Income Tax Rebate On Government Contribution To Nps Yes employer contribution to NPS should be added to gross salary as per Section 17 1 of the Income tax act However you can claim deduction u s 80CCD 2

To be eligible for Income Tax deduction under the NPS Tier 2 Account one must contribute a minimum of Rs 3 000 per annum or Rs 250 per month There is an In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means that if you belong to the

Income Tax Rebate On Government Contribution To Nps

Income Tax Rebate On Government Contribution To Nps

https://i.ytimg.com/vi/uAk_BoLiYYE/maxresdefault.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-768x524.jpg

How To Make Contribution To NPS Account

https://finlib.in/wp-content/uploads/2022/06/4-Make-contribution-to-nps.png

Individuals who are self employed and contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 20 of gross income under What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible

Tax Benefits on Contribution to NPS Account For Tier I Account Mandatory Own Contribution NPS subscribers are eligible to claim tax benefits up to INR 1 5 lakh under Section 80C Employer s NPS contribution for the benefit of employee up to 10 of salary Basic DA is deductible from taxable income up to 7 5 Lakh Corporates Employer s Contribution

Download Income Tax Rebate On Government Contribution To Nps

More picture related to Income Tax Rebate On Government Contribution To Nps

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://freefincal.com/wp-content/uploads/2015/12/Online-contribution-NPS.jpg

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

https://feeds.abplive.com/onecms/images/uploaded-images/2022/04/02/f76f68da854ba91279b6eb80f97615cb_original.jpg?impolicy=abp_cdn&imwidth=1200&imheight=628

How To Make Contribution To NPS Account

https://finlib.in/wp-content/uploads/2022/06/2-Make-contribution-to-nps-1024x436.png

Further the employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for government employees If a Government employee contributes towards Tier II of NPS the tax benefit of Section 80C for deduction up to Rs 1 50 000 will be available to them provided that there is a lock in period of 3 years

Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for others This Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS website says There

NPS Cabinet Approves Raising Government Contribution To NPS To 14

https://img.etimg.com/thumb/msid-66976437,width-1200,height-630,imgsize-523188,overlay-etwealth/photo.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Home-Loan-Deduction-Under-Section-80c-750x362.jpg

https://cleartax.in › taxability-on-nps-employers-contribution

Yes employer contribution to NPS should be added to gross salary as per Section 17 1 of the Income tax act However you can claim deduction u s 80CCD 2

https://cleartax.in

To be eligible for Income Tax deduction under the NPS Tier 2 Account one must contribute a minimum of Rs 3 000 per annum or Rs 250 per month There is an

NPS Can I Claim Deduction On My Contribution To NPS As Well That Put

NPS Cabinet Approves Raising Government Contribution To NPS To 14

How To Make Contribution To NPS Account

How To Make Contribution To NPS Account

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

NPS Bonanza For Govt Employees More Tax Benefits Higher Centre s

NPS Bonanza For Govt Employees More Tax Benefits Higher Centre s

Your Employer s Contribution To NPS Can Make A Huge Difference

How To Make Contribution To NPS Account

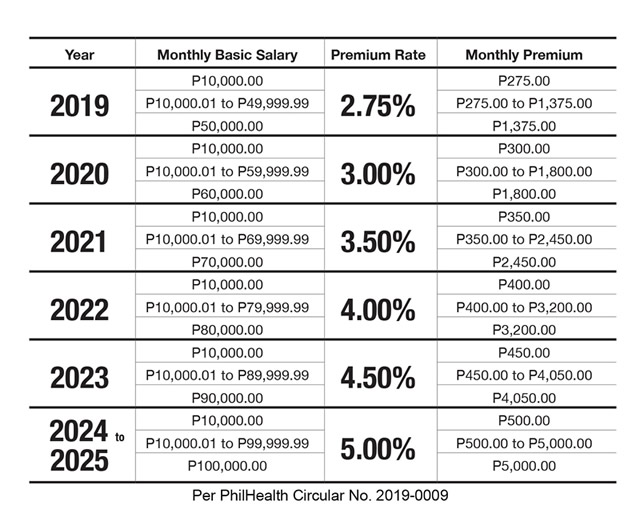

PhilHealth Contribution Calculator

Income Tax Rebate On Government Contribution To Nps - Tax Benefits on Contribution to NPS Account For Tier I Account Mandatory Own Contribution NPS subscribers are eligible to claim tax benefits up to INR 1 5 lakh under Section 80C