Irs Solar Tax Credit Rental Property Calculating the Federal Solar Tax Credit for rental properties entails assessing the eligible expenses and applying the credit against tax liability Identify the total eligible costs associated with the solar installation on the rental property including equipment and installation costs

Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Irs Solar Tax Credit Rental Property

Irs Solar Tax Credit Rental Property

https://www.solarsam.com/wp-content/uploads/2021/01/File-the-Federal-Tax-Credit-Form-5695-to-Claim-the-Solar-ITC-on-Taxes-and-have-Solar-Panels-Professionally-Installed-by-Solar-Sam-1536x974.png

Filing For The Solar Tax Credit Wells Solar

https://wellssolar.com/wp-content/uploads/2020/01/IRS-solar-tax-credit-form-5695-sm.jpg

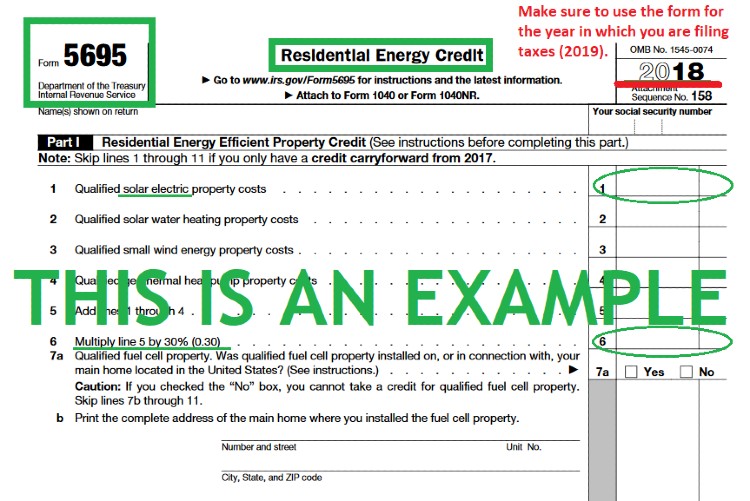

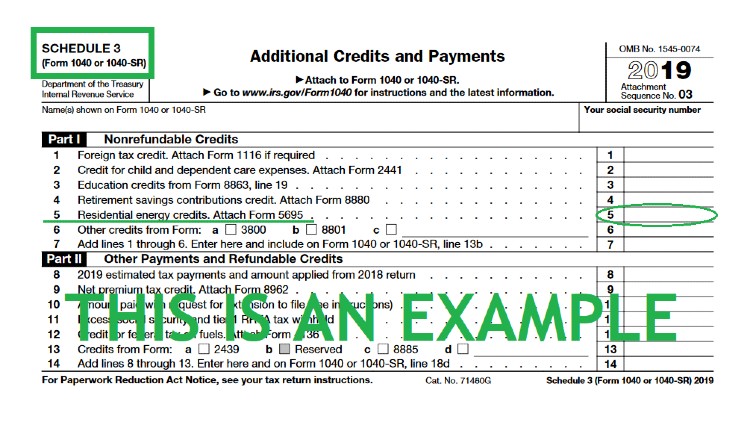

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Claiming the solar tax credit for rental property you own You can t claim the Residential Clean Energy solar tax credit for installing solar power at rental properties you own unless you also live in the house for part of the year and A valuable 30 credit for the cost of solar panels and related property is available for qualifying property installed in residential property used as a personal residence as well as for residential property held for rent

Download Irs Solar Tax Credit Rental Property

More picture related to Irs Solar Tax Credit Rental Property

.png)

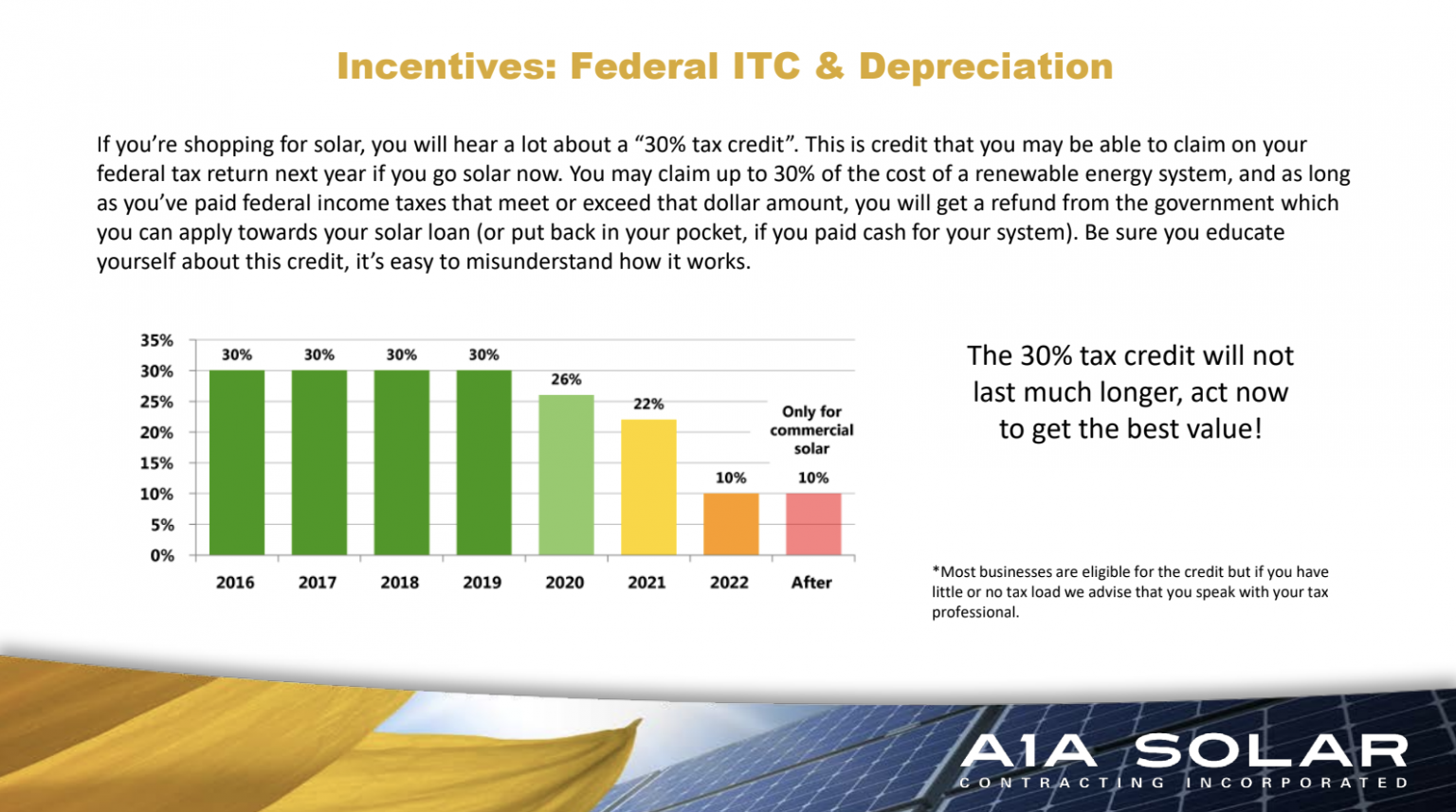

Federal Solar Tax Credit Steps Down After 2019 Solar

https://s3.amazonaws.com/solarassets/wp-content/uploads/Pick My Solar LIVE (9).png

Irs Solar Tax Credit 2022 Form

https://sunwork.org/wp-content/uploads/2021/01/Solar-Tax-Credit-Timeline-2.jpg

Federal Solar Tax Credit BenefitsFinder

https://benefitsfinder.com/wp-content/uploads/sites/4/2023/02/federal-solar-tax-credit.jpg

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re eligible Step by step instructions for using IRS Form 5695 to claim the 30 federal solar tax credit

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses How do I claim my solar tax credit from the IRS The solar tax credit is claimed on tax form 5695 when you file your federal income tax return This credit must be claimed in the same tax year that your system was

Irs Solar Tax Credit 2021 SolarDailyDigest

https://www.solardailydigest.com/wp-content/uploads/just-passed-in-congress-solar-federal-tax-credit-extended-2-years.jpeg

Filing For The Solar Tax Credit Wells Solar

https://wellssolar.com/wp-content/uploads/2020/01/IRS-solar-tax-credit-schedule-3-form-1040-sm.jpg

https://resident.com/resource-guide/2024/01/17/...

Calculating the Federal Solar Tax Credit for rental properties entails assessing the eligible expenses and applying the credit against tax liability Identify the total eligible costs associated with the solar installation on the rental property including equipment and installation costs

https://www.irs.gov/newsroom/energy-incentives-for...

Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property

What Is The Solar Tax Credit Investment Tax Credit SaveOnEnergy

Irs Solar Tax Credit 2021 SolarDailyDigest

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

Federal Tax Credit For Saving Money On Solar Panels KC Green Energy

2022 Solar Tax Credit Explained Get Solar Now Save Money

IRS Tax Credit For Year 2022 And 2023 DIY Solar Power Forum

IRS Tax Credit For Year 2022 And 2023 DIY Solar Power Forum

Commercial Solar Tax Credit Guide 2023

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

Solar Tax Credit 2016 Solar Investment Tax Credit FAQ NATiVE

Irs Solar Tax Credit Rental Property - Claiming the solar tax credit for rental property you own You can t claim the Residential Clean Energy solar tax credit for installing solar power at rental properties you own unless you also live in the house for part of the year and