How Is Rebate Calculated Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim section

Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable income is upto Tax rebates are calculated at the end of the financial year which always runs between 6 April and 5 April of the next year When HMRC has worked out who is owed a tax

How Is Rebate Calculated

How Is Rebate Calculated

https://i.ytimg.com/vi/Gm-LyXhsTao/maxresdefault.jpg

Rebates

https://cljgives.org/wp-content/uploads/2017/08/20170809-MM0000809-rebates.png

Rebate What Is Forex Rebate Earn More With Best Forex Cashback

https://i.ytimg.com/vi/Hztq_FdPKLk/maxresdefault.jpg

To calculate and claim the 2021 Recovery Rebate Credit you ll need to know the amounts of any third Economic Impact Payments you received This includes any plus up How can I calculate a rebate under 87A To calculate rebate under section 87A calculate your gross income and subtract the available deductions under Sections 80C to 80U Now if your net taxable income is less

The table below breaks down how much you will receive from the rebate approximately four times over the next year Canada Carbon Rebate quarterly amount Rural supplement of 20 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income

Download How Is Rebate Calculated

More picture related to How Is Rebate Calculated

Prestige Campaigns Rebate Campaign

https://www.prestigeinvest.finance/assets/campaigns/rebate_campaign-6e71d07bdfe4e53ff9660d7974eee03eecb1c992f32c563c5b4dda098806ec52.jpg

Rebate Calculations 101 How Are Rebates Calculated Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63638715cda5ce39da72168b_Blog banners 2400x1348px3.png

How Is Rebate Recovery Credit Calculated Leia Aqui What Determines

https://www.efile.com/image/actc-step1.png

The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim Threshold for Rebate For incomes exceeding Rs 7 27 775 the rebate under Section 87A becomes Nil Conclusion This adjustment ensures that taxpayers like Mr Varun who earn just above the Rs 7 lakh threshold are not unduly

A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be How to calculate surcharge or rebate on income tax You just have to input your income and deduction details in the Income tax calculator and it will calculate your tax liability along with

Greek Rebate Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/270000/velka/greek-rebate.jpg

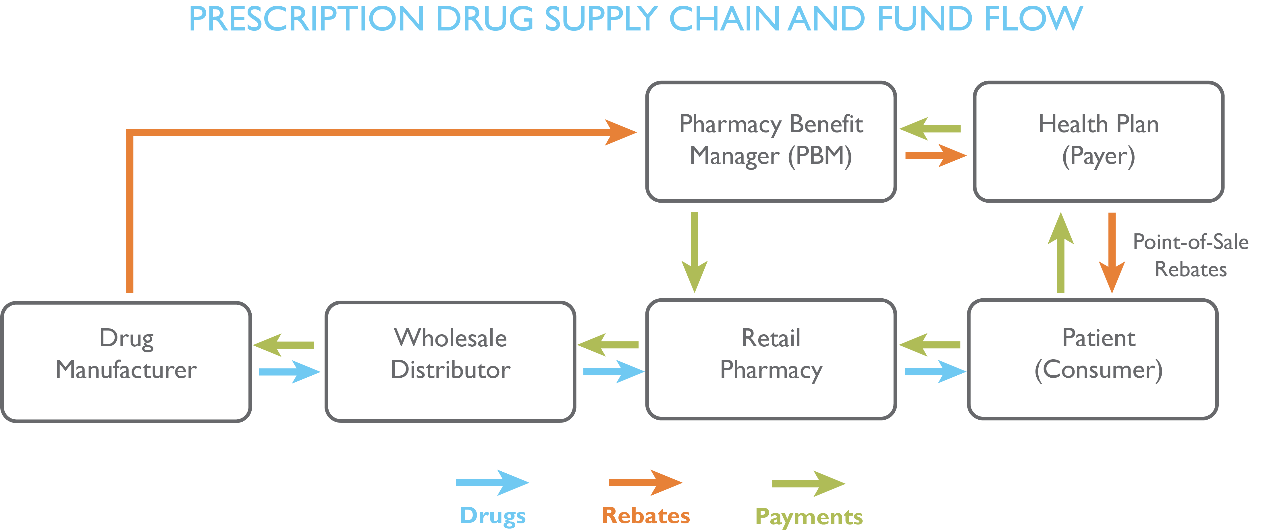

Plaintalk Blog What Is A Drug Rebate CIVHC

https://civhc.org/wp-content/uploads/2022/05/Drug-Rebate-Flow-Chart-Graphic.png

https://cleartax.in/s/income-tax-rebate-us-87a

Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim section

https://tax2win.in/guide/section-87a

Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable income is upto

Traderider Rebate Program Verify Trade ID

Greek Rebate Free Stock Photo Public Domain Pictures

Rebate Management Software QuyaSoft

Rebate What Is It Example Vs Discount Types Regulations

A Guide To Rebates On Discounted Bills

Rebate Definition Of Rebate YouTube

Rebate Definition Of Rebate YouTube

Your Prosperity Is Connected To Your Purpose Today s Word With Rick Pina

Rebates Zilla

Rebates Vs Discounts What Are The Differences Enable

How Is Rebate Calculated - You can use the private health insurance PHI rebate calculator to find out your private health rebate percentage updated annually on 1 April income for surcharge