How Many Times Can You Claim The Federal Solar Tax Credit How long does a taxpayer have to claim the credit added Jan 17 2025 A2 The credit is allowed for a taxable year for certain amounts a taxpayer pays or incurs during such

If permanently imposed we estimate the 25 percent tariffs on Canada excluding energy at 10 percent and Mexico plus 10 percent tariffs on China would increase federal tax revenues by 1 1 trillion 963 billion on a You can claim the annual credit every year that you install eligible property until the credit begins to phase out in 2033 Fuel cell property is limited to 500 for each half kilowatt of

How Many Times Can You Claim The Federal Solar Tax Credit

How Many Times Can You Claim The Federal Solar Tax Credit

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

Federal Solar Tax Credit Resources Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Federal-Solar-Tax-Credit-Resources.png?itok=GmU0gJL6

How many times can I claim the solar tax credit Homeowners can claim the solar tax credit once per solar and or battery system installed on an eligible property and the credit When you ask the question can you claim solar tax credit twice the answer is no You cannot claim the solar tax credit twice for the same solar panel system The Residential Clean Energy Credit is a federally supported and

By the authority vested in me as President by the Constitution and the laws of the United States of America it is hereby ordered Section 1 Assuming the Inflation Reduction Act gets signed yes 26 USC 25D a 1 allows a taxpayer to take a tax credit for qualified solar electric property expenditures

Download How Many Times Can You Claim The Federal Solar Tax Credit

More picture related to How Many Times Can You Claim The Federal Solar Tax Credit

What s Going On With The Federal Solar Tax Credit

https://massachusetts.revolusun.com/wp-content/uploads/sites/2/2019/10/capital-building.jpg

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

How do I qualify for the solar tax credit To qualify for claiming the solar tax credit on your tax return you ll first need to meet some eligibility criteria Your solar equipment needs You can claim the solar tax credit only once However you may be able to claim it more times in case you have more than one solar powered property

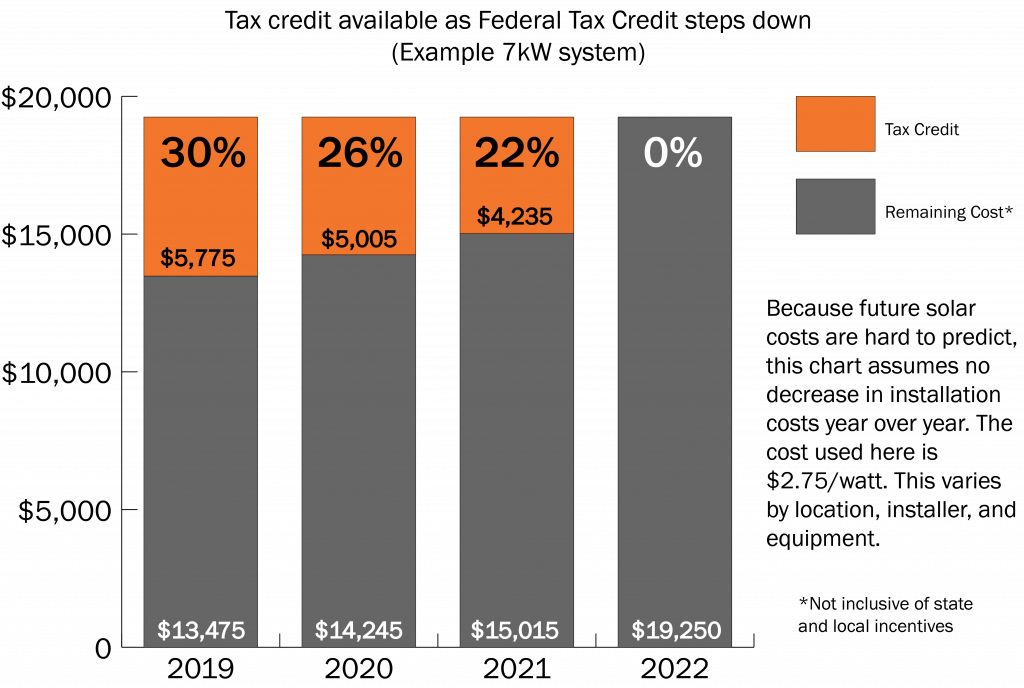

The Solar Investment Tax Credit ITC provides a valuable incentive for those considering solar installations But how many times can you claim this tax credit In this The Solar Tax Credit allows you to deduct 26 of the cost of installing a solar system from your federal taxes This means that if you install a system between January 1st and December 31st

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

https://www.irs.gov › credits-deductions › frequently...

How long does a taxpayer have to claim the credit added Jan 17 2025 A2 The credit is allowed for a taxable year for certain amounts a taxpayer pays or incurs during such

https://taxfoundation.org › research › all › f…

If permanently imposed we estimate the 25 percent tariffs on Canada excluding energy at 10 percent and Mexico plus 10 percent tariffs on China would increase federal tax revenues by 1 1 trillion 963 billion on a

When Does Solar Tax Credit End SolarProGuide 2022

Federal Solar Tax Credit What It Is How To Claim It For 2023

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

The Federal Solar Tax Credit What You Need To Know 2022

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit 2022 How Does It Work ADT Solar

Federal Solar Tax Credit 2022 How Does It Work ADT Solar

Everything You Need To Know The New 2021 Solar Federal Tax Credit

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

Federal Solar Tax Credit For Residential Solar Energy

How Many Times Can You Claim The Federal Solar Tax Credit - Can You Claim The Solar Tax Credit Twice The simple answer to this question is yes but only under certain circumstances It s essential to clarify that this doesn t mean you