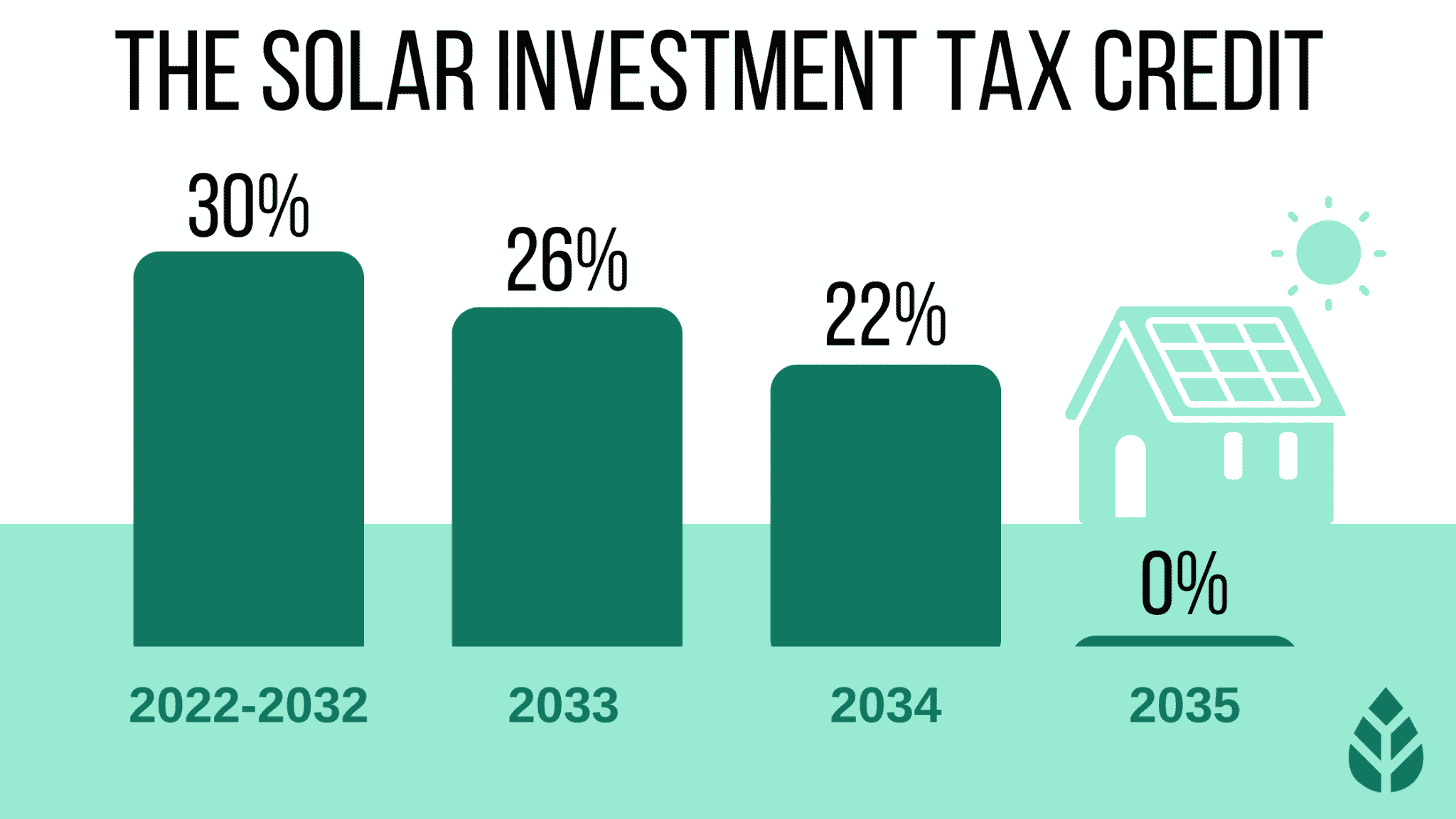

Is There An Income Limit For Federal Solar Tax Credit Is there a dollar or lifetime limit on the federal solar tax credit No there is neither a dollar limit nor is there a lifetime limit on the tax credit The credit is only limited to 30 of qualified

Under most circumstances subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law 7 When this is the case Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022

Is There An Income Limit For Federal Solar Tax Credit

Is There An Income Limit For Federal Solar Tax Credit

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

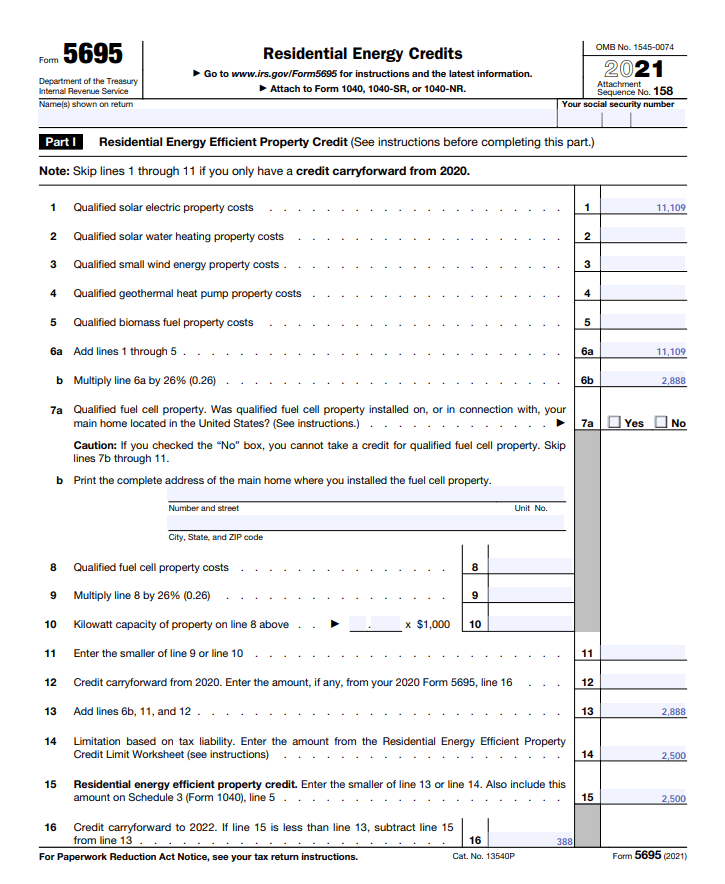

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.altestore.com/blog/wp-content/uploads/2021/12/form-5695-example.png

How To Claim The Solar Tax Credit DroneQuote

https://blog.dronequote.net/wp-content/uploads/2023/02/form-1040-for-declaration-of-personal-income-tax-2022-12-16-12-35-32-utc-scaled.jpg

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year There are no income limits on the solar tax credit so all individual taxpayers are eligible to claim the credit on qualifying solar energy equipment investments made to their homes within the United States

The federal Solar Tax Credit There s no income limit for claiming the credit making it accessible to a wide range of homeowners The credit rate is 30 of the cost of your solar system and this rate is locked in through 2032 Income brackets and the solar tax credit There is no household income limit on the federal solar tax credit Therefore you cannot be barred from tax credit eligibility because you make too much money or are in a high

Download Is There An Income Limit For Federal Solar Tax Credit

More picture related to Is There An Income Limit For Federal Solar Tax Credit

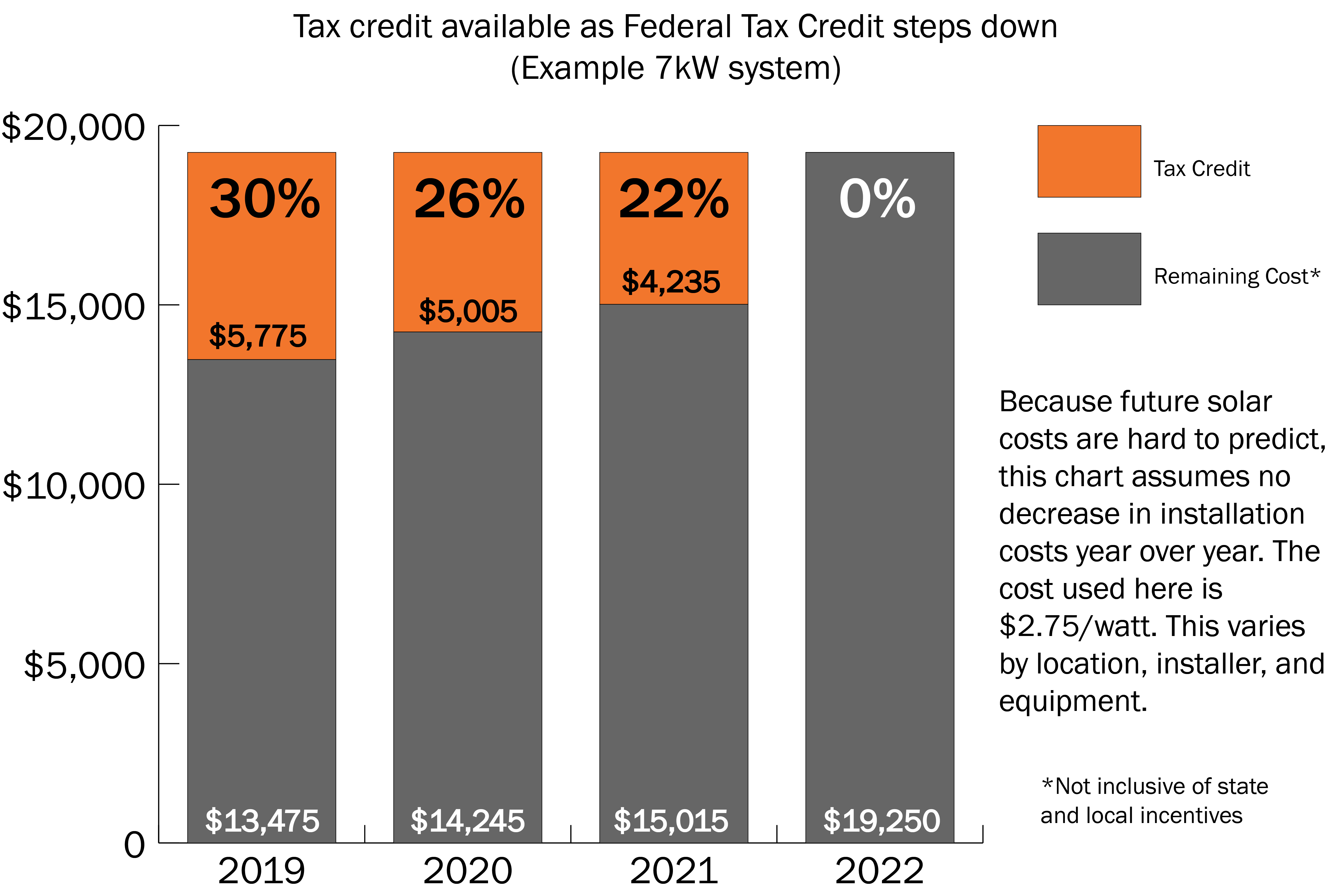

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/solar-tax-credit-before-and-after-inflation-reduction-act-1024x1013.jpg

The Federal Solar Tax Credit What You Need To Know 2022

https://sandbarsc.com/wp-content/uploads/2017/07/solar-tax-credit.jpg

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2021/10/What-is-a-Solar-Tax-Credit-R01-1089x1536.jpg

Federal income tax law While many states label their energy efficiency incentives as rebates that reduce the purchase price these incentives may not qualify as rebates under federal income The year you install solar you can claim a solar tax credit also sometimes called an Investment Tax Credit or ITC on your federal income taxes by filling out IRS Form 5695

The solar credit will offset income taxes line 12 of the 1040 it will not offset self employment taxes or other types of taxes and penalties shown on Schedule 2 of the 1040 What is the income limit for the federal tax credit There is no income limit to use the federal solar tax credit Is the federal solar tax credit a refund No the federal solar tax

The Solar Tax Credit Also Know As The ITC Is A Dollar For Dollar

https://i.pinimg.com/originals/58/28/2c/58282c905274c1827d1d8b95646b152a.jpg

The Federal Solar Tax Credit Extension Can We Win If We Lose

http://ilsr.org/wp-content/uploads/2015/09/value-of-federal-itc-over-time-ilsr.jpg

https://www.energy.gov › sites › default › files › ...

Is there a dollar or lifetime limit on the federal solar tax credit No there is neither a dollar limit nor is there a lifetime limit on the tax credit The credit is only limited to 30 of qualified

https://www.energy.gov › sites › default › files

Under most circumstances subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law 7 When this is the case

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

The Solar Tax Credit Also Know As The ITC Is A Dollar For Dollar

Earned Income Tax Credit For Households With One Child 2023 Center

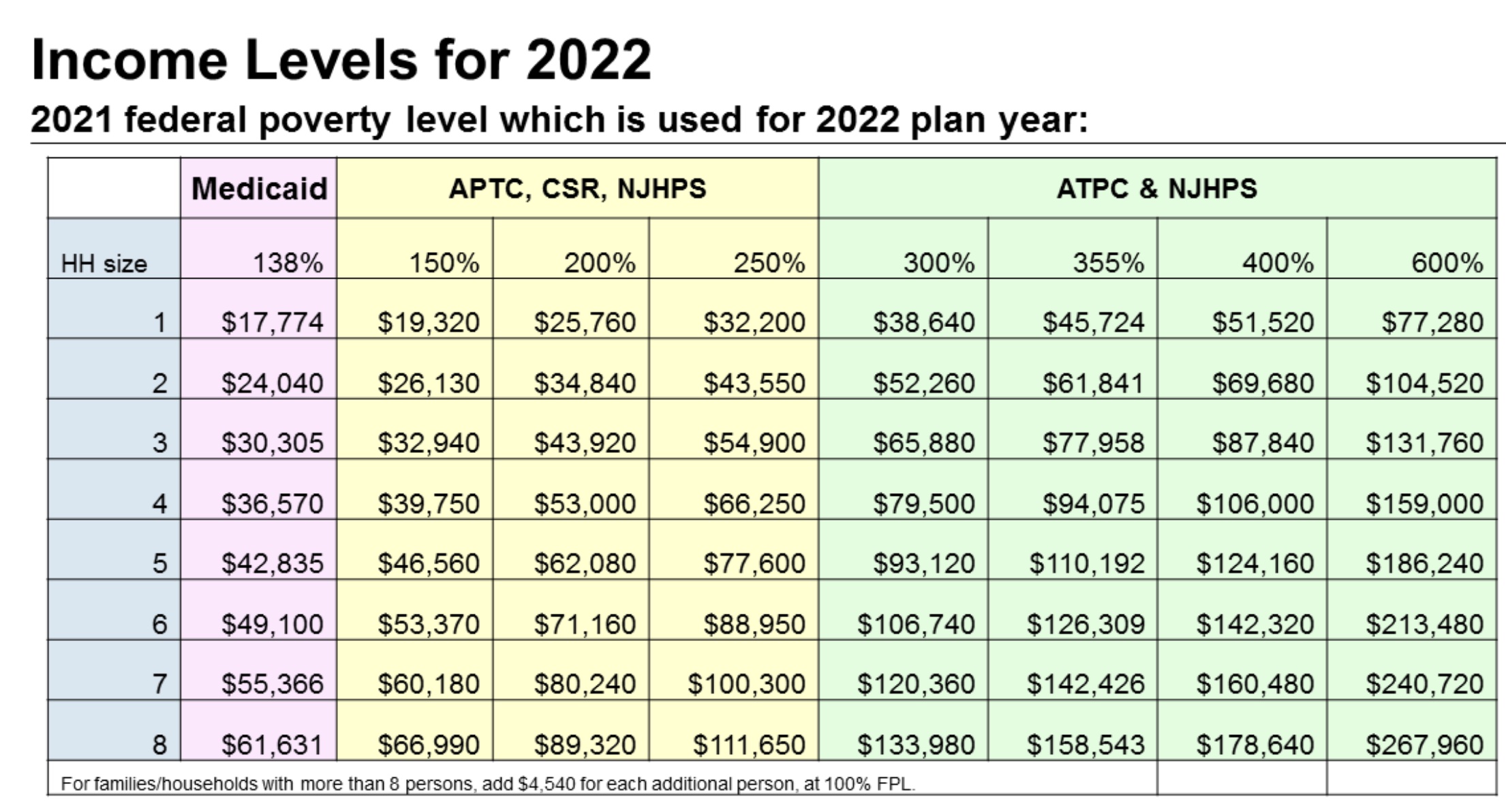

What Are The 2022 Federal Poverty Levels For The New Jersey Marketplace

How To Maximize Your Solar Tax Credits In New Mexico Oracle Globe

Federal Solar Tax Credit For Residential Solar Energy

Federal Solar Tax Credit For Residential Solar Energy

Congress Gets Renewable Tax Credit Extension Right Institute For

Solar Tax Credit Graph without Header Solar United Neighbors

Arizona Solar Tax Credit Form Donny Somers

Is There An Income Limit For Federal Solar Tax Credit - For instance when you re in the market for solar panels the federal solar tax credit also known as the Investment Tax Credit ITC aims to encourage investments in renewable