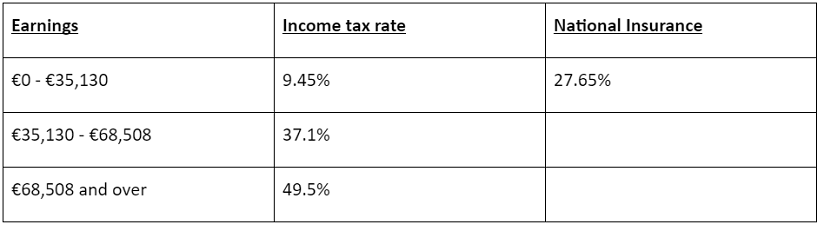

How Much Is The Tax In The Netherlands The Netherlands taxes its residents on their worldwide income non residents are subject to tax only on income derived from specific sources in the Netherlands mainly income from employment director s fees business income and income from Dutch immovable property Personal income tax rates

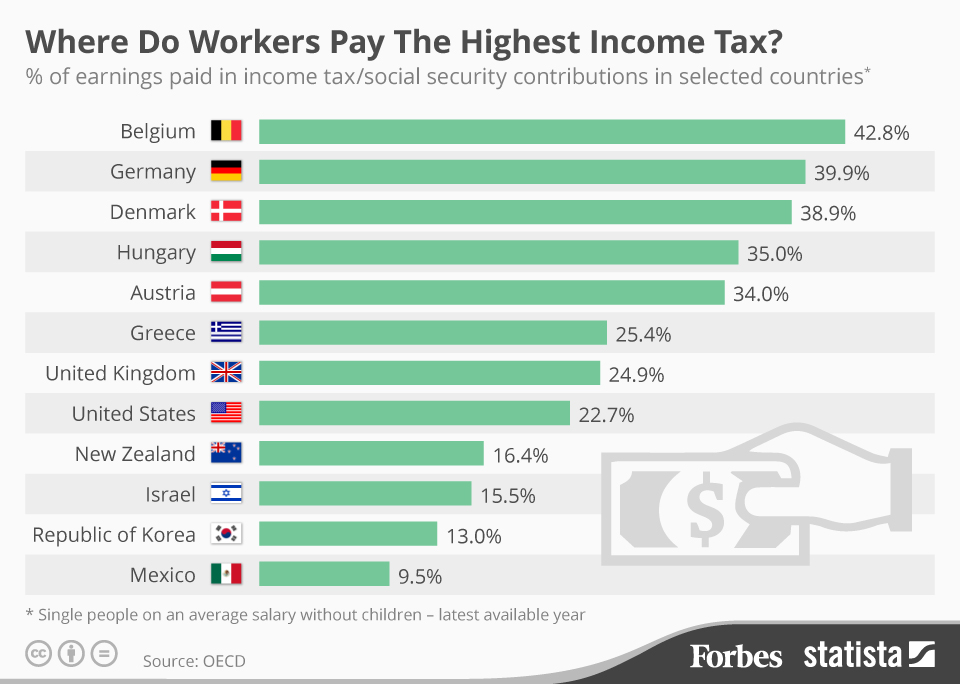

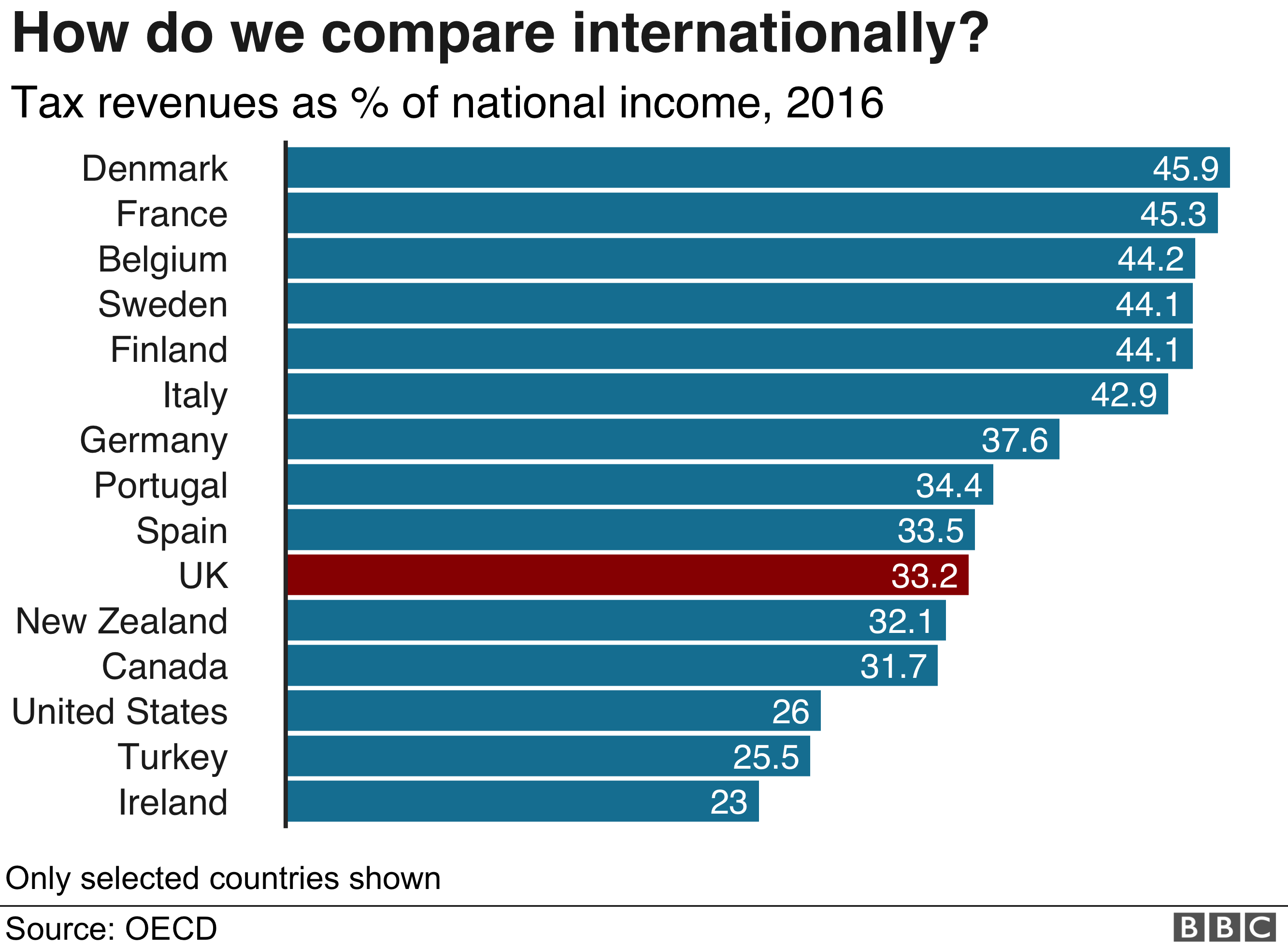

The annual taxable salary for an employee with a master s degree and who is younger than 30 years must be more than 35 048 2023 31 891 The annual taxable salary for other employees must be more than 46 107 2023 41 954 In 2024 the top income tax rate in the Netherlands is 49 5 While some might feel that Dutch income taxes are high it could be worse According to the Tax Foundation Denmark 55 9 France 55 4 and Austria 55 have the highest top tax rates in the European Union EU

How Much Is The Tax In The Netherlands

How Much Is The Tax In The Netherlands

https://i1.wp.com/infographicfacts.com/wp-content/uploads/2016/12/Tax-in-Netherland.jpg?fit=2480%2C1753

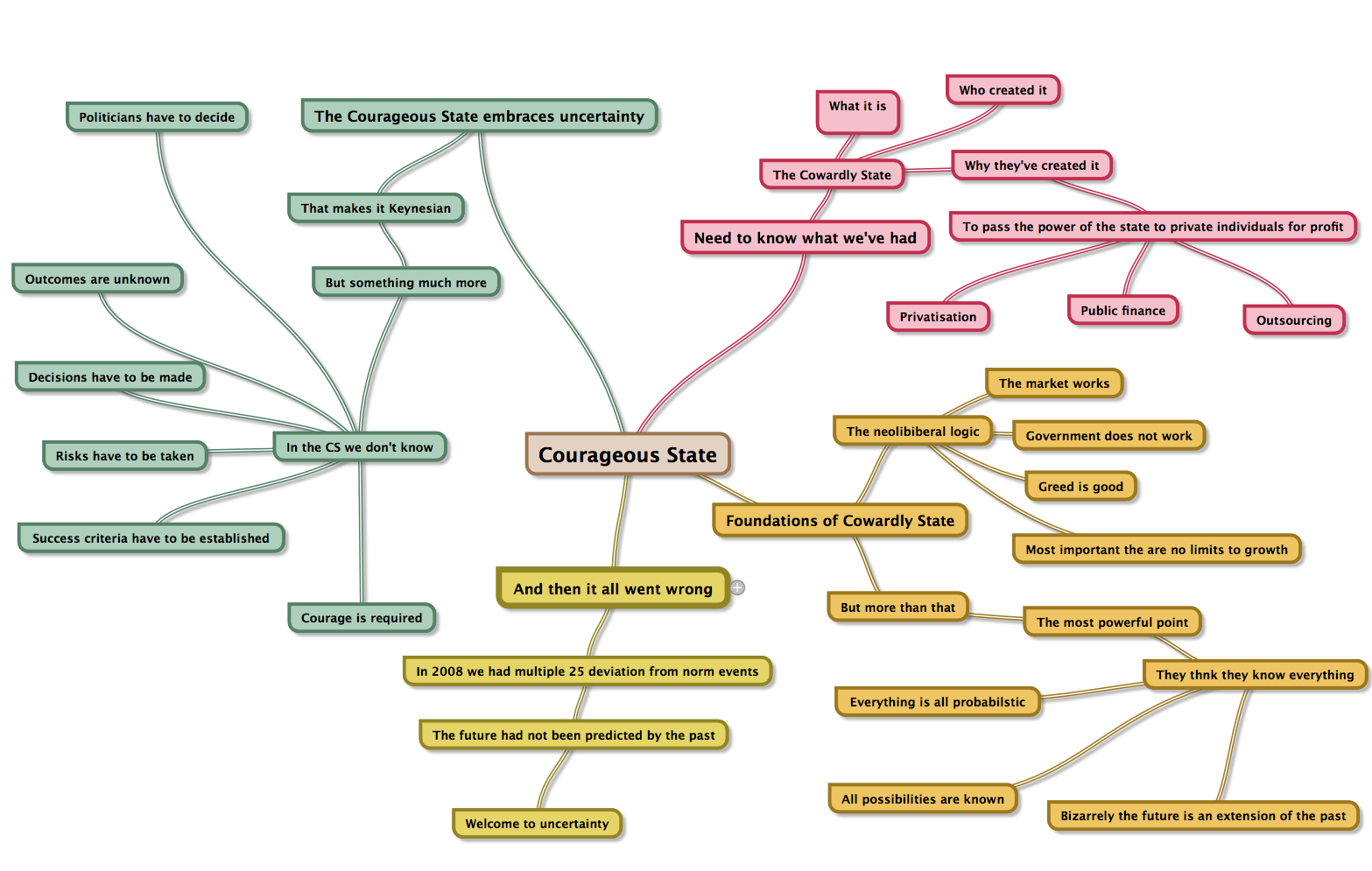

Innovations And Ideas In Tax In The Netherlands

http://www.taxresearch.org.uk/Blog/wp-content/uploads/2012/09/Screen-shot-2012-09-24-at-09.00.021.png

Corporate Tax In The Netherlands A Guide For Businesses Expatica

https://www.expatica.com/app/uploads/sites/3/2021/03/corporate-tax-netherlands-1536x1024.jpg

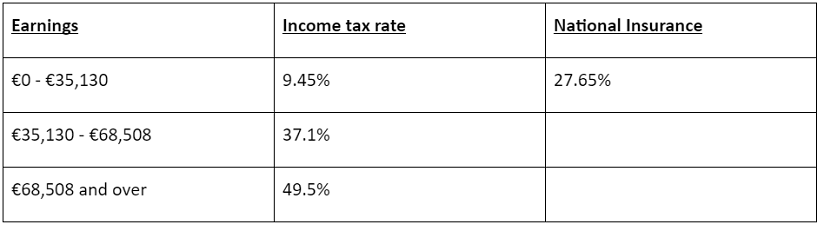

The 30 reimbursement ruling is a tax advantage for certain expat employees in the Netherlands The most significant benefit is that the taxable amount of your gross Dutch salary is reduced from 100 to 70 So 30 of your wage is tax free Visit the 30 ruling page for more information Income tax rate The income tax you pay is the total amount of tax calculated on your income your financial interests in a company and your savings and investments less deductible items Tax credits are deducted from the total tax payable

Dutch salary calculator with 30 ruling option Learn how much tax you pay on your income in Netherlands You pay tax in the Netherlands on your income on your financial interests in a company and on your savings and investments The Tax and Customs Administration collects income tax It uses the tax revenues to pay for roads benefits and the judiciary

Download How Much Is The Tax In The Netherlands

More picture related to How Much Is The Tax In The Netherlands

How Do I Settle My Tax In The Netherlands Through DigiD Aangifte24

https://aangifte24.com/wp-content/uploads/2023/02/How-do-I-settle-my-tax-in-the-Netherlands-through-DigiD.png

Learn More About Filing US Expat Taxes Netherlands

https://www.greenbacktaxservices.com/wp-content/uploads/2020/07/us-expatriate-tax-in-Netherlands.jpg

Payroll And Tax In The Netherlands

https://info.leap29.com/hubfs/eGuide - Landing Page33.jpg

The income tax in the Netherlands for 2023 is 36 93 between 0 73 071 and 49 50 between 73 071 and upwards Are taxes high in the Netherlands The Netherlands is considered a Welfare state where higher earners pay up to 49 5 taxes over their salary The total tax is the sum in the three boxes minus the general tax credit algemene heffingskorting a maximum of 3070 as of 2023 and labor tax credit arbeidskorting a maximum of 5052 as of 2023 that both are income dependent

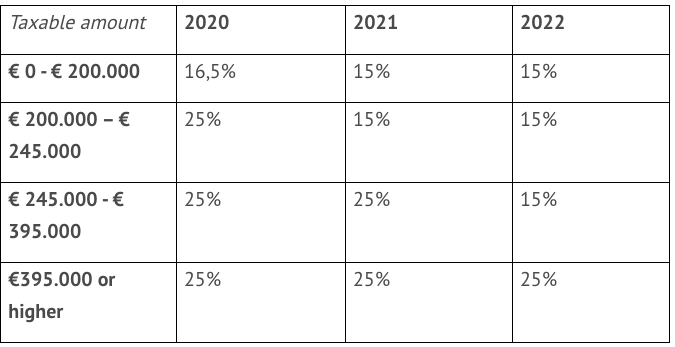

The Income tax rates and personal allowances in Netherlands are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in We analyze the most important Taxes in the Netherlands to understand how much tax workers companies investors consumers and buyers of real estate pay

Taxes A Dutch Salary Of 3 000 EUR What Is My Net And Can I Live On

http://i.stack.imgur.com/R3YBN.png

Dutch 2021 Tax Bill Presented Lexology

https://d2dzik4ii1e1u6.cloudfront.net/images/lexology/static/6acc7e7a-739f-4a60-8990-009102861788.png

https://taxsummaries.pwc.com/netherlands/...

The Netherlands taxes its residents on their worldwide income non residents are subject to tax only on income derived from specific sources in the Netherlands mainly income from employment director s fees business income and income from Dutch immovable property Personal income tax rates

https://thetax.nl

The annual taxable salary for an employee with a master s degree and who is younger than 30 years must be more than 35 048 2023 31 891 The annual taxable salary for other employees must be more than 46 107 2023 41 954

Top 10 Countries With The Highest Income Tax Rate Vlassis Co

Taxes A Dutch Salary Of 3 000 EUR What Is My Net And Can I Live On

A Sugar Tax In The Netherlands Could That Even Work Erasmus

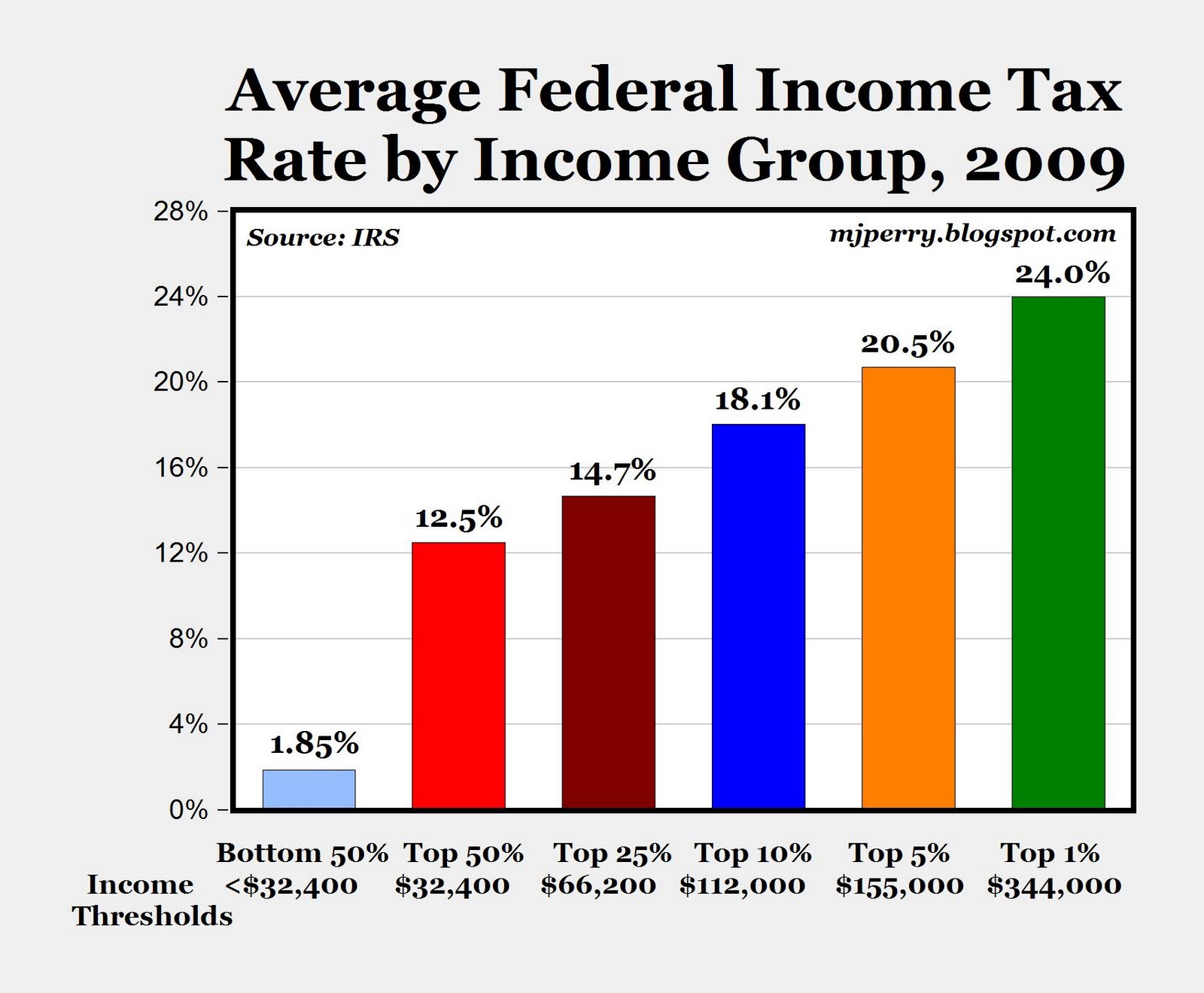

Canadians Now Paying Lower Income Taxes Than Americans OECD Data Shows

Basic Rate Of Income Tax Economics Help

Ghidul T u Privind Taxele Din Olanda

Ghidul T u Privind Taxele Din Olanda

General Election 2019 How Much Tax Do British People Pay BBC News

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Warren Buffett Updates He Sheltered Millions Through Giving To Charity

How Much Is The Tax In The Netherlands - The 30 reimbursement ruling is a tax advantage for certain expat employees in the Netherlands The most significant benefit is that the taxable amount of your gross Dutch salary is reduced from 100 to 70 So 30 of your wage is tax free Visit the 30 ruling page for more information