How Does Tuition Affect Taxes An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to

However taxpayers who paid qualified tuition and fees in 2018 2019 and 2020 could claim a maximum deduction of 4 000 The loss of this deduction highlights How does financial aid affect your tax refund If you have grants scholarships or federal student loans and spend them on non qualified education expenses you may need to report the aid as taxable

How Does Tuition Affect Taxes

How Does Tuition Affect Taxes

https://static.wixstatic.com/media/32f3ac_ded8e52383d64b6c85cbc36a707971b3~mv2.jpg/v1/fit/w_2500,h_1330,al_c/32f3ac_ded8e52383d64b6c85cbc36a707971b3~mv2.jpg

Tuition Assisting 101

https://www.assisting101.com/wp-content/uploads/2018/06/Tuition-1024x311.jpg

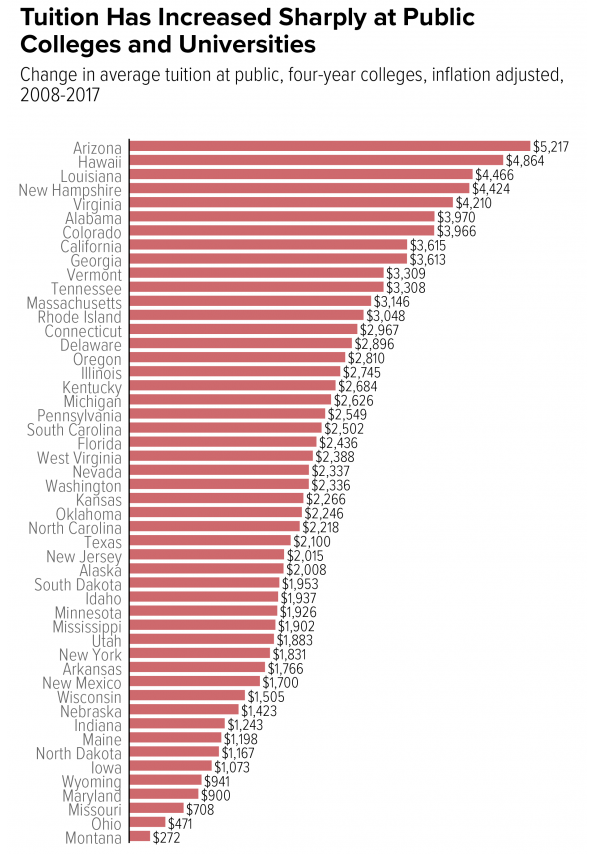

How Much Public College Tuition Costs Have Risen In Each State

https://www.collegefinancinggroup.com/wp-content/uploads/2017/08/tuition-rises-in-each-state.png

There are several options for deducting college tuition and textbooks on your federal income tax return including the American Opportunity Tax Credit Lifetime Learning Tax The tuition tax credit is a non refundable tax credit available to post secondary students This means that if you pay for tuition and other educational costs under certain conditions you can let the

Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an If you are allowed to study tuition free or for a reduced rate of tuition you may not have to pay tax on this benefit This is called a tuition reduction You don t have to include a qualified tuition reduction in your income

Download How Does Tuition Affect Taxes

More picture related to How Does Tuition Affect Taxes

You Give Us Your Money Here s What Happens Next MyOCADU Community

https://blog.ocad.ca/wordpress/dfisher/files/2016/04/20140912_tuition_infographic_final_web.jpg

Taxes Application Stock Image Colourbox

https://d2gg9evh47fn9z.cloudfront.net/1600px_COLOURBOX14153206.jpg

Taxes Clipart Clip Art Library Clip Art Library

https://clipart-library.com/2023/100279878-Screen-Shot-2012-12-05-at-9.46.31-AM.1910x1000.jpg

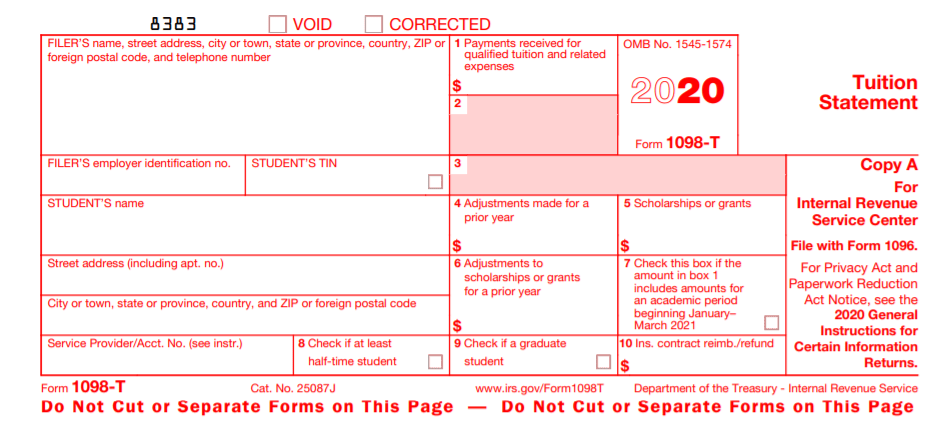

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post secondary

If you paid 5 000 of eligible tuition fees in the 2023 tax year for example you would be entitled to a 750 tax credit The tuition tax credit is subtracted from the Key Takeaways The Tuition and Fees Deduction was extended through the end of 2020 and allows you to deduct up to 4 000 from your income for qualifying

Taxes HISTORY

https://cropper.watch.aetnd.com/cdn.watch.aetnd.com/sites/2/2018/05/GettyImages-50617471-1.jpg

How To Get An IRS Tax Extension To File Your Return

https://cdn.aarp.net/content/dam/aarp/money/taxes/2021/05/1140-tax-time.imgcache.reva2f30f4db617fe33d681b5205d473932.jpg

https://www.forbes.com/advisor/taxes/tuition-and-fees-deduction

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to

https://smartasset.com/taxes/is-college-tuition-tax-deductible

However taxpayers who paid qualified tuition and fees in 2018 2019 and 2020 could claim a maximum deduction of 4 000 The loss of this deduction highlights

Home My Free Taxes

Taxes HISTORY

Pas De Nouvelles Taxes MR

Tax Season 2021 What To Know About 2020 Changes

Free Tax Return Cliparts Download Free Tax Return Cliparts Png Clip

The Best Small Business Tax Preparation Resources

The Best Small Business Tax Preparation Resources

What Is The Impact Of Strikes For Employers And Employees

-480a.jpg)

Visualizing Taxes By State

1098 T Form Printable Printable Forms Free Online

How Does Tuition Affect Taxes - The tuition tax credit is a non refundable tax credit available to post secondary students This means that if you pay for tuition and other educational costs under certain conditions you can let the