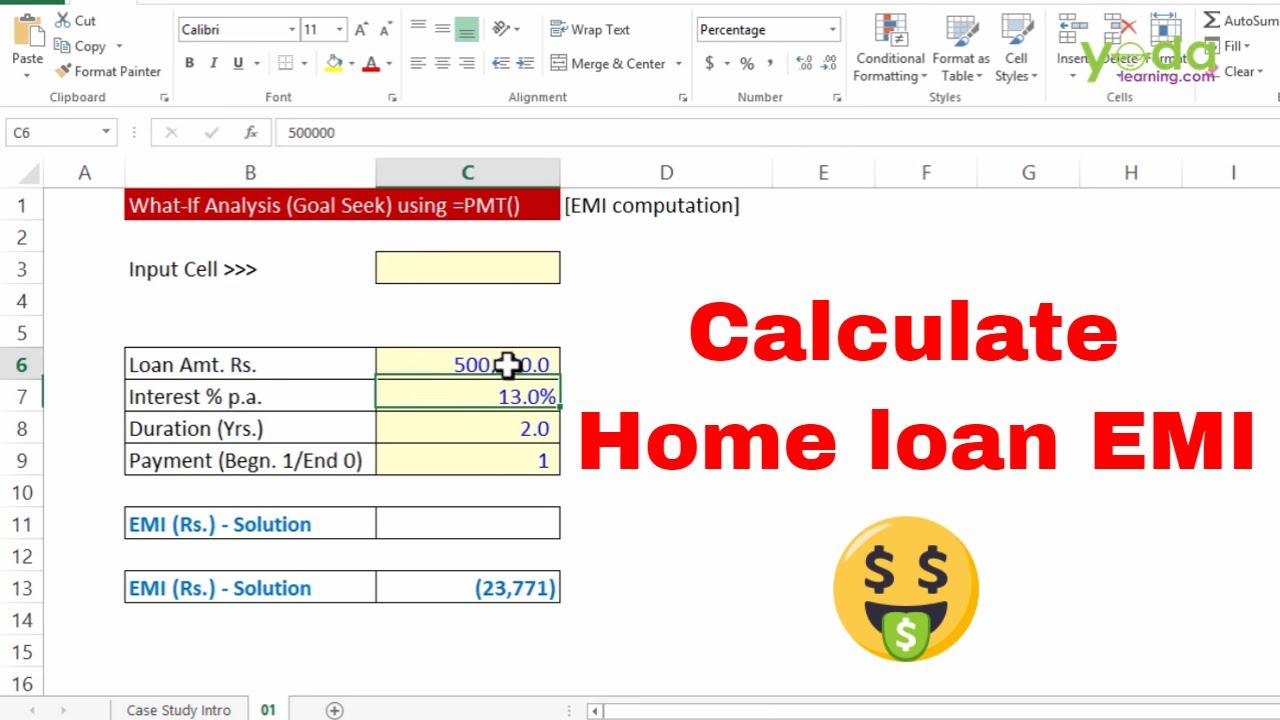

Housing Loan Interest Tax Exemption India Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C Section 80EEA Tax deduction against home loan interest paid Income tax rebate on home loan Budget 2021 Extension of safe harbour limit to benefit buyers inventory hit builders

Housing Loan Interest Tax Exemption India

Housing Loan Interest Tax Exemption India

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

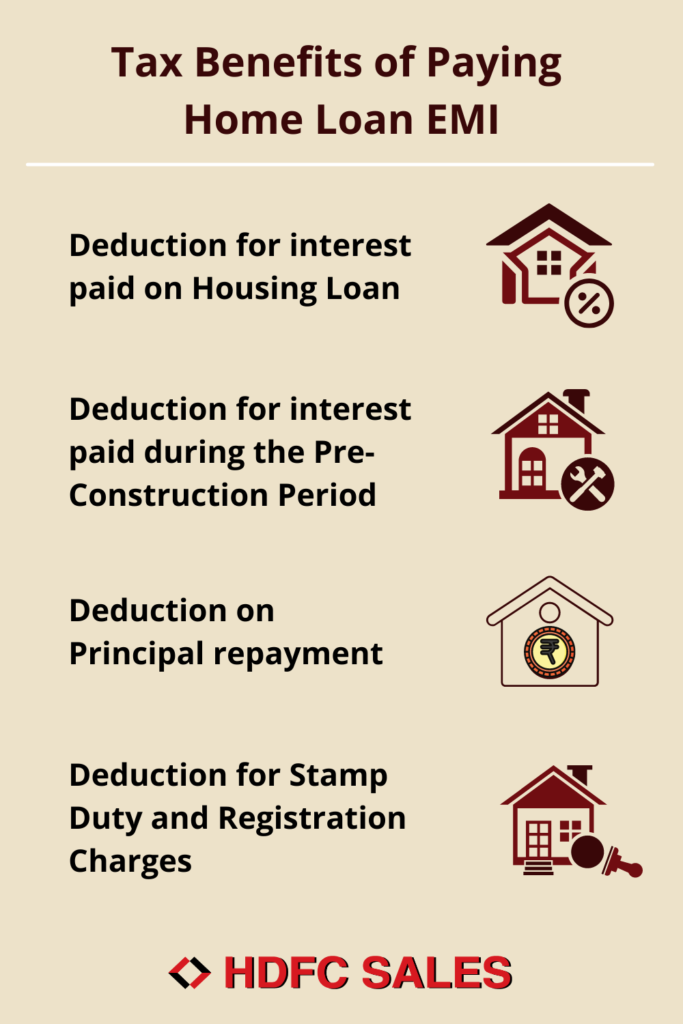

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

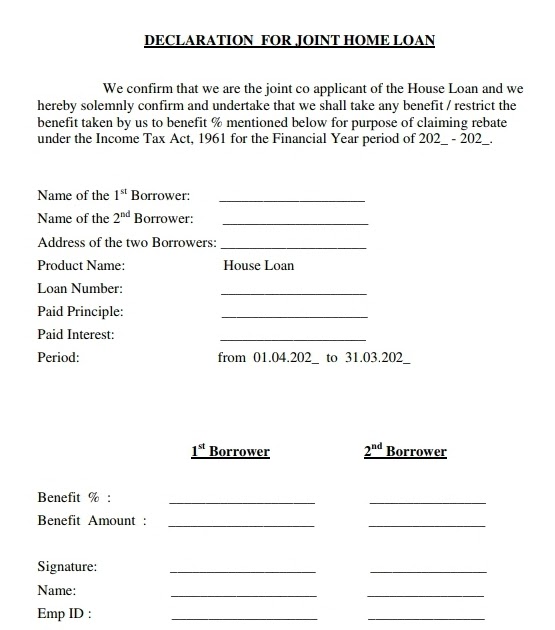

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

No housing loan interest is not entirely tax exempt in India However the Indian tax code offers deductions for a portion of the interest you pay on your home Check out the Home Loan tax benefits under Sections 24 b 80EE and 80C to save tax on your Home Loan Learn how much tax exemption you can claim on a housing loan

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing finance company You can claim a deduction of Section 80EE of the Income Tax Act introduced in the Financial Year 2013 14 offers an additional deduction on interest payments made towards home loans This

Download Housing Loan Interest Tax Exemption India

More picture related to Housing Loan Interest Tax Exemption India

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

https://www.taxontips.com/wp-content/uploads/2020/04/interest-on-housing-loan.jpg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest Individuals who apply for a home loan can receive home loan tax benefits under several sections such as Section 80 EEA and Section 24b of the Income Tax Act

A home loan can help you claim an 80C deduction of up to 1 5 lakh a 80EE deduction of 50 000 and a 24 b deduction of 2 lakh making a total taxable value deduction of up There s no upper cap for claiming tax exemption on interest for a property let out on rent This implies that the entire interest paid on your home loan can be

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

https://www.realestate-tokyo.com/media/15205/housing-loan-tax-exemption.jpg

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The

https://www.hdfc.com/.../home-loan-tax-be…

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C

Housing Loan 0363675100002233 Provisional Certificate 2017 18 PDF PDF

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Joint Home Loan Declaration Form For Income Tax Savings And Non

How To Calculate Interest On Housing Loan For Income Tax Haiper

Home Loan Interest Rates Compare Rates Of Top Banks Loanfasttrack

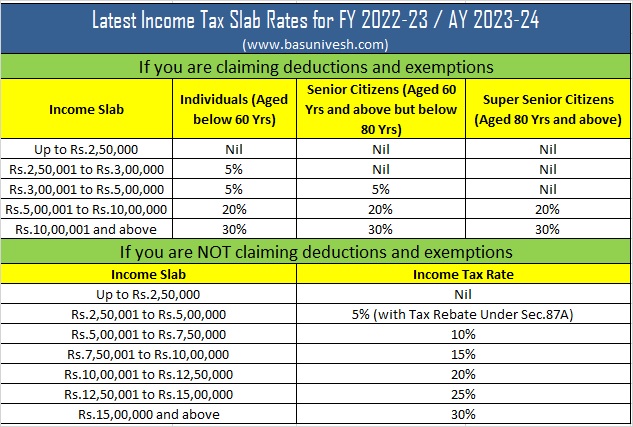

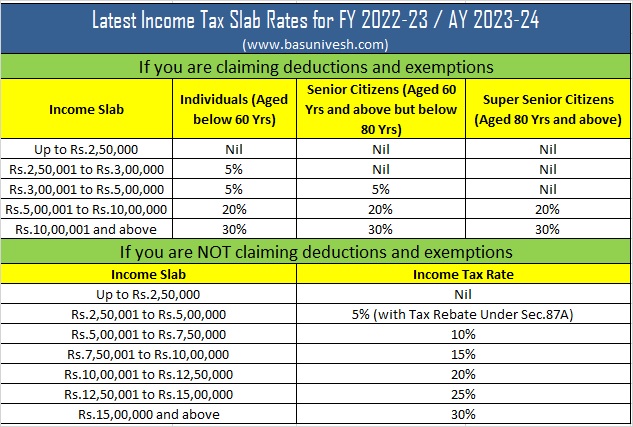

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Housing Loan Interest Tax Deduction Clarification In Telugu Section 80EE

Corporate Tax Exemption For Companies And Startup India In Budget 2020

Housing Loan Interest Tax Exemption India - Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs