Is Child Daycare Tax Deductible Web 1 Dez 2023 nbsp 0183 32 The IRS allows you to deduct certain childcare expenses on your tax return If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you can claim a child and dependent care tax credit

Web 6 Apr 2017 nbsp 0183 32 If your child attends a private school you can deduct 30 of the school fees up to a maximum of 5 000 However costs for accommodation childcare and meals may not be taken into account The costs for accommodation and childcare are already included in the above mentioned education allowance and childcare costs Web 16 Dez 2023 nbsp 0183 32 If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of up to 35 percent of qualifying expenses of 3 000 1 050 for one child or dependent or up to 6 000 2 100 for two or more children or dependents

Is Child Daycare Tax Deductible

Is Child Daycare Tax Deductible

https://i.etsystatic.com/23403566/r/il/69a95f/3736849799/il_1588xN.3736849799_qvr5.jpg

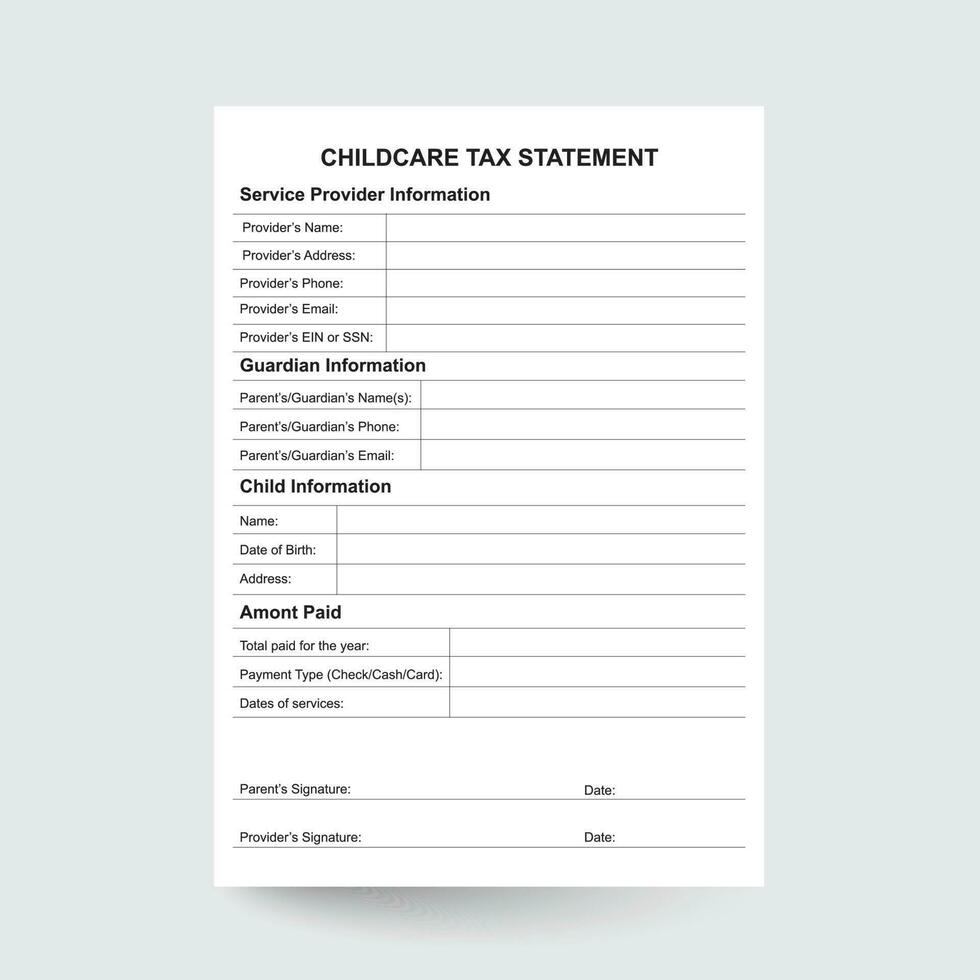

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/f7133a/3736849859/il_794xN.3736849859_31z4.jpg

Daycare Tax Statement End Of Year Tuition Report For Parents

https://i.etsystatic.com/10352854/r/il/ec9265/3618084393/il_1588xN.3618084393_ehdc.jpg

Web 5 Dez 2022 nbsp 0183 32 If your day care expenses don t qualify for the child care tax credit don t worry There are plenty of other child related deductions or credits that may help you save a little money or get a little more back from Uncle Sam The Child Tax Credit provides up to 2 000 per child under age 16 Web 11 Juni 2021 nbsp 0183 32 FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons

Web 23 Aug 2023 nbsp 0183 32 TRAVERSE CITY MI US August 22 2023 EINPresswire In a move set to ease the financial burden on families significantly the Internal Revenue Service IRS has announced that daycare expenses will Web 2 M 228 rz 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

Download Is Child Daycare Tax Deductible

More picture related to Is Child Daycare Tax Deductible

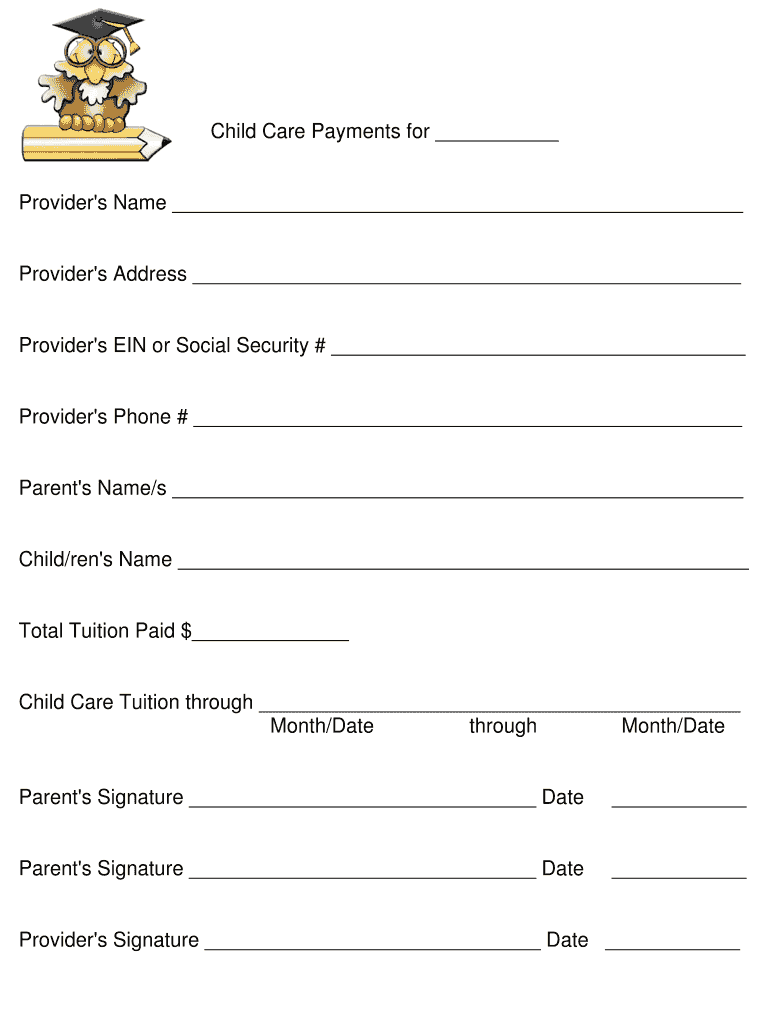

Child Care Receipt Daycare Payment Form Daycare Tax Form Printable

https://static.vecteezy.com/system/resources/previews/023/627/673/non_2x/child-care-receipt-daycare-payment-form-daycare-tax-form-printable-daycare-tuition-receipt-receipt-template-daycare-balance-due-child-care-form-child-care-receipt-free-vector.jpg

Home Daycare Tax Worksheet Personal Budget Spreadsheet Budgeting

https://i.pinimg.com/originals/ca/43/e0/ca43e0d9e04562c9fe549f7e609ef8b9.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/7a55e3/3981264249/il_1140xN.3981264249_lgte.jpg

Web Vor 6 Tagen nbsp 0183 32 Child tax credit 2023 taxes filed in 2024 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married Web 30 Dez 2022 nbsp 0183 32 Your 2022 Child and Dependent Care Tax Credit ranges from 20 to 35 of what you spent on daycare up to 3 000 for one dependent or up to 6 000 for two or more dependents Your applicable percentage depends on your adjusted gross income AGI and decreases with the more you earn

Web 30 Nov 2023 nbsp 0183 32 The Employer Provided Childcare Credit offers employers a tax credit up to 150 000 per year to offset 25 of qualified childcare facility expenditures and 10 of qualified childcare resource and referral expenditures Find details in Internal Revenue Code IRC Section 45F Paid someone to care for your child Web 15 Juni 2023 nbsp 0183 32 Daycare payments for services provided outside your household to an elderly person who regularly spends at least 8 hours each day in your household may qualify as dependent care expenses if the person is incapable of self care lives with you for more than one half of the tax year and is either your spouse or a dependent Additional

Is Child Care Tax Deductible Choklits Child Care

https://www.choklits.com.au/wp-content/uploads/2023/02/Is-child-care-tax-deductible-pdf.jpg

Daycare Business Income And Expense Sheet To File Your Daycare Business

https://i.pinimg.com/originals/67/62/b1/6762b1bcb53c6074dab4289dd09b60a5.jpg

https://nationaltaxreports.com/can-you-deduct-child-care-expenses

Web 1 Dez 2023 nbsp 0183 32 The IRS allows you to deduct certain childcare expenses on your tax return If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you can claim a child and dependent care tax credit

https://www.lifeinduesseldorf.com/children-german-tax-return

Web 6 Apr 2017 nbsp 0183 32 If your child attends a private school you can deduct 30 of the school fees up to a maximum of 5 000 However costs for accommodation childcare and meals may not be taken into account The costs for accommodation and childcare are already included in the above mentioned education allowance and childcare costs

Investment Expenses What s Tax Deductible Charles Schwab

Is Child Care Tax Deductible Choklits Child Care

Taxes For In Home Daycare Home Daycare Daycare Organization Family

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

Home Daycare Tax Worksheet

School Supplies Are Tax Deductible Wfmynews2

School Supplies Are Tax Deductible Wfmynews2

A Daycare Tax Statement Must Be Given To Parents At The End Of The Year

Daycare Tax Statement Template

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

Is Child Daycare Tax Deductible - Web 23 Aug 2023 nbsp 0183 32 TRAVERSE CITY MI US August 22 2023 EINPresswire In a move set to ease the financial burden on families significantly the Internal Revenue Service IRS has announced that daycare expenses will