How Does Tuition Impact Taxes The tuition tax credit is a non refundable tax credit available to post secondary students This means that if you pay for tuition and other educational costs

When you pay tuition you not only get an education you also get a tax credit which can help your tax bill when you file a return As a medical or dental student you might not Tax Credits Deductions How College Costs and Financial Aid Affect Tax Returns Record expenses and aid carefully so you can

How Does Tuition Impact Taxes

How Does Tuition Impact Taxes

https://www.ceeol.com/api/image/getissuecoverimage?id=picture_2016_38783.jpeg

Will The Inflation Reduction Act Raise Your Taxes Flipboard

https://aurn.com/wp-content/uploads/2022/08/AP22209625086601-scaled.jpg

Elections Depth And Taxes

https://depthandtaxes.com/wp-content/uploads/2020/11/cropped-Cover-scaled-1.jpeg

OVERVIEW Eligible colleges or other post secondary institutions send Form 1098 T to students who paid qualified educational expenses in the preceding tax year The deduction for college tuition and fees became no longer available as of December 31 2020 However you can still help yourself with college expenses through

Residents International students studying in Canada who have to file an income tax return due to residency or due to earning income in Canada are able to use form T2202 to reduce any taxes they owe The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid

Download How Does Tuition Impact Taxes

More picture related to How Does Tuition Impact Taxes

How Does Home Tuition Help Students Improve Their Grades Scholarly

https://scholarlyoa.com/wp-content/uploads/2021/07/home-tuition.jpg

Tuition Assisting 101

https://www.assisting101.com/wp-content/uploads/2018/06/Tuition-1024x311.jpg

Taxes Clipart Clip Art Library Clip Art Library

https://clipart-library.com/2023/100279878-Screen-Shot-2012-12-05-at-9.46.31-AM.1910x1000.jpg

The tax system subsidizes the families of college students through tax advantaged savings plans credits a deduction for tuition costs and loan interest an If you paid 5 000 of eligible tuition fees in the 2023 tax year for example you would be entitled to a 750 tax credit The tuition tax credit is subtracted from the amount of tax

The good thing is that students can claim their tuition in their annual income taxes if they meet specific conditions required by the Canada Revenue Agency CRA Personal income tax Claiming deductions credits and expenses Line 32300 Your tuition education and textbook amounts Eligible tuition fees Generally a course

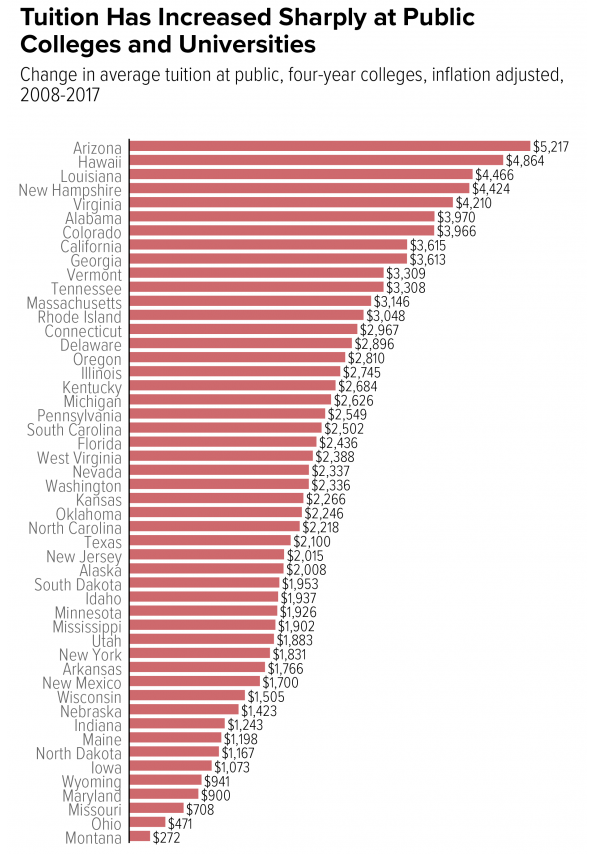

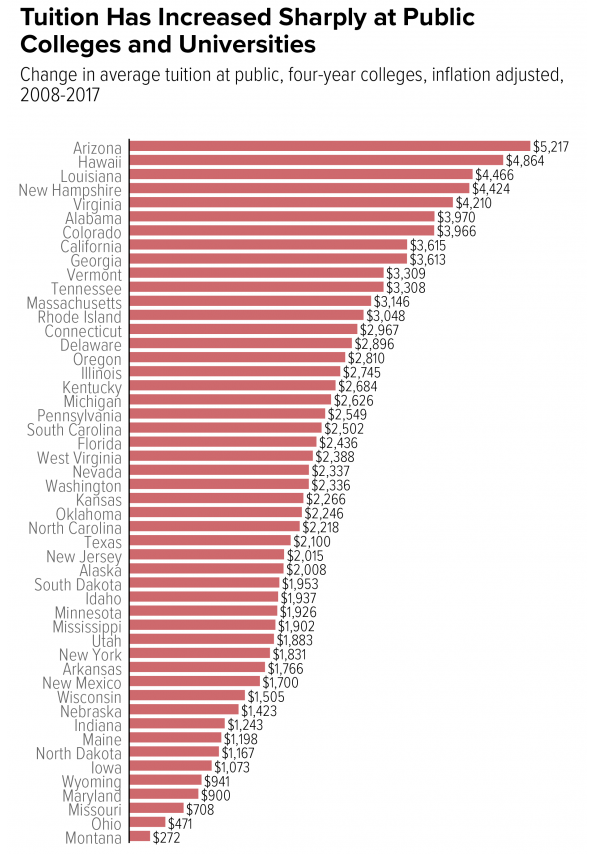

How Much Public College Tuition Costs Have Risen In Each State

https://www.collegefinancinggroup.com/wp-content/uploads/2017/08/tuition-rises-in-each-state.png

You Give Us Your Money Here s What Happens Next MyOCADU Community

https://blog.ocad.ca/wordpress/dfisher/files/2016/04/20140912_tuition_infographic_final_web.jpg

https://turbotax.intuit.ca/tips/understanding-tuition-tax-credits-6549

The tuition tax credit is a non refundable tax credit available to post secondary students This means that if you pay for tuition and other educational costs

https://discover.rbcroyalbank.com/tuition-tax...

When you pay tuition you not only get an education you also get a tax credit which can help your tax bill when you file a return As a medical or dental student you might not

Taxes HISTORY

How Much Public College Tuition Costs Have Risen In Each State

Impact Finance Pro

How To Get An IRS Tax Extension To File Your Return

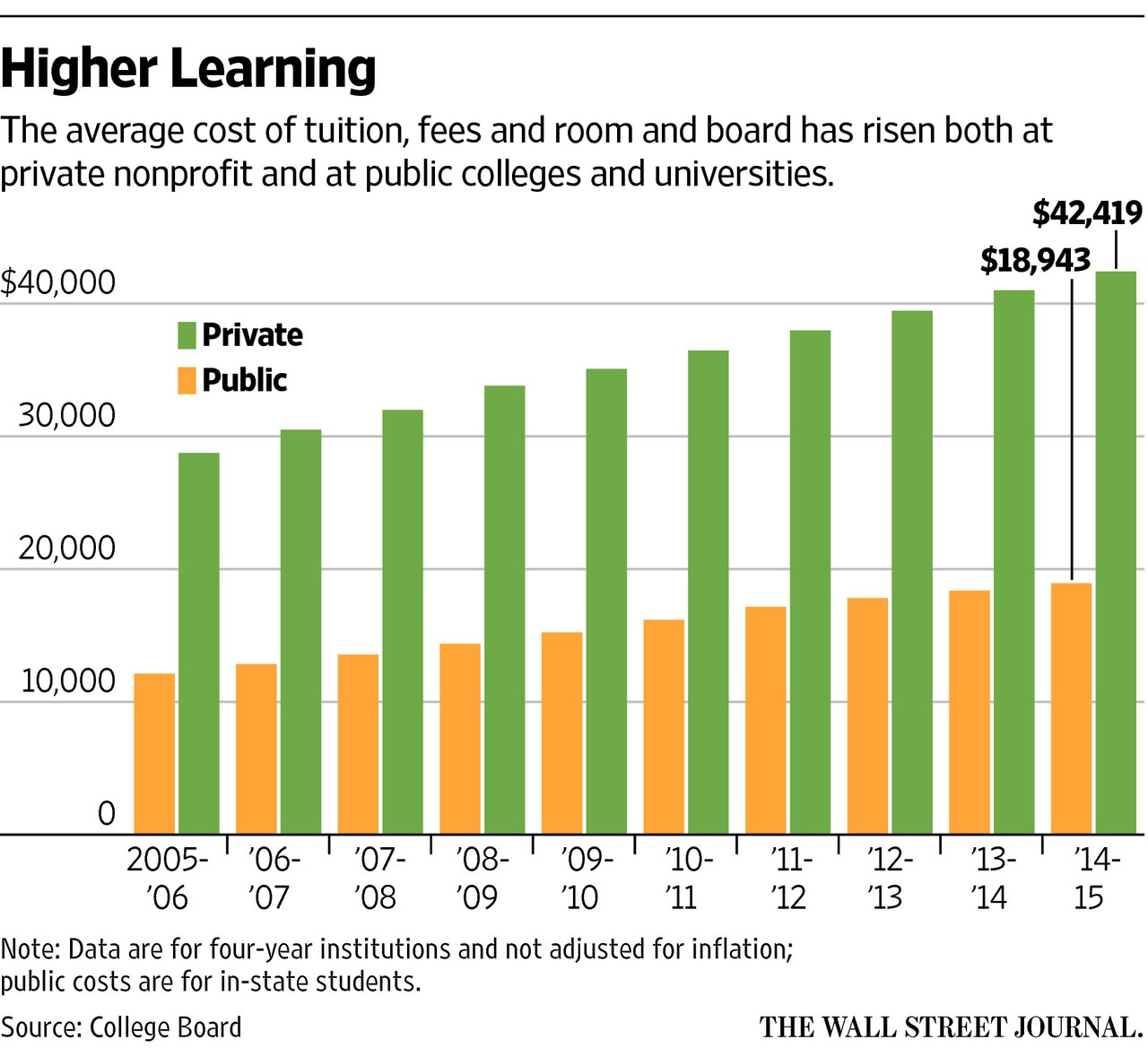

On The Continuous Rise Of College Tuition In The U S

8 Business Taxes You May Need To Pay In 2020 TCM Wealth Advisors

8 Business Taxes You May Need To Pay In 2020 TCM Wealth Advisors

Tax Season 2021 What To Know About 2020 Changes

The Best Small Business Tax Preparation Resources

Pas De Nouvelles Taxes MR

How Does Tuition Impact Taxes - The deduction for college tuition and fees became no longer available as of December 31 2020 However you can still help yourself with college expenses through