Income Tax Deduction For Charitable Donations India Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The

Section 80G of Indian Income Tax Act allows tax deductions for donations made to charitable trusts or NGOs Charitable institutions play a crucial role in social Contributions to relief funds and humanitarian organizations can be deducted under Section 80G of the Internal Revenue Code Any taxpayer whether a person a corporation a

Income Tax Deduction For Charitable Donations India

Income Tax Deduction For Charitable Donations India

https://i.pinimg.com/736x/56/c2/f8/56c2f82c540b892c04e5c20f94e392ad.jpg

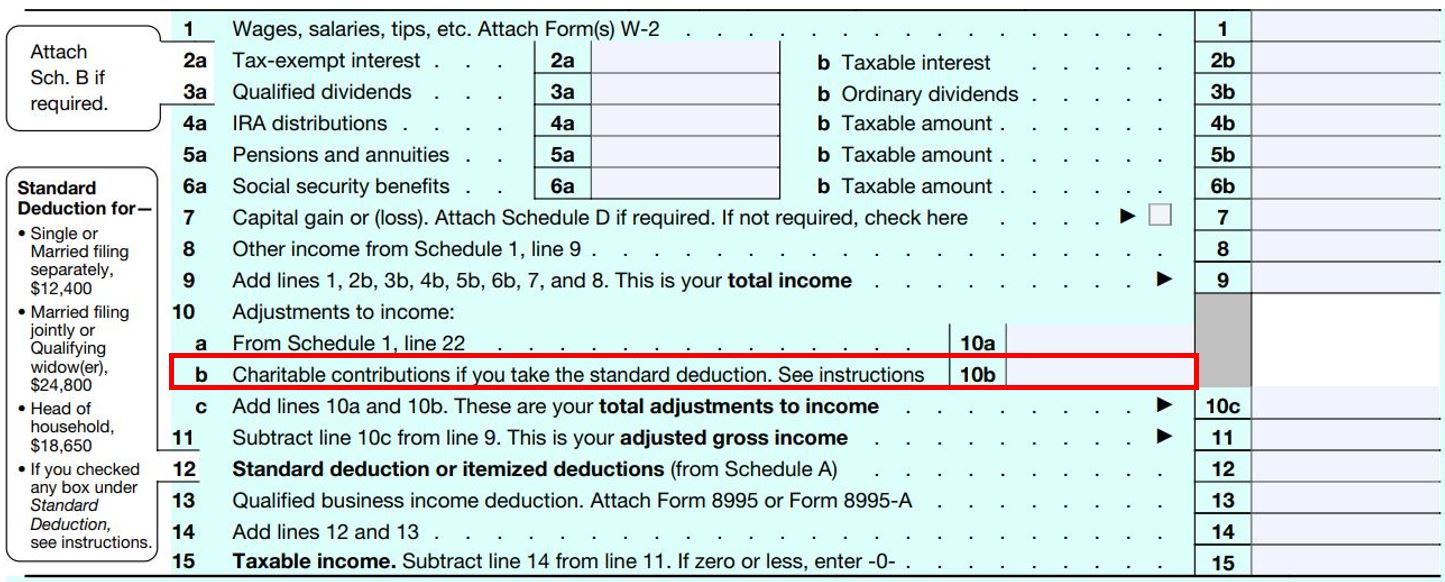

Get 300 Tax Deduction For Cash Donations In 2020 2021

https://cdn.aarp.net/content/dam/aarp/money/taxes/2020/12/1140-online-donation-screen.imgcache.rev9aad3c0f802258a825bf512a713d6041.jpg

Guide To Tax Deduction For Charitable Donations Backpacks USA

https://cdn.shopify.com/s/files/1/0533/2241/6308/files/guide-to-tax-deductions-for-charitable-donations-infographic.jpg

Introduced and implemented in 1961 Section 80G of the Income Tax Act enables taxpayers to claim up to 50 to 100 of their charitable donations as tax Section 80G of income tax act allows tax deductions on donations made to certain organizations and relief funds This deduction encourages taxpayers to donate and avail the satisfaction of giving back

In India Section 80G of the Income Tax Act allows you to claim deductions on your income tax returns for donations made to charity This article will explore this 80G deduction tax What is Section 80G The Income Tax Act allows deduction while calculating the total taxable income to every assessee One such deduction is allowed under section 80G of Income Tax Act 1961 for

Download Income Tax Deduction For Charitable Donations India

More picture related to Income Tax Deduction For Charitable Donations India

The IRS Encourages Taxpayers To Consider Charitable Contributions

https://www.irs.gov/pub/image/acl-charitable-contributions-870.jpg

Tips On Tax Deductions For Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

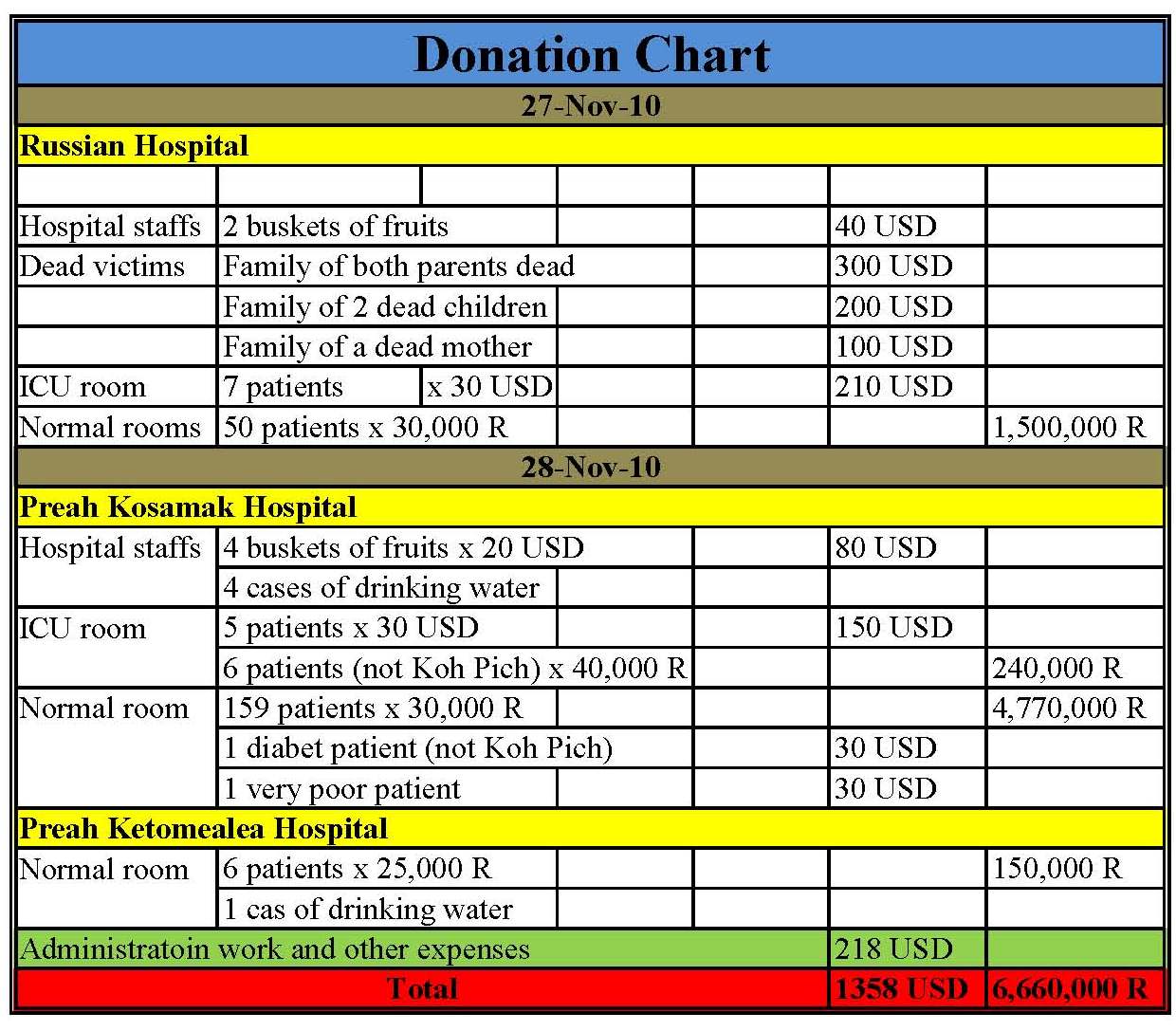

Donation Chart Template

http://4.bp.blogspot.com/_n-8w21PwsUY/TPXZW9cIGCI/AAAAAAAAB08/45h_e3L8QEQ/s1600/Donation+chart1.jpg

Section 80G tax exemption is a provision in the Indian Income Tax Act that encourages charitable giving by offering tax deductions for donations made to specified institutions This means you can reduce 52 rowsSection 80G of the Income Tax Act 1961 offers tax deductions to the charitable trust as well as the associated donor provided the NGO is registered under the Act You

Only donations in cash cheque are eligible for the tax deduction under section 80G Donations in kind do not entitle for any tax benefits For example during natural disasters such as floods Discover how to deduct donations to particular charity or organisations Deduct the amount from your taxed income under Part 80G of the Income Tax Act

How To Legally Claim A Tax Deduction For Charitable Giving From Your

http://www.wealthsafe.com.au/wp-content/uploads/2015/02/charity-hand.jpg

Section 80G Deduction For Donation To Charitable Organizations

https://assets.learn.quicko.com/wp-content/uploads/2020/04/17135805/flow-chart.png

https://tax2win.in/guide/80g-deduction-…

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The

https://cleartax.in/s/charitable-trusts-ngo-income-tax-benefits

Section 80G of Indian Income Tax Act allows tax deductions for donations made to charitable trusts or NGOs Charitable institutions play a crucial role in social

Gift Receipt Template

How To Legally Claim A Tax Deduction For Charitable Giving From Your

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

A 2020 Charitable Giving Strategy You Don t Want To Miss

12 Tax Smart Charitable Giving Tips For 2023 Retirement Plan Services

Printable Donation Receipt Template

Printable Donation Receipt Template

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

Printable Itemized Deductions Worksheet

Donation List For Taxes Charitable Donations Tracker Tax Deductions Tax

Income Tax Deduction For Charitable Donations India - What is Section 80G The Income Tax Act allows deduction while calculating the total taxable income to every assessee One such deduction is allowed under section 80G of Income Tax Act 1961 for