Income Tax Benefit On Fixed Deposit Tax saving fixed deposit accounts offer a tax deduction under Section 80C and locked for 5 years They are low risk with interest taxable compared with ELSS funds they have lower returns but guaranteed capital protection

Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks Income Tax Tax Benefits on Fixed Deposits Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed deposits can be avoided by submitting Form 15G and saying he she is not eligible for TDS Fixed Deposits and Taxes

Income Tax Benefit On Fixed Deposit

Income Tax Benefit On Fixed Deposit

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500-768x432.jpg

Income Tax Filing Income Tax India Income Tax Return Income Tax Benefit

https://static.india.com/wp-content/uploads/2021/07/income-tax-benefits.jpg

What You Need To Know About Income Tax Renewpurpose

https://www.businessleague.in/wp-content/uploads/2021/08/Income-Tax-Rules-for-Fixed-Deposit.jpg

Tax Benefits Investments in tax saving fixed deposits are eligible for a deduction of up to 1 5 Lakhs under Section 80C of the Income Tax Act This deduction helps reduce the taxable income of the investor Interest Rate The interest rates on tax saving fixed deposits are usually competitive and comparable to regular fixed deposits One can opt for a monthly quarterly pay out of Interest or the reinvestment option which gives one the benefit of compounding Income Tax and Fixed Deposit Fixed Deposits allow taxpayers to exhaust the potential under Section 80C which permits a deduction of INR 1 5 lakh

Income Tax Exemptions on Fixed Deposits Exemptions under Section 80C Under Section 80C of the Income Tax Act tax saving FD schemes offer a tax deduction benefit These FDs come with a lock in period of 5 years and deposits of up to Rs 1 5 lakh per financial year are eligible for the deduction Updated on 16 Jan 2024 05 49 PM Fixed deposits are considered the most secure avenue for investing your hard earned money in India But like every other good thing it also comes with a price You need to disclose the earning while filing your income tax return which also has tax implications

Download Income Tax Benefit On Fixed Deposit

More picture related to Income Tax Benefit On Fixed Deposit

Fnb Fixed Deposit

https://nerdfree173.weebly.com/uploads/1/3/6/8/136816057/352248463.png

Income Tax Return And Tax Benefit Claim Koppel Services

https://www.koppelservices.com/wp-content/uploads/2017/03/tax-benefit.jpg

Infograph Things You Didn t Know About Tax Saving Visual ly

https://i.visual.ly/images/infograph--things-you-didnt-know-about-tax-saving_564c2dd8542dd_w1500.jpeg

Here are some of the key benefits 1 Tax benefits The most significant benefit of a Tax Saver Fixed Deposit is the tax advantage under Section 80C of the Income Tax Act 1961 You can claim a tax deduction of up to Rs 1 5 lakh in a financial year on the amount invested in a Tax Saver FD 2 A tax saving Fixed Deposit offers the benefit of deducting your investment amount from your taxable income as per Section 80C of the Income Tax Act 1961 The same cannot be said about regular Fixed Deposits These FDs enable you to save from your monthly income but do not qualify for tax exemptions

Fixed Deposit Tax Benefits Below are the strategies for obtaining income tax benefits and avoiding TDS on FDs are below Make a Bet on a Tax Saving Fixed Deposit Tax saving FDs allow you to make a deposit and receive a tax deduction as per section 80C What if you choose to go with the tax system in place before You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account The scheme ensures returns along with capital protection

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

https://carajput.com/blog/wp-content/uploads/2022/04/INCOME-TAX-BENEFIT-ON-INVESTMENT-IN-STARTUPS-Section-54GB-1-885x1024.jpg

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Tax saving fixed deposit accounts offer a tax deduction under Section 80C and locked for 5 years They are low risk with interest taxable compared with ELSS funds they have lower returns but guaranteed capital protection

https://www.paisabazaar.com/fixed-deposit/tax...

Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks

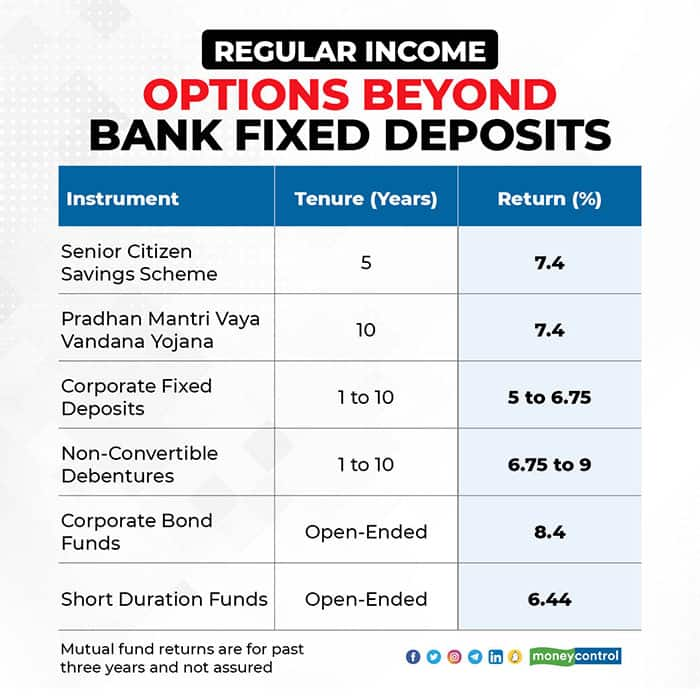

Fixed Deposit Rates Are At All time Lows Here Are Some Better

Income Tax Benefits On Housing Loan In India

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

Income Tax On Fixed Deposit FD Interest Income FD Tax Benefits

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Home Loan Loanfasttrack

What Are The Tax Benefit On Home Loan FY 2020 2021

Safe Mode Of Investment

Updates On International Tax Developments Global Financial Centres

Income Tax Benefit On Fixed Deposit - Fixed deposits are a great way for you to protect savings from inflation and also provide low risk returns in real inflation adjusted terms However fixed deposit interests contribute to an increase in your income