How Do Energy Tax Credits Work How do energy tax credits work When governments want to encourage a particular economic activity one action they can take is to provide incentives in the tax code Tools such as tax deductions and tax credits can

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner

How Do Energy Tax Credits Work

How Do Energy Tax Credits Work

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/us_energy_consumption_by_source.png?itok=2rdJNT4H

How it works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

Q How do I know if my Home Energy Audit is eligible for a credit A Consumers can visit this IRS page on the Energy Efficient Home Improvement Credit Q What products How do renewable energy tax credits work Renewable energy tax credits incentivize the adoption of eco friendly energy sources benefiting both the environment and the economy

Download How Do Energy Tax Credits Work

More picture related to How Do Energy Tax Credits Work

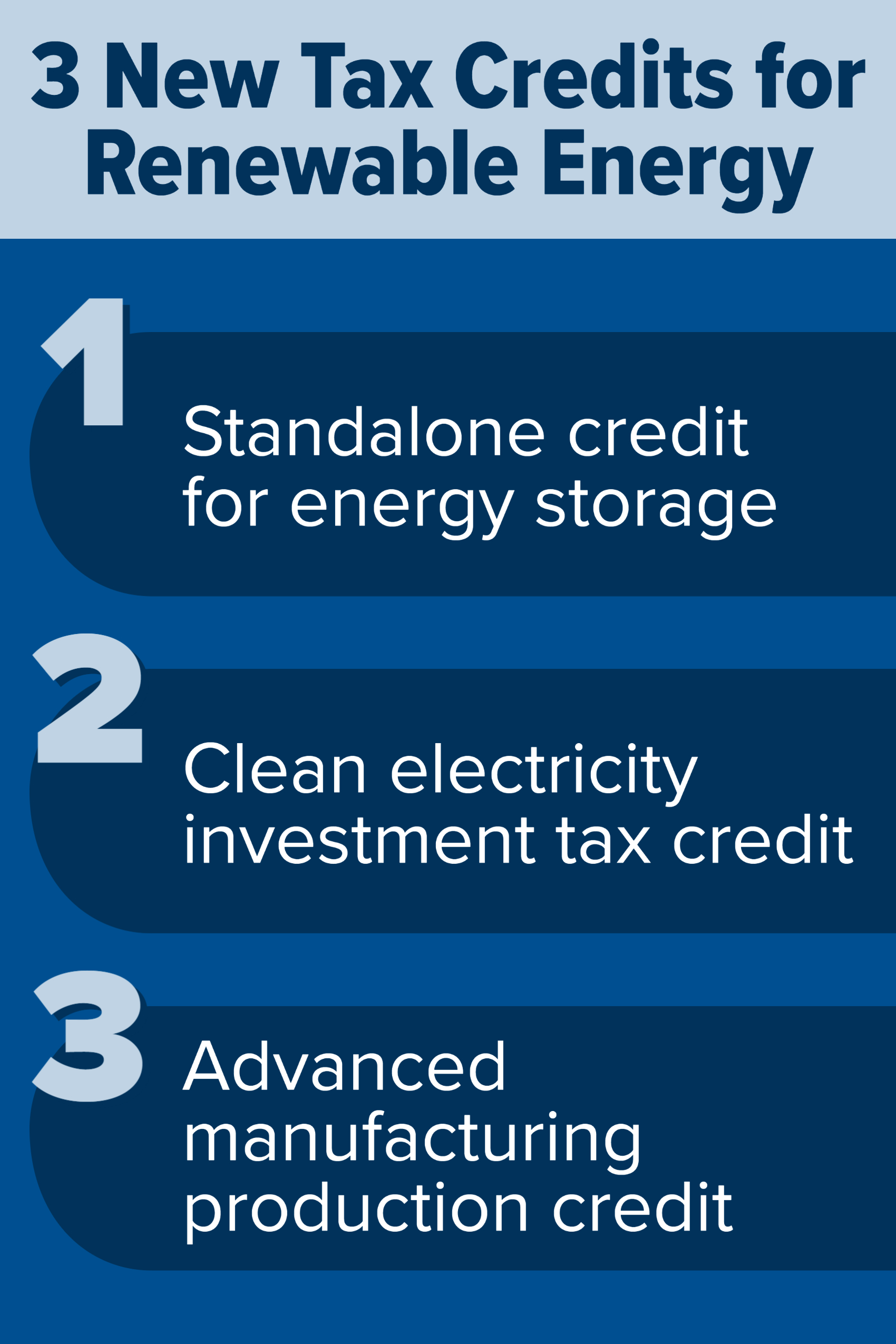

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Energy Tax Credits You Could Save 500 On Your Taxes Sun Heating

https://www.sunheating.com/media/energy-tax-credits.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Direct_Pay.png

The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings more The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar

The deal terms are relatively straightforward the buyer is buying or committing to buy a tax credit at an agreed price based on the assurances indemnities and guarantees How to claim energy efficient tax credits from ENERGY STAR To claim the Energy Efficient Home Improvement Credit for appliances that meet applicable ENERGY

What Are Clean Energy Tax Credits And How Do They Work Evergreen Action

https://evergreenaction.com/blog/hero-image/ira-clean-energy-tax-credits-social.jpg

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

https://cdn.vox-cdn.com/thumbor/2gql3h858HsUI4E0PQLbQIdsRDI=/0x106:1000x669/1600x900/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

https://turbotax.intuit.com › tax-tips › g…

How do energy tax credits work When governments want to encourage a particular economic activity one action they can take is to provide incentives in the tax code Tools such as tax deductions and tax credits can

https://www.irs.gov › credits-deductions › home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

What Are Clean Energy Tax Credits And How Do They Work Evergreen Action

Federal Solar Tax Credit What It Is How To Claim It For 2023

Residential Energy Tax Credits Overview And Analysis

Receive Your Tax Credits

Energy Tax Credits Types Of Renewable Energy

Energy Tax Credits Types Of Renewable Energy

How The Inflation Reduction Act Changes Tax And Healthcare Laws

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

How Tax Credits Work YouTube

How Do Energy Tax Credits Work - Here s an example of how the solar tax credit works If you installed a home solar power system for 20 000 you could claim a tax credit of 6 000 20 000 solar installation costs X 30