Income Tax Rebate Limit On Home Loan Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Web 12 juin 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b Web 4 janv 2023 nbsp 0183 32 Key Takeaways Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax

Income Tax Rebate Limit On Home Loan

Income Tax Rebate Limit On Home Loan

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web 7 janv 2023 nbsp 0183 32 The maximum amount of deduction that can be claimed is Rs 2 lakh per financial year for a self occupied property There is an express need for more tax sops for home buyers as well as investors The tax Web 31 janv 2023 nbsp 0183 32 Budget 2023 Latest Update As Union Finance Minister Nirmala Sitharaman is all set to present Union Budget 2023 on Wednesday analysts are expecting an increase in the income tax exemption limit

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on Web Section 80C deals with the principal amount deductions For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every year from taxable

Download Income Tax Rebate Limit On Home Loan

More picture related to Income Tax Rebate Limit On Home Loan

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Good News Income Tax Rebate Limit Up At Rs 5 Lakh Standard Deduction

https://financialexpresswpcontent.s3.amazonaws.com/uploads/2019/02/we.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct interest on

Web Breaker box 4 000 limit Electric wiring 2 500 limit Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you Web 10 mars 2021 nbsp 0183 32 a The additional deduction with respect to interest on loan taken will be applicable only for residential house property b It s only for first time home buyers c

Recovery Rebate Income Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-q-a-about-recovery-rebates-student-loans-health-care-4.png

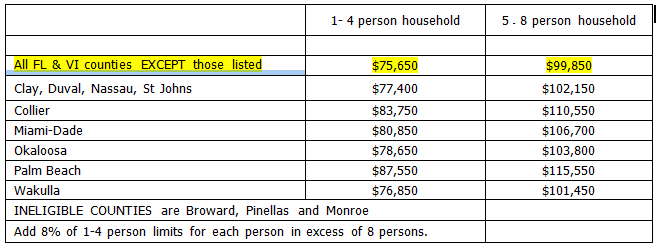

2017 USDA Household Income Limits USDA Mortgage Source

http://www.usdamortgagesource.com/wp-content/uploads/2015/05/Florida-USDA-Rural-Income-limits-2015.png

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b

Rep Matt Bradford On Twitter The Property Tax Rent Rebate Is An

Recovery Rebate Income Limits Recovery Rebate

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

House Loan Limit In Income Tax Home Sweet Home

What s The Distinction Between PMI And Home Loan Defense Insurance

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Income Tax Deductions List FY 2019 20

Increase In Rebate Limit Relief On Home Loan Here s What Taxpayers

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate Limit On Home Loan - Web 31 janv 2023 nbsp 0183 32 Budget 2023 Latest Update As Union Finance Minister Nirmala Sitharaman is all set to present Union Budget 2023 on Wednesday analysts are expecting an increase in the income tax exemption limit