Irs Electric Vehicle Rebate Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Web We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new Web 16 ao 251 t 2022 nbsp 0183 32 To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those

Irs Electric Vehicle Rebate

Irs Electric Vehicle Rebate

https://i0.wp.com/www.fordrebates.net/wp-content/uploads/2023/05/ontario-electric-vehicle-rebate-eligibility-electricrebate.jpg?fit=720%2C1280&ssl=1

Illinois Electric Vehicle Rebate PaymentGrant Refund Cheque Funny

https://funnyinterestingcool.com/download/file.php?id=435

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you Web Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for

Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit Bestselling Chevy Bolts and Tesla Model 3s and Model Ys are Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under

Download Irs Electric Vehicle Rebate

More picture related to Irs Electric Vehicle Rebate

Electric Vehicle Rebate 2019 VPPSA

https://vppsa.com/wp-content/uploads/2018/12/Screenshot-2018-12-14-14.10.01.png

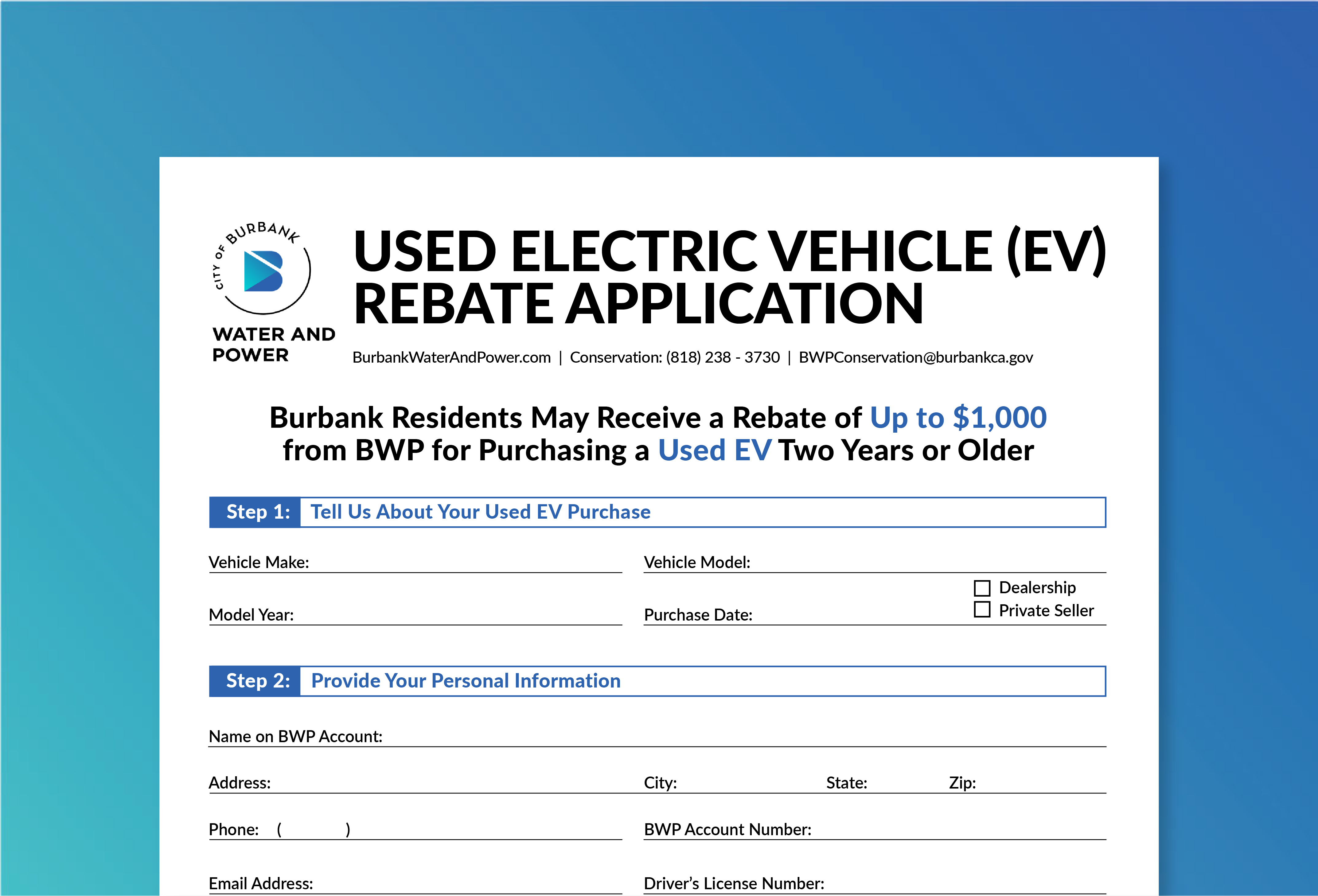

Used Electric Vehicle Rebate

https://www.burbankwaterandpower.com/images/2020/02/11/used-ev_application_image.jpg

Oregon s Electric Vehicle Rebate Program Could Get 30M Boost

https://www.statesmanjournal.com/gcdn/presto/2022/03/11/PSAL/7895c254-08cd-432c-aab3-037c18d2e060-ElectricVehicles021.JPG?crop=5982,3365,x0,y432&width=3200&height=1801&format=pjpg&auto=webp

Web Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act Web That s why fully electric vehicles are generally eligible for the maximum 7 500 sum while hybrids often qualify for less How do I claim it The year after buying a new EV fill out

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web 7 mai 2022 nbsp 0183 32 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only qualifies for the leasing company The credit

Electric Vehicle Rebate 2019 VPPSA

https://vppsa.com/wp-content/uploads/2019/05/EV.png

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

https://funnyinterestingcool.com/download/file.php?id=418

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

https://www.irs.gov/clean-vehicle-tax-credits

Web We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new

Toronto s First Electric Vehicle Rebate Approved MRS News

Electric Vehicle Rebate 2019 VPPSA

Used Electric Vehicle Rebate

Illinois EPA Opens Second Round Of Electric Vehicle Rebates Chronicle

Electric Vehicle Rebates Dakota Electric Association

Koehler backed Electric Vehicle Rebate Program Opens In Illinois

Koehler backed Electric Vehicle Rebate Program Opens In Illinois

Federal Electric Vehicle Rebate ElectricRebate

Electric Vehicle Rebate Available Until 3 31 McLeod Cooperative Power

Illinois Electric Vehicle Rebate Program Funding Ran Out What Does

Irs Electric Vehicle Rebate - Web WASHINGTON March 31 Reuters The U S Treasury Department unveiled stricter electric vehicle tax rules on Friday that will reduce or remove tax credits on some zero