Is Fuel Tax Exempt KPMG has urged the federal government to clarify the confusion surrounding the removal of Automobile Gas Oil AGO or diesel from Value Added Tax VAT Modification Order 2021 recently signed by

What is Tax exemption Tax exemption has been variously defined as follows An amount allowed by law as reduction of income or profit that would otherwise be taxed An amount of taxpayer s income that is not subject to tax and Immunity from the obligation of paying taxes in whole or in part Legislation Oil and gas companies involved in downstream operations are to be taxed under CITA and not PPTA The tax rate is 30 of the chargeable profit Education Tax Act LFN 2004 This tax is imposed on the assessable profit of

Is Fuel Tax Exempt

Is Fuel Tax Exempt

https://www.banlaw.com/wp-content/uploads/2021/12/who-can-claim-fuel-tax-credits-1024x763.jpg

Fuel And Fuel Taxes Trucking Blogs ExpeditersOnline

https://www.expeditersonline.com/cms/uploads/2022-3rd-quarter-ifta-fuel-tax-rates-4-august-2022_001.png

The Fuel Tax Is Defunct Innovation Is The Culprit RealClearEnergy

https://assets.realclear.com/images/50/502170_6_.jpg

The federal government has announced its intention to temporarily exempt diesel from value added tax VAT for the next six months The federal government is also committed to fast tracking the Nigerians protest demand Kyari s sack as fuel scarcity persists Naira trades at N1 640 as dollar scarcity hits black market Oyedele speaking further said that the committee has recommended the exemption of small businesses from tax payments including withholding taxes company income tax adding that their employees have

Some new exemptions were introduced such as the exemption of imported LPG from VAT compared to the VAT Modification Order VMO 2021 which only exempted locally produced LPG Also the circular exempts feed gas for all processed gas This should mean that natural gas is now exempt from VAT Companies Exempted The following categories of companies are exempted from MinTax under the Act As this might mean that such companies would still be liable to taxes where the gas credits allowances have reduced the tax payable to almost or completely NIL position The MinTax payable in such instances may be substantial

Download Is Fuel Tax Exempt

More picture related to Is Fuel Tax Exempt

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/UBFLSPGCVKYTZ6W5NVXCLIVFTI.jpg)

Fuel Tax Cuts Will Increase Emissions But Government Still Plans To

https://www.nzherald.co.nz/resizer/jJs9PNjt4OjC6RNjR4mHjsogwgs=/1200x675/filters:quality(70)/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/UBFLSPGCVKYTZ6W5NVXCLIVFTI.jpg

As Fuel Tax Proceeds Plummet States Weigh Charging By The Mile Instead

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1d6Nku.img?w=3790&h=2526&m=4&q=75

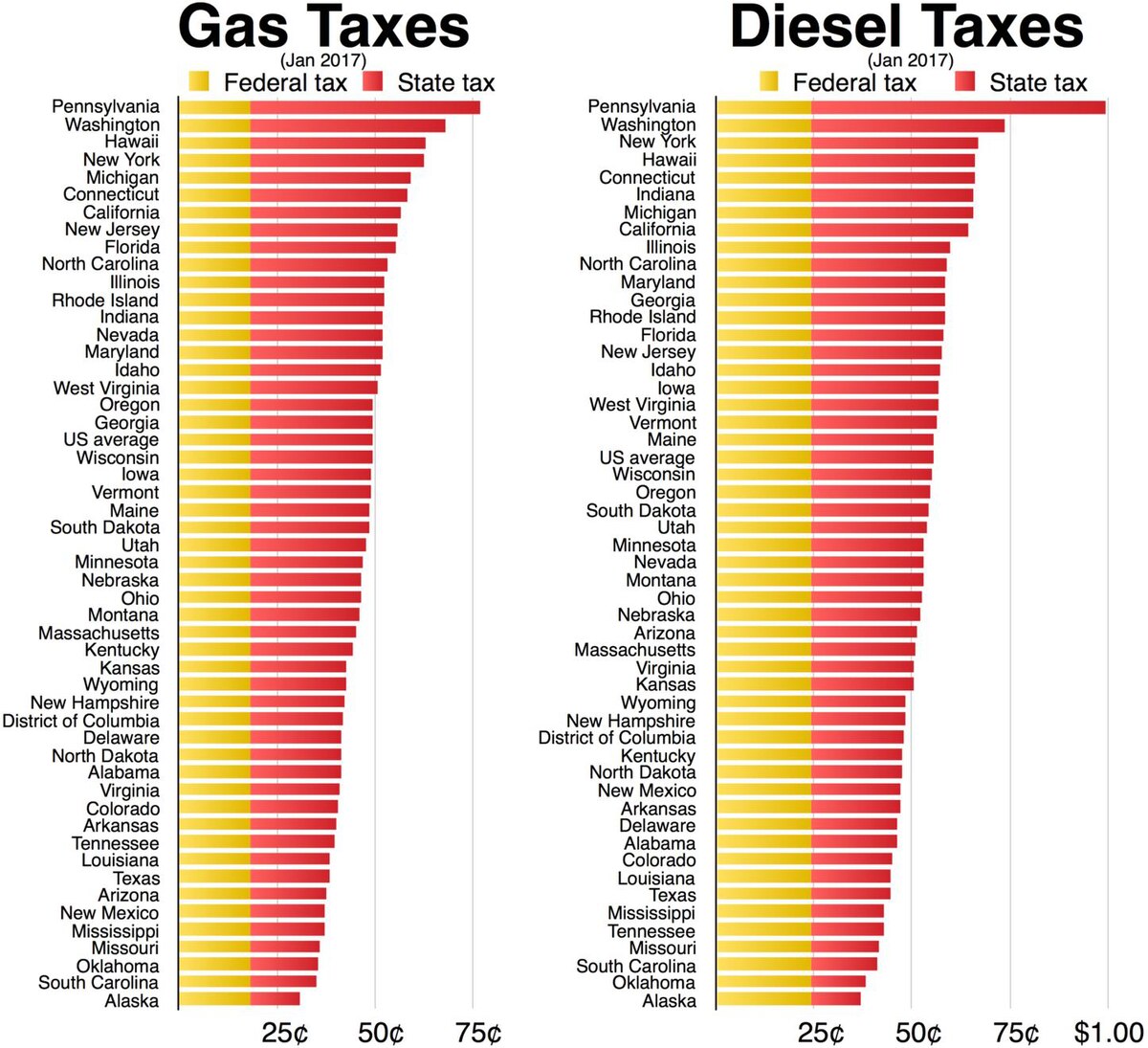

Fuel Taxes In The United States Wikipedia

https://upload.wikimedia.org/wikipedia/commons/thumb/a/a8/Gas_and_Diesel_taxes.pdf/page1-1200px-Gas_and_Diesel_taxes.pdf.jpg

The PIB intends to repeal the provisions of the petroleum Profits Tax Act PPTA Petroleum Act and some sections of the Companies Income Tax Act CITA It also introduces a new tax called the Nigerian Hydrocarbon Tax A pay per mile scheme sees road users paying a charge based on how far they travel in a given time period By 2030 the government could lose 9 billion of fuel tax revenue thanks to electric vehicles according to accounting firm PwC A 5p per litre cut in fuel duty was introduced by the Conservative government in March 2022

[desc-10] [desc-11]

Increase Tax Savings With The Fuel Tax Credit Landmark CPAs

https://www.landmarkcpas.com/wp-content/uploads/2022/12/Fuel-Tax-Credit-1024x640.jpg

IFTA Quarterly Fuel Tax Filing Payhip

https://images.payhip.com/o_1ghu5udijclf18t51c7q1vu2131br.jpg

https://allafrica.com/stories/202111160169.html

KPMG has urged the federal government to clarify the confusion surrounding the removal of Automobile Gas Oil AGO or diesel from Value Added Tax VAT Modification Order 2021 recently signed by

https://businessday.ng/personal-finance/article/...

What is Tax exemption Tax exemption has been variously defined as follows An amount allowed by law as reduction of income or profit that would otherwise be taxed An amount of taxpayer s income that is not subject to tax and Immunity from the obligation of paying taxes in whole or in part Legislation

Fuel Taxes Greater Auckland

Increase Tax Savings With The Fuel Tax Credit Landmark CPAs

Why Do We Have A Fuel Tax Fuel Express

Tax Exempt Church Pastor Politics Endorse

Tax To Blame For High Fuel Prices Auto Express

Fillable Form Dr 0241 Application For Fuel Tax Exemption Certificate

Fillable Form Dr 0241 Application For Fuel Tax Exemption Certificate

Webinar Fuel Tax Credits Scheme With KPMG Building A More Profitable

Fuel Tax Application Edit Fill Sign Online Handypdf

Fuel Tax Holidays And IFTA Listen Online

Is Fuel Tax Exempt - [desc-13]