How Much Home Loan Interest Is Tax Exemption For Fy 2022 23 Web So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Income Tax

Web 25 M 228 rz 2016 nbsp 0183 32 Loan amount should be less than Rs 35 Lakh The value of the house should not be more than Rs 50 Lakh amp The home buyer Web 5 Feb 2023 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

How Much Home Loan Interest Is Tax Exemption For Fy 2022 23

How Much Home Loan Interest Is Tax Exemption For Fy 2022 23

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

TDS Rate Chart For FY 2022 23 AY 2023 24 SimBizz

https://simbizz.in/wp-content/uploads/2022/06/simbizz.in-blog.png

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

https://www.thepeak.com/wp-content/uploads/2021/02/20210219-MEM.png

Web 20 M 228 rz 2023 nbsp 0183 32 As we all know under section 24 b we can get deduction of up to 2 lakh on home loan interest but you can also claim up to 1 50 000 deduction under Section Web 4 Jan 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

Web You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting Web 18 Juli 2023 nbsp 0183 32 If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file separately

Download How Much Home Loan Interest Is Tax Exemption For Fy 2022 23

More picture related to How Much Home Loan Interest Is Tax Exemption For Fy 2022 23

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

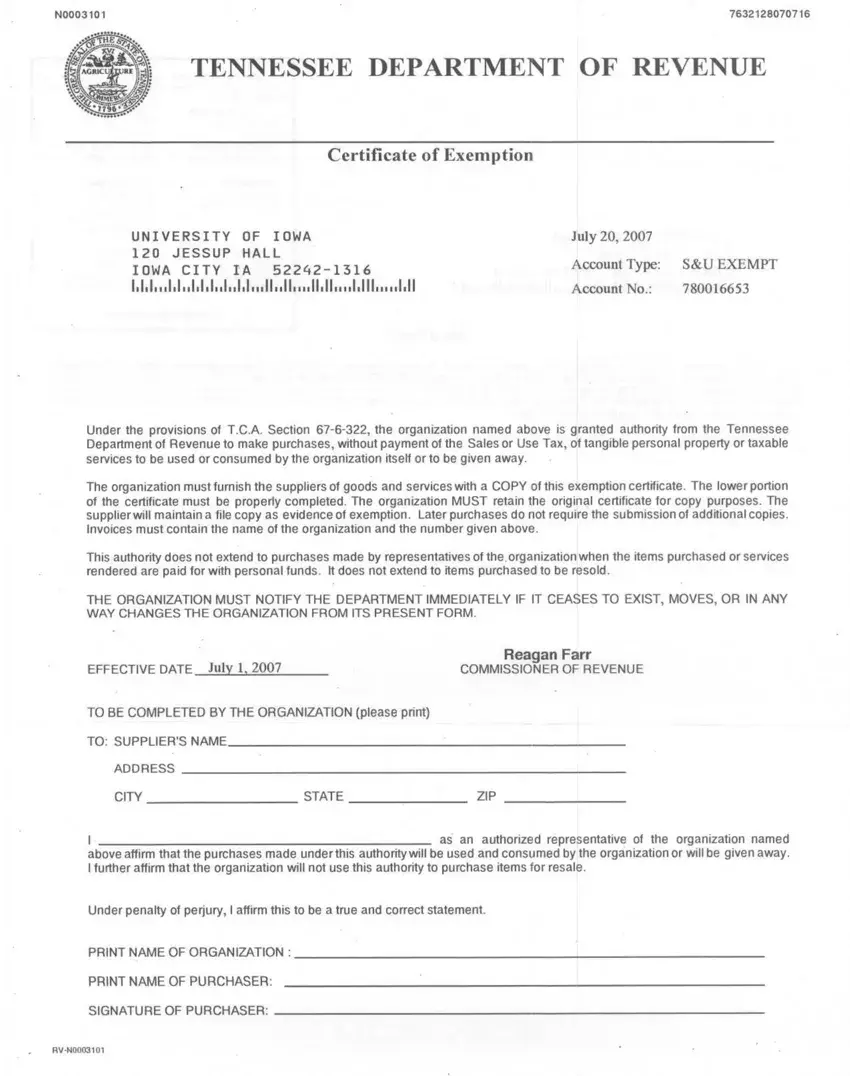

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-india-2022-23-1024x576.webp

Web 22 Sept 2023 nbsp 0183 32 In general you can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing Web 17 Nov 2022 nbsp 0183 32 As a part of the Government of India s incentivization scheme to promote Housing for All the first time home buyer is eligible to claim an additional deduction of

Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your Web 28 Dez 2023 nbsp 0183 32 Tax benefits on Home Loan FY 2022 23 AY 2023 24 Income Tax Deduction for Home Loan Repayment of Principal Amount u s 80C Conditions for

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

https://www.livemint.com/money/personal-finance/new-income-tax-r…

Web So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Income Tax

https://blog.saginfotech.com/tax-benefi…

Web 25 M 228 rz 2016 nbsp 0183 32 Loan amount should be less than Rs 35 Lakh The value of the house should not be more than Rs 50 Lakh amp The home buyer

Tennessee Exemption Certificate PDF Form FormsPal

Solved Please Note That This Is Based On Philippine Tax System Please

Income Tax Calculator For FY 2022 23 Kanakkupillai

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

How Much House Can I Afford Insider Tips And Home Affordability

2017 PAFPI Certificate of TAX Exemption Certificate Of

2017 PAFPI Certificate of TAX Exemption Certificate Of

Illinois Tax Exempt Certificate Five Mile House

State Lodging Tax Exempt Forms ExemptForm

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

How Much Home Loan Interest Is Tax Exemption For Fy 2022 23 - Web 4 Jan 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages