How Do Energy Efficient Tax Credits Work Residential Clean Energy Tax Credit The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 Getty In the U S several tax credits are designed to make boosting energy efficiency more attractive to homeowners developers manufacturers and various types of business owners Some of these

How Do Energy Efficient Tax Credits Work

How Do Energy Efficient Tax Credits Work

https://www.ny-engineers.com/hs-fs/hubfs/tax credit.jpg?width=750&name=tax credit.jpg

Revised Procedures Efficiency Tax Credits Accredited Software Tools

https://www.resnet.us/wp-content/uploads/RESNET_Pub_001-2020_rev_07-27-20-pdf-791x1024-cover.jpg

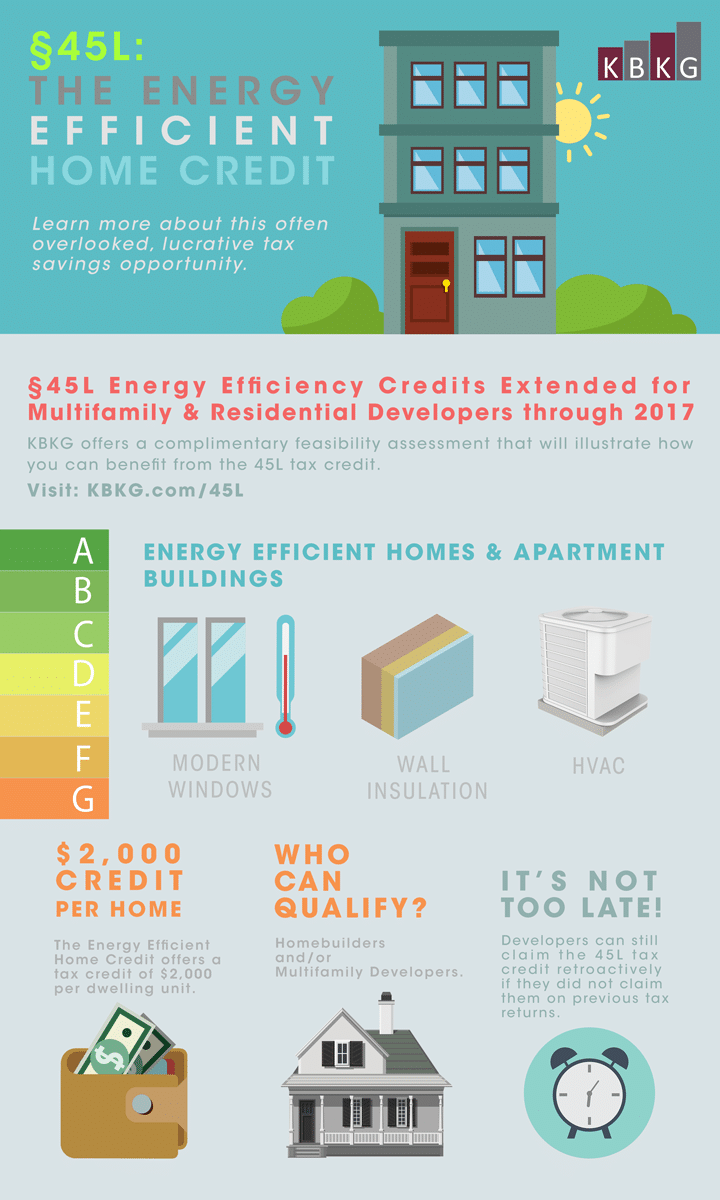

45L The Energy Efficient Home Credit Extended Through 2017

https://www.kbkg.com/wp-content/uploads/45L-02-23-18.png

How the Tax Credits Work for Homeowners Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Air Source Heat Pumps Heat Pump Water If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

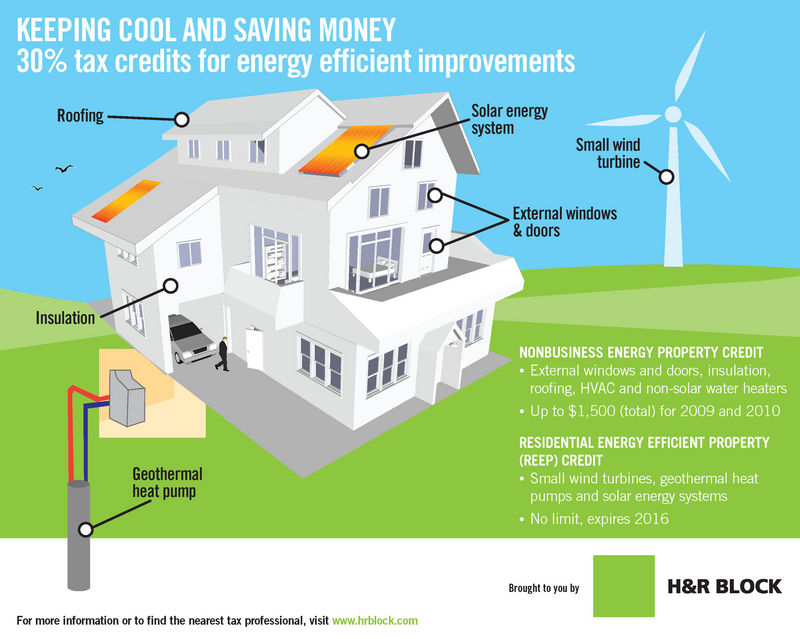

Homeowners can deduct 30 of the cost of certain energy improvement purchases including exterior doors exterior windows and skylights home energy audits and appliances including What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Are roofing expenditures covered by the Residential Clean Energy Credit How do energy tax credits work Are energy tax credits refundable Will these energy efficiency tax credits make home improvements

Download How Do Energy Efficient Tax Credits Work

More picture related to How Do Energy Efficient Tax Credits Work

How To Qualify For Energy Efficiency Tax Credits In 2020

https://images.ctfassets.net/0fol1oltsp9p/7fECLuxqXKDTEh9izw3DDS/b7500db5e159c6ea9949a6968d4971e8/Energy_Tax_Credits_For_Home_Improvements.jpg?w=1200&h=630&fit=fill

45L Energy Efficient Tax Credits Engineered Tax Services

https://ei4ypxa34qd.exactdn.com/wp-content/uploads/The-Real-Estate-Owners-Guide-to-Specialty-Tax-Incentives-Ebook-Cover-1187x1536.jpg?strip=all&lossy=1&ssl=1

What Tax Credits Are Available For Making Your Home Energy Efficient

https://www.brubakerinc.com/wp-content/uploads/2020/10/Residential-Energy-Credits_Thumb.jpg

These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work General overview of the Energy Efficient Home Improvement Credit Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by Tax Credit Available for 2022 Tax Year Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity 30 of cost Fuel Cells Wind Turbine Battery Storage N A 30 of cost Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per year Heat pump water heaters Biomass

Like the Residential Clean Energy Credit this credit can be claimed by someone who uses their home for business less than 20 of the time If a taxpayer uses their home for business more than 20 Claiming tax credits for solar panels Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal government This covers up to 30 of the

Tax Credits For Energy Efficient Home Improvements Kiplinger

https://cdn.mos.cms.futurecdn.net/jL8hKibD7YHkjQxA6muNGM-1920-80.jpg

Tax Credits Available For Making Efficiency Improvements Heartland Energy

https://heartlandenergy.com/wp-content/uploads/2023/01/feat-image-energy-cost.jpg

https:// tax.thomsonreuters.com /blog/understanding...

Residential Clean Energy Tax Credit The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

https://www. irs.gov /credits-deductions/home-energy-tax-credits

Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

Update Some Summertime Projects Pay Off In Spring Tax Green

Tax Credits For Energy Efficient Home Improvements Kiplinger

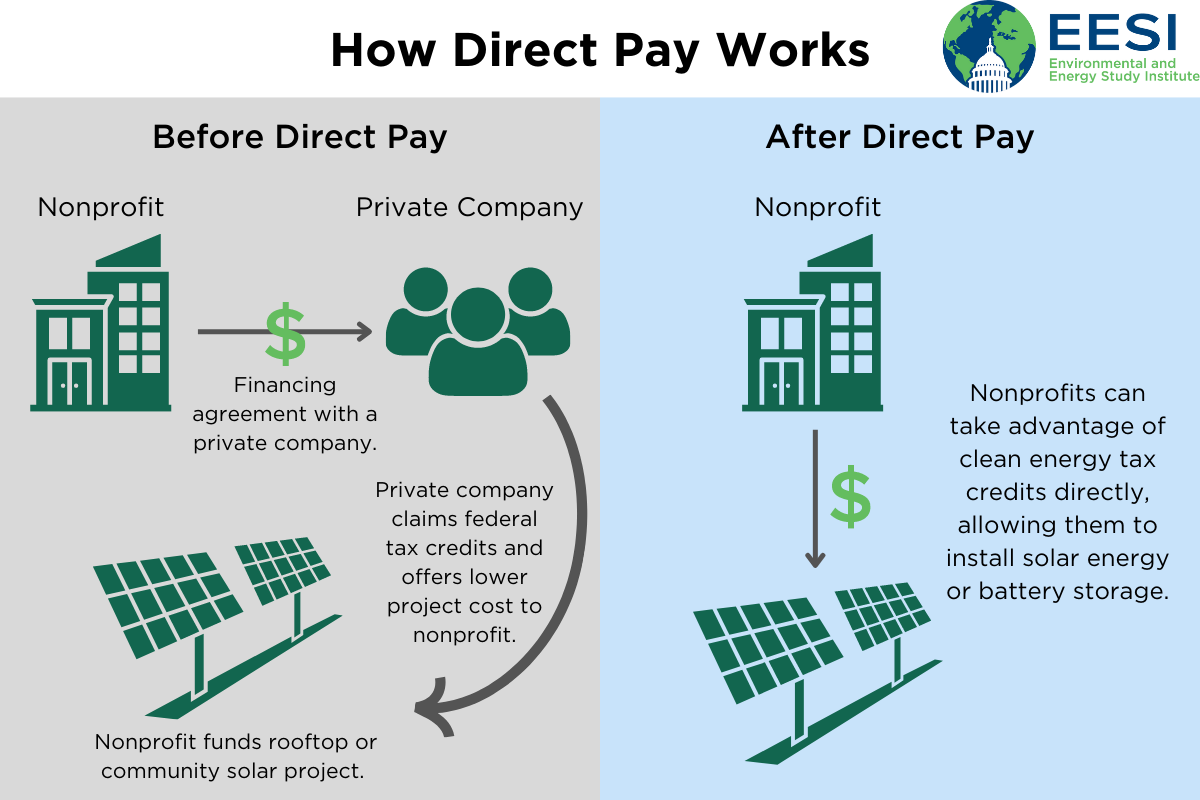

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Energy Efficiency Rebates And Tax Credits 2023 New Incentives For Home

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

How To Claim The Section 179D Energy Efficient Tax Deduction

How To Claim The Section 179D Energy Efficient Tax Deduction

Tracy s Tax Tips 10 Credit For Energy Efficient Improvements News

Residential Energy Tax Credit Use Eye On Housing

How Do I Claim The Residential Clean Energy Tax Credit

How Do Energy Efficient Tax Credits Work - The installation of the system must be complete during the tax year Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible