Income Tax Benefit Rule Meaning Learn what the tax benefit rule is and how it affects your income tax reporting Find out when you need to include or exclude amounts recovered for your loss in your gross income depending

Learn how the Tax Benefit Rule affects taxpayers and businesses when they recover previously deducted expenses Explore different scenarios financial statement Learn what the tax benefit rule is and how it prevents taxpayers from getting a double benefit from a deduction and its recovery See an example of how to apply the rule to

Income Tax Benefit Rule Meaning

Income Tax Benefit Rule Meaning

https://www.annuity.org/wp-content/uploads/annuity-tax-deferral.jpg

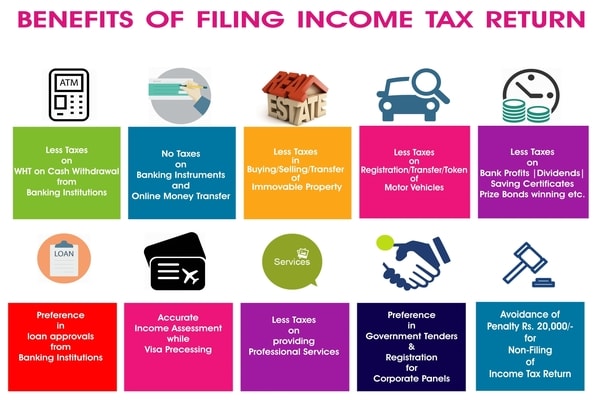

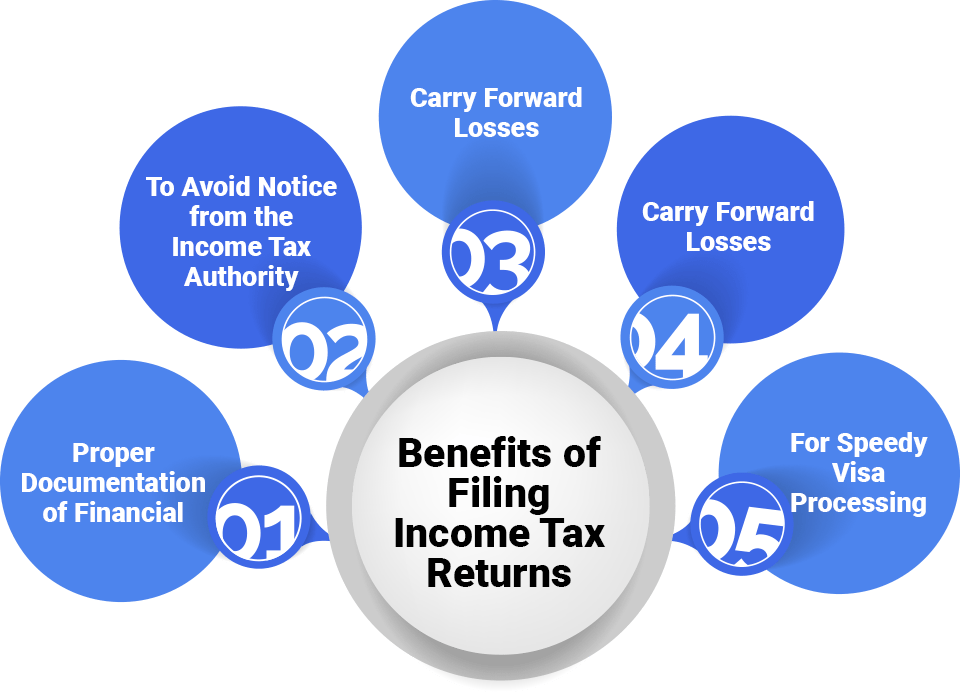

6 Benefits Of Filing Income Tax Return ITR

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/6-benefits-of-filing-income-tax-return.jpg

Federal Income Tax Videos The Tax Benefit Rule Quimbee

https://embed-ssl.wistia.com/deliveries/d5984ac637719164bedad887d77addea581855c5.jpg?image_play_button=true&image_resize=750

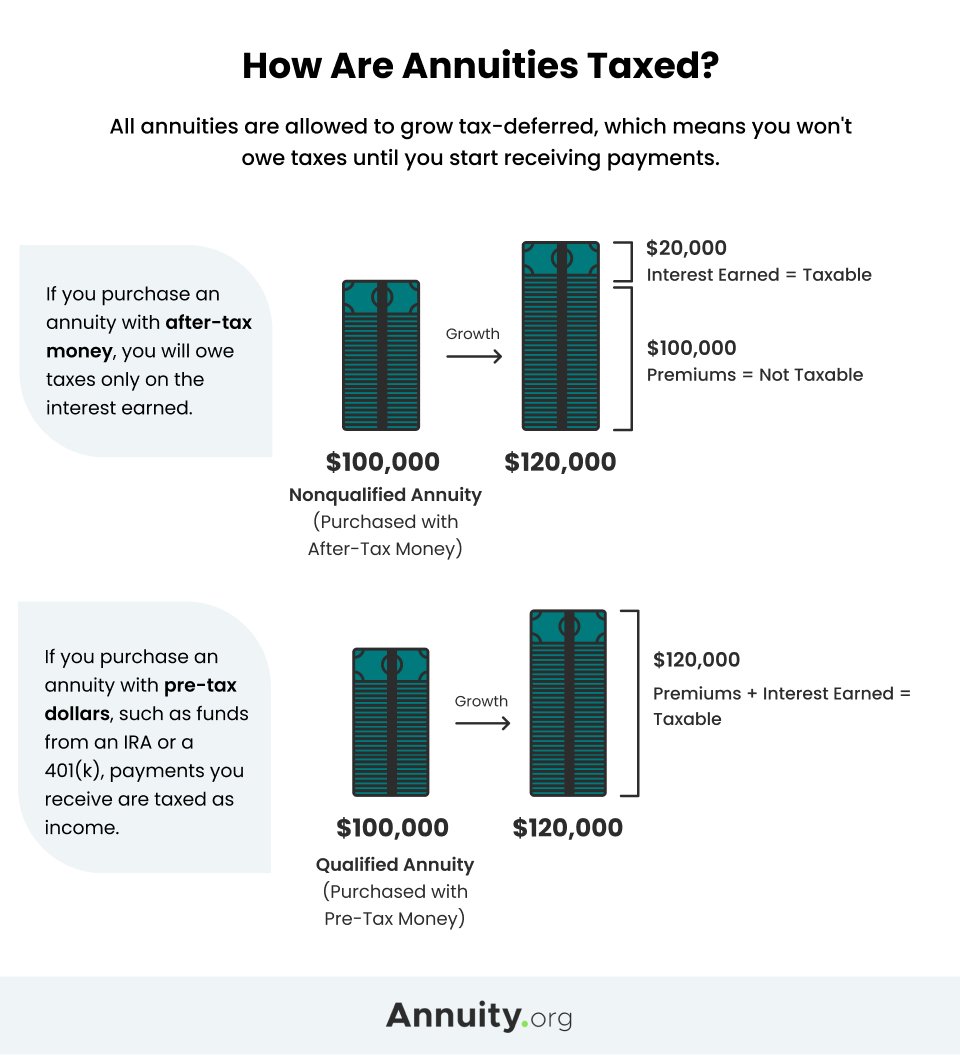

The tax benefit rule is a principle in tax law that affects how individuals and businesses report their income To put it simply if you received a tax deduction in a previous year and later A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit Tax benefits include tax credits tax deductions and tax deferrals Some tax benefits can show up directly on your paycheck

The Tax Benefit Rule in accounting refers to the principle that governs the treatment of tax benefits or deductions in financial reporting and income tax calculations The benefits received rule is a tax theory that says people should pay taxes based on the benefits they receive from the government or a tax provision that limits charitable

Download Income Tax Benefit Rule Meaning

More picture related to Income Tax Benefit Rule Meaning

9 HIDDEN Income Tax Return Benefits Tips You Need To Learn Now

https://updatedyou.com/wp-content/uploads/2018/12/Webp.net-resizeimage-27.jpg

Tax Benefit Rule Examples Matilde Painter

https://thumbor.forbes.com/thumbor/711x358/https://specials-images.forbesimg.com/imageserve/618be34d322f395ce83b72d2/Joint-tax-rates-2022/960x0.jpg?fit=scale

Income Tax Return Filing Online ITR Filing Eligibility Enterslice

https://enterslice.com/learning/wp-content/uploads/2020/12/Benefits-of-Filing-Income-Tax-Returns.png

The meaning of TAX BENEFIT RULE is a tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be This publication explains the rules for determining what income is taxable and what is not It covers topics such as wages tips unemployment compensation retirement plans and

Learn how to apply the tax benefit rule IRC section 111 to state and local tax refunds and save taxes See examples of different scenarios and how to reconcile Form 1099 A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden It s also the name of an IRS rule requiring companies to pay taxes on

Tax Benefit Rule Or Doctrine CPA EA Exam YouTube

https://i.ytimg.com/vi/UaG2oAF0Rc0/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGCUgTSh_MA8=&rs=AOn4CLDp9qyLmSKQ9lI3VylXpiZKjvgFRw

Understanding The 50 30 20 Rule To Help You Save MagnifyMoney

https://www.magnifymoney.com/wp-content/uploads/2019/06/Graphic-1.png

https://klasing-associates.com › ... › tax-benefit-rule-significance

Learn what the tax benefit rule is and how it affects your income tax reporting Find out when you need to include or exclude amounts recovered for your loss in your gross income depending

https://accountinginsights.org › tax-benefit-rule...

Learn how the Tax Benefit Rule affects taxpayers and businesses when they recover previously deducted expenses Explore different scenarios financial statement

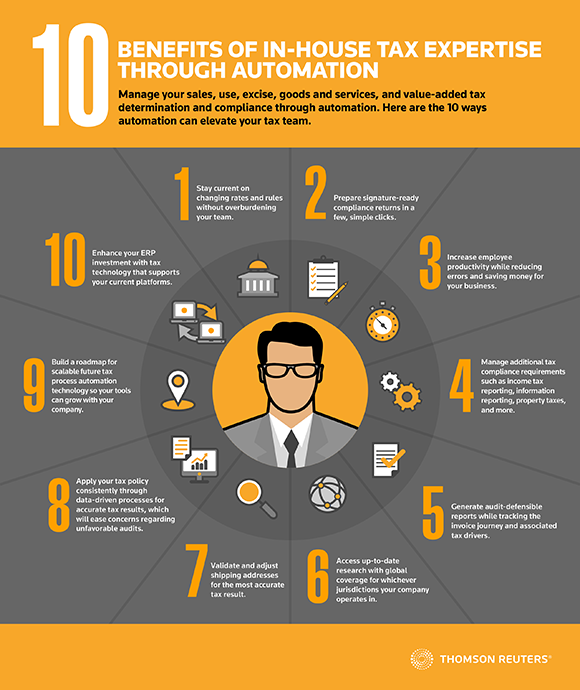

10 Benefits Of In house Tax Expertise Through Automation Thomson Reuters

Tax Benefit Rule Or Doctrine CPA EA Exam YouTube

What Is Income Tax Return Meaning How To File ITR

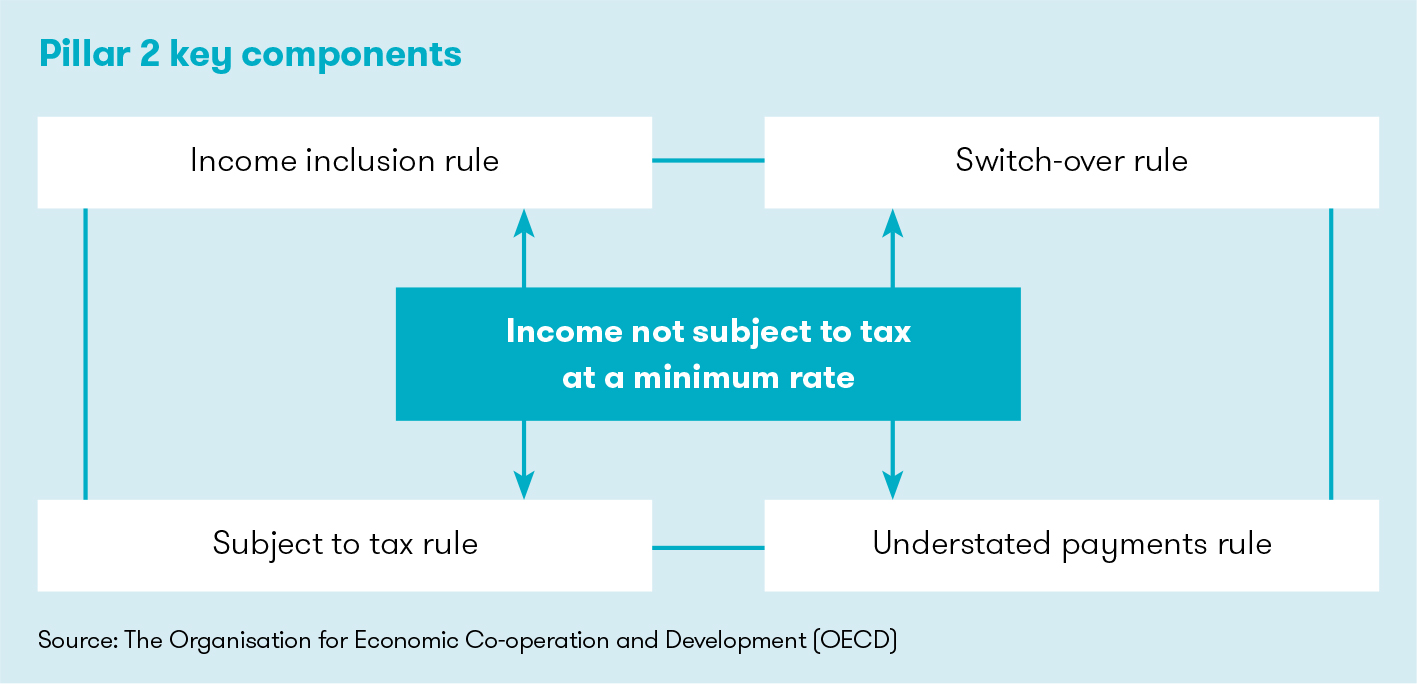

BEPS Pillar 2 Grant Thornton Insights

Tax Benefit Rule Explained YouTube

Income Tax Rule That Are In Effect From 1ST April 2022 Ebizfiling

Income Tax Rule That Are In Effect From 1ST April 2022 Ebizfiling

Extended Compliance Due Date Under Income Tax Act 1961 And Income Tax

Set Off And Carry Forward Of Losses Rules Restrictions

What Is Taxable Income 2023

Income Tax Benefit Rule Meaning - Once entities have identified their uncertain tax positions they need to determine when if ever the tax return benefit or expected tax return benefit should be recognized for financial