Income Limit For Federal Solar Tax Credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

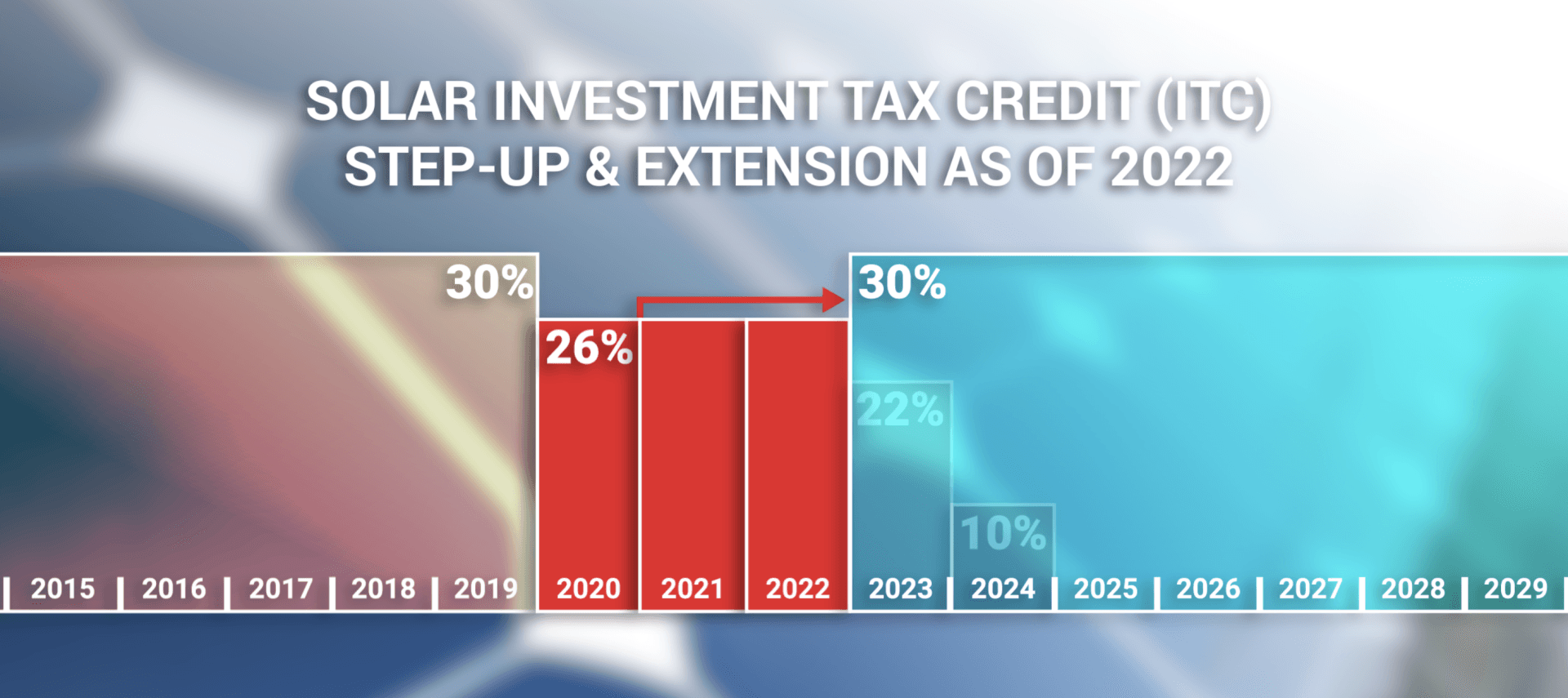

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Income Limit For Federal Solar Tax Credit

Income Limit For Federal Solar Tax Credit

https://news.measuresolar.com/wp-content/uploads/2022/03/Large-Rectangle-2-1-1024x576.png

Federal Solar Tax Credit Now 30 RL ROOFING

https://rlroofing.com/wp-content/uploads/2019/10/AdobeStock_235134005-1024x683.jpeg

Your Guide To The Increased 30 Federal Solar Tax Credit Absolute

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

There is no income limit for the federal solar tax credit However you need a large enough taxable income to claim the full credit The Inflation Reduction Act expanded the federal solar tax credit to 30 until 2032 We ll show you exactly how to take advantage of it

Download Income Limit For Federal Solar Tax Credit

More picture related to Income Limit For Federal Solar Tax Credit

IRS Tax Credit For Year 2022 And 2023 DIY Solar Power Forum

https://www.leafscore.com/wp-content/uploads/2022/08/federal-solar-tax-credit-inflation-reduction-act-scaled.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

The federal solar tax credit is a dollar for dollar income tax credit equal to 30 of solar installation costs Homeowners earn an average solar tax credit of 6 000 The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in Key takeaways In 2024 the ITC currently allows both homeowners and businesses to claim 30 of their solar system costs as a tax credit The tax credit will stay at 30 for the next nine years until 2033 at which point it will drop to 26

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

How Does The Federal Solar Tax Credit Work PB Roofing Co

https://pbroofingco.com/wp-content/uploads/2021/06/federal-solar-tax-credit.png

https://www.energy.gov › eere › solar › homeowners-guide...

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

https://www.nerdwallet.com › article › taxes › solar-tax-credit

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

The Federal Solar Tax Credit What You Need To Know 2024 Tax

Federal Investment Solar Tax Credit Guide Learn How To Claim The

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Federal Solar Tax Credit Ecohouse Solar LLC

Everything You Need To Know About The Federal Solar Tax Credit

The Federal Solar Tax Credit What You Need To Know 2022

Income Limit For Federal Solar Tax Credit - There is no income limit for the federal solar tax credit However you need a large enough taxable income to claim the full credit