Is Hsa Account Tax Deductible Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded from your income on your W 2 So the HSA deduction rules don t allow an additional deduction for those contributions

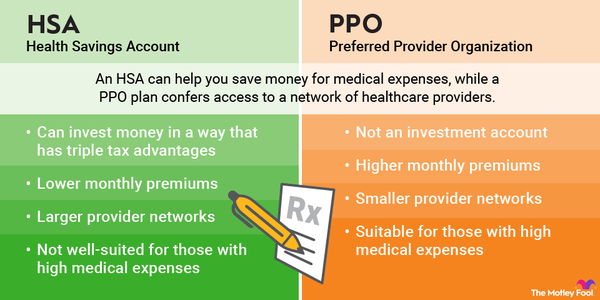

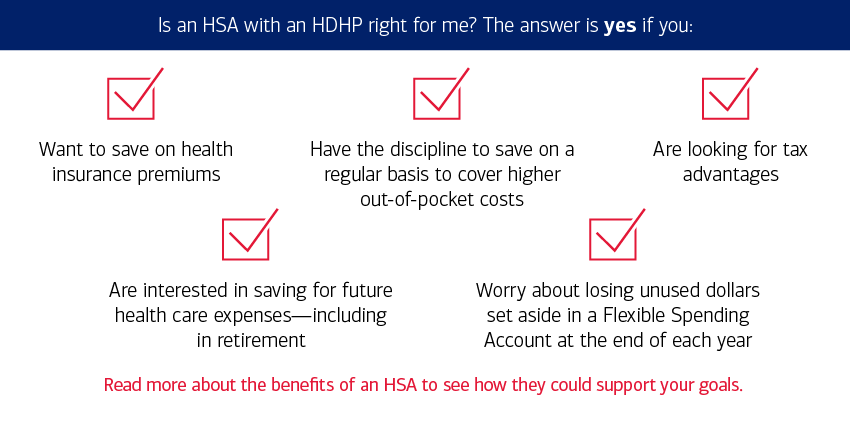

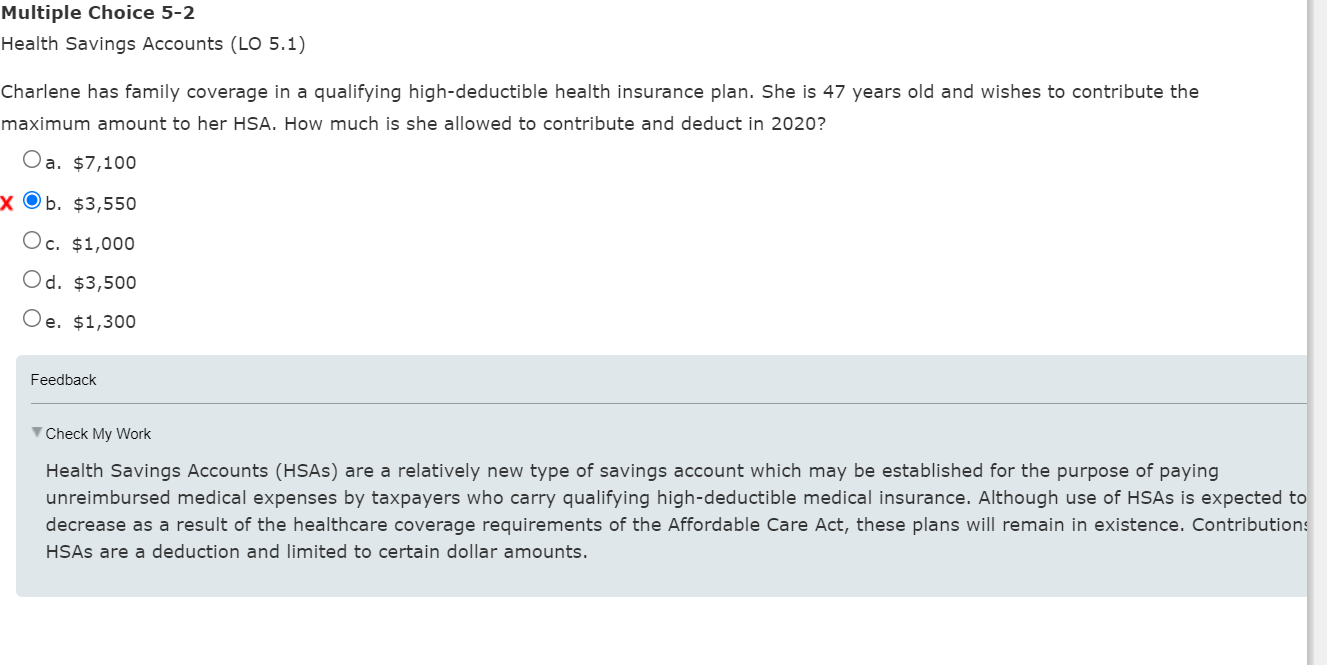

You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year the maximum contribution amounts are 3 650 for individuals and 7 300 for family coverage For An HSA is a tax exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur You must be an eligible individual to contribute to an HSA

Is Hsa Account Tax Deductible

Is Hsa Account Tax Deductible

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

Health Savings Accounts How HSAs Work And The Tax Advantages

http://www.ilhealthagents.com/wp-content/uploads/2018/04/Tax-Advantages-of-an-HSA-1024x795-1024x795-768x596.png

USING AN HSA AS A RETIREMENT ACCOUNT RAA Blog

https://i0.wp.com/www.raablog.com/wp-content/uploads/2016/10/HSA.jpg?fit=800%2C526&ssl=1

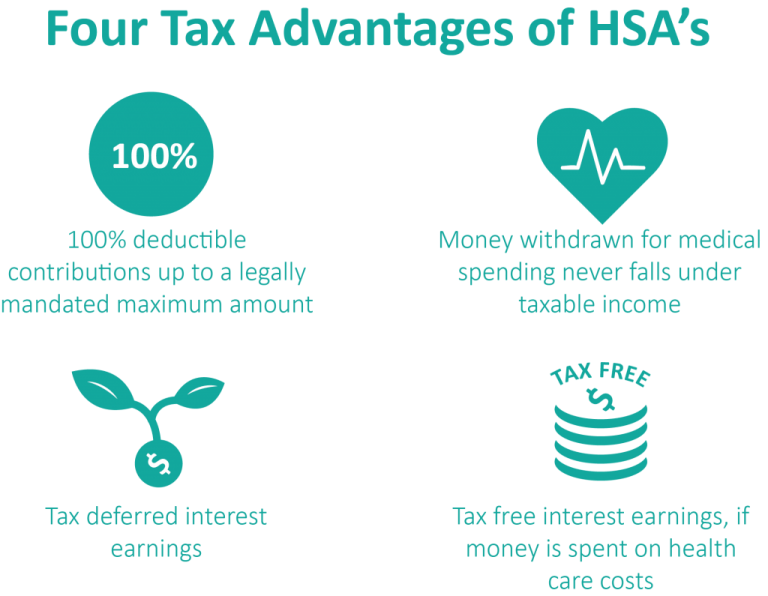

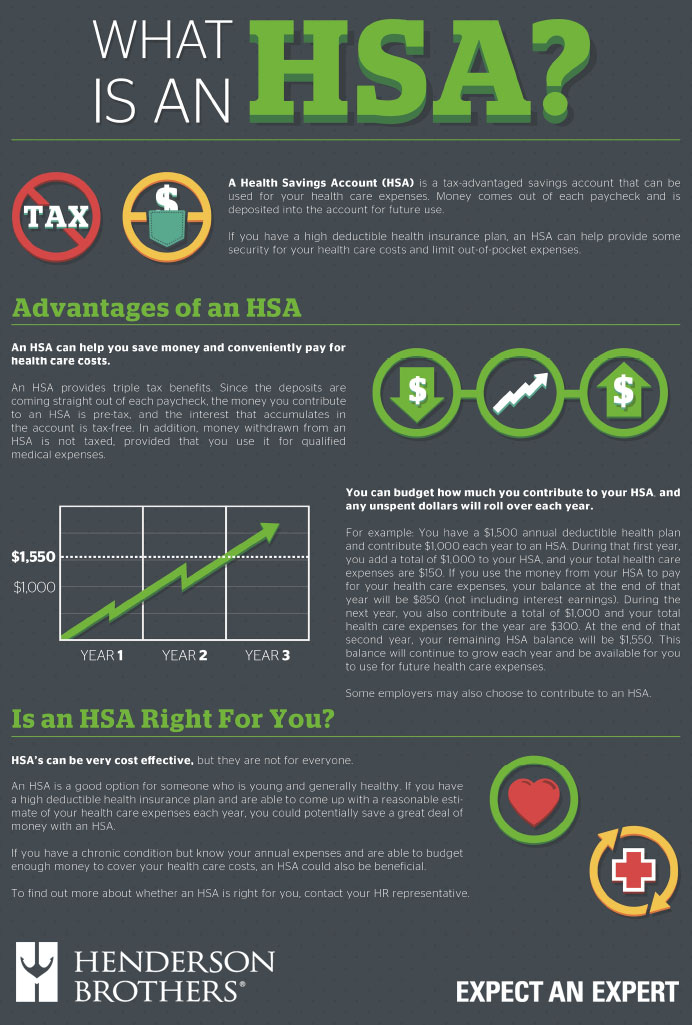

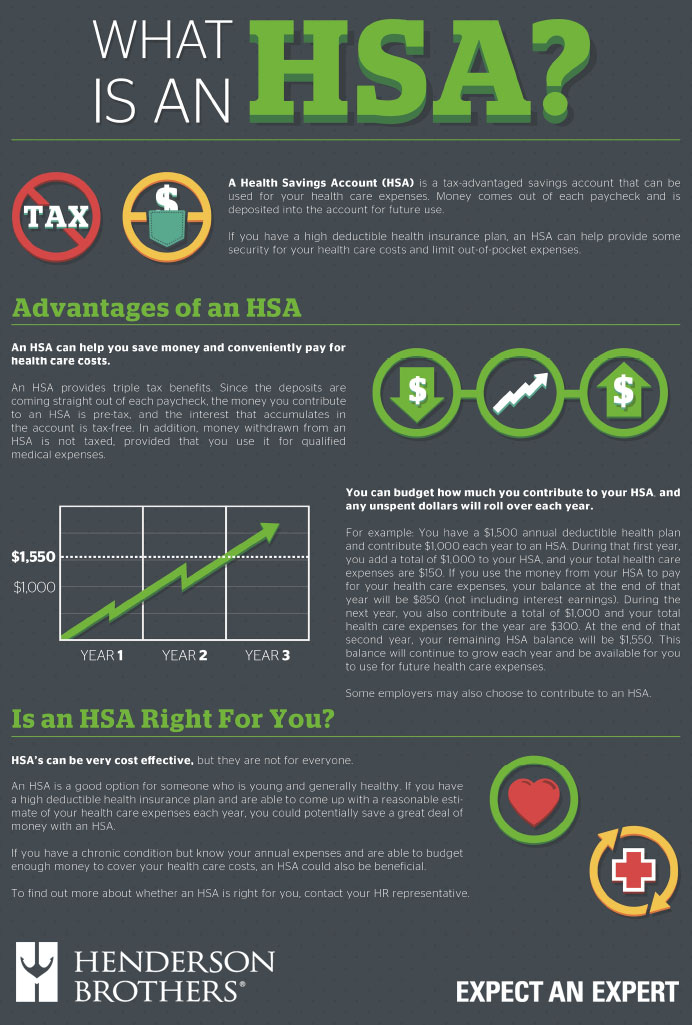

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses A Health Savings Account HSA is a tax advantaged account to help you save for medical expenses that are not reimbursed by high deductible health plans HDHPs No tax is levied on

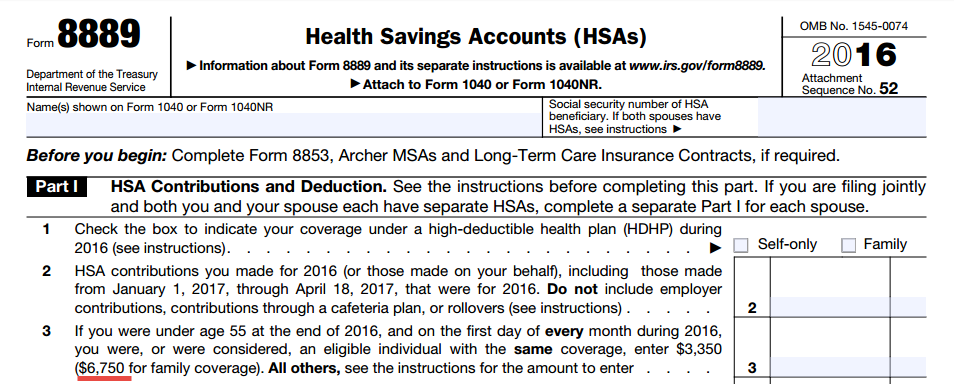

This form allows you to claim a tax deduction for any HSA contributions you made outside of payroll deductions and ensures money withdrawn from your account was spent on qualified health care expenses Are HSA contributions tax deductible Yes HSA contributions may be tax deductible depending on how the funds are added to the account If you contribute money to your HSA through your paycheck you can not deduct the contribution on your tax return

Download Is Hsa Account Tax Deductible

More picture related to Is Hsa Account Tax Deductible

2024 HSA HDHP Limits

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/2024-HSA-HDHP-Limits-Graphics.jpg

What You Need To Know About Health Savings Accounts HSAs

https://irp-cdn.multiscreensite.com/207226d8/dms3rep/multi/Depositphotos_317550154_l-2015.jpg

HSA Vs PPO Which Is Better The Motley Fool

https://m.foolcdn.com/media/dubs/images/HSA-vs-PPO-plans-infographic.width-600.png

Any contributions you or your employer may make to your HSA are federal tax free and could help you pay for the HSA eligible health plan s deductible or other qualified medical expenses on a tax free basis in the current year or be saved for future qualified expenses A health savings account HSA is a tax advantaged way to save for qualified medical expenses HSAs pair with an HSA eligible health plan Because it offers potential tax advantages and money within the account can be invested an HSA can be used to pay for both near term medical expenses and expenses in retirement

All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income Your contributions may be 100 percent tax deductible meaning contributions can be deducted from your gross income A health savings account HSA is a type of tax advantaged investment account available only to individuals with high deductible health plans HDHPs HSAs enable investors to save

Are You Healthy I HOPE You re Using An HSA Pacific Crest Management

https://pcrestmgt.com/wp-content/uploads/2017/06/Diagram-PiggyBank.jpg

What Is A Health Savings Account HSA HSA Search

https://www.hsasearch.com/wp-content/uploads/hsavsretirementaccounts-1024x660.png

https://www.hrblock.com/tax-center/filing/...

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded from your income on your W 2 So the HSA deduction rules don t allow an additional deduction for those contributions

https://www.investopedia.com/articles/personal...

You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year the maximum contribution amounts are 3 650 for individuals and 7 300 for family coverage For

The Pros And Cons Of A Health Savings Account HSA

Are You Healthy I HOPE You re Using An HSA Pacific Crest Management

FAQ About Health Savings Accounts HSA

Is An HSA Right For Me

Solved Multiple Choice 5 2 Health Savings Accounts LO 5 1 Chegg

HSAs Health Savings Accounts Henderson Brothers

HSAs Health Savings Accounts Henderson Brothers

Key HSA Features 2018 Compliance The Safegard Group Inc The

2016 HSA Form 8889 Instructions And Example HSA Edge

HSA And FSA Accounts What You Need To Know Readers

Is Hsa Account Tax Deductible - Are HSA contributions tax deductible Yes HSA contributions may be tax deductible depending on how the funds are added to the account If you contribute money to your HSA through your paycheck you can not deduct the contribution on your tax return