Is Car Loan Interest Tax Deductible Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers But if you re self employed and use your car for business you may be able to write off at least a portion of your interest payment

Types of interest not deductible include personal interest such as Interest paid on a loan to purchase a car for personal use Credit card and installment interest incurred for personal expenses Find out about your state taxes property taxes tax rates and brackets common forms and much more Dependents Need to know how to claim a dependent or if someone qualifies

Is Car Loan Interest Tax Deductible

Is Car Loan Interest Tax Deductible

https://blog.way.com/wp-content/uploads/2022/07/car-loan-tax-deductible.jpg

Is Car Loan Interest Tax Deductible Lantern By SoFi

https://images.ctfassets.net/dzdmblwsahji/1FIXxzMjHMo27fnpoH0e2L/7ddac202d4cbe4f2bdbbe427df6cad5a/Is_Car_Loan_Interest_Tax_Deductible?fl=progressive&fm=jpg

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

https://media.marketrealist.com/brand-img/DIZm9nweS/1280x670/gettyimages-461479730-1645646485129.jpg

Interest on car loans If you are an employee you can t deduct any interest paid on a car loan This interest is treated as personal interest and isn t deductible If you are self employed and use your car in that business see Interest earlier under Experts agree that auto loan interest charges aren t inherently deductible This is why you need to list your vehicle as a business expense if you wish to deduct the interest you re paying on a car loan In order to do this your vehicle needs to fit into one of these IRS categories Investment interest Qualified mortgage interest

Some interest is not tax deductible such as that you pay on personal car loans and credit card balances Understanding Tax Deductible Interest Interest is the amount of money you pay a lender Deducting car loan interest on your tax returns can be a valuable write off if you re a small business owner or you re self employed But before you claim this deduction be sure you

Download Is Car Loan Interest Tax Deductible

More picture related to Is Car Loan Interest Tax Deductible

Is Car Loan Interest Tax Deductible

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18nDL8.img?h=630&w=1200&m=6&q=60&o=t&l=f&f=jpg

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

https://media.marketrealist.com/brand-img/tWByqgLRT/0x0/gettyimages-85644473-1645659085162.jpg

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

https://media.marketrealist.com/brand-img/qsB1dLdpQ/640x335/is-car-loan-interest-tax-deductible-1645731550732.jpg?position=top

Claiming Car Loan tax benefits is easy as long as you are actually using the car for legitimate business purposes For claiming the benefit at the time of filing tax returns include the loan interest paid in a year in the business expenses column In reality car loan payments and lease payments are usually not fully tax deductible This article will explain exactly why using three different scenarios We ll explore how much of your monthly car payment you can write off with a financed personal vehicle a financed company car and a leased vehicle

Short answer You will be able to deduct car loan interest from your tax returns only if you own a car for business purposes If you re self employed you will be able to write off a portion of your interest payment depending on You re already paying a lot of money on your car loan so why not get some extra money back Unfortunately most people cannot take advantage of writing off car payment interest on their taxes This deduction usually applies only to those who are self employed or own their own business

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

https://blog.way.com/wp-content/uploads/2022/07/car-loan-tax-deductible-2-1024x624.jpg

3 Situations In Which Personal Loan Interest Is Tax Deductible

https://images.prismic.io/pigeon-loans/731fa247-4f28-4040-9e77-d1f0909bc76a_leon-dewiwje-ldDmTgf89gU-unsplash.jpg?auto=compress,format&rect=0,0,4365,2912&w=820&h=547

https://lanterncredit.com/auto-loans/is-car-interest-tax-deductible

Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers But if you re self employed and use your car for business you may be able to write off at least a portion of your interest payment

https://www.irs.gov/taxtopics/tc505

Types of interest not deductible include personal interest such as Interest paid on a loan to purchase a car for personal use Credit card and installment interest incurred for personal expenses

Car Lease Tax Deduction Hmrc Jeraldine Will

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Is Personal Loan Interest Tax Deductible Where Is My US Tax Refund

Is Car Loan Interest Tax Deductible In Canada Above Reproach Memoir

Is Margin Loan Interest Tax Deductible Marotta On Money

Is Home Equity Loan Interest Tax Deductible For Rental Property

Is Home Equity Loan Interest Tax Deductible For Rental Property

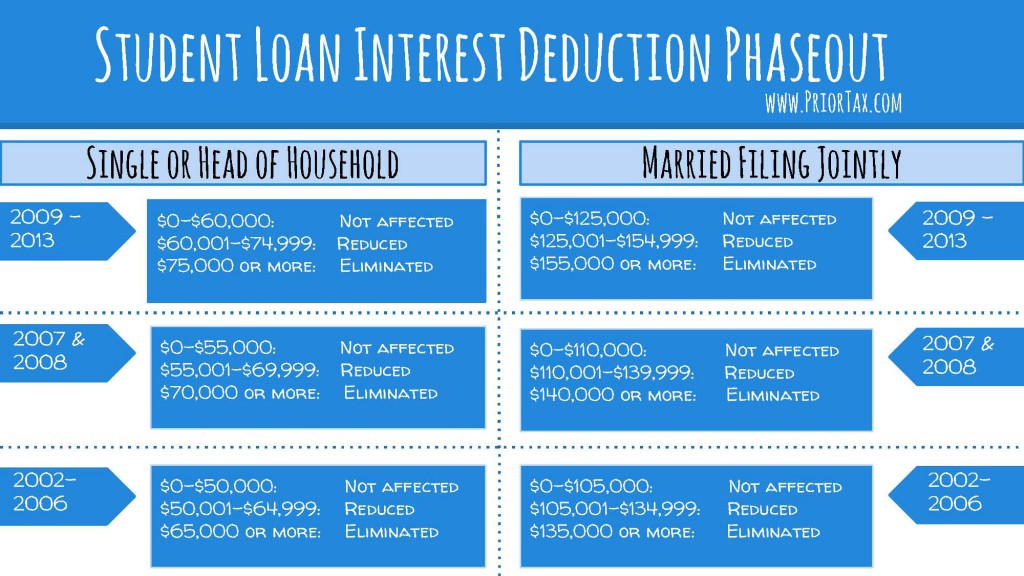

Student Loan Interest Deduction 2013 PriorTax Blog

Is Reverse Mortgage Interest Tax Deductible REVERSE MORTGAGE LOAN

Is Car Loan Interest Tax Deductible In Canada Above Reproach Memoir

Is Car Loan Interest Tax Deductible - Deducting car loan interest on your tax returns can be a valuable write off if you re a small business owner or you re self employed But before you claim this deduction be sure you