Income Tax Law 20 20 21

All Cyprus tax resident individuals are taxed on all chargeable income including certain employment benefits accrued or derived from all sources in Cyprus and abroad Individuals who are not tax residents of Cyprus are taxed on certain income accrued or derived from sources in Cyprus Guide to completing the Income Tax Return for Individuals 2022 Explanatory Table for the implementation of sections 21 and 21A of article 8 of the Income Tax Law Explanatory Table for the implementation of sections 23 and 23A of article 8 of the Income Tax Law

Income Tax Law

Income Tax Law

https://blog.tax2win.in/wp-content/uploads/2018/12/Income-tax-law-infographic.jpg

Tax Law Free Of Charge Creative Commons Legal 1 Image

https://pix4free.org/assets/library/2021-01-21/originals/tax_law.jpg

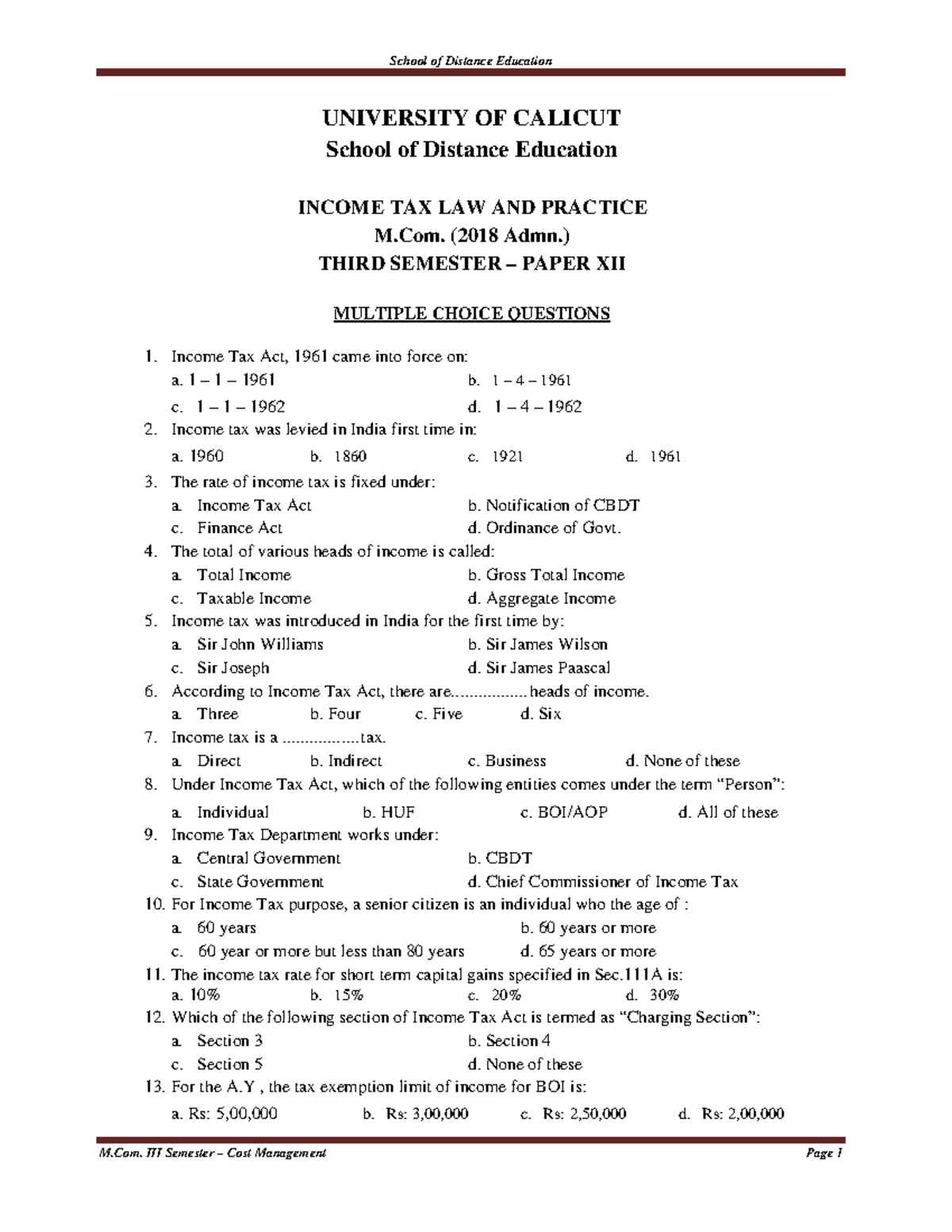

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

Personal income tax PIT Cyprus PIT is imposed on the worldwide income of individuals who are tax residents in Cyprus Individuals who are not tax residents of Cyprus are taxed only on certain types of income accrued or derived from sources in Cyprus The following table lists the PIT rates and bands currently applicable to individuals Income tax authorities Section 66 Total income Section 14 Heads of income Section 104 Income tax on undistributed income of certain companies Section 110 Determination of tax where total income includes income on which no tax is payable

Direct Taxation Legislation Common Legislation Income Tax Assesment and Collection of Taxes Special Defence Contribution Capital Gains Immovable Property Mutual Assistance Other Direct Taxation Laws Judgements of the Supreme Court Returns Employees Self Employed Companies Employers Immovable Property Capital All Cyprus tax resident individuals are taxed on all chargeable income including certainemployment benefits accrued or derived from all sources in Cyprus and abroad Individuals who are not tax residents of Cyprus are taxed on certain income accrued or derived from sources in Cyprus

Download Income Tax Law

More picture related to Income Tax Law

China Adopts New Personal income Tax Law Chinadaily cn

http://img2.chinadaily.com.cn/images/201808/31/5b88ee3ca310add1c69985f3.jpeg

Five Most Serious Offences Under The Income Tax Act

https://blog.ipleaders.in/wp-content/uploads/2019/11/30023384350_3fa5295abc_b.jpg

Income Tax Law What Are The Components Of Income Tax Law Tax2win

https://blog.tax2win.in/wp-content/uploads/2018/12/Income-tax-law-1.jpg

In detail On 15 December 2020 amending law No 7 which amends Article 8 21 of the Cyprus Income Tax Law was published in the Cyprus Government Gazette Article 8 21 grants a five year exemption from income tax of the lower of 20 of the remuneration arising from employment in Cyprus or EUR 8 550 In brief On 1 November 2022 the Cyprus Tax Authorities CTA issued Circular 10 2022 the Circular clarifying certain aspects of the exemptions introduced through Articles 8 21A and 8 23A of the Cyprus Income Tax Law ITL on employment income of certain individuals fulfilling specific conditions

[desc-10] [desc-11]

A Brief About Indian Income Tax Law For Law Students And Lawyers

https://www.caclubindia.com/img/preview/paidnfree/jan_1.jpg?imgver=43251

Business 2013 Understanding Of Income Tax Laws Training

http://1.bp.blogspot.com/-O9W17gwA2K0/Tqb61UUwVhI/AAAAAAAAAVc/vIXgJL72Wxw/s1600/income+tax+laws.jpg

http://www.cylaw.org/nomoi/enop/non-ind/2002_1_118/index.html

20 20 21

https://www.pwc.com.cy/en/publications/assets/tff...

All Cyprus tax resident individuals are taxed on all chargeable income including certain employment benefits accrued or derived from all sources in Cyprus and abroad Individuals who are not tax residents of Cyprus are taxed on certain income accrued or derived from sources in Cyprus

Income Tax Law And Practice Multiple Choice Questions Are Included

A Brief About Indian Income Tax Law For Law Students And Lawyers

Routemybook Buy Income Tax Law And Practice Assessment Year 2020

Tips To Ensure You Are Not Breaking income Tax Law

Income Tax Law

Income Tax Law And Practice Buy Income Tax Law And Practice Online

Income Tax Law And Practice Buy Income Tax Law And Practice Online

BLOG BASIC PRINCIPLES OF INCOME TAX LAW LAWYERSGYAN

Law Of Taxation CCSU LL B 2nd Semester Examination June 2016 Law VI

Income Tax Law By Vern Krishna

Income Tax Law - [desc-14]