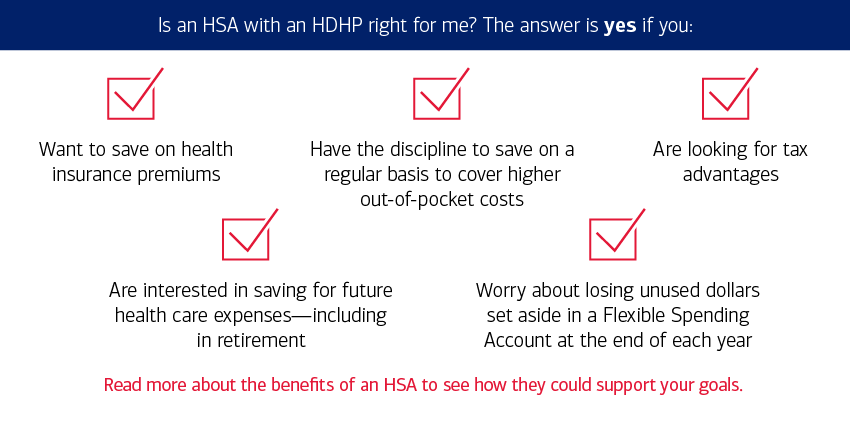

Is Hsa Tax Deductible A health savings account or HSA is a tax advantaged account that those with coverage under a high deductible health plan HDHP can use to save for qualified medical expenses and insurance coverage under very specific rules

In nearly every area of the country there are HSA qualified high deductible health plans available through the exchange Marketplace or directly from insurers that sell ACA compliant coverage Here s more about how ACA regulations mesh with HSA compliance rules How can I enroll in an HDHP Contributions to an HSA are tax deductible For employer sponsored plans the contributions are deducted from paychecks If you re self employed the deductions can be taken when your

Is Hsa Tax Deductible

Is Hsa Tax Deductible

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

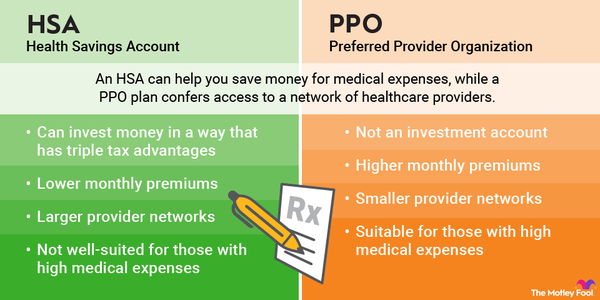

HSA Vs PPO Which Is Better The Motley Fool

https://m.foolcdn.com/media/dubs/images/HSA-vs-PPO-plans-infographic.width-600.png

:max_bytes(150000):strip_icc()/hsa-vs-ppo-5191333_round2-5443d932f915427a9510be94226152d3.png)

HSA Vs PPO

https://www.investopedia.com/thmb/YlS7oDOLm-E124dm3HQ-pzxlH0Q=/1500x1000/filters:no_upscale():max_bytes(150000):strip_icc()/hsa-vs-ppo-5191333_round2-5443d932f915427a9510be94226152d3.png

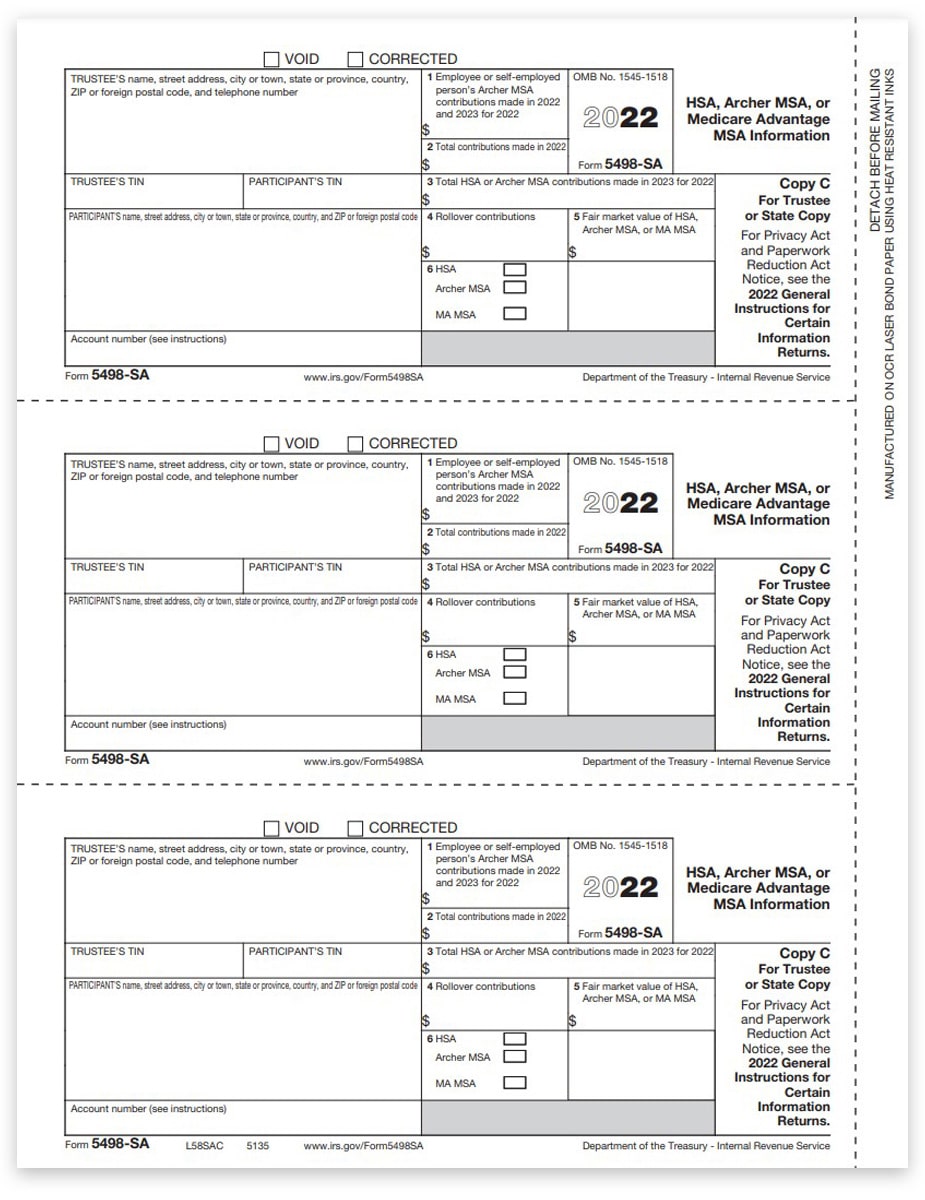

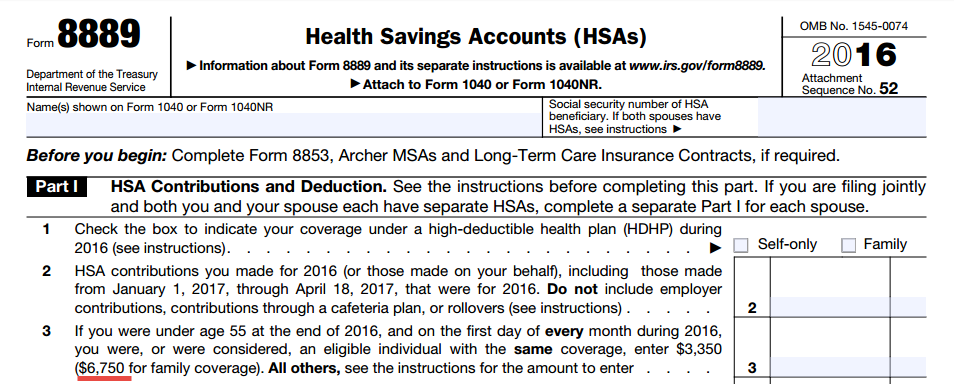

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons the amount you withdraw will be subject to income tax and may be subject to an additional 20 tax In order to enjoy the full tax benefits of an HSA and stay compliant with IRS rules you need to complete and file Form 8889 each year you contribute to or distribute money from your HSA

Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income What Is a Health Savings Account HSA A Health Savings Account HSA is a tax advantaged account created for or by individuals covered under high deductible health plans HDHPs to save for

Download Is Hsa Tax Deductible

More picture related to Is Hsa Tax Deductible

2024 HSA HDHP Limits

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/2024-HSA-HDHP-Limits-Graphics.jpg

5 Things To Know About Health Savings Accounts ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

What Is An HSA and How You Will Save Money With One Thrifty Tony

https://thriftytony.com/wp-content/uploads/2021/09/what-is-an-hsa.jpg

Your health savings account HSA contributions may be tax deductible Learn the rules for HSA deductions and contributions and how they affect your taxes Are HSA contributions tax deductible In short contributions to an HSA made by you or your employer may be claimed as tax deductions even if you don t itemize deductions on a Schedule A Form 1040

[desc-10] [desc-11]

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

https://www.investopedia.com/thmb/u2wJjKORNGwYIkLIUBgzZkTPInY=/1500x1000/filters:fill(auto,1)/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg

2023 Hsa Form Printable Forms Free Online

https://www.discounttaxforms.com/wp-content/uploads/2022/08/5498SA-Form-Copy-C-Trustee-State-L58SAC-FINAL-min.jpg

https://www.hrblock.com › tax-center › filing › ...

A health savings account or HSA is a tax advantaged account that those with coverage under a high deductible health plan HDHP can use to save for qualified medical expenses and insurance coverage under very specific rules

https://www.healthinsurance.org › faqs › how-does-a

In nearly every area of the country there are HSA qualified high deductible health plans available through the exchange Marketplace or directly from insurers that sell ACA compliant coverage Here s more about how ACA regulations mesh with HSA compliance rules How can I enroll in an HDHP

What You Need To Know About Health Savings Accounts HSAs

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

Is An HSA Right For Me

Are You Healthy I HOPE You re Using An HSA Pacific Crest Management

2016 HSA Form 8889 Instructions And Example HSA Edge

FAQ About Health Savings Accounts HSA

FAQ About Health Savings Accounts HSA

The Pros And Cons Of A Health Savings Account HSA

Guide To HSA Deductions And Fees

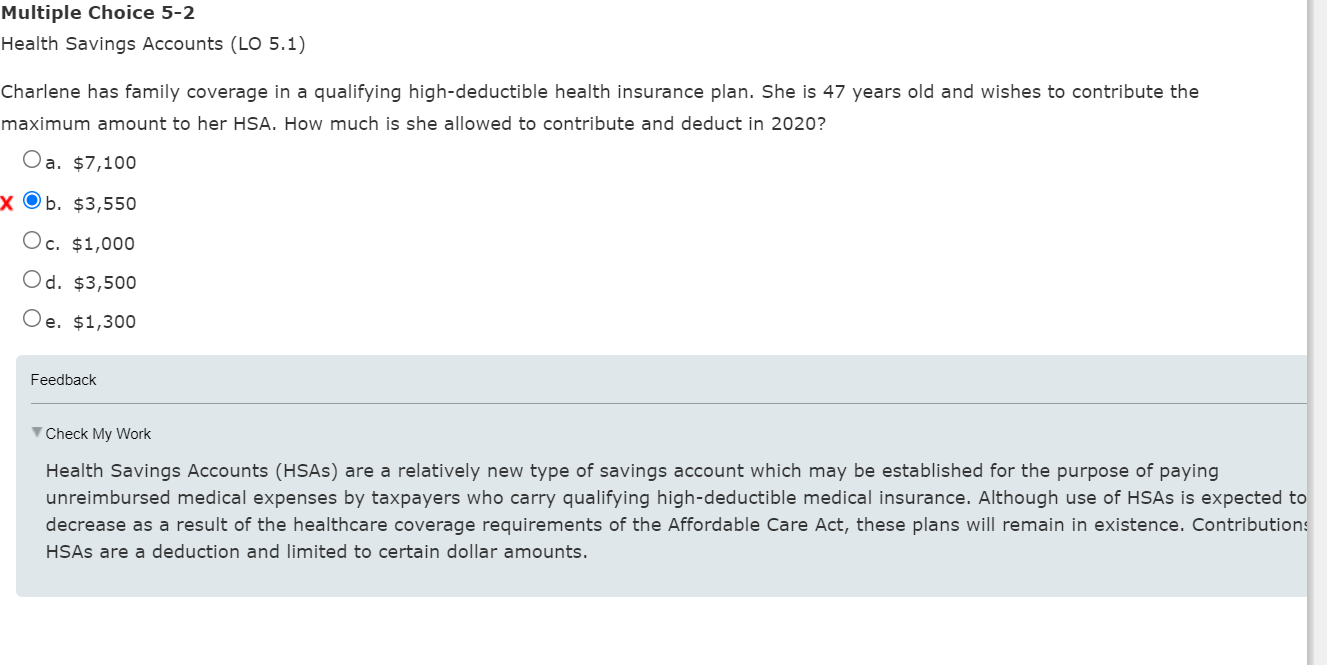

Solved Multiple Choice 5 2 Health Savings Accounts LO 5 1 Chegg

Is Hsa Tax Deductible - You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons the amount you withdraw will be subject to income tax and may be subject to an additional 20 tax