How Much Is Fuel Benefit Tax Calculate tax on employees company cars Expenses and benefits for employers Running payroll

The Van Benefit and Car and Van Fuel Benefit No 2 Order 2021 SI 2021 1422 set the charges for 2022 to 2023 It set the van benefit at 3 600 the car Calculate the company car tax and any fuel benefit charge on your actual income Just select your vehicle or enter the P11D value and BIK rate to calculate Instantly compare

How Much Is Fuel Benefit Tax

How Much Is Fuel Benefit Tax

https://www.banlaw.com/wp-content/uploads/2021/12/who-can-claim-fuel-tax-credits-1024x763.jpg

Poor Records High Costs Car Fuel Benefit Tax Impact

https://www.chippendaleandclark.com/wp-content/uploads/2021/01/blog-Company-Cars.jpg

How Much Fuel Tax Is On Petrol And Diesel Ask The Car Expert

https://www.askthecarexpert.com/wp-content/uploads/2020/10/How-much-do-we-pay-in-fuel-duty-700x510.jpg?x21968

Company car fuel benefit is the tax you pay to HMRC on the free for personal use fuel you get from your employer Like all HRMC taxes there is a calculation that is used to Fuel Benefit is the value of fuel that will be taxed on a company car driver It is the salary equivalent in the eyes of HMRC though like most benefits it escapes National

The Van Fuel Benefit Charge is 757 for the 2023 24 tax year It is set by HMRC and is a fixed amount To calculate the tax you ll pay multiply 757 by your personal income tax Fuel benefit tax is based on flat annual rate that s 27 800 in the 2023 34 financial year The percentage of that figure that you have to pay in tax is tied to your

Download How Much Is Fuel Benefit Tax

More picture related to How Much Is Fuel Benefit Tax

Tax Saving Salary Components BetterPlace

https://www.betterplace.co.in/blog/wp-content/uploads/2020/02/19-1.jpg

Government Is Now Eyeing To Suspend Excise Tax On Fuel CarGuide PH

https://4.bp.blogspot.com/-U2cT_mrQd4k/WwZDclGbIRI/AAAAAAAAyDE/CFMgMZH1azAVzqvf6MoDowVjbqdEyWjIgCLcBGAs/s1600/fuel_filling.jpg

How You Can Benefit From Tax Experts And Tax Reform Nerdynaut

https://www.nerdynaut.com/wp-content/uploads/2019/08/How-You-Can-Benefit-from-Tax-Experts-and-Tax-Reform.png

A company car fuel benefit is a tax charged to you for using the fuel paid for by your employer as HMRC considers it as free fuel Therefore it will still cost you to Our Company Car Benefit And Tax Calculator gives you an instant calculation of the company car benefit and tax often called the benefit in kind or BIK calculator on a

Conservative estimates put U S direct subsidies to the fossil fuel industry at roughly 20 billion per year with 20 percent currently allocated to coal and 80 percent For example you pay a rate of 52 95 pence per litre for petrol diesel biodiesel and bioethanol and a rate of 28 88 pence per kg for LPG Fortunately you can

7 Lessons I Learned From An Accidental Millionaire

http://www.danieledelnero.com/wp-content/uploads/2020/07/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png

How Much Is Fuel Price In Your Area YouTube

https://i.ytimg.com/vi/CaOw6OselaI/maxresdefault.jpg

https://www.gov.uk/expenses-and-benefits-company-cars

Calculate tax on employees company cars Expenses and benefits for employers Running payroll

https://www.gov.uk/government/publications/van...

The Van Benefit and Car and Van Fuel Benefit No 2 Order 2021 SI 2021 1422 set the charges for 2022 to 2023 It set the van benefit at 3 600 the car

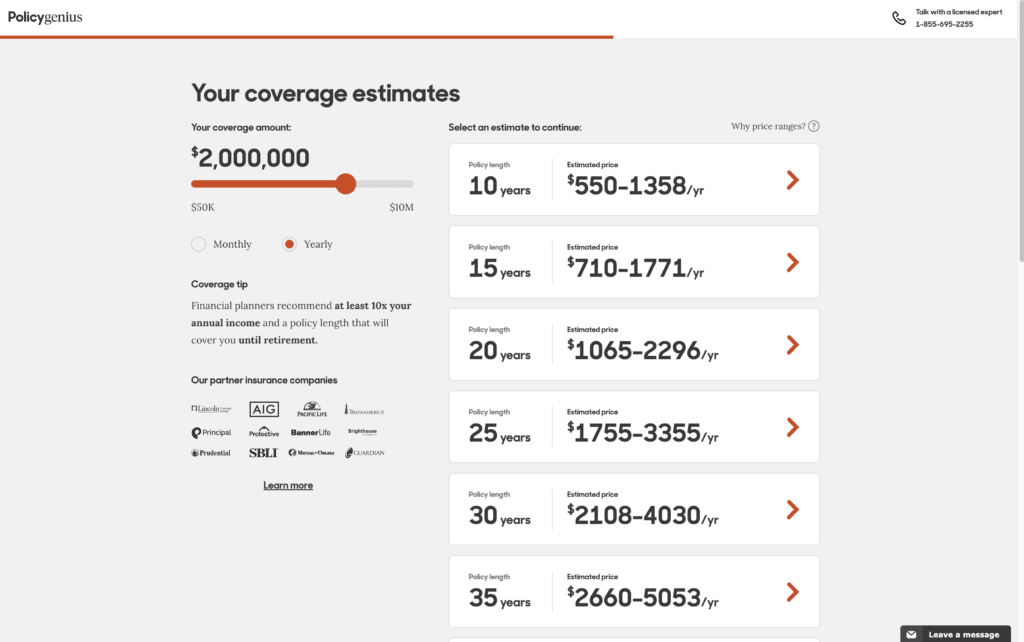

How Much Is 2 Million Life Insurance

7 Lessons I Learned From An Accidental Millionaire

How Much Is Fuel Duty What Tax Costs Per Litre And If It Will Be Cut

How Much Is Fuel In Your Area Politics Nigeria

What Is BBVA Immediate Cash And How Much Is The Commission American Post

How Much Does It Cost To Get Fuel Delivered Your 2021 Guide Reality

How Much Does It Cost To Get Fuel Delivered Your 2021 Guide Reality

Find Out How Much Putin s Fortune Amounts To American Post

Fuel Scarcity Politics Nigeria

Winter Fuel Payment How Much Is It And How Do I Claim OVO Energy

How Much Is Fuel Benefit Tax - The taxable amount is 3 960 for 2023 24 up from 3 600 for 2022 23 The rise means that a basic rate taxpayer will pay 792 a year in tax and a higher rate