Is Credit Card Interest Tax Deductible In Canada Do not deduct interest on money you borrowed for personal purposes or to pay overdue income taxes Fees penalties or bonuses paid for a loan You can deduct the fee you pay to reduce the interest rate on your loan You can also deduct any penalty or bonus a financial institution charges you to pay off your loan before it is due

If the CRA paid interest on your income tax refund report the interest on line 12100 of your return in the year that you received it If the CRA then reassessed your return and you repaid any of the refund interest in 2023 you can claim on line 22100 of your return a deduction for the amount you repaid up to the amount you had reported as It s tax time and you re wondering if some of your carrying charges and interest fees are tax deductible The short answer is yes Some expenses can be deducted but you must also meet certain conditions

Is Credit Card Interest Tax Deductible In Canada

Is Credit Card Interest Tax Deductible In Canada

https://kudospayments.com/wp-content/uploads/2017/01/Understanding-Whether-Your-Credit-Card-Interest-Is-Tax-Deductible.jpg

Is The Interest On Your Mortgage Tax Deductible In Canada Lionsgate

https://www.lionsgatefinancialgroup.ca/wp-content/uploads/2022/04/Investing-3-1200x800-layout1194-1h6d5mc.png

Is Credit Card Interest Tax Deductible Authorized Credit Card Systems

https://authorizedccs.com/wp-content/uploads/2016/04/U-S-income-tax-form.jpg

Interest paid may be tax deductible under the right circumstances Find out which scenario might apply to you Photo by Windows on Unsplash Taxpayers may be eligible to claim a tax deduction Credit card interest can be tax deductible but not just anyone can do it Interest paid on personal purchases for instance is not deductible and hasn t been since the Tax Reform Act of 1986

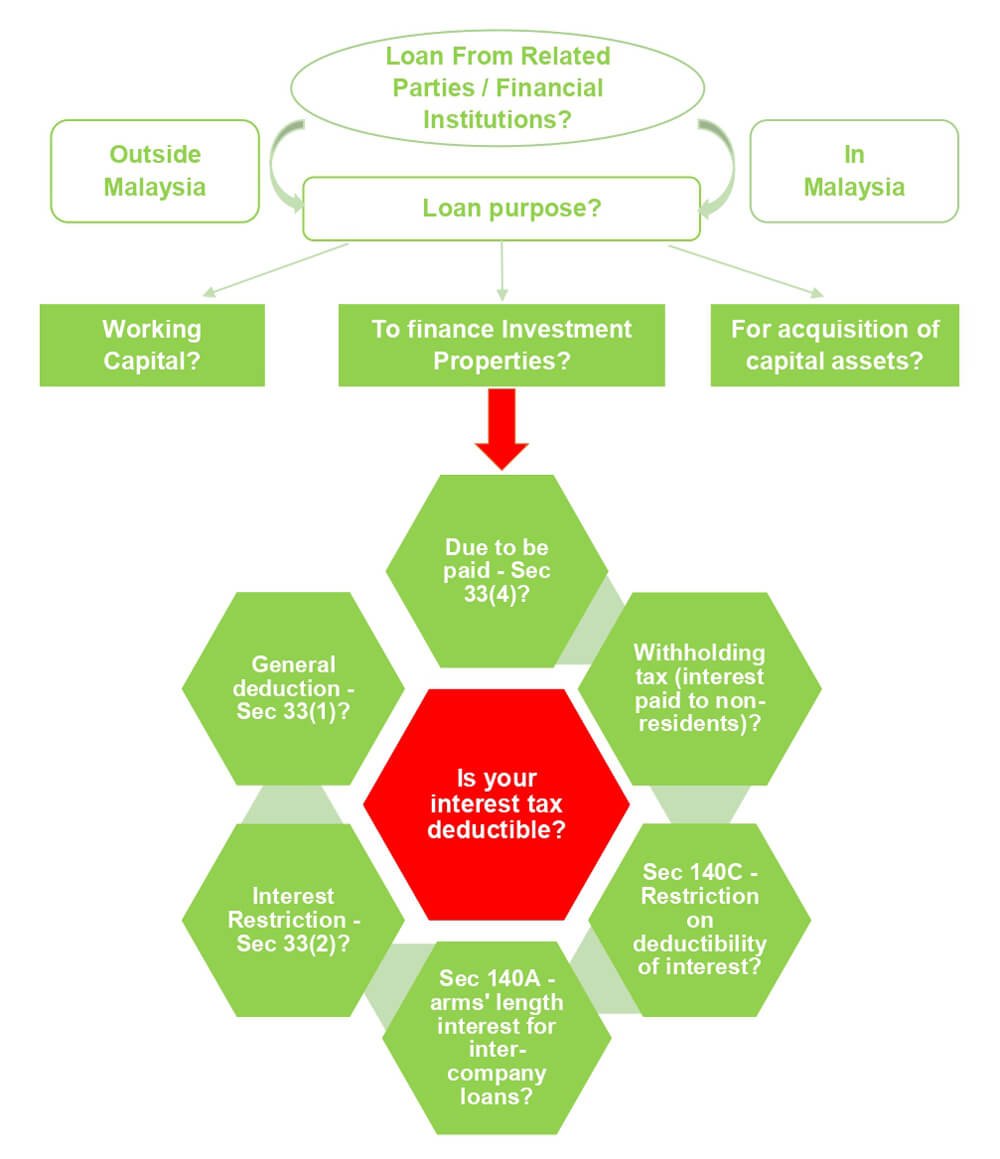

Generally interest expense is considered to be a capital expenditure and is not deductible unless it meets specific requirements of the Act such as those contained in paragraph 20 1 c Among other specific requirements is the requirement that It is important for all businesses operating in Canada to understand the fundamentals of interest deductibility found in paragraph 20 1 c of Canada s Income Tax Act the Act

Download Is Credit Card Interest Tax Deductible In Canada

More picture related to Is Credit Card Interest Tax Deductible In Canada

Is Credit Card Interest Tax Deductible

https://z4j6a4v4.rocketcdn.me/wp-content/uploads/2020/02/CreditCards.com-post.png

Are Credit Card Fees Tax Deductible For Businesses What Every Merchant

https://paymentdepot.com/wp-content/uploads/2019/11/taxdeductible-deduct-768x768.jpg

Is Credit Card Interest Deductible For Small Businesses Lendio

https://www.lendio.com/wp-content/uploads/2019/03/credit-cards.jpg

It s important to note that interest expense related to personal loans such as a car loan or credit card debt is generally not tax deductible in Canada However there are some exceptions such as if the loan was used for income producing purposes or to invest in a business or property If you use your credit card for personal expenses your card fees aren t tax deductible But if you use your credit card for business expenses you can get tax deductions on most of your credit card fees

Many tax payers in Canada pay interest on personal borrowing such as mortgage interest car loans lines of credit and credit cards but few Canadians can deduct that interest on their tax returns A way exists however for some tax payers to convert that non deductible interest into a tax deduction Credit card interest isn t deductible when used for personal purchases but may be tax deductible when it relates to business purchases

Is Credit Card Interest Tax Deductible SuperMoney

https://d15584r18i7pqj.cloudfront.net/wp-content/uploads/2022/04/are-credit-card-rewards-tax-deductible.jpg

Is Your Mortgage Interest Tax Deductible In Canada Zolo

https://www.zolo.ca/blog/wp-content/uploads/2022/02/is-your-mortgage-interest-tax-deductible-1.png

https://www.canada.ca/.../line-8710-interest.html

Do not deduct interest on money you borrowed for personal purposes or to pay overdue income taxes Fees penalties or bonuses paid for a loan You can deduct the fee you pay to reduce the interest rate on your loan You can also deduct any penalty or bonus a financial institution charges you to pay off your loan before it is due

https://www.canada.ca/en/revenue-agency/services/...

If the CRA paid interest on your income tax refund report the interest on line 12100 of your return in the year that you received it If the CRA then reassessed your return and you repaid any of the refund interest in 2023 you can claim on line 22100 of your return a deduction for the amount you repaid up to the amount you had reported as

Is Mortgage Interest Tax Deductible In Canada Nesto ca

Is Credit Card Interest Tax Deductible SuperMoney

:max_bytes(150000):strip_icc()/GettyImages-1004712242-17b61e9d3caf400b905875183ba8c24a.jpg)

Is Credit Card Interest Tax Deductible

Is Credit Card Interest Tax Deductible

Is Credit Card Interest Tax Deductible CNET Money

Nesto Academy Is Your Mortgage Interest Tax Deductible In Canada

Nesto Academy Is Your Mortgage Interest Tax Deductible In Canada

Is Credit Card Interest Tax Deductible 2023

Is Credit Card Interest Tax Deductible Forbes Advisor

Is Your Interest Tax Deductible ShineWing TY TEOH

Is Credit Card Interest Tax Deductible In Canada - Interest expense You can deduct interest you paid on money you borrowed to buy a motor vehicle passenger vehicle or zero emission passenger vehicle that you use to earn employment income Include the interest you paid when you calculate your allowable motor vehicle expenses