How Much Tax Exemption For Home Loan Learn how to claim tax deductions on home loan principal and interest under Section 80C 24 80EE and 80EEA Find out the eligibility criteria upper limits and terms and conditions for each section

Estimate your tax savings from mortgage interest deduction with this online tool Enter your home value loan amount income taxes and other expenses to see how home ownership can benefit you financially You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

How Much Tax Exemption For Home Loan

How Much Tax Exemption For Home Loan

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

Community Health Taxscan Simplifying Tax Laws

https://www.taxscan.in/wp-content/uploads/2022/12/Tariff-rate-Customs-Duty-CESTAT-re-adjudication-Excise-Customs-Service-Tax-taxscan.jpg

How Is Tax Exemption On Home Loan Calculated TESATEW

https://i.pinimg.com/originals/04/62/34/046234867367b7ad436a0e41931ed5ea.png

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to Individuals who apply for a home loan can receive home loan tax benefits under several sections such as Section 80 EEA and Section 24b of the Income Tax Act 1961 which grants income tax benefits of up to Rs 1 5 lakh

Labour s first budget since 2010 includes 40bn worth of tax rises and spending cuts across government as well as promises to invest in infrastructure and support working people In his latest targeted tax relief promise former President Donald Trump said Sunday that he d push for a tax credit for family caregivers as well as to make interest on car loans

Download How Much Tax Exemption For Home Loan

More picture related to How Much Tax Exemption For Home Loan

How To Use Exemptions When Filing For Chapter 13 Bankruptcy

https://rosenblumlaw.com/wp-content/uploads/2020/04/exemptions-1024x1024.png

Tax Letter Template Format Sample And Example In PDF Word

https://bestlettertemplate.com/wp-content/uploads/2020/10/IRS-Tax-exempt-Letter.png

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Learn how to claim tax deduction on home loan principal and interest under Sections 80C and 24 b of Income Tax Act Find out the eligibility conditions and limits for different types of home loans and properties Compare the tax benefits of buying vs renting a home with this calculator Enter your home value loan amount interest rate tax information and other deductions to see how much you

The IRS announced the annual inflation adjustments for tax year 2025 including standard deductions marginal rates alternative minimum tax exemption amounts and more Find out your tax exemption on home loan with Kotak Bank s online tool Enter your income loan details and deductions to see how much you can save on your tax liability

Sec 142 1 Of Income Tax Act Income Tax Notice Reply Under Section 131

https://www.neusourcestartup.com/Usefull/Blog/BannerImages/59/59.jpg

Certificate Of Exemption Tax Exemption Sales Taxes In The United States

https://imgv2-1-f.scribdassets.com/img/document/26404047/original/f7f9f667d9/1568237767?v=1

https://housing.com/news/home-loans-…

Learn how to claim tax deductions on home loan principal and interest under Section 80C 24 80EE and 80EEA Find out the eligibility criteria upper limits and terms and conditions for each section

https://www.mortgagecalculator.org/c…

Estimate your tax savings from mortgage interest deduction with this online tool Enter your home value loan amount income taxes and other expenses to see how home ownership can benefit you financially

How To Calculate Members Voluntary Liquidation Tax Tax Calculator

Sec 142 1 Of Income Tax Act Income Tax Notice Reply Under Section 131

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

Virginia Tax Exempt Form Fill Out Sign Online DocHub

How Much Tax Do You Pay On Debt related Investments Mint

Tax Exempt Forms San Patricio Electric Cooperative

Tax Exempt Forms San Patricio Electric Cooperative

Texas Sales Tax Exemption Certificate From The Texas Human Rights

Sales Tax Exemption For Start ups Makes Sense Or Not Publisher Of

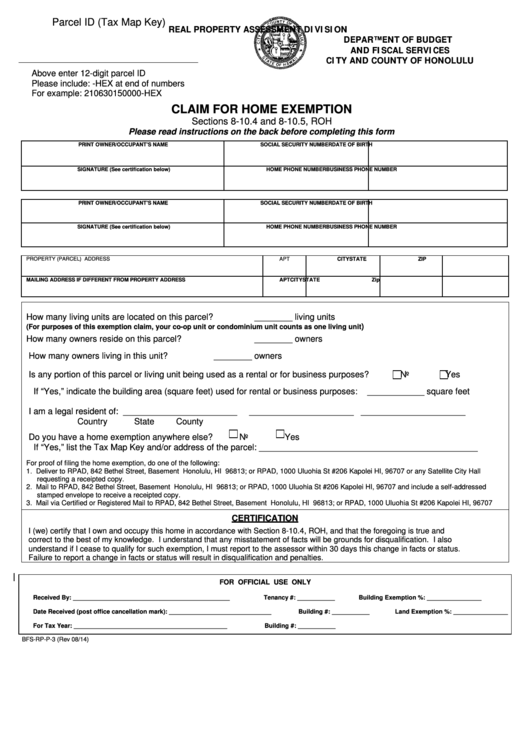

Orange County Homeowners Exemption Form ExemptForm

How Much Tax Exemption For Home Loan - Individuals who apply for a home loan can receive home loan tax benefits under several sections such as Section 80 EEA and Section 24b of the Income Tax Act 1961 which grants income tax benefits of up to Rs 1 5 lakh