Is Car Loan Interest Tax Deductible In Canada You can deduct interest you paid on money you borrowed to buy a motor vehicle passenger vehicle or zero emission passenger vehicle that you use to earn employment income Include the interest you paid when you calculate your

You can deduct interest on money you borrow to buy a motor vehicle zero emission vehicle passenger vehicle or zero emission passenger vehicle you use to earn business income Include this interest as an expense when you calculate your allowable motor vehicle expenses The answer to is car loan interest tax deductible is normally no But you can deduct these costs from your income tax if it s a business car It can also be a vehicle you use for both personal and business purposes but you need to account for the usage

Is Car Loan Interest Tax Deductible In Canada

Is Car Loan Interest Tax Deductible In Canada

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cadba1015bd2a6cd57b8_60d8c68a8d0859749e4ecab1_Car-loan-interest-tax-deductible.jpeg

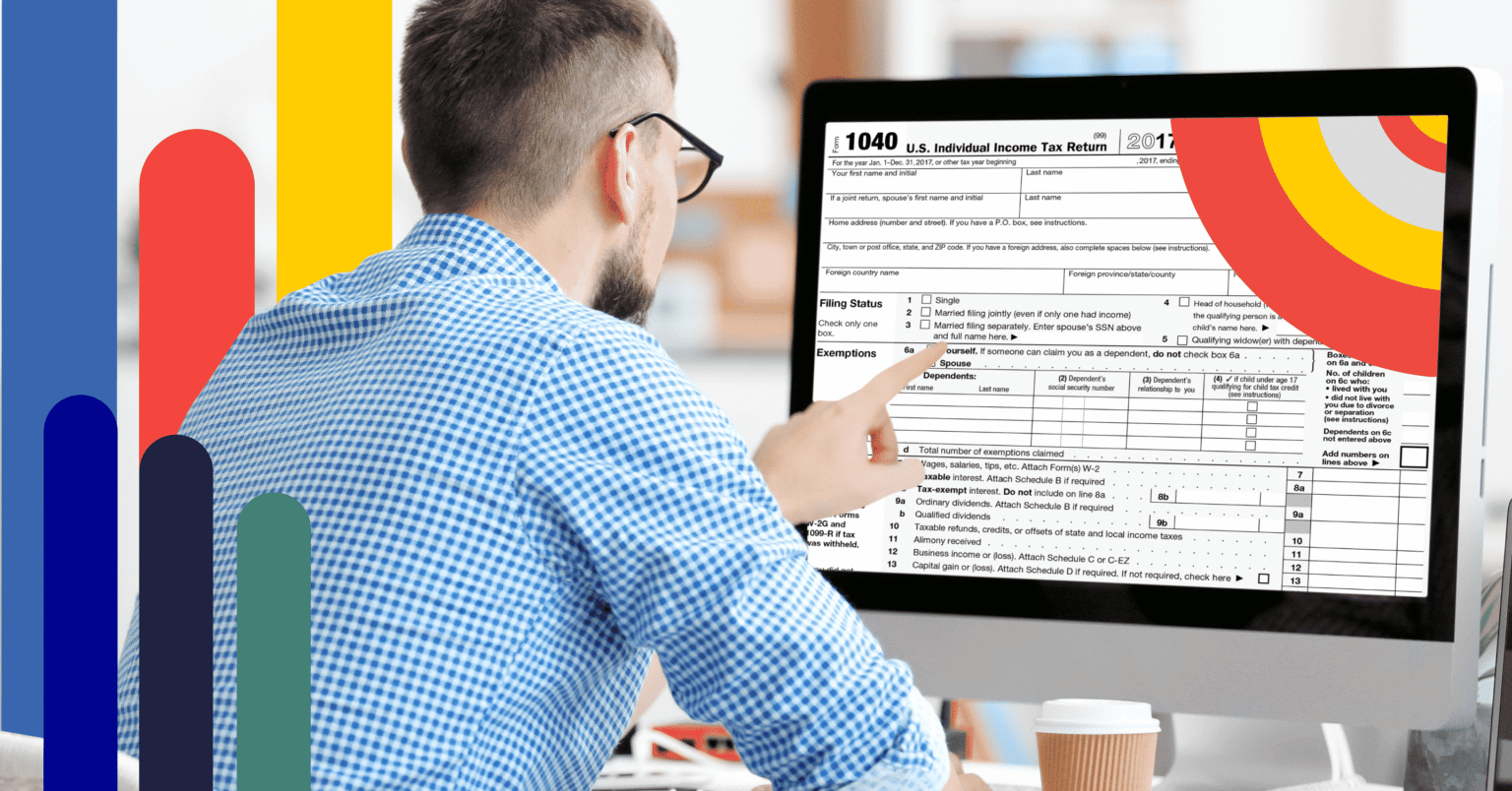

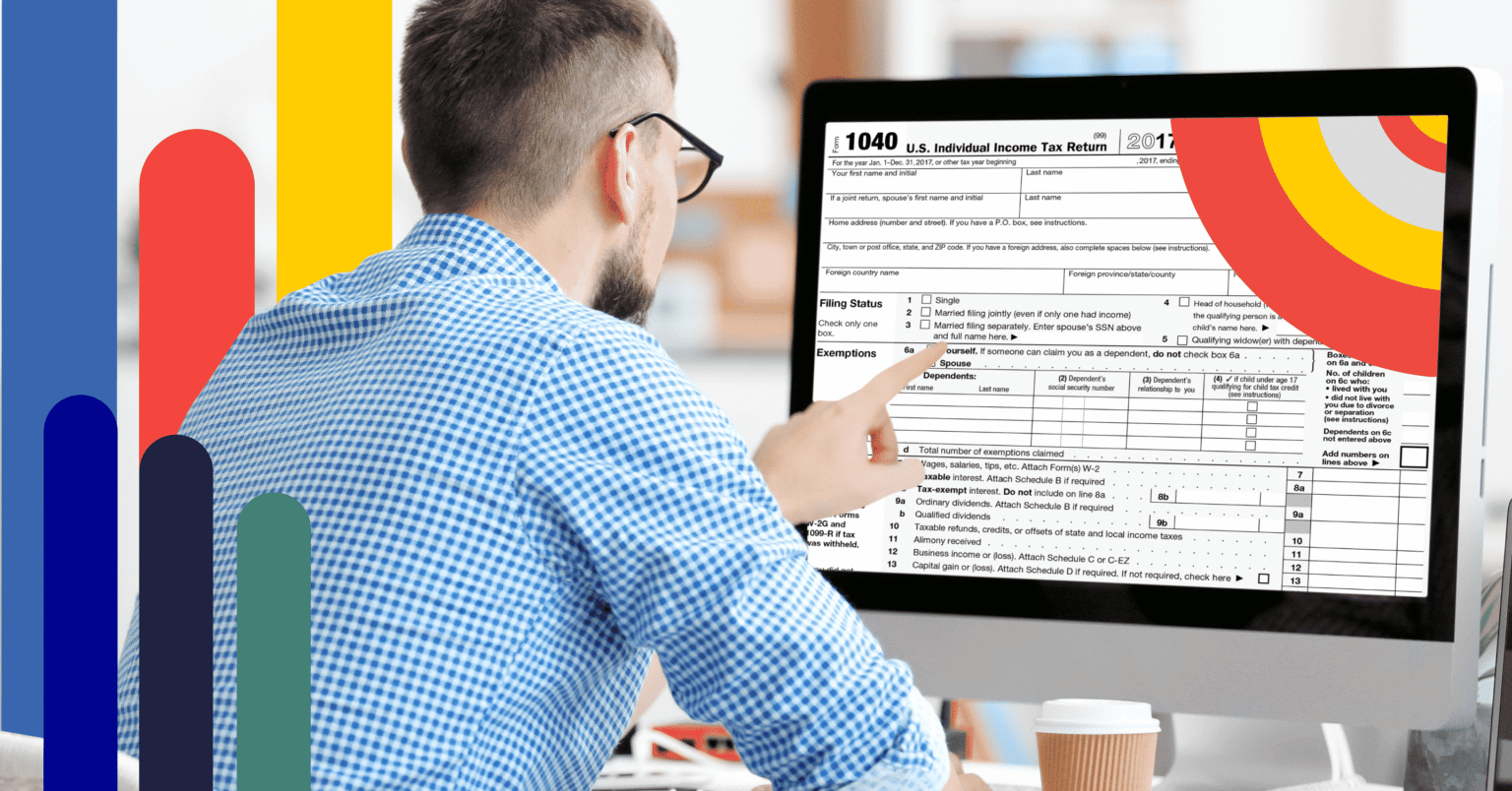

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

https://www.bankrate.com/2022/02/25231313/Is-car-loan-interest-tax-deductible.jpeg

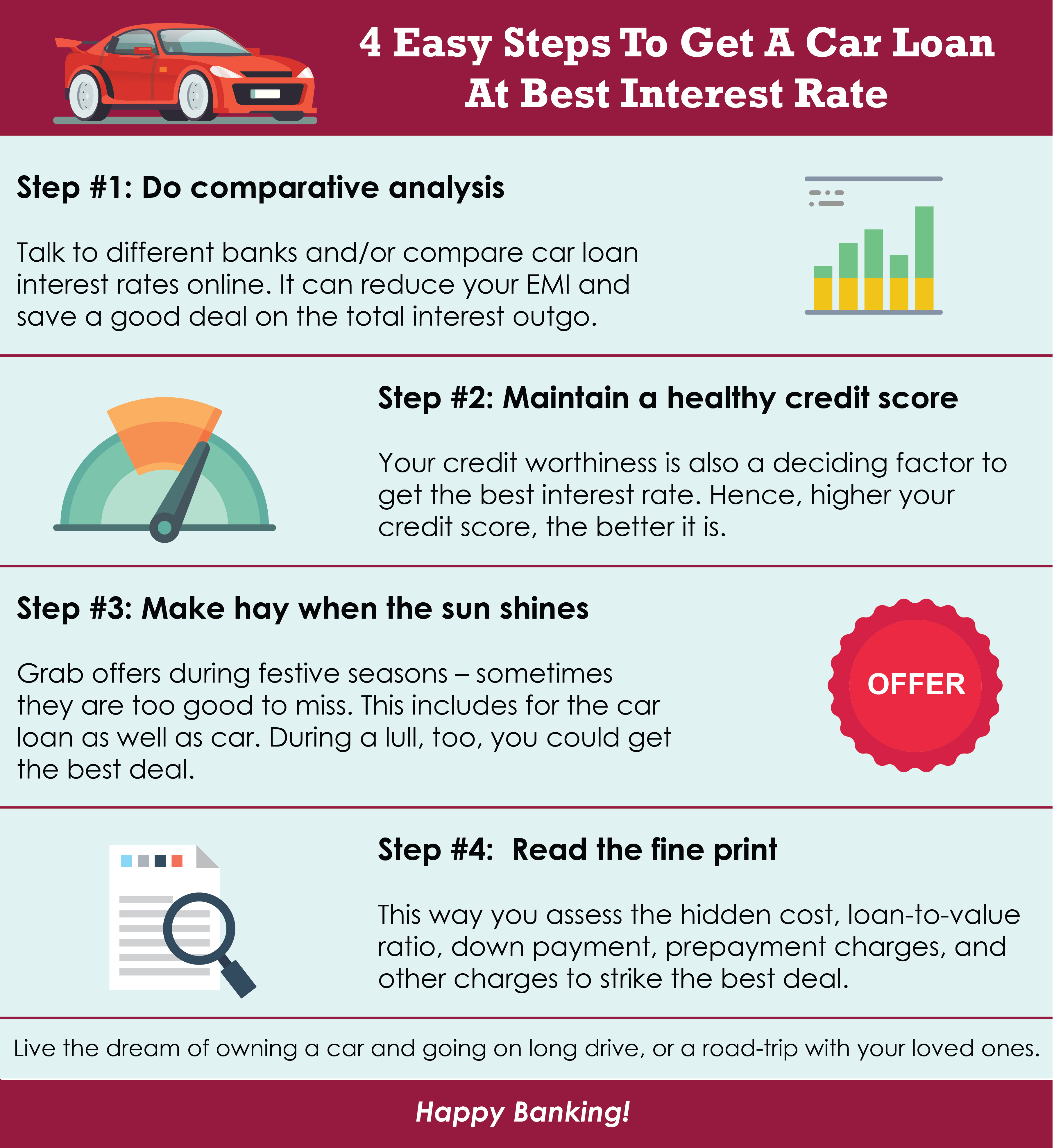

What To Look For In Car Loan Interest

https://www.axisbank.com/images/default-source/progress-with-us/4-easy-steps-to-get-a-car-loan-at-best-interest-rate-link-6.jpg

Some of the interest you pay on your mortgage loans or credit cards may be deductible on your tax return Whether interest is deductible depends on how you use the money you borrow Interest you pay on money used to generate income may be deductible if it meets the Canada Revenue Agency criteria Interest on car loans may be deductible if you use the car to help you earn income Interest on loans is deductible under CRA approved allowable motor vehicle expenses Read on for details on how to deduct car loan interest on your tax return

The CRA limits the deduction on the amount of interest paid on a loan to buy a vehicle This amount can be calculated as either the total interest paid on the automobile or 10 this amount varies depending on the age of the vehicle multiplied by the number of days you used the vehicle for work It s tax time and you re wondering if some of your carrying charges and interest fees are tax deductible The short answer is yes Some expenses can be deducted but you must also meet certain conditions

Download Is Car Loan Interest Tax Deductible In Canada

More picture related to Is Car Loan Interest Tax Deductible In Canada

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

https://media.giphy.com/media/l0HlOAfAzrR7e4ngA/giphy.gif

Deducting Car Loan Interest Sun Loan

https://www.sunloan.com/wp-content/uploads/2023/02/[email protected]

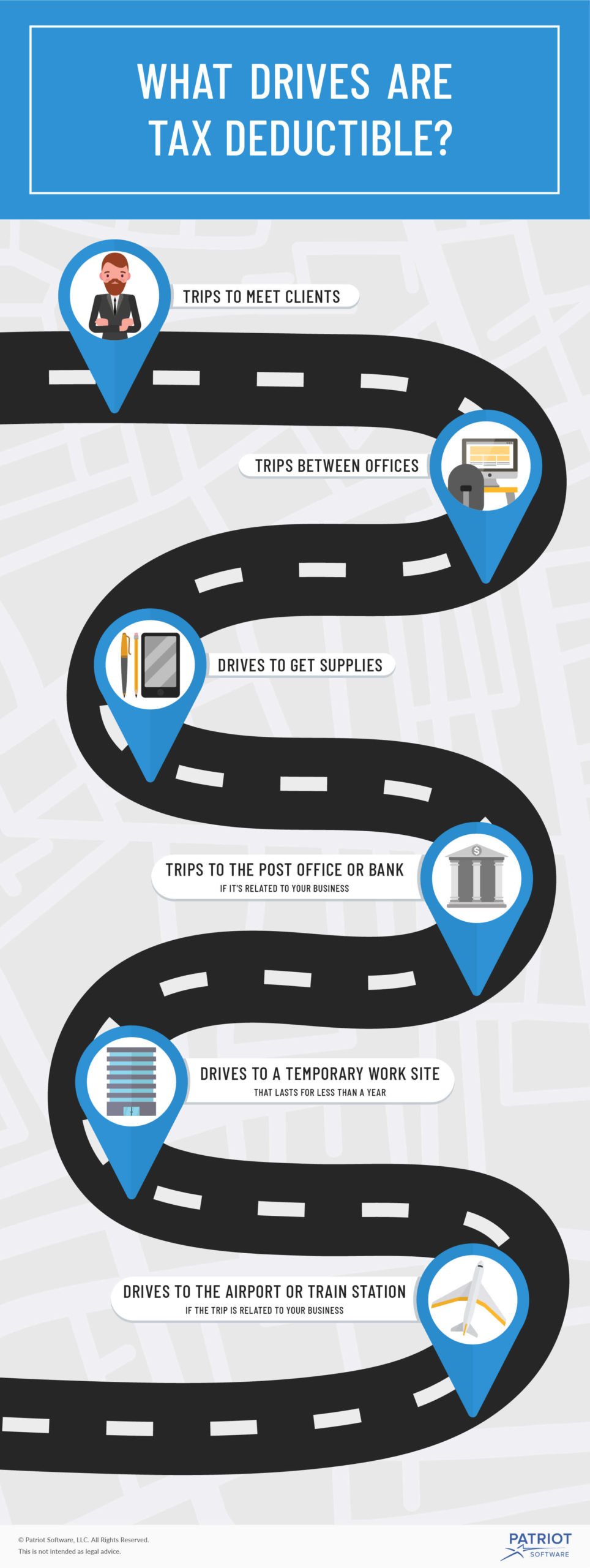

What Drives Are Tax Deductible Claiming Tax Deductions For Mileage

https://www.patriotsoftware.com/wp-content/uploads/2020/01/tax_deductable_drives_69080-01__1_-scaled.jpg

If you borrow to buy your car you can include the interest on the loan in your total car expenses Record this amount but keep in mind that the deductible interest is limited to 350 per month for new automobile loans entered into on or after January 1 2024 increased from 300 per month Interest on money borrowed to buy a motor vehicle You can deduct the interest you paid on your motor vehicle loan if you use the car to earn a business income Maintenance and repairs the cost of vehicle repairs and general maintenance to keep your vehicle running smoothly is a deductible expense

The interest is not tax deductible simply because the debt is on a rental property If you use a rental property line of credit to buy a new car the interest on that portion of the debt is Car loans are not taxable and the interest paid is typically not tax deductible for personal use vehicles You can t claim any interest payments incurred on your personal car loan as a tax deduction on your income tax return

Is Mortgage Interest Tax Deductible In Canada Nesto ca

https://www.nesto.ca/wp-content/uploads/2022/02/is-mortgage-interest-tax-deductible-in-canada-1536x804.png

Is Car Loan Interest Tax Deductible In Canada Above Reproach Memoir

https://i.pinimg.com/originals/0b/b6/ca/0bb6cac042882695ff6bce96913fec40.jpg

https://www.canada.ca/.../motor-vehicle-expenses/interest-expense.html

You can deduct interest you paid on money you borrowed to buy a motor vehicle passenger vehicle or zero emission passenger vehicle that you use to earn employment income Include the interest you paid when you calculate your

https://www.canada.ca/.../motor-vehicle-expenses.html

You can deduct interest on money you borrow to buy a motor vehicle zero emission vehicle passenger vehicle or zero emission passenger vehicle you use to earn business income Include this interest as an expense when you calculate your allowable motor vehicle expenses

Is The Interest On Your Mortgage Tax Deductible In Canada Loans Canada

Is Mortgage Interest Tax Deductible In Canada Nesto ca

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Home Builder Construction Loan Interest Tax Deductible

Is Mortgage Interest Tax Deductible In Canada Ratehub ca

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

Is Your Interest Tax Deductible ShineWing TY TEOH

Is Your Interest Tax Deductible ShineWing TY TEOH

Is Car Loan Interest Tax Deductible In The UK

Is A Car Lease Tax Deductible

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

Is Car Loan Interest Tax Deductible In Canada - The CRA limits the deduction on the amount of interest paid on a loan to buy a vehicle This amount can be calculated as either the total interest paid on the automobile or 10 this amount varies depending on the age of the vehicle multiplied by the number of days you used the vehicle for work