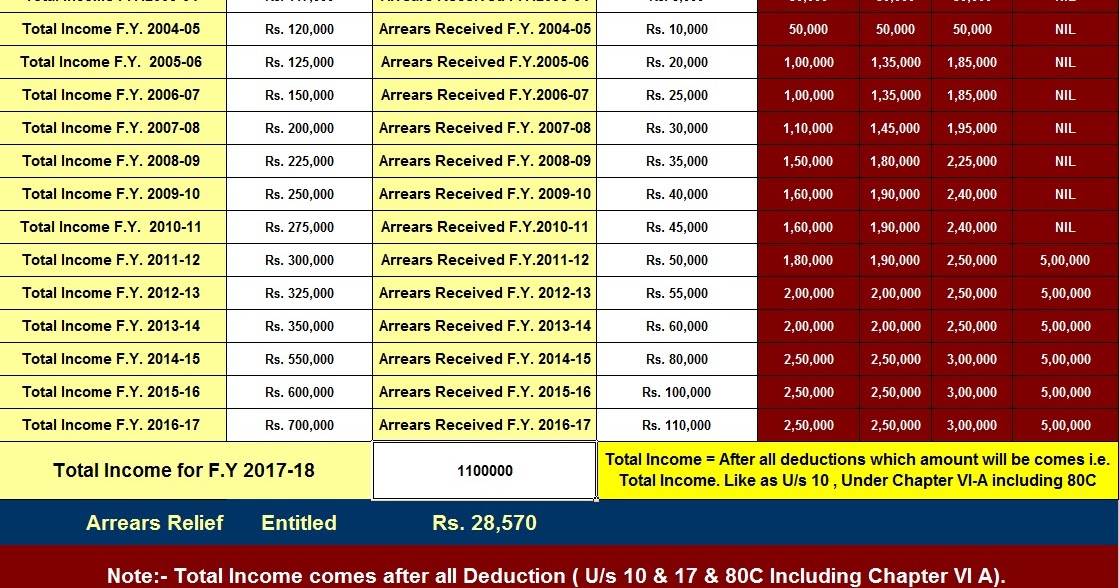

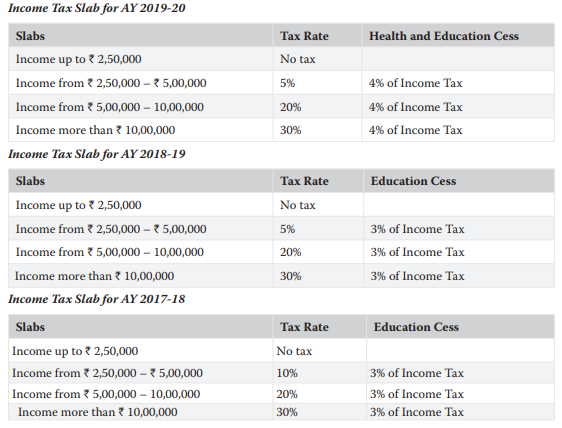

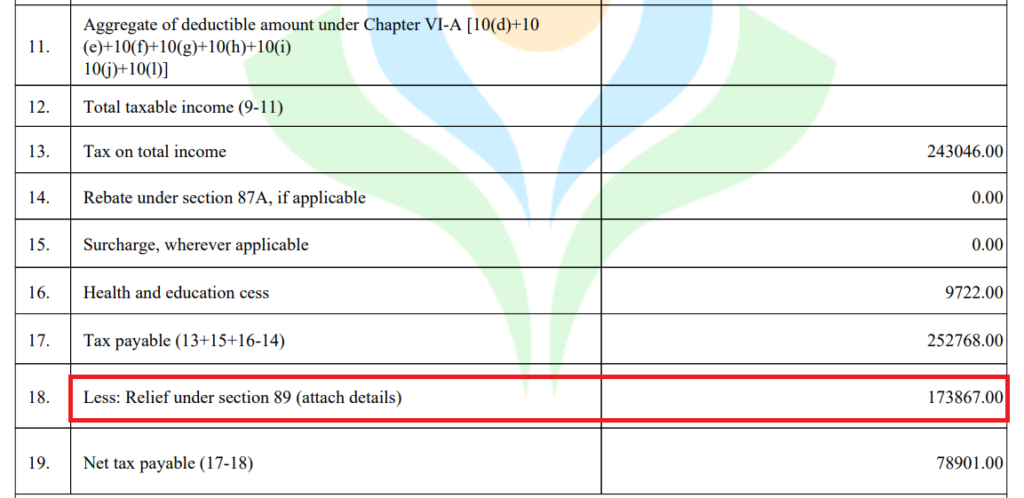

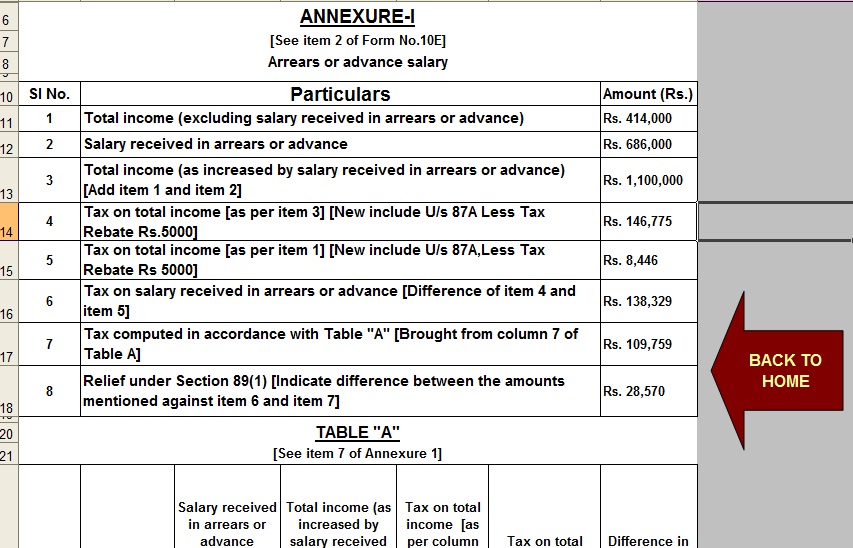

Income Tax Rebate On Salary Arrears Web How to Calculate Tax Relief under Section 89 1 on Salary Arrears 1 Calculate tax payable on the total income including additional salary arrears or compensations in the year it is received 2 Calculate tax

Web 26 ao 251 t 2021 nbsp 0183 32 As per Section 89 1 tax deduction relief is provided by recalculating tax for the year in which arrears are received and the year to which the arrears pertain and the Web 29 sept 2020 nbsp 0183 32 1 Calculate tax payable on the total income including arrears in the year it is received 2 Calculate tax payable on the total income excluding arrears in the year it is received 3 Calculate

Income Tax Rebate On Salary Arrears

Income Tax Rebate On Salary Arrears

https://2.bp.blogspot.com/-Iz5qsw-tk4Q/WZhb8UB7AaI/AAAAAAAAFOo/j7DEJ6iUiKEjoIBcibl6UpWAUZLKDPzSwCLcBGAs/w1200-h630-p-k-no-nu/Arrears%2BRelief%2BPage%2B1.jpg

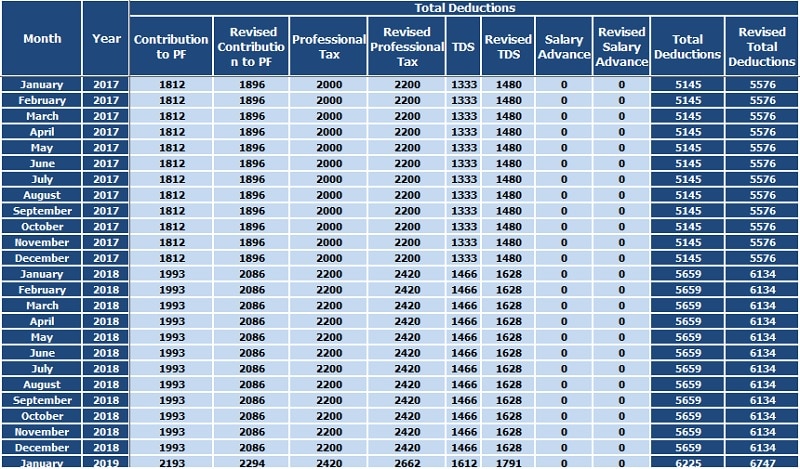

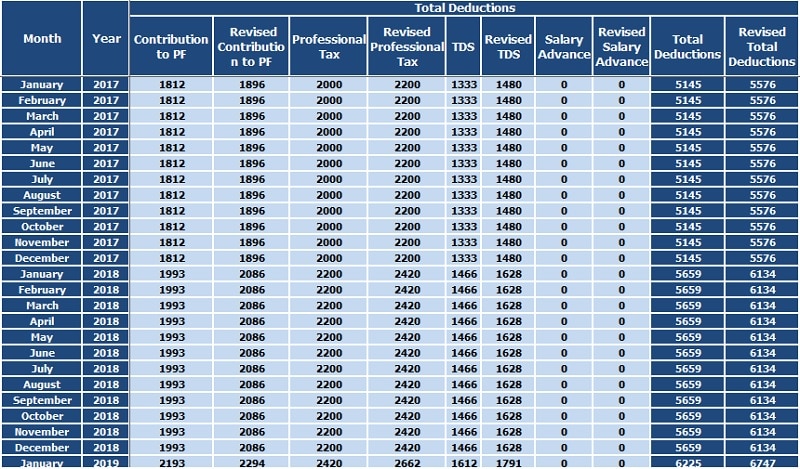

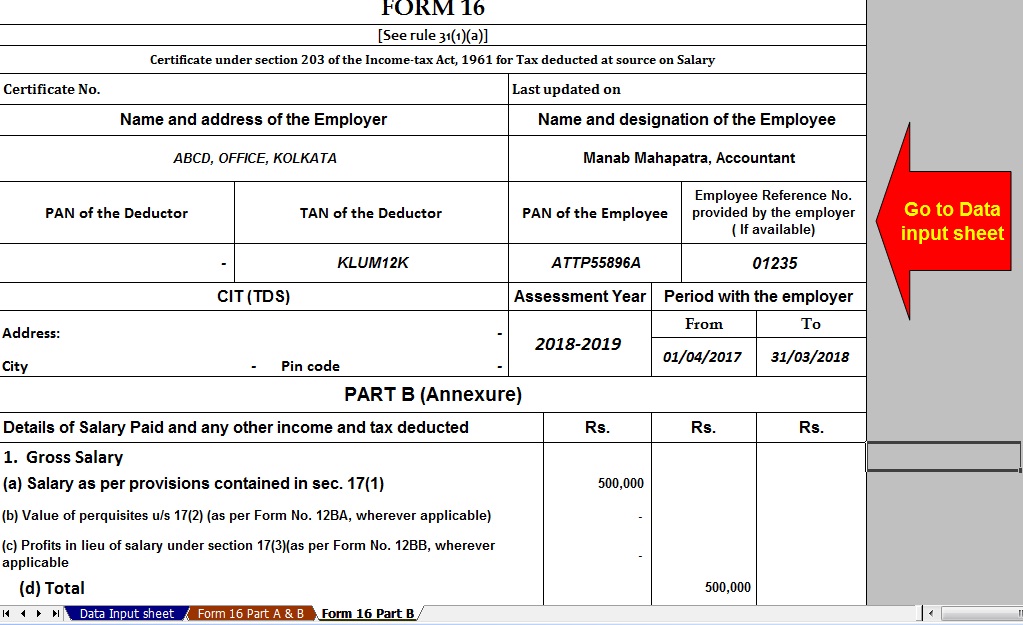

Download Salary Arrears Calculator Excel Template ExcelDataPro

https://exceldatapro.com/wp-content/uploads/2019/06/Deductions-SAC.jpg

TAX BY MANISH Save Tax On Salary Arrears Tax Relief Calculations U s

http://2.bp.blogspot.com/-QAMHUqWWyWs/TacABm2-f0I/AAAAAAAAAd8/rw0semcLwRk/s1600/Calculation.GIF

Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is Web 8 f 233 vr 2022 nbsp 0183 32 If your total income includes any past dues paid in the current financial year you may be worried about paying a higher tax on such arrears Hence in order to

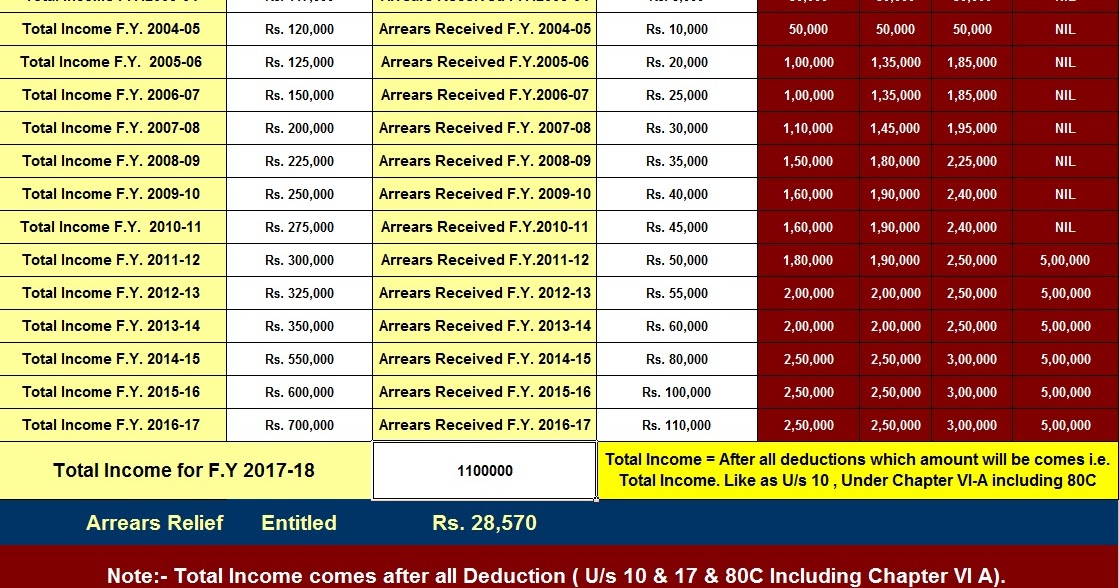

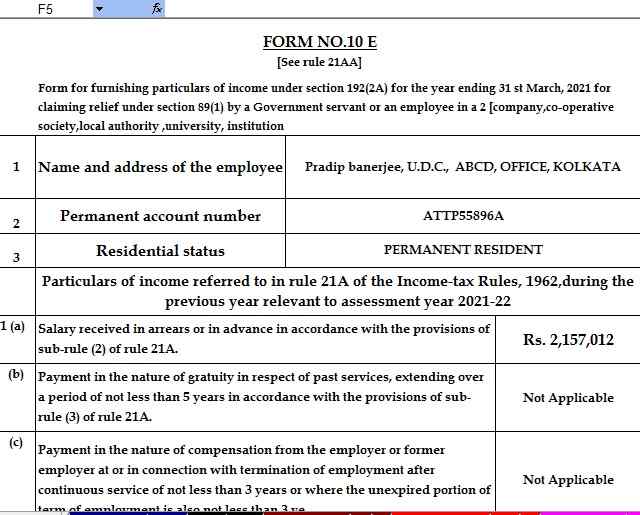

Web Bank Employees may claim the Income Tax relief on Arrears paid from 01 Nov 2012 after submitting the Form 10 E which can easily be automatically generated with the help of this calculator including the Income Tax Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of previous

Download Income Tax Rebate On Salary Arrears

More picture related to Income Tax Rebate On Salary Arrears

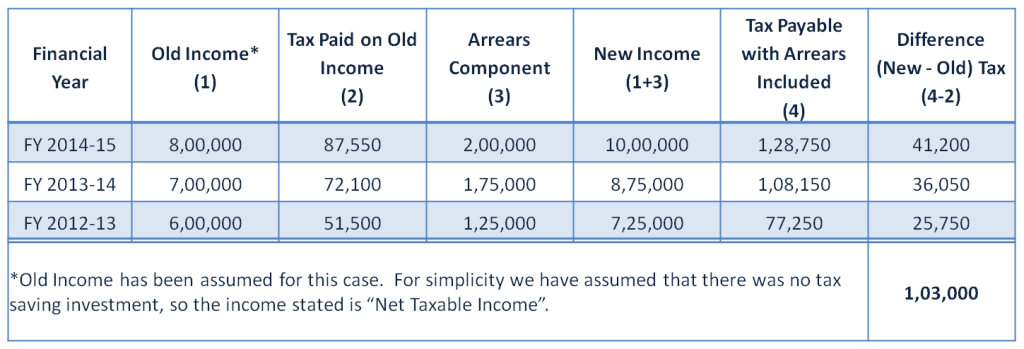

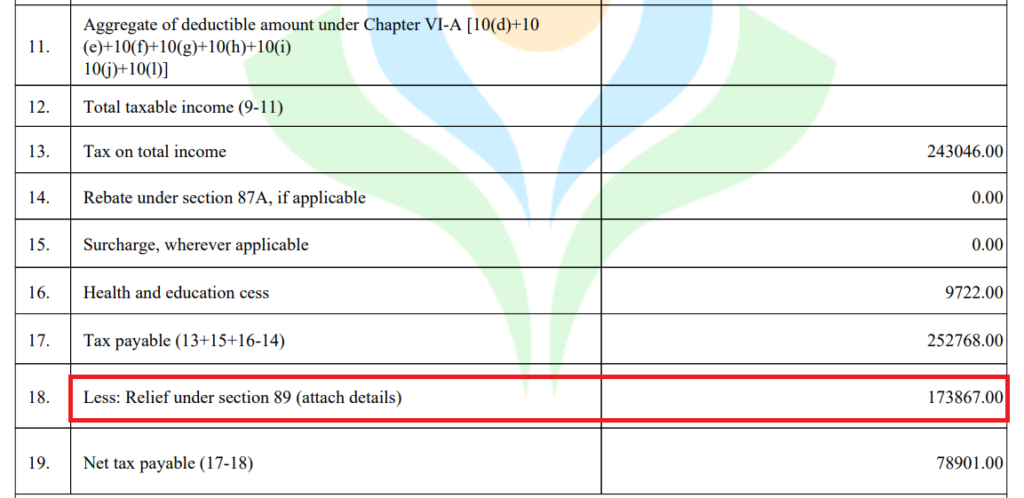

How To Calculate Tax On Arrears U s 89 1 Show It In ITR

https://www.apnaplan.com/wp-content/uploads/2016/02/Calculating-Tax-on-Arrears-1024x349.png

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

https://1.bp.blogspot.com/-WTvGRg9xCHQ/XjLLfZM21sI/AAAAAAAALwo/3xvMPCS82_Yg_BVdqkSeIR70cstX3PL6ACNcBGAsYHQ/w1200-h630-p-k-no-nu/Picture%2Bof%2BHRA%2BExemption.jpg

INCOME TAX ON SALARY ARREARS RELIEF UNDER 89 1 SIMPLE TAX INDIA

https://1.bp.blogspot.com/-HDFR4jdtwY8/XC1xAg3SEOI/AAAAAAAAFNU/138eGrCvIG0-8cO1kkEd2_b-ClDNUm5-gCLcBGAs/s1600/screenshot-resource.cdn.icai.org-2019.01.03-07-32-32.png

Web 12 juil 2023 nbsp 0183 32 Below are the detailed steps to calculate the relief under section 89 Step 1 We need to calculate the tax payable on the total income including the arrears of Web 5 avr 2023 nbsp 0183 32 However one can claim relief under section 89 1 for arrears of salary or advance salary if the Rate of tax on salary in the current year is more than the rate of

Web 3 ao 251 t 2023 nbsp 0183 32 Salary is received in arrears or in advance Salary received for more than 12 months in one financial year Family Pension is received in arrears Gratuity Web 3 janv 2019 nbsp 0183 32 Individuals can get relief on account of arrears in salary to the extent of difference between Increase in the Tax Liability of Current year and Increase in Tax

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

https://assets.learn.quicko.com/wp-content/uploads/2021/02/11153055/Salary-Arrears-1024x498.png

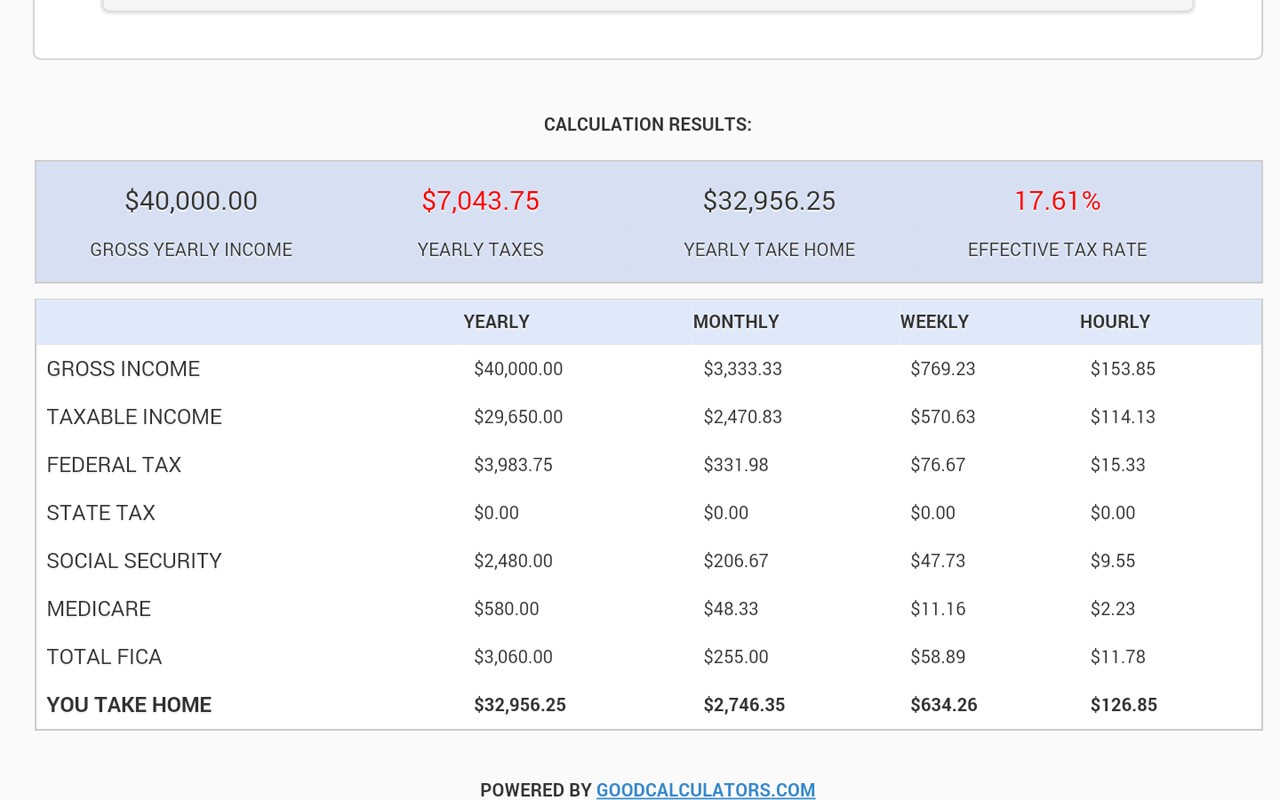

United States Salary Tax Calculator

https://www.thegreatapps.com/application/upload/Apps/2016/07/united-states-salary-tax-calculator-158.png

https://www.canarahsbclife.com/tax-university…

Web How to Calculate Tax Relief under Section 89 1 on Salary Arrears 1 Calculate tax payable on the total income including additional salary arrears or compensations in the year it is received 2 Calculate tax

https://taxguru.in/income-tax/section-89-tax-relief-salary-arrears...

Web 26 ao 251 t 2021 nbsp 0183 32 As per Section 89 1 tax deduction relief is provided by recalculating tax for the year in which arrears are received and the year to which the arrears pertain and the

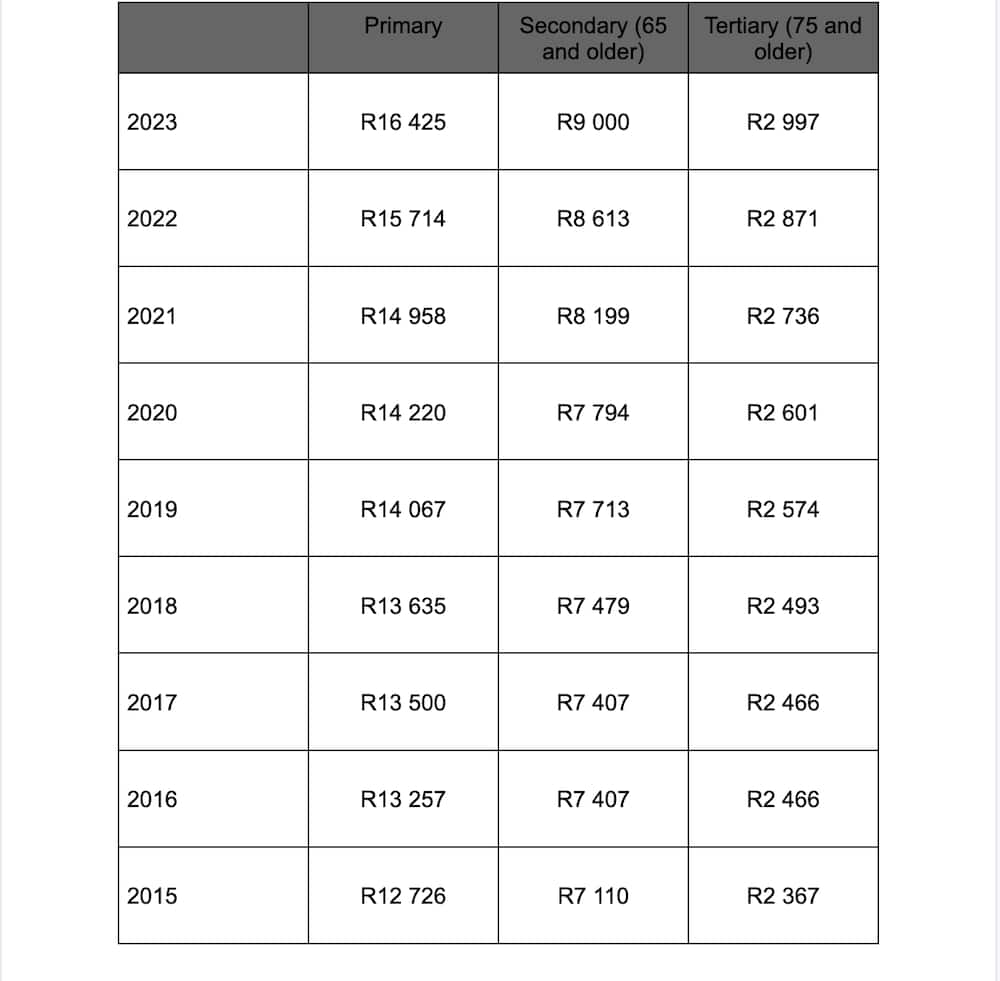

How To Calculate PAYE On Salary 2022 Step by step Guide Briefly co za

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

Automated Excel Form 10 E Salary Arrears Relief Calculator For Claiming

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Claim Income Tax Relief Under Section 89 1 On Salary Arrears

Claim Income Tax Relief Under Section 89 1 On Salary Arrears

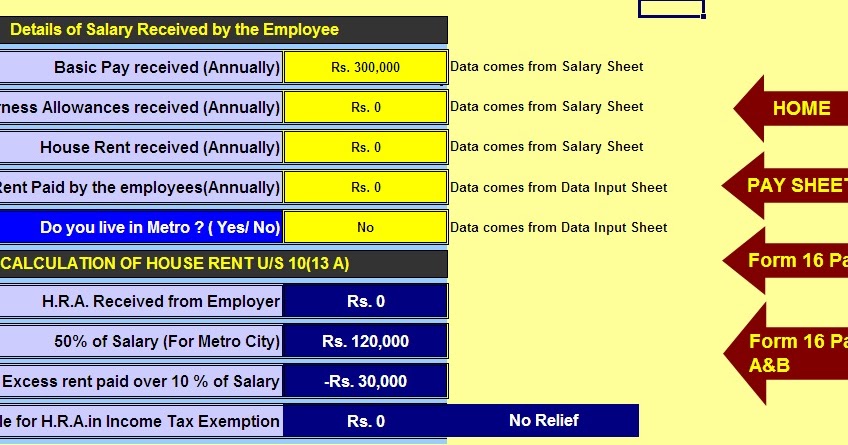

Download Automated Tax Computed Sheet HRA Calculation Arrears

Received Salary Arrears Know The Tax Deduction

Download New Form 12BB To Claim Tax Deduction On LTA And HRA With

Income Tax Rebate On Salary Arrears - Web Bank Employees may claim the Income Tax relief on Arrears paid from 01 Nov 2012 after submitting the Form 10 E which can easily be automatically generated with the help of this calculator including the Income Tax