How Much Tax Credit Do You Get For Paying Student Loans Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

Verkko 10 helmik 2020 nbsp 0183 32 If you are a student and make more than 12 000 in taxable income in a fiscal year you can use one of these student loan tax credits and the tax Verkko 27 lokak 2023 nbsp 0183 32 Key takeaways Tax credits and deductions can help students their parents and educators offset the costs of higher education and classroom supplies

How Much Tax Credit Do You Get For Paying Student Loans

How Much Tax Credit Do You Get For Paying Student Loans

https://www.unigo.com/wp-content/uploads/2015/11/5-tips-for-paying-back-student-loans.jpg

.jpeg#keepProtocol)

Student Loan Forgiveness And Your Taxes

https://www.toptaxdefenders.com/hubfs/student loan forgiveness and your taxes (1).jpeg#keepProtocol

10 Steps To Paying Off Your Student Loans Fast TwentyFree

https://www.twentyfree.co/wp-content/uploads/2020/09/10-Steps-To-Paying-Off-Your-Student-Loans-Fast-1024x576.png

Verkko 25 tammik 2023 nbsp 0183 32 Yes You can still receive 40 of the American opportunity tax credit s value up to 1 000 even if you earned no income last year or owe no tax For example if you qualified for a Verkko 13 helmik 2023 nbsp 0183 32 The credit is calculated as 100 of the first 2 000 of qualifying expenses plus 25 of the next 2 000 making the maximum credit 2 500 per student Eligible expenses include tuition and

Verkko 29 tammik 2020 nbsp 0183 32 This tax credit covers qualified educational expenses whether you paid these with scholarships personal income college savings account money or Verkko 22 lokak 2023 nbsp 0183 32 Up to 2 500 of student loan interest paid each year can be claimed as a deduction on Schedule 1 of the Form 1040 For 2023 the break begins to phase out

Download How Much Tax Credit Do You Get For Paying Student Loans

More picture related to How Much Tax Credit Do You Get For Paying Student Loans

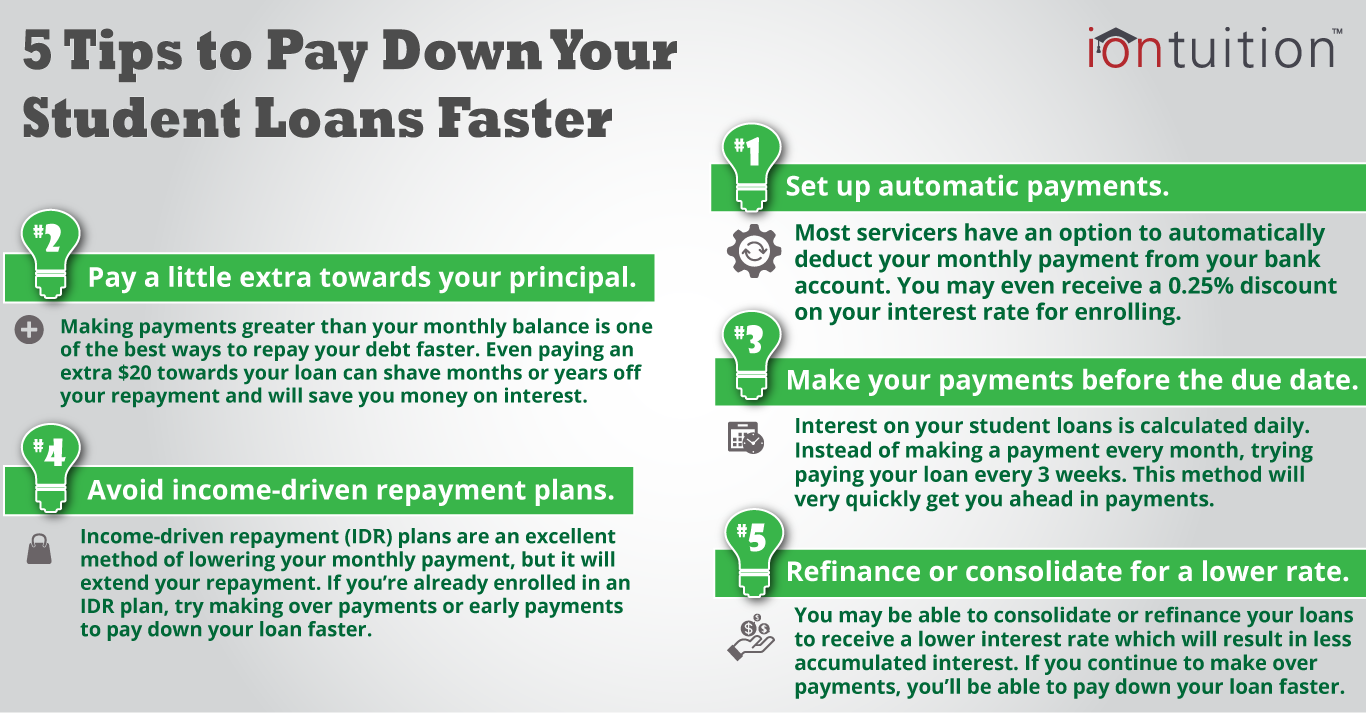

5 Tips To Repay Your Student Loans Faster IonTuition

https://s28637.pcdn.co/wp-content/uploads/2017/12/5-tips-to-pay-down-your-student-loans-faster_content.png

Request Letter From Parents For Payment Of Fees School Fees Payment

https://i.ytimg.com/vi/MZI_MAmpzbc/maxresdefault.jpg

How To Pay Off Student Loans Fast With These 15 Proven Strategies

https://i.pinimg.com/originals/f2/9f/b1/f29fb1b31c8d4e7ba08a6142ec4b49e8.png

Verkko Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the Verkko 11 jouluk 2023 nbsp 0183 32 In 2023 if your MAGI is below 75 000 for single filers or 150 000 for married filing jointly you can claim the full student loan tax deduction if certain

Verkko 26 lokak 2023 nbsp 0183 32 The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct the interest paid on your student loans from your taxable income You can claim this deduction

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return

https://cdn.mos.cms.futurecdn.net/Q6FW9iHViwDjjo7YZxrHj3.jpg

What To Do After Paying Your Student Loans CreditCarder

https://creditcarder.com/wp-content/uploads/4862-min-1-scaled.jpg

https://www.nerdwallet.com/.../loans/student-loans/8-student-faqs-taxes

Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

.jpeg#keepProtocol?w=186)

https://collegefinance.com/tax-credit/tax-credits-for-student-loans...

Verkko 10 helmik 2020 nbsp 0183 32 If you are a student and make more than 12 000 in taxable income in a fiscal year you can use one of these student loan tax credits and the tax

7 Genius Tips For Paying Student Loans Off Savings And Sangria

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return

How To Pay Off Student Loan Faster Even If You Are Broke My Worthy

10 Effective Ways To Reduce Your Student Loan Debt Student Loan Debt

How To Pay Off Student Loans Quickly Paying Off Student Loans

Earned Income Tax Credit

Earned Income Tax Credit

Student Loan Payments Set To Resume What Borrowers Need To Know About

4 Ways To Pay Off Your Student Loans Faster Bright Money By Bright

Pros And Cons Of Paying Off Student Loans Early Estudentloan

How Much Tax Credit Do You Get For Paying Student Loans - Verkko 10 marrask 2022 nbsp 0183 32 Deducting student interest lowers your adjusted gross income AGI which can help you qualify for other deductions and tax credits with AGI limits