How Home Loan Is Exempt From Income Tax On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan borrowers should be informed Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations

How Home Loan Is Exempt From Income Tax

How Home Loan Is Exempt From Income Tax

https://3.bp.blogspot.com/-N4IqHJhEXFA/WJHv5VBbpUI/AAAAAAAAFhA/k6e0LrV20oUtUBO4u7O-324H6C785_KLgCEw/s1600/1.JPG

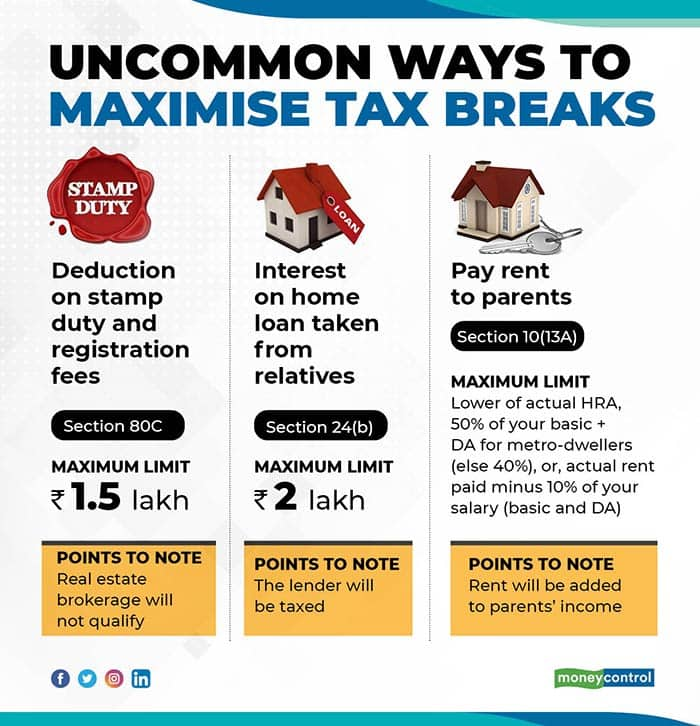

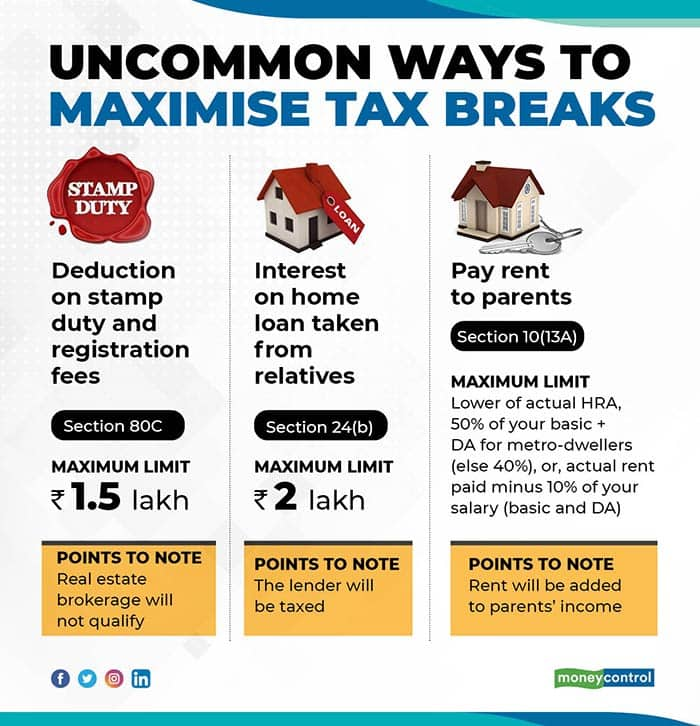

Paying A Home Loan EMI Or Staying On Rent Know The Tax Benefits

https://images.moneycontrol.com/static-mcnews/2020/01/Preeti-Jan-14.jpg

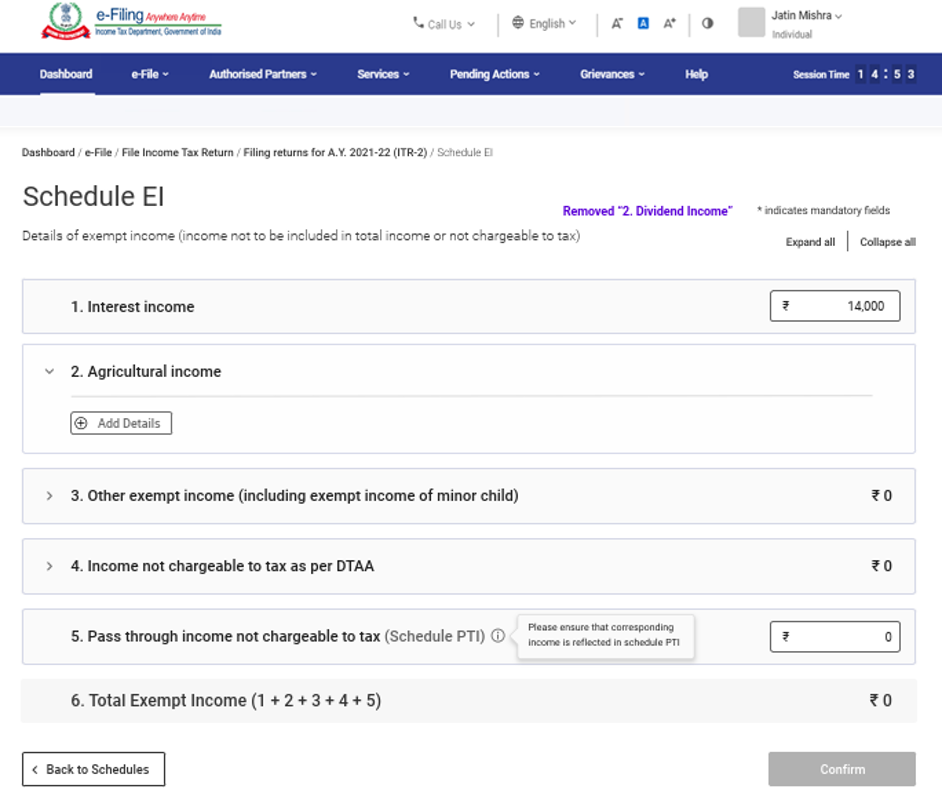

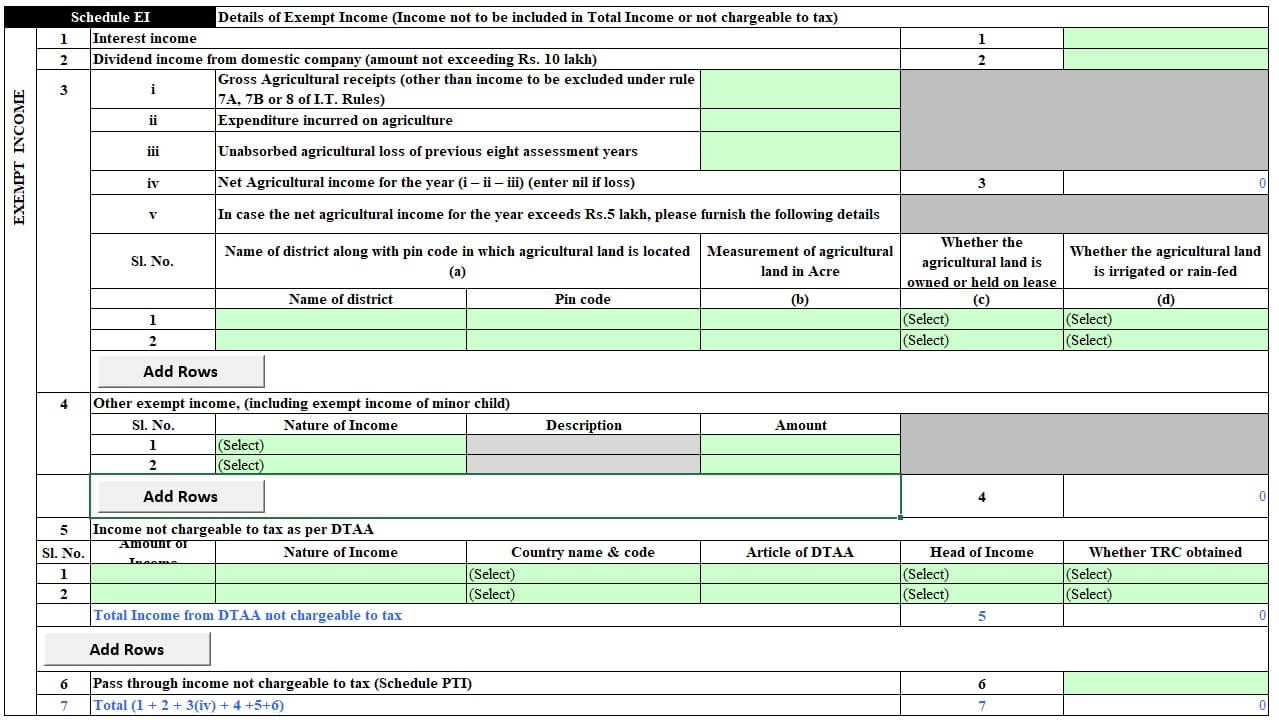

Exempt Income Under Income Tax Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2021/02/05110413/Exempt-Income-ITR-2-ITR-3-1-1024x761.png

Individuals who apply for a home loan can receive home loan tax benefits under several sections such as Section 80 EEA and Section 24b of the Income Tax Act Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C If you have rented out the property the entire interest on the home loan is allowed as a deduction Your deduction on interest is limited to Rs 30 000 if you fail to

Download How Home Loan Is Exempt From Income Tax

More picture related to How Home Loan Is Exempt From Income Tax

Image Of 2020 IRS Form 1040 With Line 2a Highlighted

https://studentaid.gov/sites/default/files/2020-tax-exempt-interest-income.PNG

All You Need To Know On Exempted Income In Income Tax Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/income-exempted.png

House Loan Interest Tax Deduction Home Sweet Home Insurance

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Home loan borrowers may claim an income tax deduction of up to Rs 1 50 000 on the principal amount paid back throughout the year under Section 80C of the Income Tax Act For obtaining tax advantages Taxpayers have extra time up to six months after the due date of the taxpayer s federal income tax return for the disaster year without regard to any

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a

Income Exempt From Federal Tax Loan Insurance Blog

https://sdgaccountant.com/wp-content/uploads/2021/08/How-does-Exempt-from-Federal-Tax-Withholding-Work-770x367.jpg

File ITR 2 Online User Manual Income Tax Department

https://www.incometax.gov.in/iec/foportal/sites/default/files/inline-images/Picture19_2.png

https://housing.com/news/home-loans-…

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax

https://economictimes.indiatimes.com…

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan borrowers should be informed

Exempt Income And Income Tax Return

Income Exempt From Federal Tax Loan Insurance Blog

Exempt Income Meaning Types How It Works In Tax

TAX Updates4U Claim Tax Benefit On HRA As Well As Tax Deduction On

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Money Received From Relatives Is Exempt From Income Tax

Money Received From Relatives Is Exempt From Income Tax

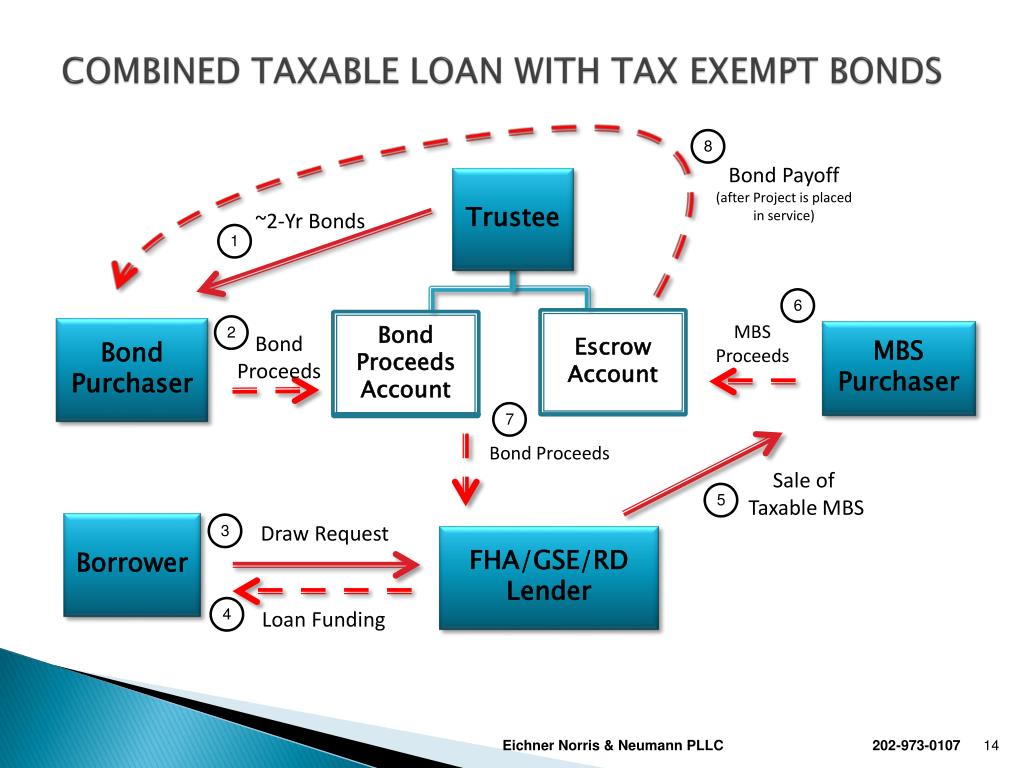

PPT Tax Exempt Bonds With 4 Low Income Housing Tax Credits September

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

Tax Exemption In Salary Everything That You Need To Know

How Home Loan Is Exempt From Income Tax - If you have rented out the property the entire interest on the home loan is allowed as a deduction Your deduction on interest is limited to Rs 30 000 if you fail to