Importance Of Input Tax Credit What is input tax credit Input tax credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance amount Here s how When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

Input Tax Credit means claiming the credit of the GST paid on the purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit is the backbone of GST and is one of the most important reasons for the introduction of GST Reconcile the input tax credit claimed in GST returns with the books of accounts to maintain accuracy and consistency By following these best practices businesses can maximize input tax credits reduce tax liabilities and ensure compliance with GST regulations

Importance Of Input Tax Credit

Importance Of Input Tax Credit

https://images-eu.ssl-images-amazon.com/images/G/31/amazonservices/Blog/Documents_required_to_get_a_business_loan_Banner_V2._SL1280_FMjpg_.jpg

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

https://www.taxmann.com/post/wp-content/uploads/2021/10/BlogBanner_Pushpinder1.jpg

What Is Input Tax Credit And How To Claim It YouTube

https://i.ytimg.com/vi/pDMQR1e2g4w/maxresdefault.jpg

Understanding what an input tax credit is and why it matters is crucial for small businesses Once your business s turnover reaches A 75 000 or more you must register for goods and services tax GST Input Tax Credit ITC allows businesses to claim GST paid on purchases for further use in business purposes Latest amendments include time limits to claim ITC conditions for eligible ITC claims and items ineligible for ITC

Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit is the backbone of GST and is one of the most important reasons for the introduction of GST Unlock the secrets of Input Tax Credit ITC under GST regime Learn eligibility types claiming process common mistakes and FAQs for seamless compliance

Download Importance Of Input Tax Credit

More picture related to Importance Of Input Tax Credit

New Year With New Restriction On Input Tax Credit From 01 01 2022

https://fintaxwisers.com/wp-content/uploads/2021/12/Input-Tax-Credit.jpg

What Is Input Tax Credit ITC INSIGHTSIAS

https://www.insightsonindia.com/wp-content/uploads/2020/12/ITC.png

Conditions Made To Claim Input Tax Credit Authoritative Blog

https://certicom.in/wp-content/uploads/2019/09/XLsVdg0ncW8OEkKP.jpg

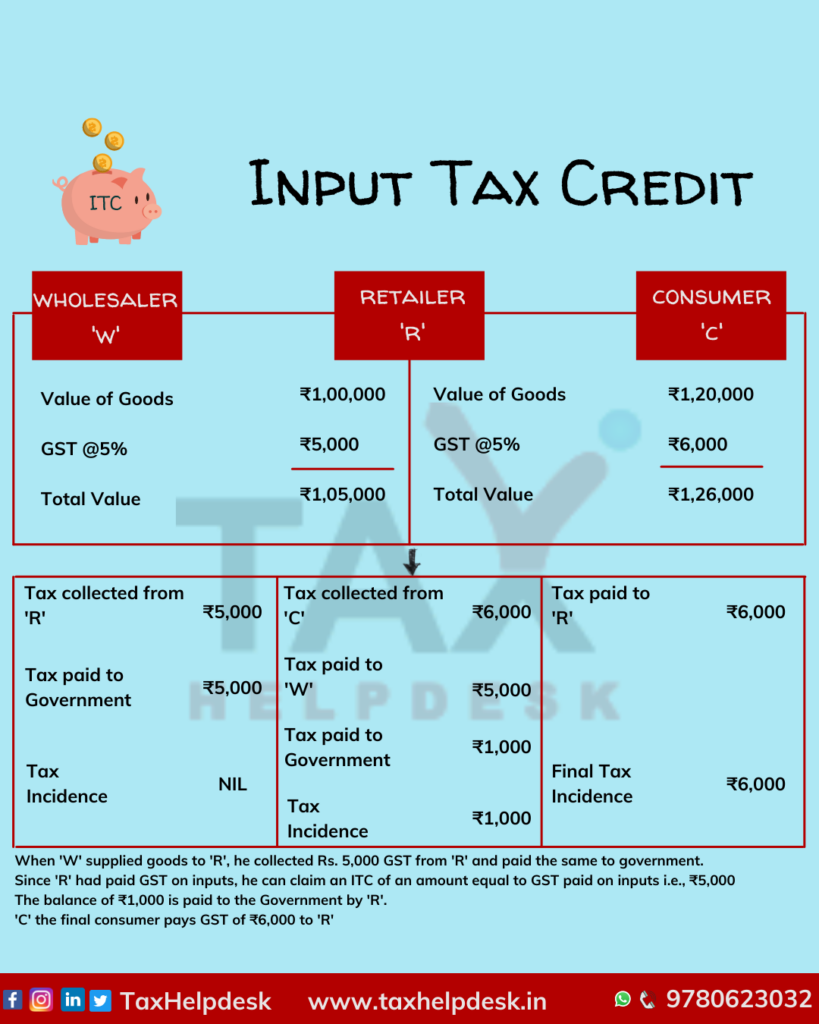

Input tax credit or ITC enables businesses to reduce the tax liability as it makes a sale by claiming the credit depending on how much GST was paid on the business s purchases For example let us say you manufacture a product and the tax payable on output is Rs 1500 while the tax paid on input is Rs 1000 Input Tax Credits offer numerous advantages including improved cash flow for businesses reduction in the cost of business inputs minimization of cascading taxes throughout supply chains and overall transparency in tax liabilities

Input Tax Credit ITC is one of the fundamental features of the Goods and Services Tax GST regime It is a mechanism that enables businesses to claim a credit for the taxes paid on their purchases which can be Input Tax Credit becomes crucial to avoid double taxation and mitigate the cascading impact The Input Tax Credit mechanism is a linchpin for businesses offering a pathway to cost efficiency effective tax management and a

Amended Rules Of Input Tax Credit ITC Utilisation Under GST TaxGyata

https://www.taxgyata.com/admin/article/input-tax-credit-utilisation-rules-under-gst.jpg

Input Tax Credit

https://cdn.slidesharecdn.com/ss_thumbnails/inputtaxcredit-170805162211-thumbnail-4.jpg?cb=1501950257

https://cleartax.in/s/gst-input-tax-credit

What is input tax credit Input tax credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance amount Here s how When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

https://cfo.economictimes.indiatimes.com/news/...

Input Tax Credit means claiming the credit of the GST paid on the purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit is the backbone of GST and is one of the most important reasons for the introduction of GST

An In depth Look At Input Tax Credit Under GST Razorpay Business

Amended Rules Of Input Tax Credit ITC Utilisation Under GST TaxGyata

Taxation Archives ProfitBooks

Input Tax Credit Know How Does It Work

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

Restriction Of Input Tax Credit Under GST To 20 AKT Associates

Restriction Of Input Tax Credit Under GST To 20 AKT Associates

Input TAX Credit CHAPTER 6 INPUT TAX CREDIT For The Sake Of Brevity

Understanding GST Input Tax Credit When Exempted Taxable Supplies Are Made

New Rule 88A Order Of Utilization Of Input Tax Credit With Examples

Importance Of Input Tax Credit - Input Tax Credit ITC allows businesses to claim GST paid on purchases for further use in business purposes Latest amendments include time limits to claim ITC conditions for eligible ITC claims and items ineligible for ITC