Hra Deduction Income Tax Verkko Income Tax Department gt Tax Tools gt House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent Allowance

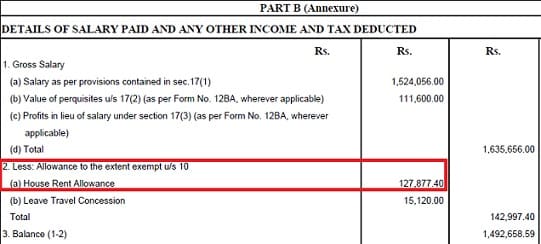

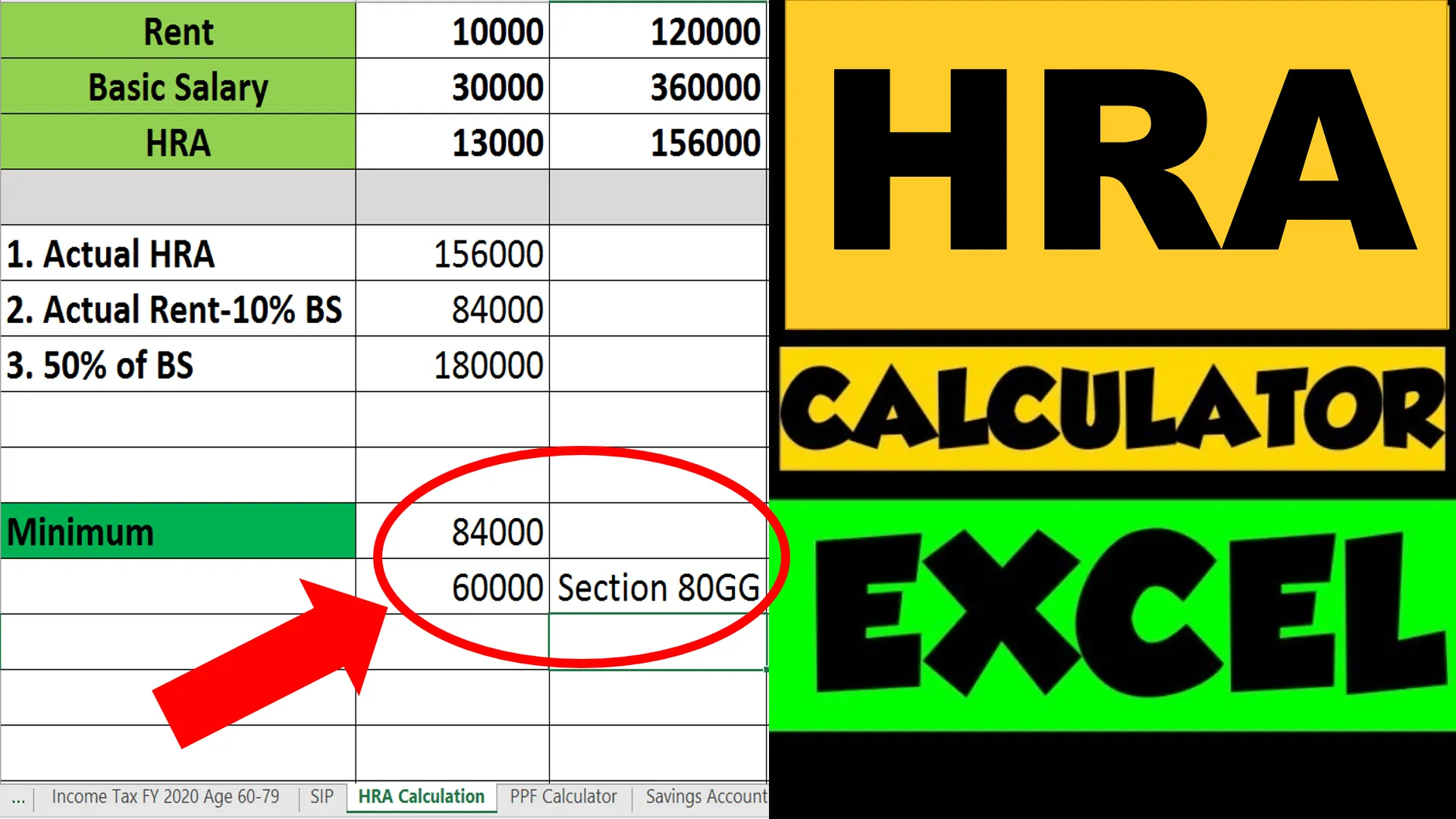

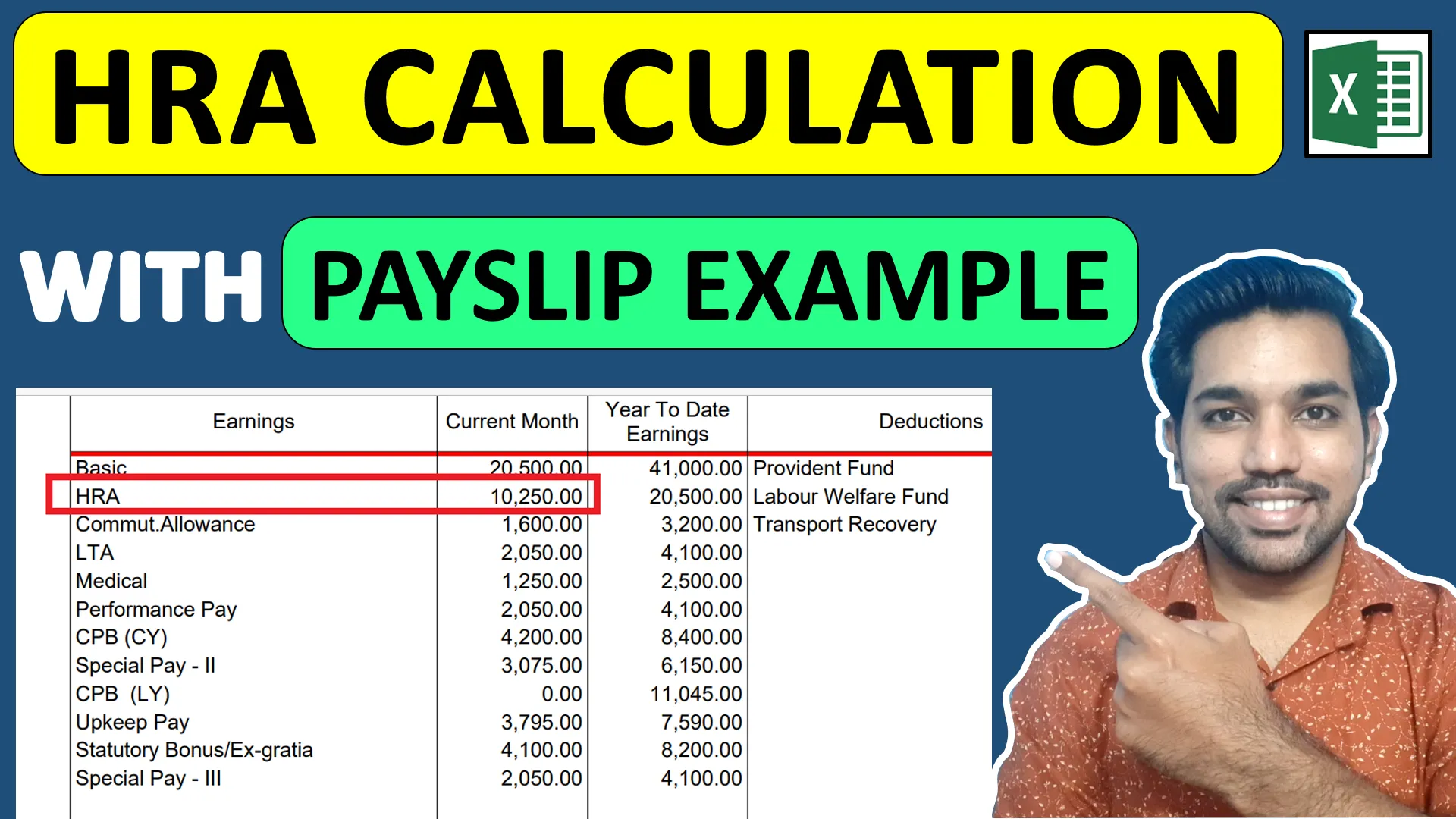

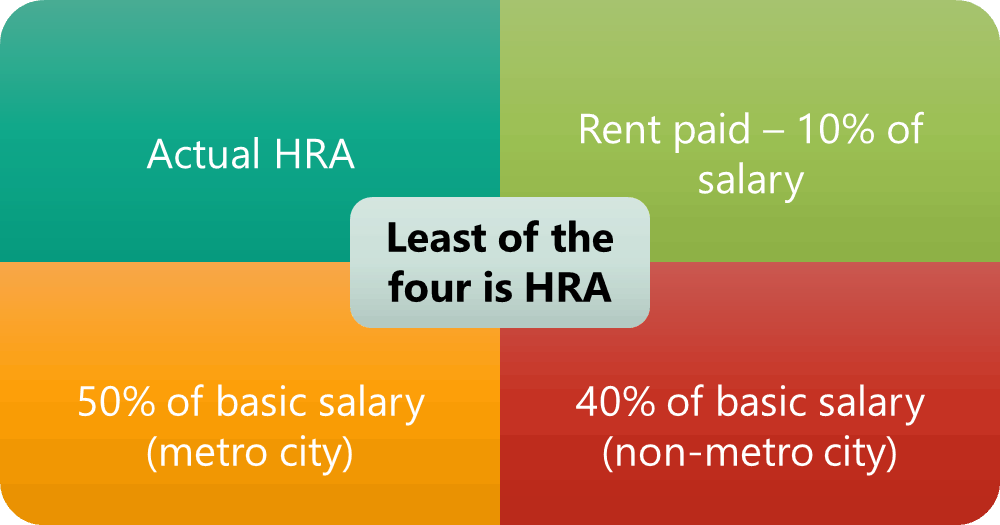

Verkko 5 toukok 2020 nbsp 0183 32 Rent paid exceeds 10 of Salary HRA is a part of Salary Can be seen in Form 16 B Sr no 2 e Not paying rent to spouse 2 HOW MUCH DEDUCTION CAN BE TAKEN Deduction available is least of the following i Actual HRA Received ii 50 of Basic salary DA for living in Metro Cities 40 for Non Verkko Yes the amount of your home loan or mortgage you repay during a given financial year can be claimed as a deduction from your total taxable income The principal component of your home loan EMIs is deductible up to 1 5 Lakhs per year u s 80C of the Income Tax Act 1961 while the interest component is deductible up to 2 Lakhs per year u s

Hra Deduction Income Tax

Hra Deduction Income Tax

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

https://i.ytimg.com/vi/J04no0lpYJA/maxresdefault.jpg

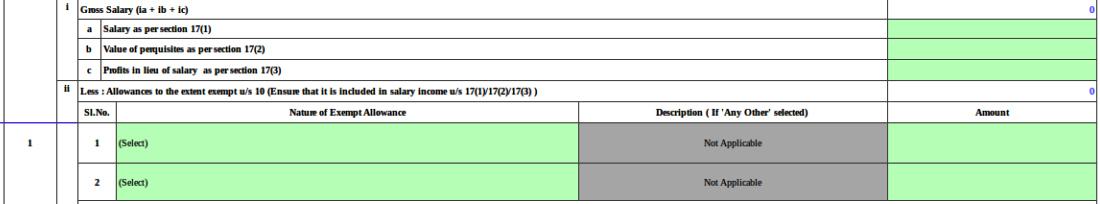

How To Show HRA Not Accounted By The Employer In ITR

http://bemoneyaware.com/wp-content/uploads/2016/07/hra-in-form-16-section-10.jpg

Verkko Rs 2 000 per month 25 of total income Actual Rent less 10 of Income In both the above cases income to exclude long term capital gain short term capital gain under section 111A and Income under section 115A or 115D and deductions 80C to 80U Also income is before making deduction under section 80GG How to claim HRA when Verkko Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A

Verkko 19 jouluk 2023 nbsp 0183 32 To claim HRA from their employers many salaried employees usually use either rent receipts or rent agreement as proof of the rent paid in a financial year However tax experts point out that assessing officer of the income tax department can reject HRA tax exemption claim if any one of the documentary evidence is missing Verkko 16 kes 228 k 2023 nbsp 0183 32 Despite being a portion of your compensation HRA is not taxed Section 10 13A of the Income Tax Act of 1961 exempts a portion of HRA from taxes subject to specific restrictions The whole HRA exemption is subtracted from gross income before determining taxable income This enables a person to reduce their tax

Download Hra Deduction Income Tax

More picture related to Hra Deduction Income Tax

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Know Income Tax Deduction For HRA House Rent Allowance

https://image.slidesharecdn.com/hra-191227124416/95/know-income-tax-deduction-for-hra-house-rent-allowance-1-638.jpg?cb=1577450691

Verkko 1 hein 228 k 2022 nbsp 0183 32 HRA calculation Delhi based Rajat Ghai s monthly basic salary is Rs 50 000 and he receives Rs 18 000 as HRA For his rented home he pays Rs 15 000 as monthly rent In his case the deduction will be the least of the three amounts 50 of his basic salary Rs 25 000 Actual HRA Rs 18 000 Actual rent minus 10 of the Verkko 26 jouluk 2023 nbsp 0183 32 HRA tax exemption guide As the year ends employees often have to deal with tax matters and investment declarations especially those living in rented homes The House Rent Allowance HRA can

Verkko 22 syysk 2022 nbsp 0183 32 You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable The calculation of HRA deduction depends on multiple factors such as Your salary HRA received Actual rent paid City of residence 2 Eligibility Criteria To Claim Tax Deduction On HRA Verkko 5 kes 228 k 2023 nbsp 0183 32 House rent allowance HRA is the amount of your salary that your employer pays you to assist with your rent The government allows you to deduct a portion or the whole amount from your taxable income according to Section 10 13A of the Income Tax Act The rule is straightforward

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/hra-exemption-calculation-house-rent-allowance-excel-examples-video.webp

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://assets-news.housing.com/news/wp-content/uploads/2021/03/15192807/All-you-need-to-know-about-HRA-exemptions-FB-1200x700-compressed.jpg

https://incometaxindia.gov.in/Pages/tools/house-rent-allowance...

Verkko Income Tax Department gt Tax Tools gt House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent Allowance

https://taxguru.in/income-tax/house-rent-allowance-hra-exemption-rule…

Verkko 5 toukok 2020 nbsp 0183 32 Rent paid exceeds 10 of Salary HRA is a part of Salary Can be seen in Form 16 B Sr no 2 e Not paying rent to spouse 2 HOW MUCH DEDUCTION CAN BE TAKEN Deduction available is least of the following i Actual HRA Received ii 50 of Basic salary DA for living in Metro Cities 40 for Non

House Rent Allowance HRA Lenvica HRMS

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

HRA House Rent Allowance Exemption Rules Tax Deductions

What Is House Rent Allowance HRA Exemption Rules For FY 2018 19

Income Tax Savings HRA

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

HRA Exemption In Income Tax 2023 Guide InstaFiling

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

Hra Deduction Income Tax - Verkko 26 tammik 2023 nbsp 0183 32 The person applying for the HRA deduction is an employee or self employed The individual must reside in a rented home HRA tax calculations is not liable if you live in your own home You must be able to provide proof of rent paid ie valid receipts for house rent In other words if you don t pay the rent you can t claim the