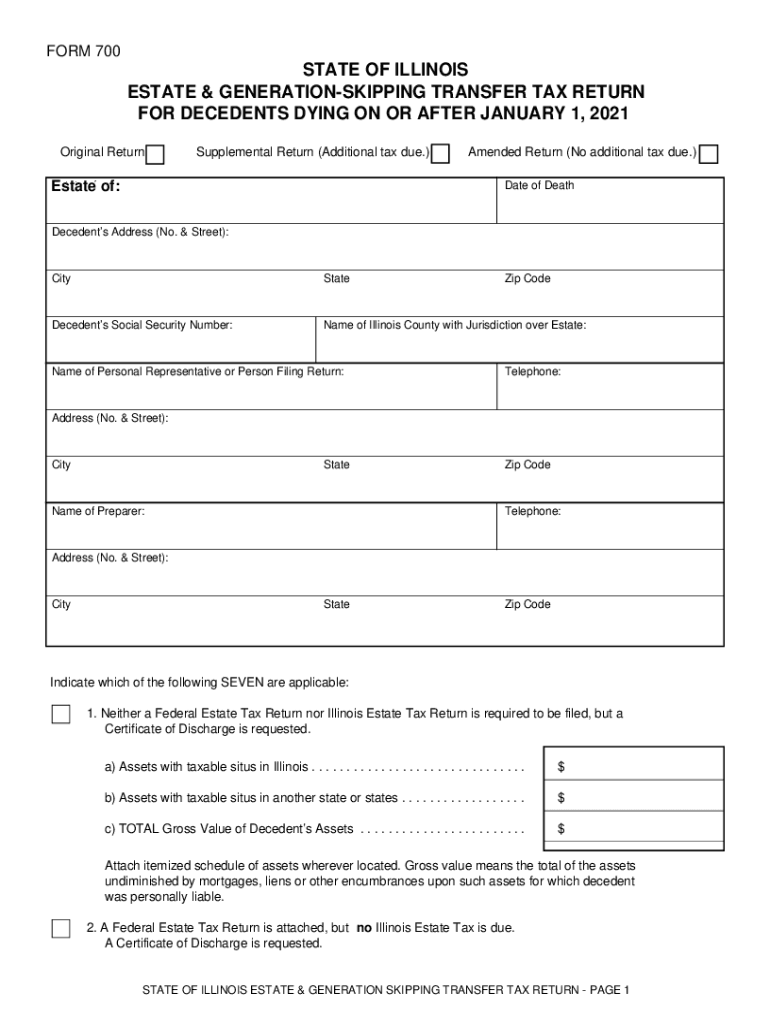

Illinois Estate Tax Return Form Verkko Estate Tax Forms Each year the Attorney General makes available forms and instructions to calculate and file estate taxes base on the year the individual died The

Verkko FORM 700 STATE OF ILLINOIS ESTATE amp GENERATION SKIPPING TRANSFER TAX RETURN FOR DECEDENTS DYING ON OR AFTER JANUARY 1 2023 For Office Verkko Illinois Estate Tax purposes are required to file the following Returns with the Illinois Attorney General 1 A Form 700 Illinois Estate and Generation Skipping Transfer

Illinois Estate Tax Return Form

Illinois Estate Tax Return Form

https://tbrnewsmedia.com/wp-content/uploads/2017/07/estate-tax-return-form.jpg

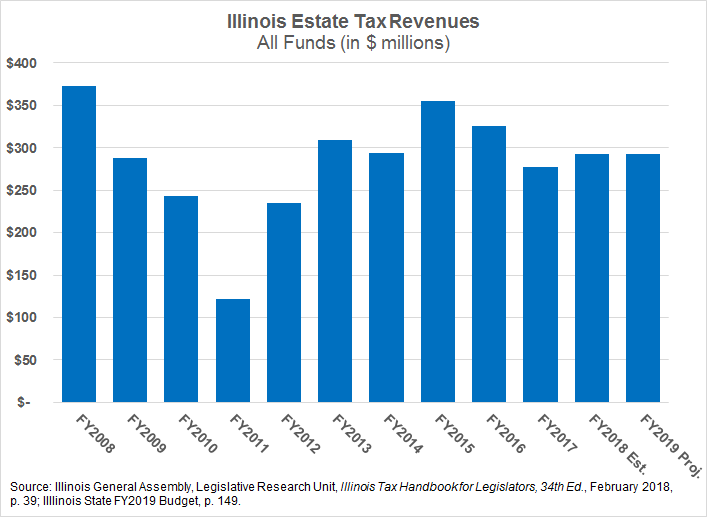

Whither The Illinois Estate Tax Civic Federation

https://www.civicfed.org/sites/default/files/estate_tax_3.png

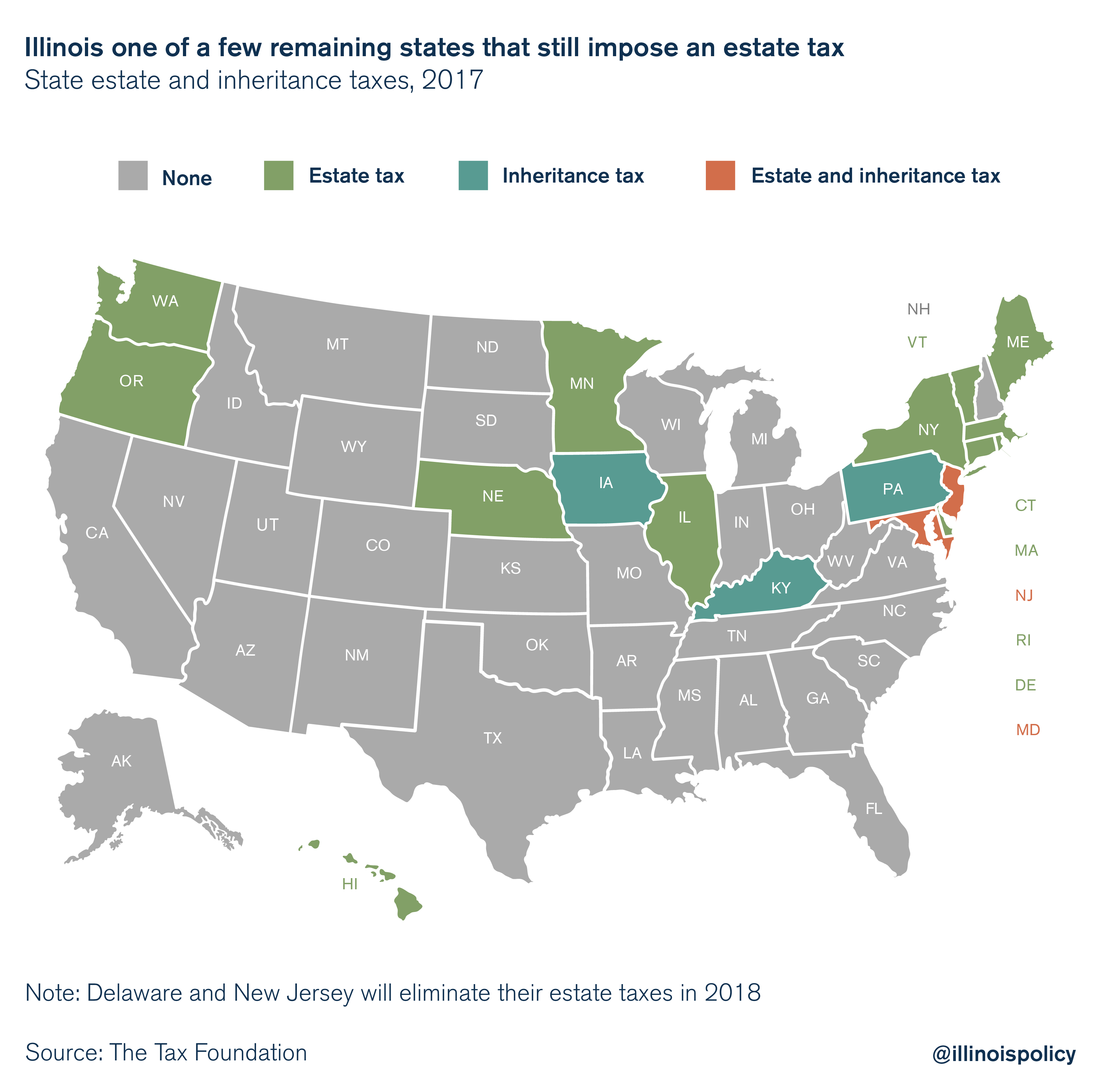

As Other States Repeal Illinois Death Tax Remains

https://files.illinoispolicy.org/wp-content/uploads/2017/11/Estate-tax_Graphic-2.png

Verkko You must file Form IL 1041 Fiduciary Income and Replacement Tax Return if you are a fiduciary of a trust or an estate and the trust or the estate has net income or loss as Verkko Estate Tax Payments Payments can be accepted via check e check or ACH An Estate Tax Payment Form must be completed when submitting payments Estate Tax

Verkko 3 tammik 2024 nbsp 0183 32 The estate tax rate for Illinois is graduated and the top rate is 16 Remember that in Illinois you pay taxes on the entire estate if it is above the 4 million threshold Find your taxable estate Verkko Payment of all taxes interest and penalties must be made to the Illinois State Treasurer with the Illinois State Treasurer Estate Tax Payment Form at the address

Download Illinois Estate Tax Return Form

More picture related to Illinois Estate Tax Return Form

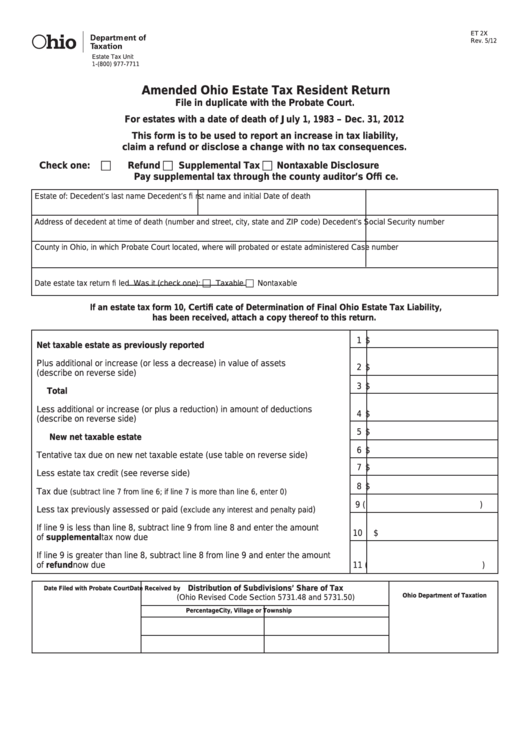

Fillable Estate Tax Form 2 Ohio Estate Tax Return For All Resident

https://data.formsbank.com/pdf_docs_html/355/3555/355541/page_1_thumb_big.png

Ma Fillable Tax Forms Instructions Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1819/18191/1819135/form-m-706-massachusetts-estate-tax-return-massachusetts_print_big.png

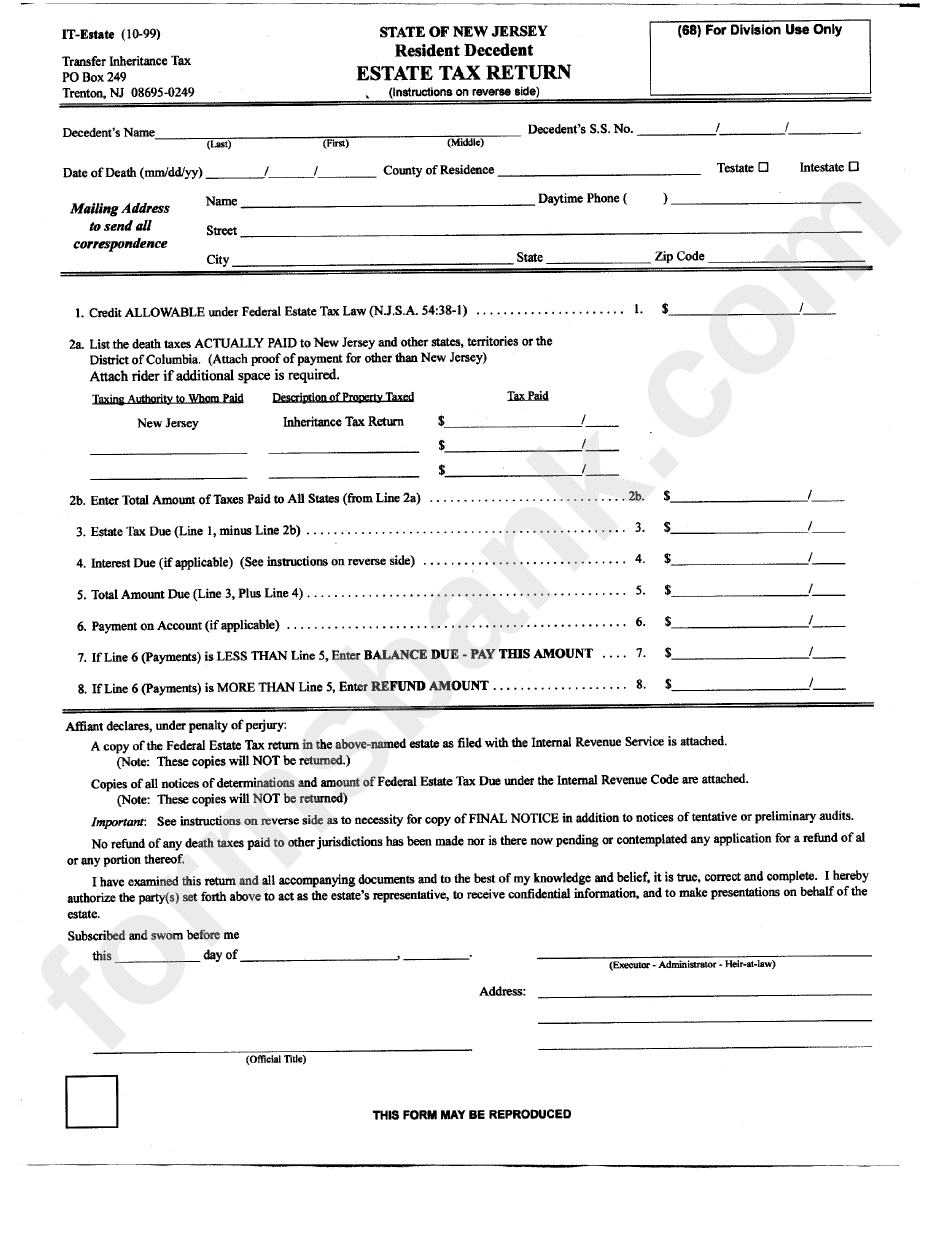

Form It Estate Estate Tax Return State Of New Jersey Printable Pdf

https://data.formsbank.com/pdf_docs_html/282/2821/282195/page_1_bg.png

Verkko OFFICE OF THE ILLINOIS STATE TREASURER ESTATE TAX PAYMENT FORM Send this completed form along with your payment to the following address Illinois Verkko A Form 700 Illinois Estate and Generation Skipping Transfer Tax Return available on the Attorney General s website https illinoisattorneygeneral gov estate taxes

Verkko 5 huhtik 2023 nbsp 0183 32 The Illinois estate tax is a tax on the transfer of property at death The tax is imposed on the estate of every resident of Illinois who dies with a taxable estate The tax is also imposed on the Verkko 3 elok 2022 nbsp 0183 32 The Illinois Attorney General AG Aug 1 issued an important notice and fact sheet on state estate taxes The federal exemption for federal estate tax

Tax Planning To Avoid Or Limit The Illinois Estate Tax Friedman Huey

https://fhassoc.com/wp-content/uploads/2023/06/FH-Illinois-Estate-Tax.png

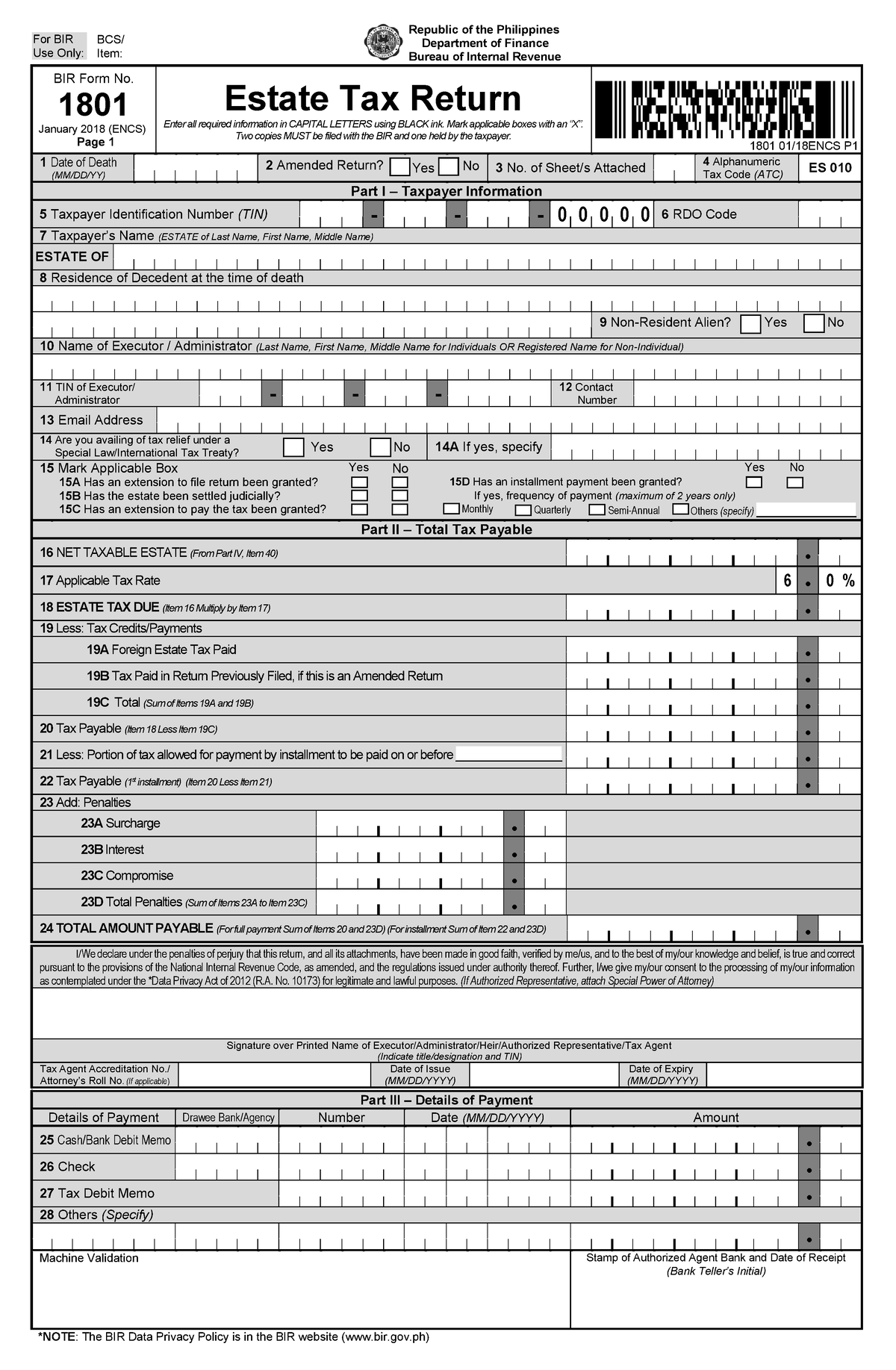

Estate Tax Return Form Sample For BIR Use Only BCS Item BIR Form

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c914811aa9f9747808e3c2ee340a4e82/thumb_1200_1835.png

https://illinoisattorneygeneral.gov

Verkko Estate Tax Forms Each year the Attorney General makes available forms and instructions to calculate and file estate taxes base on the year the individual died The

https://illinoisattorneygeneral.gov

Verkko FORM 700 STATE OF ILLINOIS ESTATE amp GENERATION SKIPPING TRANSFER TAX RETURN FOR DECEDENTS DYING ON OR AFTER JANUARY 1 2023 For Office

How To Compute File And Pay Estate Tax YouTube

Tax Planning To Avoid Or Limit The Illinois Estate Tax Friedman Huey

What Do I Need To Know About Property Transfer Tax Silver Law

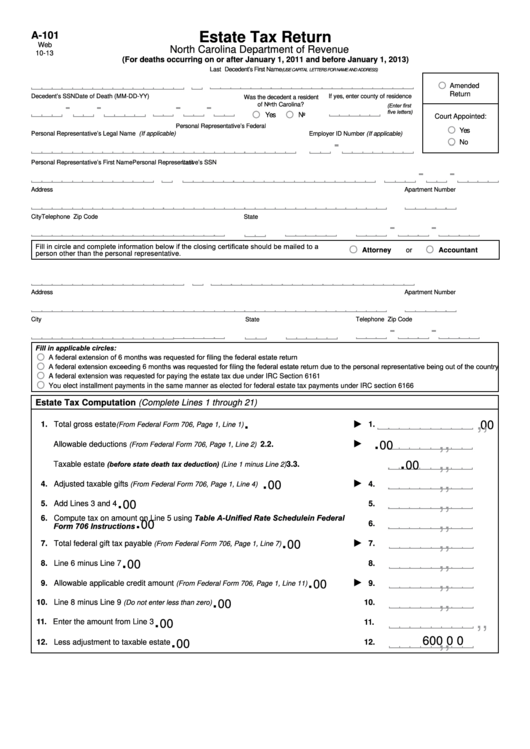

Fillable Form A 101 Estate Tax Return Printable Pdf Download

Fillable Form Et 2x Amended Ohio Estate Tax Resident Return Printable

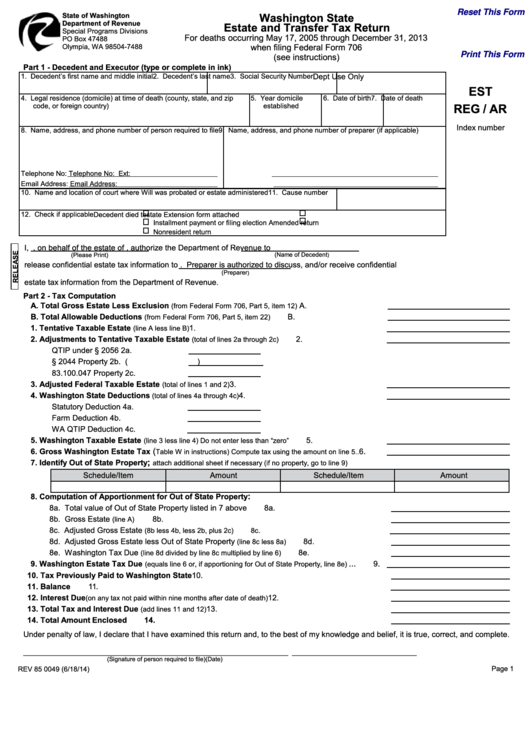

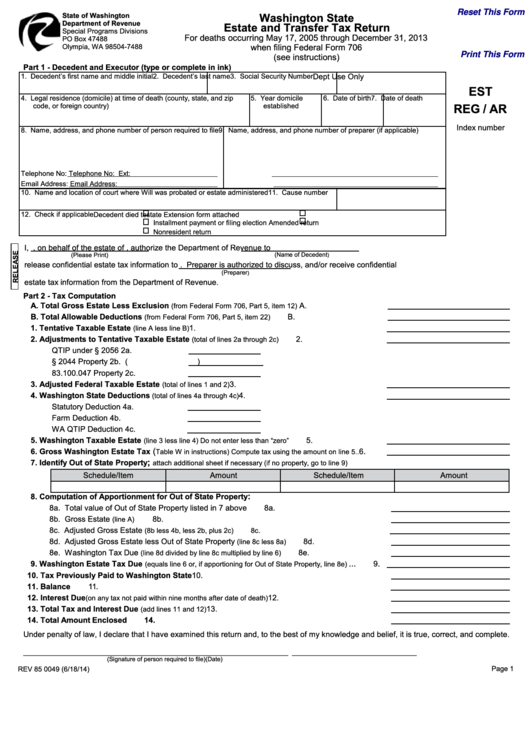

Fillable Washington State Estate And Transfer Tax Return Form Printable

Fillable Washington State Estate And Transfer Tax Return Form Printable

Tax S 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

Illinois Estate Tax Return Due Date He Has Nice Webcast Image Library

Illinois Estate Tax Return Form - Verkko A Federal Estate Tax Return Form 706 must be filed for the estate of each decedent whose gross estate exceeds 5 250 000 for 2013 decedents