Income Tax Exemption For Salaried Employees Web 14 Dez 2023 nbsp 0183 32 Who is exempt from income tax in Germany No one is exempt from paying tax in Germany if their income exceeds the tax free personal allowance 10 347

Web 97 Zeilen nbsp 0183 32 1 10 13A House Rent Allowance Sec 10 13A amp Rule 2A Least of the Web Learn about the different forms and returns applicable for salaried individuals in India including the income tax exemption for salary pension up to 50 lakh Find out the

Income Tax Exemption For Salaried Employees

Income Tax Exemption For Salaried Employees

https://i0.wp.com/hrtalk.in/wp-content/uploads/2023/05/Income-Tax-exemption-limit-for-leave-encashment-upon-retirement-for-salaried-employees-hiked-to-Rs-25-lakh.webp?fit=1600%2C900&ssl=1

Income Tax Exemption List For Salaried Employees In AY 2021 22 Blog

https://www.tickertape.in/blog/wp-content/uploads/2022/02/12.png

Salaried Employees Alert Income Tax Exemption Limit Likely To Be

https://i0.wp.com/taxconcept.net/wp-content/uploads/2023/01/TDSOnSalary1.png?fit=1379%2C919&ssl=1

Web 27 Dez 2022 nbsp 0183 32 And also provides multiple income tax exemptions or deductions for salaried employees to reduce tax liability These tax savings are beyond the widely popular Section 80C tax savings under Web 14 Feb 2022 nbsp 0183 32 Section 80EE Section 80G Section 80TTA Section 80TTB Section 80U Deductions and exemptions not claimable under the new tax regime The bottom line Income tax exemptions for salaried

Web Income Tax Slabs for Salaried Employees and HUF All about Income Tax Slabs for Employed Individuals and HUF With the financial year 2022 23 coming to a close it is Web 21 Okt 2023 nbsp 0183 32 Under the Act it is taxable under Section 15 on a due or accrual basis irrespective of whether it is paid in addition to or in lieu of salary However some

Download Income Tax Exemption For Salaried Employees

More picture related to Income Tax Exemption For Salaried Employees

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

https://static.tnn.in/thumb/msid-96597124,imgsize-100,updatedat-1672313818106,width-1280,height-720,resizemode-75/96597124.jpg

5 Tax Saving Tips For Salaried Employees How To Save Maximum Tax For

https://i.ytimg.com/vi/RLgLve37oC0/maxresdefault.jpg

All The Salaried Employees Out There Save More With These Simple Tax

https://www.avivaindia.com/sites/default/files/All the Salaried Employees out there- Save More with these Simple Tax Planning Tips.jpg

Web 14 Apr 2023 nbsp 0183 32 2 1 The new tax regime has rationalized the scope of taxation with five tax slab rates ranging from 0 to 30 with the basic exemption till Rs 3 lakhs exempt from tax and the highest tax rate of Web Vor 2 Tagen nbsp 0183 32 It is to be noted that deductions under Chapter VI A deduction Section 80C 80D 80E and so on are not available for taxpayers who opt for the New Tax regime

Web 28 Dez 2023 nbsp 0183 32 Standard deduction means a flat deduction to individuals earning a salary or pension income It was introduced in the Budget 2018 in lieu of the exemption of Web Vor 22 Stunden nbsp 0183 32 The limit of tax exemption on leave encashment on retirement of non government salaried employees has been increased from 3 lakh to 25 lakh 6 New

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

Income Tax Exemptions For Salaried Employees 5min Guide

https://weinvestsmart.com/wp-content/uploads/2020/01/Income-tax-exemptions-1024x683.jpg

https://www.expatica.com/de/finance/taxes/income-taxes-in-germany-10…

Web 14 Dez 2023 nbsp 0183 32 Who is exempt from income tax in Germany No one is exempt from paying tax in Germany if their income exceeds the tax free personal allowance 10 347

https://incometaxindia.gov.in/Charts Tables/List_of_benefits_available...

Web 97 Zeilen nbsp 0183 32 1 10 13A House Rent Allowance Sec 10 13A amp Rule 2A Least of the

Increased Limit For Tax Exemption On Leave Encashment For Non govt

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

7 Useful Income Tax Exemptions For The Salaried

HRA Exemption Calculator In Excel House Rent Allowance Calculation

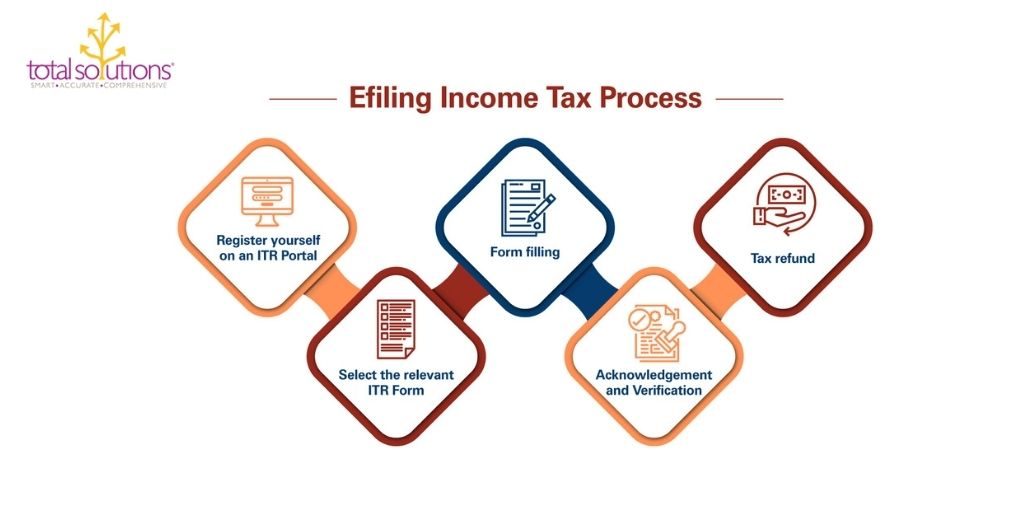

Easy Steps To File Income Tax Returns For Salaried Employees

How To File Income Tax Return Online For Salaried Employee

How To File Income Tax Return Online For Salaried Employee

PDF Financial Planning For Salaried Employee And Strategies For Tax

FY 2023 24 Income Tax Calculation On Salaried Employee CTC

Fillable Online Employee s Income Tax Declaration Form For The

Income Tax Exemption For Salaried Employees - Web Income Tax Slabs for Salaried Employees and HUF All about Income Tax Slabs for Employed Individuals and HUF With the financial year 2022 23 coming to a close it is