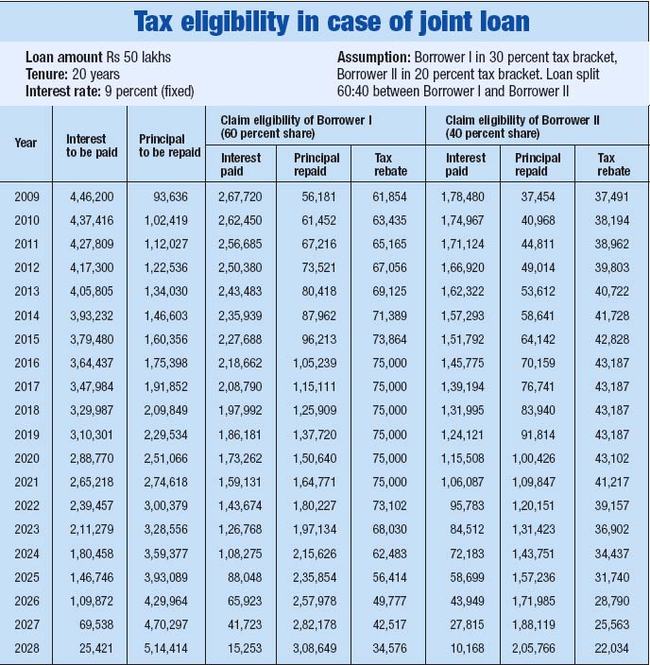

Income Tax Deduction For Joint Home Loan If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

There are three types of joint home loan tax benefits that you can avail of following the Income Tax regulations Section 80C A tax deduction of up to Rs 1 5 Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on Home Loan 1 Income Tax benefits on a joint home loan can be claimed

Income Tax Deduction For Joint Home Loan

Income Tax Deduction For Joint Home Loan

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Home Loan EMI And Tax Deduction On It EMI Calculator

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

By applying jointly for a home loan tax deduction available on home loan can be enjoyed by the co applicants separately provided they are co owners of the property and each of them is contributing to the home Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs

You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting Women homebuyers who have availed Home Loans or joint Home Loan are eligible for tax benefits As per the old tax regime in a joint Home Loan between a man and a

Download Income Tax Deduction For Joint Home Loan

More picture related to Income Tax Deduction For Joint Home Loan

How To Claim Tax Benefit For Joint Home Loan

http://www.gogofinder.com.tw/books/pida/6/s/1372218172QjDNwaf8.jpg

Section 80EE Income Tax Deduction For Interest On A Home Loan

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-pWSLuq4buU8/YgqSC60pH3I/AAAAAAAAYds/gMCrObm9nqoSd_ngGI_lj0MQT9LaKz7KACNcBGAsYHQ/s1600/1644859913400453-1.png

Joint Home Loans allow borrowers to increase income tax savings as each financial co applicant is eligible for the deduction provided the other conditions are met Here is In the case of a self occupied property both the co owners who are also financial co applicants of the joint Home Loan can claim a tax deduction of up to Rs 2

Under the Income Tax Deduction under Section 24 a homeowner can claim a deduction for a certain amount on his home loan interest provided that the borrower or As per the existing Income Tax Laws both the individuals loan applicants can claim income tax deductions on the principal repayment under section 80c and on the interest

Tax Benefits On Joint Home Loan How To Claim Guidelines Benefits

https://assets-news.housing.com/news/wp-content/uploads/2020/04/28123352/Look-to-save-more.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180144/Section-80EE-Income-tax-deduction-for-interest-component-on-home-loan-FB-1200x700-compressed.jpg

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://tax2win.in/guide/joint-home-loan-tax

There are three types of joint home loan tax benefits that you can avail of following the Income Tax regulations Section 80C A tax deduction of up to Rs 1 5

Joint Home Loan The Ultimate Guide Properly

Tax Benefits On Joint Home Loan How To Claim Guidelines Benefits

Claim Tax Benefits On Joint Home Loans Kalyan Developers Blog

Tax Benefits Of A Joint Home Loan To Co borrowers The Economic Times

How To Claim Tax Benefit For Joint Home Loan

Joint Home Loan Tax Benefits On Joint Home Loan StayHome And Learn

Joint Home Loan Tax Benefits On Joint Home Loan StayHome And Learn

Home Loan Tax Benefit 2023 24 Deduction Joint Home Loan Tax Benefit

Joint Home Loan 2023 Eligibility Tax Benefits Repayment

Benefits And Advantages Of Joint Home Loan

Income Tax Deduction For Joint Home Loan - If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs