How To Claim Eis Tax Relief For Previous Year You would only be able to include an EIS claim in your 22 23 tax return for that tax year If your claim is for tax relief on an investment of over 33333 then this

If you want to claim the tax relief against a previous year This could be the case if you wish to use carry back or if you didn t receive your EIS3 or EIS5 certificate in time for The key thing to bear in mind if you re looking to claim these reliefs separately e g if the gain you d like to defer is in the current tax year but you d like to claim income tax relief

How To Claim Eis Tax Relief For Previous Year

How To Claim Eis Tax Relief For Previous Year

https://sleek.com/uk/wp-content/uploads/sites/6/2023/01/how-to-claim-eis-tax-relief.png

How To Claim EIS Income Tax Relief Key Business Consultants

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2020/11/Claiming-EIS-Income-Tax-Relief-Step-by-Step-Guide.jpg

EIS Income Tax Relief Restriction For Connected Parties Thompson

https://www.thompsontarazrand.co.uk/wp-content/uploads/2019/02/2019-02-14-986505-1.jpg

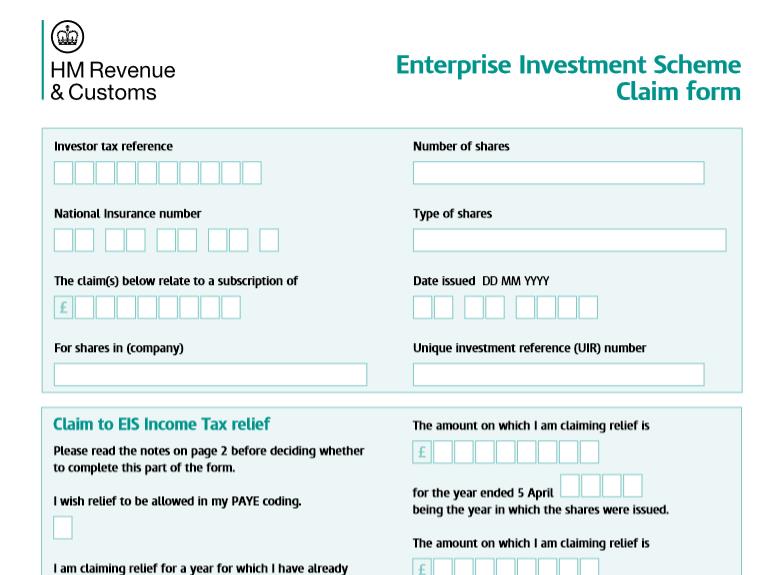

The maximum is 1 million If you have already received some relief during the year by a change in PAYE code or reduction in payment on account include this amount However if an amount is Carry back applying tax relief to a previous year Reduction or elimination of Inheritance Tax on eligible EIS shares held for two years Two options for EIS investment There are two options for investing with

Benefits There are a number of potential tax reliefs associated with EIS Income Tax relief Individuals who subscribe for shares in an EIS qualifying company will If you want to claim for the previous tax year make your claim on your Self Assessment tax return For more information see the helpsheets for Enterprise

Download How To Claim Eis Tax Relief For Previous Year

More picture related to How To Claim Eis Tax Relief For Previous Year

Here s How To Claim EIS Tax Reliefs This Tax Year

https://www.syndicateroom.com/images/banners/tax-banner-2.jpg

What Is SEIS And EIS Tax Relief Schemes In The UK Startups Investment

https://images.squarespace-cdn.com/content/v1/5ce3f8b34c89640001311321/1630575034607-C6NI0Y4YKVY72J9RJLOS/SEIS+and+EIS+Tax+Relief+Schemes-01.jpg

Here s How To Claim EIS Tax Reliefs This Tax Year

https://www.syndicateroom.com/images/EIS3-claim-form.jpg

Investors with capital gains made up to three years before or one year after an EIS investment is made can claim deferral relief against those gains at up to 24 for Investors can use the scheme s carry back feature to apply the relief to the preceding tax year on eligible investments What EIS tax reliefs are available For

Investors in unapproved EIS funds can choose to treat an investment as if it was made in the previous tax year which can be useful for tax planning It also means that up to 2 SEIS allows early stage companies to invest up to 100 000 per tax year and receive a tax break of 50 in return If you invest in SEIS you can also benefit from a tax exemption

How To File Your EIS And SEIS Claims TrendScout UK

https://www.trendscoutuk.com/wp-content/uploads/2021/03/TS-UPDATED-F.IMG-How-To-File-Your-EIS-and-SEIS-Claims-072222-1024x576.png

How To Claim Eis Client Is Claiming Eis Relief And Has Given Me Form

https://s.w-x.co/de-Eis_See_Einbruch.jpg

https://community.hmrc.gov.uk/customerforums/sa/68...

You would only be able to include an EIS claim in your 22 23 tax return for that tax year If your claim is for tax relief on an investment of over 33333 then this

https://www.wealthclub.co.uk/how-to-claim-eis-tax-relief

If you want to claim the tax relief against a previous year This could be the case if you wish to use carry back or if you didn t receive your EIS3 or EIS5 certificate in time for

.jpg)

EIS Tax Relief EIS Scheme Explained

How To File Your EIS And SEIS Claims TrendScout UK

What Is EIS Tax Relief EIS Tax Relief Explained EMV Capital

How To Claim EIS Income Tax Relief Step by step Guide How To Claim

How To Claim EIS Tax Relief Skope Entertainment Inc

How To Claim EIS Tax Relief

How To Claim EIS Tax Relief

How Do I Claim An EIS Loss Relief On My Taxes KBC

How To Claim EIS Tax Relief WIS Accountancy

How To Claim EIS Tax EMV Capital

How To Claim Eis Tax Relief For Previous Year - How do I claim for a previous year How does EIS work for jointly held shares How do I defer a capital gain EIS Infographic EIS shares must be held for a minimum of 3 years