How Many Years Can You Claim The Energy Tax Credit In 2023 you may be entitled to a tax credit covering 30 of the cost of installing energy efficient windows up to a maximum of 600 per year What Documentation Do I Need to Submit to

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who You can claim the annual credit every year that you install eligible property until the credit begins to phase out in 2033 Fuel cell property is limited to 500 for each half kilowatt of

How Many Years Can You Claim The Energy Tax Credit

How Many Years Can You Claim The Energy Tax Credit

https://www.bookstime.com/wp-content/uploads/2022/02/071b502c-c160-4956-9d3b-bbb0e94c5282.jpeg

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

https://cdn.vox-cdn.com/thumbor/WuOuOQRdPx1e96FGTdEFcOHebJ8=/0x0:1000x669/1200x800/filters:focal(525x411:685x571)/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

Home Energy Improvements Lead To Real Savings Infographic Solar

https://i.pinimg.com/originals/d9/ad/96/d9ad96393cb13907229e3e2b1609bcc1.jpg

Homeowners may claim the maximum annual credit every year that eligible improvements are made through 2032 The credits are nonrefundable so you cannot get back more on the credit than you owe in taxes You may not apply Annual overall limitation The credit allowed for any tax year cannot exceed 1 200 Annual limitation for qualified energy property The credit allowed for any tax year with respect to any item of qualified energy property cannot

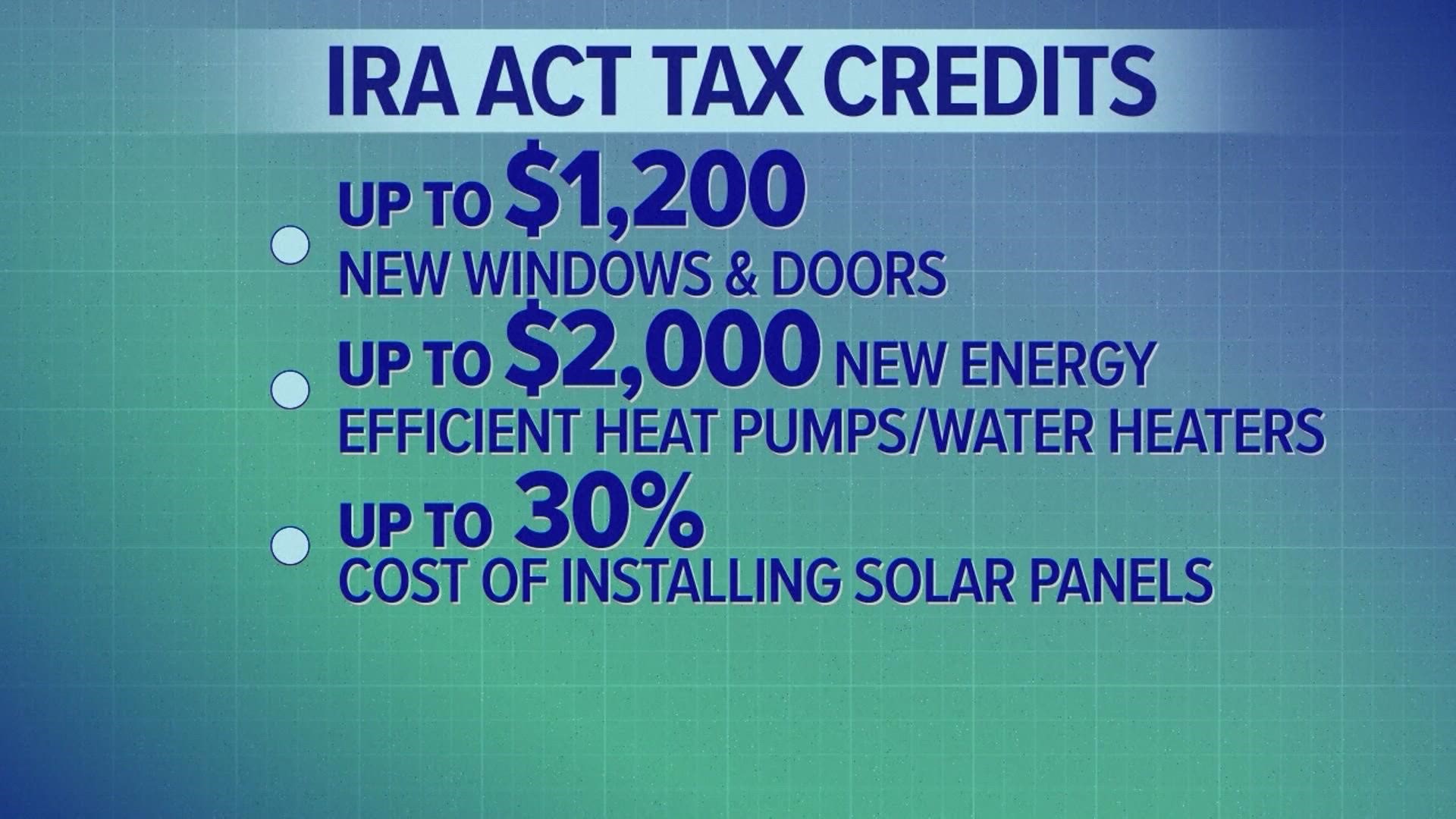

There s a 1 200 annual credit limit for purchasing items such as energy efficient doors or windows and a 2 000 annual credit limit for heat pumps and biomass stoves or boilers You can Starting January 1 2023 new federal tax credits will be in place for 10 years through 2032 Also while the tax credit amount is mostly limited to 30 of the project cost the previous lifetime cap of 500 has been changed

Download How Many Years Can You Claim The Energy Tax Credit

More picture related to How Many Years Can You Claim The Energy Tax Credit

Solar Energy Tax Credit Basics

https://s2.studylib.net/store/data/009906505_1-1c8209be4201d8616781301da40ba34d-768x994.png

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

https://media.wfaa.com/assets/WFAA/images/e2c1cb63-8375-4e50-be65-6c75edcd8446/e2c1cb63-8375-4e50-be65-6c75edcd8446_1920x1080.jpg

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

This means you can claim a maximum total yearly energy efficient home improvement credit amount up to 3 200 Residential Clean Energy Credit The Residential Clean Energy RCE Credit is a renewable energy tax credit How many years can you carry forward the solar credit The solar tax credit can be rolled over for as long as the credit is in effect which is currently scheduled through 2034 In August 2022 the signing of the Inflation

Items marked with an apostrophe are subject to a cap of 1 200 per year Who can claim the home energy credits The home energy credits are designed to be of most benefit to residents You can claim the federal tax credit once for the year you install a solar power system However if you install another solar system on a qualifying property you can claim

Do You Qualify For A Home Energy Tax Credit Benefyd

https://www.benefyd.com/wp-content/uploads/2016/02/home-energy-tax-credits0.png

The Residential Renewable Energy Tax Credit Is A Little known

https://i.pinimg.com/originals/39/9e/55/399e5509105983b931911f5b36afce98.jpg

https://www.investopedia.com/.../ener…

In 2023 you may be entitled to a tax credit covering 30 of the cost of installing energy efficient windows up to a maximum of 600 per year What Documentation Do I Need to Submit to

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg?w=186)

https://www.irs.gov/credits-deductions/home-energy-tax-credits

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who

Energy Tax Credits Armanino

Do You Qualify For A Home Energy Tax Credit Benefyd

The Basics Of ITC Vs PTC For Solar Projects Stracker Solar

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

2023 Residential Clean Energy Credit Guide ReVision Energy

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

How The Energy Tax Increase Will Affect Your Bill YouTube

Back By Popular Demand When Is The Best Day To Retire Missouri Lagers

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

How Many Years Can You Claim The Energy Tax Credit - Homeowners may claim the maximum annual credit every year that eligible improvements are made through 2032 The credits are nonrefundable so you cannot get back more on the credit than you owe in taxes You may not apply