Tax Rebates Illinois Web The individual income tax rebate is a one time payment for filing your Form IL 1040 and meeting the adjusted gross income guidelines of under 400 000 for returns with a

Web 23 ao 251 t 2022 nbsp 0183 32 For the property tax rebate the amount is equal to your property tax credit from 2021 up to a maximum of 300 This rebate is also limited by your 2021 reported Web 9 sept 2022 nbsp 0183 32 Most Illinois taxpayers will soon be getting onetime income and property tax rebates from the state Distribution of the money to

Tax Rebates Illinois

Tax Rebates Illinois

https://files.illinoispolicy.org/wp-content/uploads/2016/08/IL-High-Tax-Graphics2-1024x642.png

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/759130d/2147483647/strip/true/crop/758x413+0+0/resize/880x479!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

2022 State Of Illinois Tax Rebates Scheffel Boyle

https://scheffelboyle.com/wp-content/uploads/2022/07/2022-State-of-IL-Tax-Rebates-1382x1536.png

Web 21 sept 2022 nbsp 0183 32 Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer Web 17 oct 2022 nbsp 0183 32 The income tax rebate is for Illinois residents who filed individually in 2021 and earned under 200 000 or filed jointly and made under 400 000 To be eligible for the income tax

Web 5 mai 2023 nbsp 0183 32 How to Claim Illinois Tax Rebates a Step 1 Gather necessary documents W 2 forms or 1099s for income verification Proof of residency or business b Step 2 Web 8 mai 2023 nbsp 0183 32 2023 State of Illinois Tax Rebates At the dawn of 2023 the State of Illinois introduces exciting opportunities for its residents with the highly anticipated Tax Rebate

Download Tax Rebates Illinois

More picture related to Tax Rebates Illinois

2021 Illinois Property Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

https://www.eztaxreturn.com/blog/wp-content/uploads/2022/08/Screenshot-2022-08-29-at-17-11-37-2022-State-of-Illinois-Tax-Rebates.png

Three Chicago Fed Economists Say They Know How To Tax Illinoisans

https://i1.wp.com/www.wirepoints.com/wp-content/uploads/2018/05/IL-highest-property-taxes-C.png?resize=594%2C518

Web 27 avr 2023 nbsp 0183 32 To qualify for the Property Tax Rebate Illinois 2023 program applicants must have an annual household income of 75 000 or less This includes all sources of Web How much is the rebate If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your rebate amount is 100 50 per person If filing

Web Filing Help for Requesting Individual Income Tax Rebate and Property Tax Rebate By law Monday October 17 2022 was the last day to submit information to receive the Illinois Web 12 sept 2022 nbsp 0183 32 About 6 million Illinois taxpayers will start to receive income and property tax rebates Monday Gov JB Pritzker said Those who made less than 200 000 in

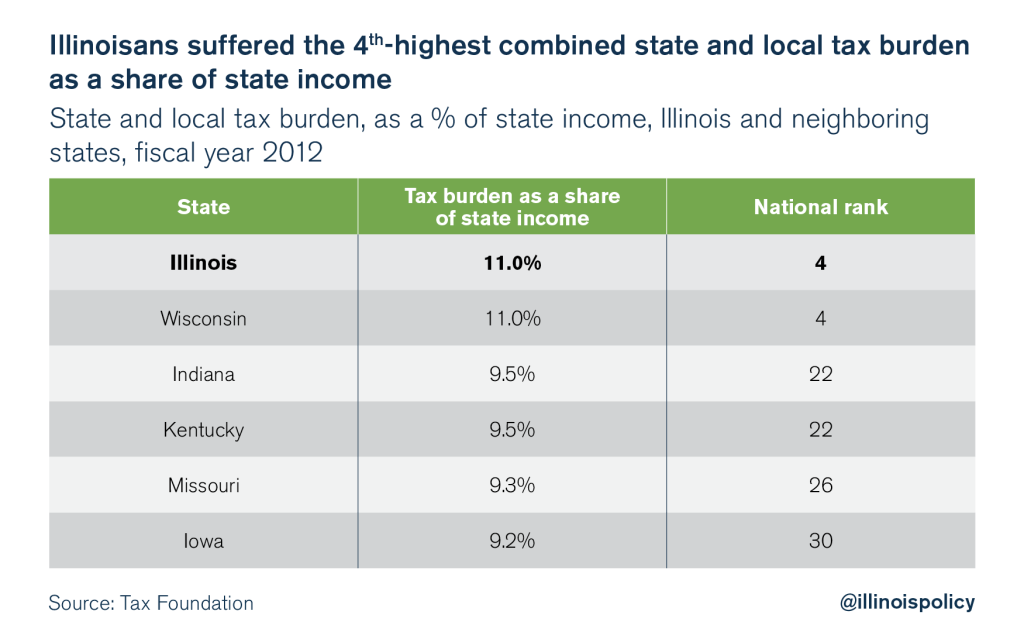

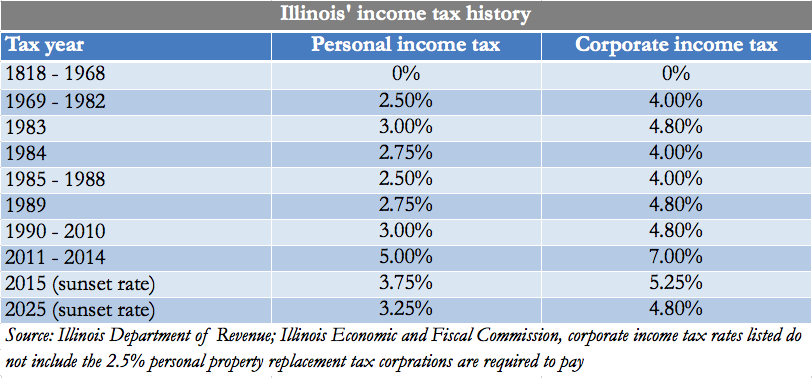

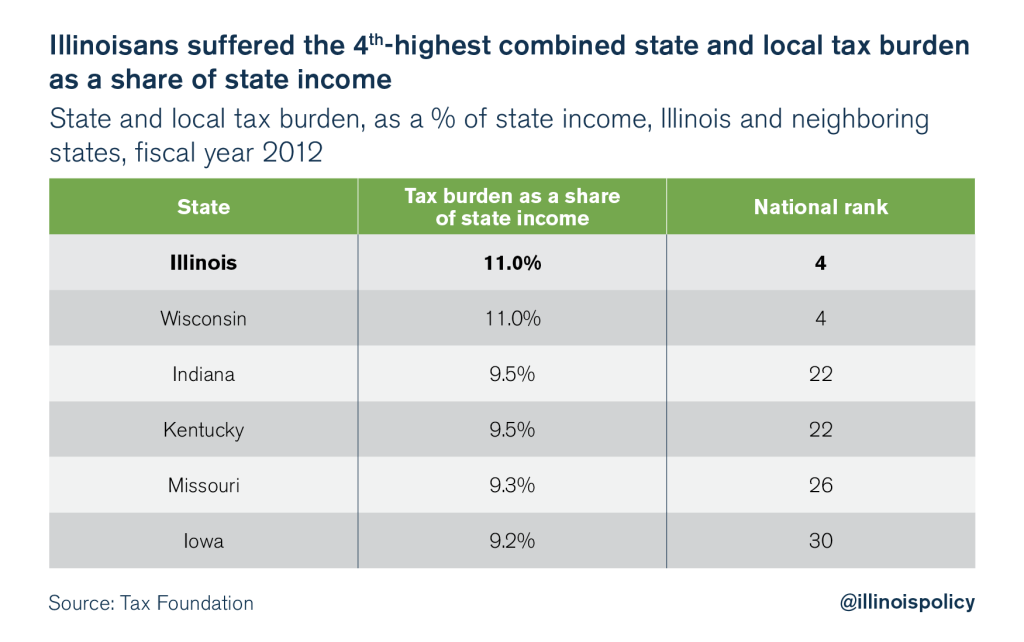

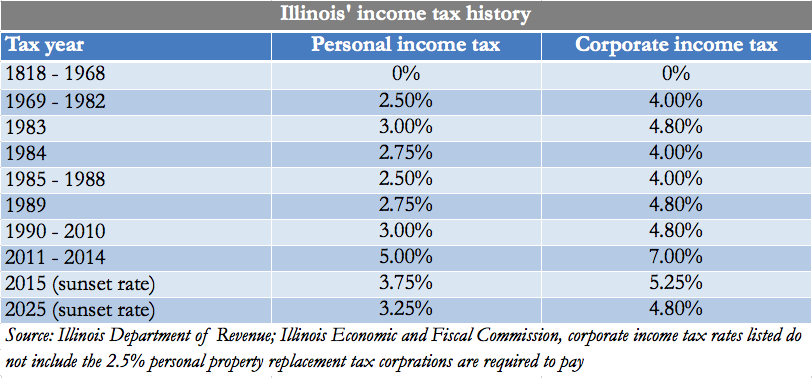

Illinois Has A Dirty Little Secret Buried In Its Tax History

http://illinoispolicy.org/wp-content/uploads/2014/01/Screen-Shot-2014-01-02-at-11.28.45-AM.png

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

https://content.govdelivery.com/attachments/fancy_images/ILDOR/2022/08/6364888/tax-rebates-082922-facebook_original.jpg

https://tax.illinois.gov/programs/rebates.html

Web The individual income tax rebate is a one time payment for filing your Form IL 1040 and meeting the adjusted gross income guidelines of under 400 000 for returns with a

https://weisscpa.com/news/illinois-tax-rebates-for-2022

Web 23 ao 251 t 2022 nbsp 0183 32 For the property tax rebate the amount is equal to your property tax credit from 2021 up to a maximum of 300 This rebate is also limited by your 2021 reported

Illinois Tax Rebate Tracker Rebate2022

Illinois Has A Dirty Little Secret Buried In Its Tax History

Tax Rebate Illinois Check Status Rebate2022

Illinois Income And Property Tax Rebates Will Be Issued Starting Monday

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

Which States Have Property Tax Rebates PropertyRebate

Which States Have Property Tax Rebates PropertyRebate

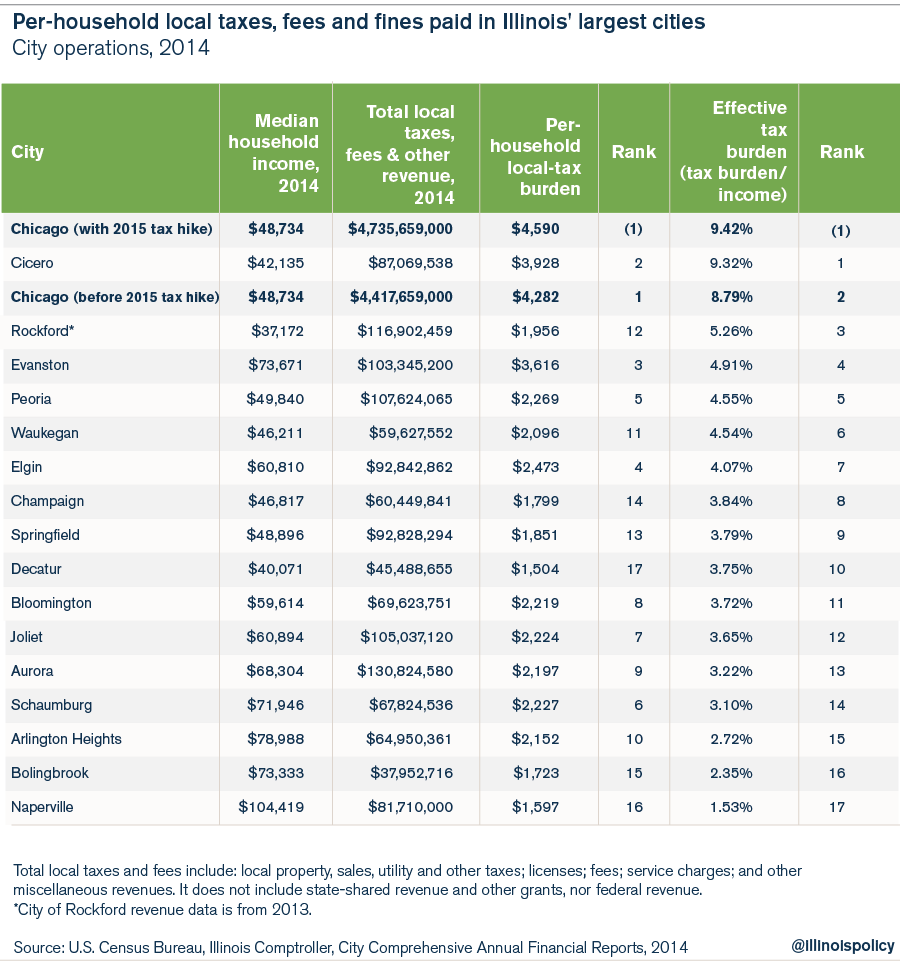

Chicagoans The Most taxed Residents In Illinois Paying More Than 30

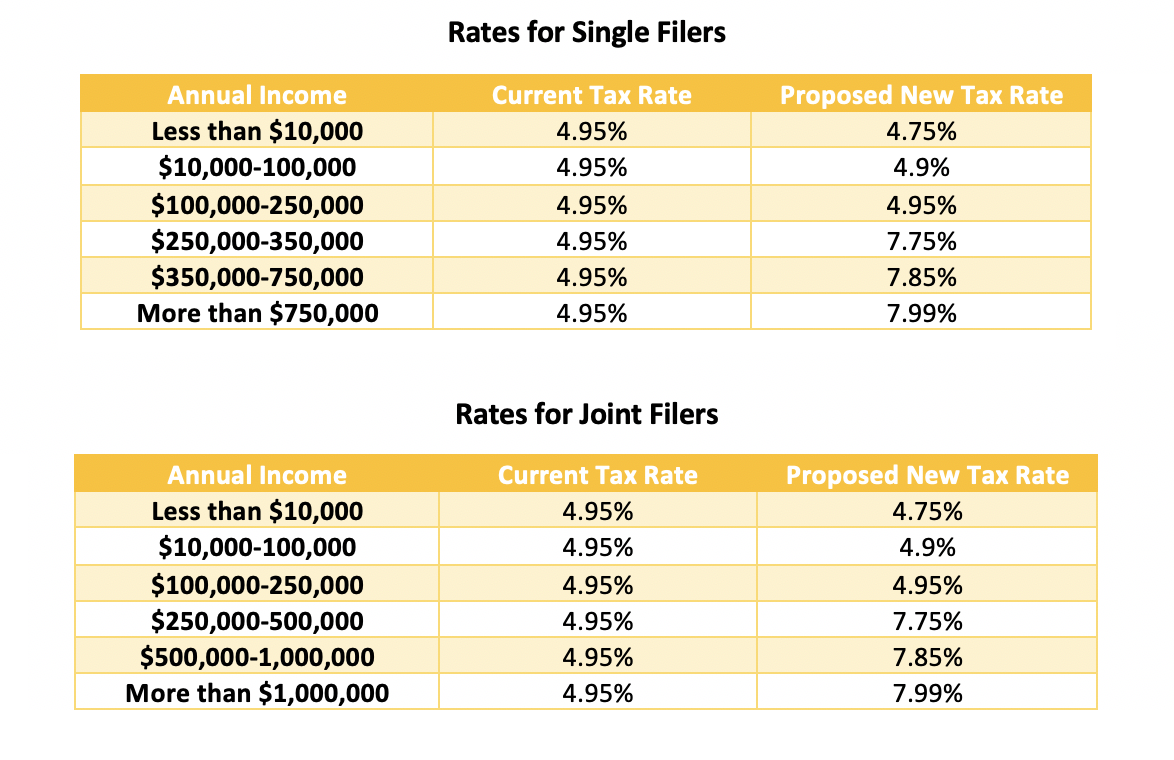

Cut Taxes Raise Revenue Can Illinois Tax Plan Work For Colorado

High Illinois Property Taxes Making Taxpayers To Leave The State

Tax Rebates Illinois - Web 5 mai 2023 nbsp 0183 32 How to Claim Illinois Tax Rebates a Step 1 Gather necessary documents W 2 forms or 1099s for income verification Proof of residency or business b Step 2