Il Property Tax Rebate 2024 A qualified veteran with a service connected disability of at least 30 but less than 50 will receive a 2 500 reduction in EAV if the veteran has a service connected disability of 50 but less than 70 the annual exemption is 5 000 and if the veteran has a service connected disability of 70 or more the residential property is exempt

Property tax You May Qualify For an Illinois Property Tax Rebate Here s How to Find Out If You re Eligible Millions of Illinois residents may be eligible for property or income CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue Service

Il Property Tax Rebate 2024

Il Property Tax Rebate 2024

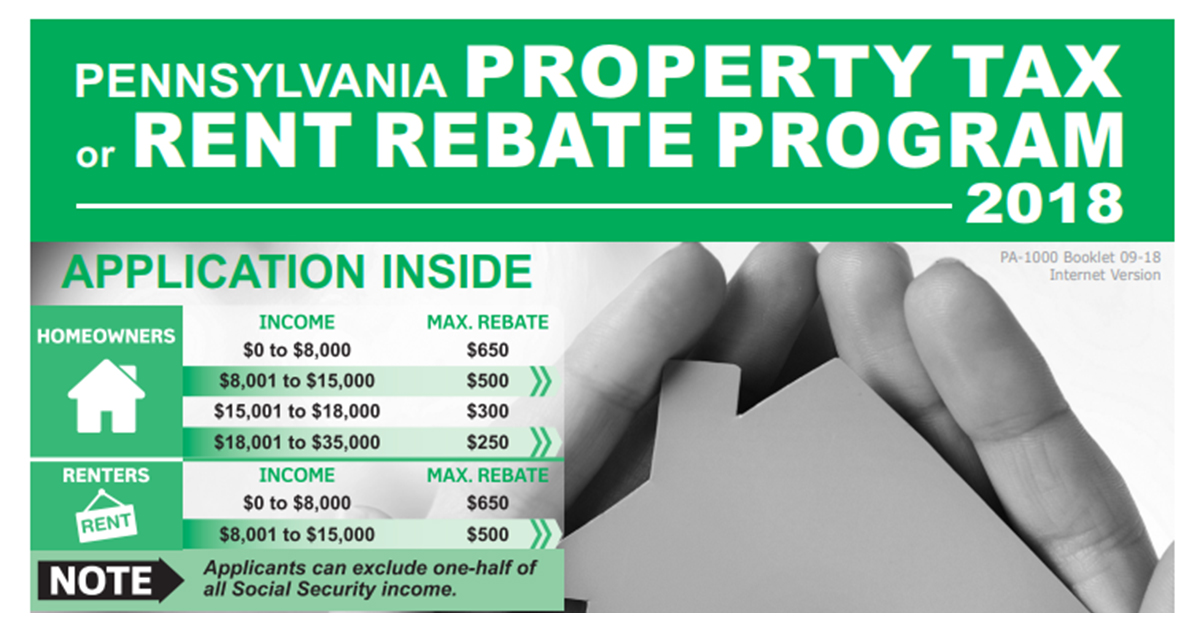

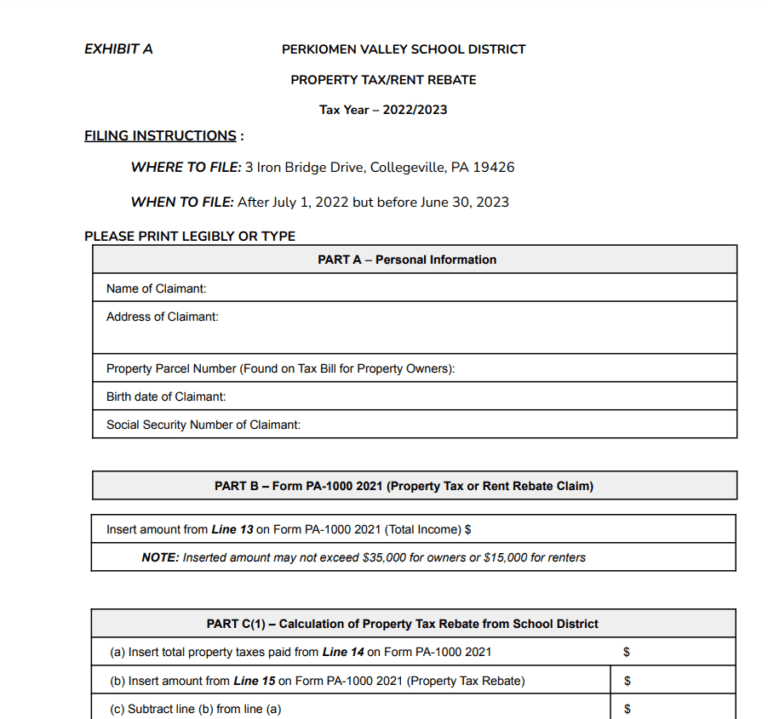

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

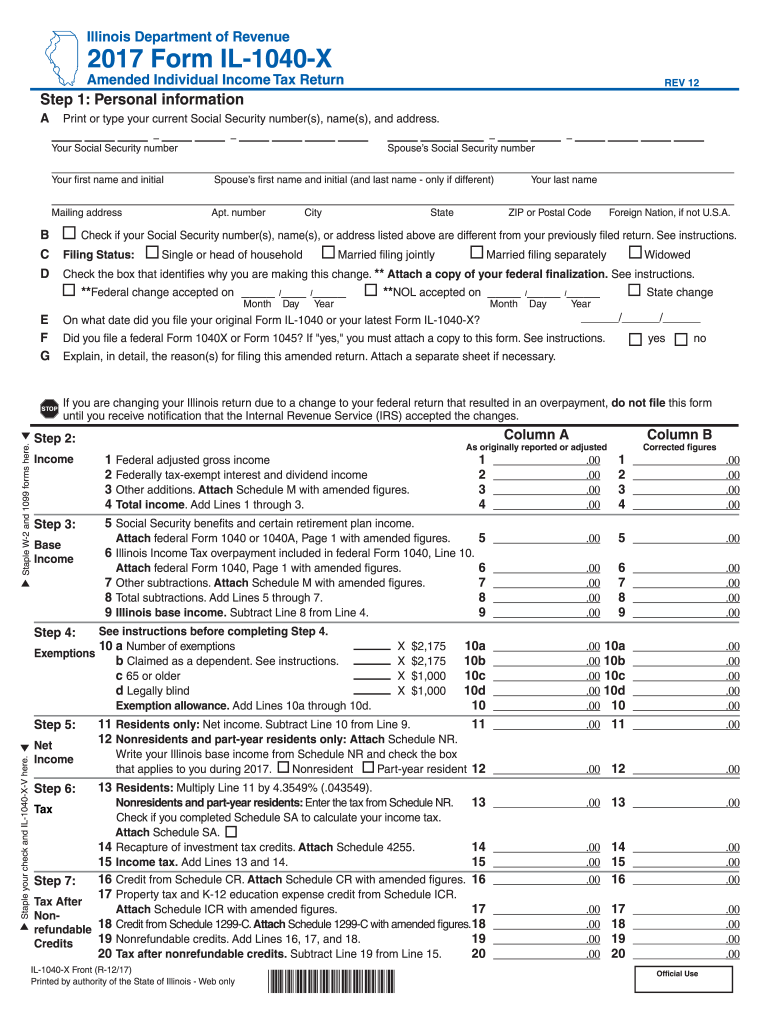

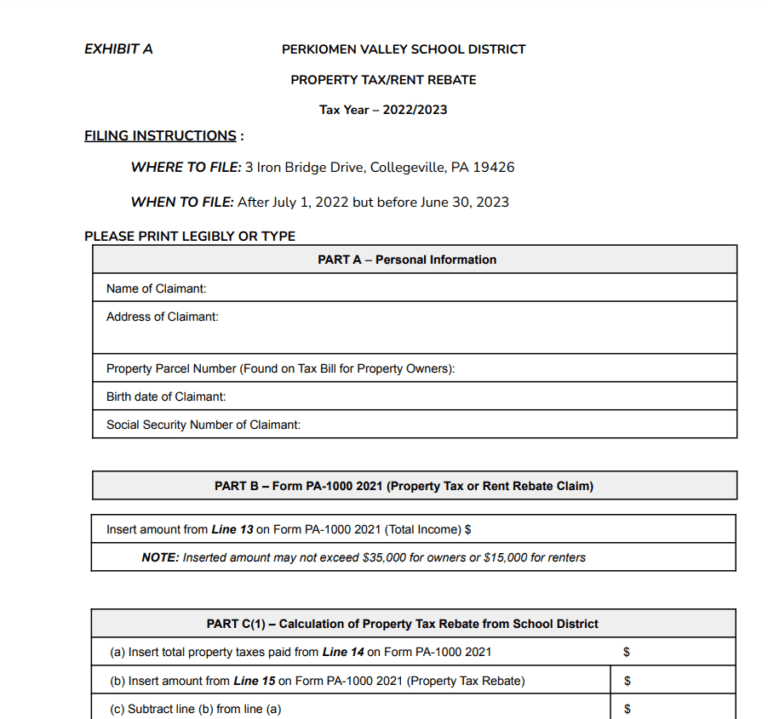

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/453/14/453014487/large.png

Quarterly 2024 estimated payments can be made in four equal installments based upon 90 percent of the expected liability for year 2024 or 100 percent of the liability of year 2023 to avoid penalty if the payments are made timely Cook County Treasurer s Office 12 21 2023 Lawndale News One of the biggest legislative reforms to the Illinois property tax system in decades takes effect with tax bills due March 1 2024 Read the story Cook County Treasurer s Office Chicago Illinois

Illinois offers senior citizens a property tax relief program that works like a loan The Senior Citizens Real Estate Tax Deferral program allows qualifying seniors to defer up to 7 500 per year in property taxes March 1 is the last day to apply for the program and seek deferral for 2023 taxes that will be due in 2024 Qualifying The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300

Download Il Property Tax Rebate 2024

More picture related to Il Property Tax Rebate 2024

Deadline For Tax And Rent Relief Extended

https://www.senatorhughes.com/wp-content/uploads/2022/06/property-tax-rebate-2021-booklet.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

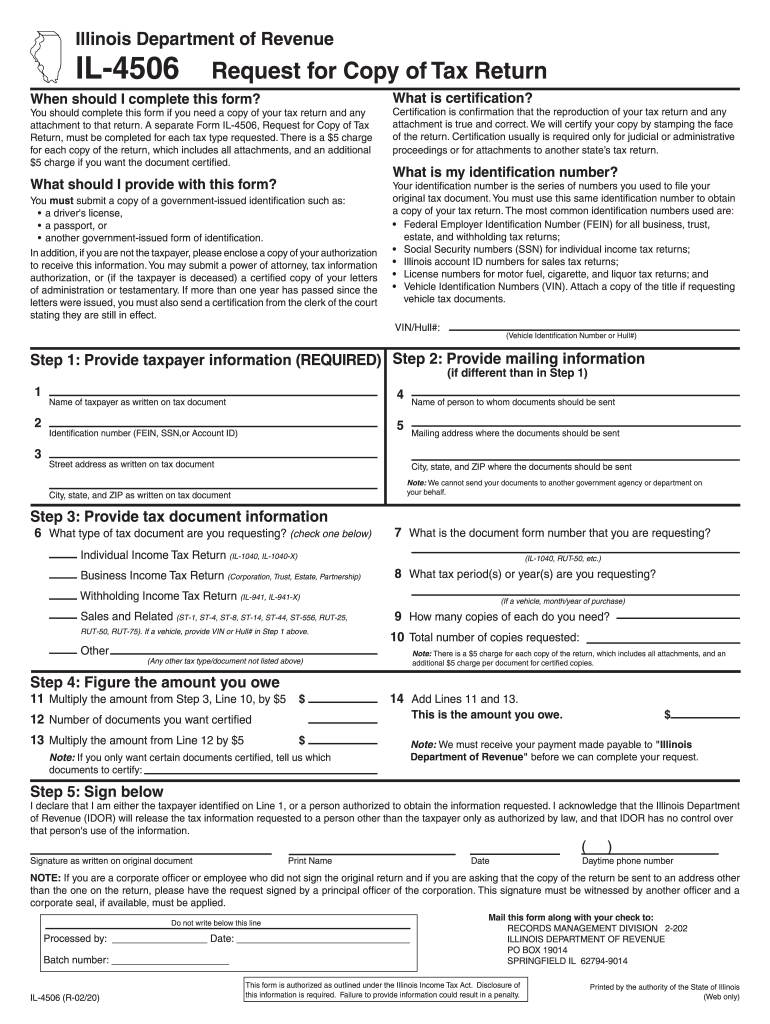

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly If filing alone your The Property Tax Rebate requires that recipients be Illinois residents who paid property taxes on their primary residence in 2021 and 2022 Their adjusted gross income must be 500 000 or

The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who is eligible for 2022 Illinois To claim only the property tax rebate older adults must complete and submit Form IL 1040 PTR either by mail or electronically through MyTax Illinois on or before Oct 17 2022 Step by step instructions are available here Additional assistance is available by calling the Illinois Department of Revenue at 1 800 732 8866 or 217 782 3336

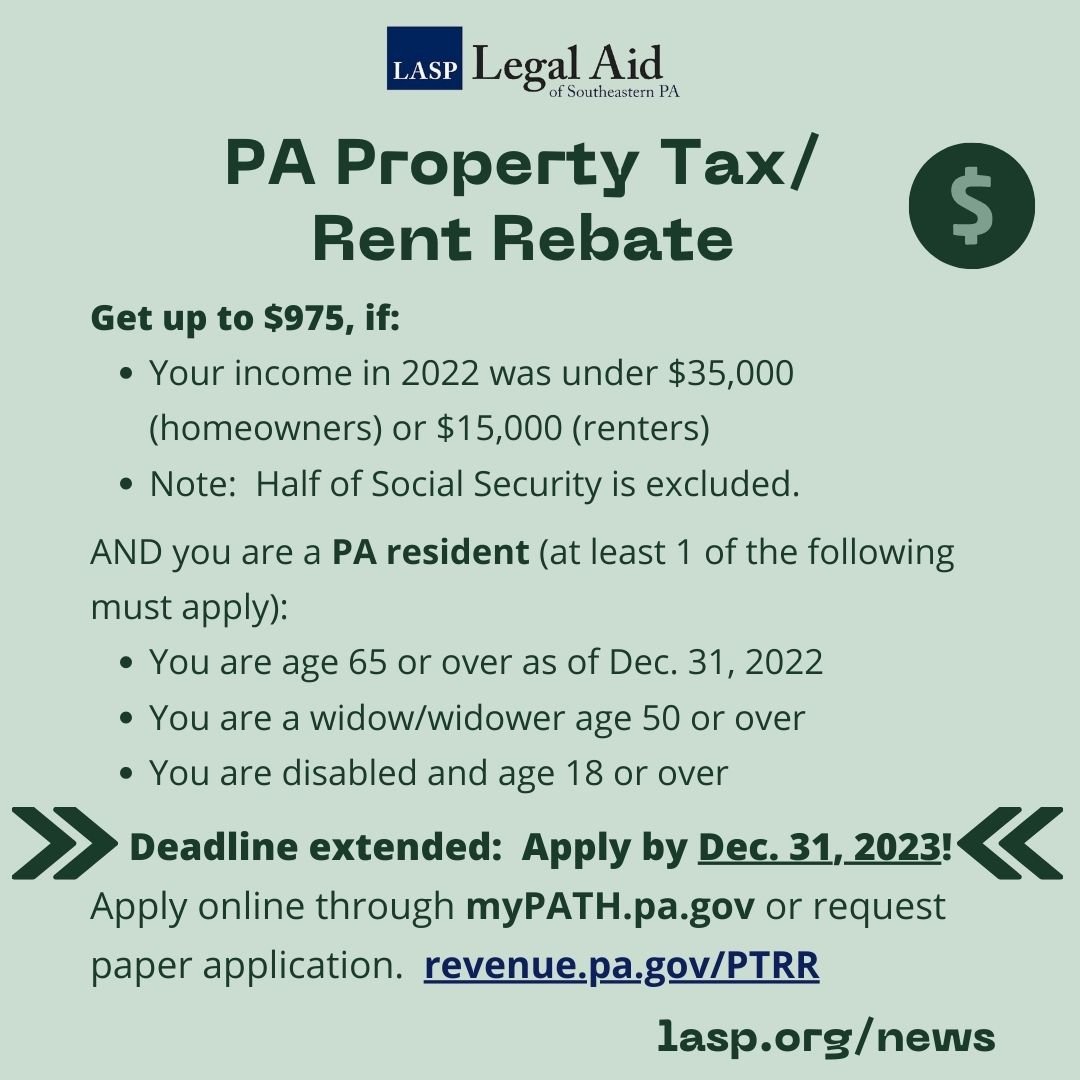

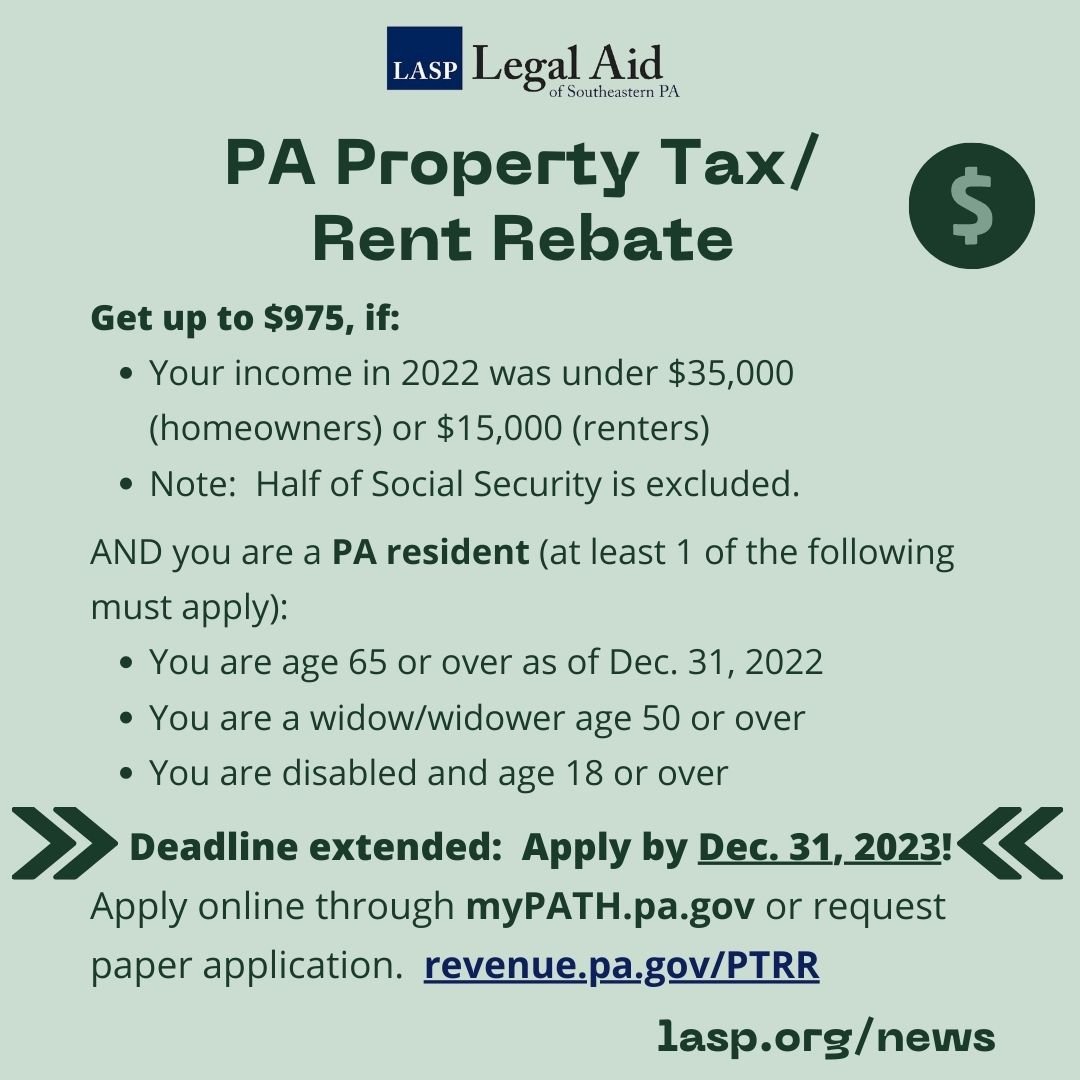

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

PA Property Tax Rebate What To Know Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2020/07/pa-property-tax-rebate.jpg

https://tax.illinois.gov/localgovernments/property/taxrelief.html

A qualified veteran with a service connected disability of at least 30 but less than 50 will receive a 2 500 reduction in EAV if the veteran has a service connected disability of 50 but less than 70 the annual exemption is 5 000 and if the veteran has a service connected disability of 70 or more the residential property is exempt

https://www.nbcchicago.com/news/local/you-may-qualify-for-an-illinois-property-tax-rebate-heres-how-to-find-out-if-youre-eligible/2954022/

Property tax You May Qualify For an Illinois Property Tax Rebate Here s How to Find Out If You re Eligible Millions of Illinois residents may be eligible for property or income

2016 Property Tax Rebate Instructional Video YouTube

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Il Form 505 I Printable Printable Forms Free Online

PROPERTY TAX REBATE Information Flyer Warminster Heights

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Il Property Tax Rebate 2024 - The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300