Is Ltc Reimbursement Taxable Income Generally your LTC reimbursement is only taxable if they exceed your medical expenses Be sure to answer the TurboTax follow up questions in the 1099 LTC interview It may be best to answer having read the below info first

No Generally your long term care LTC reimbursement is only taxable if the amount used exceeds your medical expenses It may be best to read the information below for an overall picture A qualified long term care insurance contract is treated as an accident and health insurance contract For example if LTA granted by the employer is Rs 30 000 and the actual eligible travel cost incurred by the employee is Rs 20 000 the exemption is available only to the extent of Rs 20 000 and the balance of Rs 10 000 would be

Is Ltc Reimbursement Taxable Income

Is Ltc Reimbursement Taxable Income

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

Secure Client Portal Personal Income Tax Bookkeeping

https://pclarytaxes.com/files/Personal-Income-Tax-logo.png

Is Employee Mileage Reimbursement Taxable

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Is employee mileage reimbursement taxable_featured.jpg#keepProtocol

The Leave Travel Allowance LTA Leave Travel Concession LTC amount computed above is allowed as an exemption for income tax purposes Your employer may pay you a different amount depending on your position in the organisation Discover the tax benefits of Leave Travel Concession LTC LTA under Section 10 5 of the Income Tax Act 1961 Learn how to save on your taxable income

Are Long Term Care Benefits Taxable When you receive benefits from a long term care insurance policy you typically won t owe taxes The IRS treats these payouts similarly to reimbursements for medical expenses which they don t consider taxable income Form 1099 LTC Long Term Care and Accelerated Death Benefits is the IRS form that enables individual taxpayers to report long term care LTC benefits including accelerated death

Download Is Ltc Reimbursement Taxable Income

More picture related to Is Ltc Reimbursement Taxable Income

Income Tax Calculator CC Tax 2018

https://cc.icalculator.com/img/og/CC/81.png

Is A Mileage Reimbursement Taxable

https://www.mburse.com/hubfs/2020-chevy-malibu copy.jpg#keepProtocol

How To Calculate Taxable Income A Comprehensive Guide The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg

Payments from a LTC insurance plan are considered taxable income but you may be able to exclude that income from your return But If your employer makes any contributions toward your LTC premiums the contributions must be reported as income on your return Information about Form 1099 LTC Long Term Care and Accelerated Death Benefits including recent updates related forms and instructions on how to file File this form if you pay any long term care benefits including accelerated death benefits

Report taxable payments from long term care LTC insurance contracts or Report taxable accelerated death benefits from a life insurance policy Additional information Insurance companies that pay long term care insurance benefits are required by the Internal Revenue Service IRS to provide claimants with a 1099 LTC Generally no Tax qualified Long Term Care Insurance benefits come to you tax free

Income Tax Rates For Individuals SWOT Accountants

https://www.swotaccountants.com.au/wp-content/uploads/2023/03/Income-Tax-Rates-for-Individuals-1.png

Income Tax Explained ProjectionLab

https://projectionlab.com/assets/pages/financial-terms/income-tax/hero.png

https://ttlc.intuit.com/community/tax-credits...

Generally your LTC reimbursement is only taxable if they exceed your medical expenses Be sure to answer the TurboTax follow up questions in the 1099 LTC interview It may be best to answer having read the below info first

https://ttlc.intuit.com/community/retirement/...

No Generally your long term care LTC reimbursement is only taxable if the amount used exceeds your medical expenses It may be best to read the information below for an overall picture A qualified long term care insurance contract is treated as an accident and health insurance contract

Filling Tax Form Tax Payment Financial Management Corporate Tax

Income Tax Rates For Individuals SWOT Accountants

Super Income V2 Android

What Is That Income Tax Income Tax Fiscal 2080 2081 In Nepal

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Income Tax Calculator Old Regime Vs New Regime As Proposed By Finance

Income Tax Calculator Old Regime Vs New Regime As Proposed By Finance

Unlock Your Tax Freedom Master The Art Of Non Taxable Income With Our

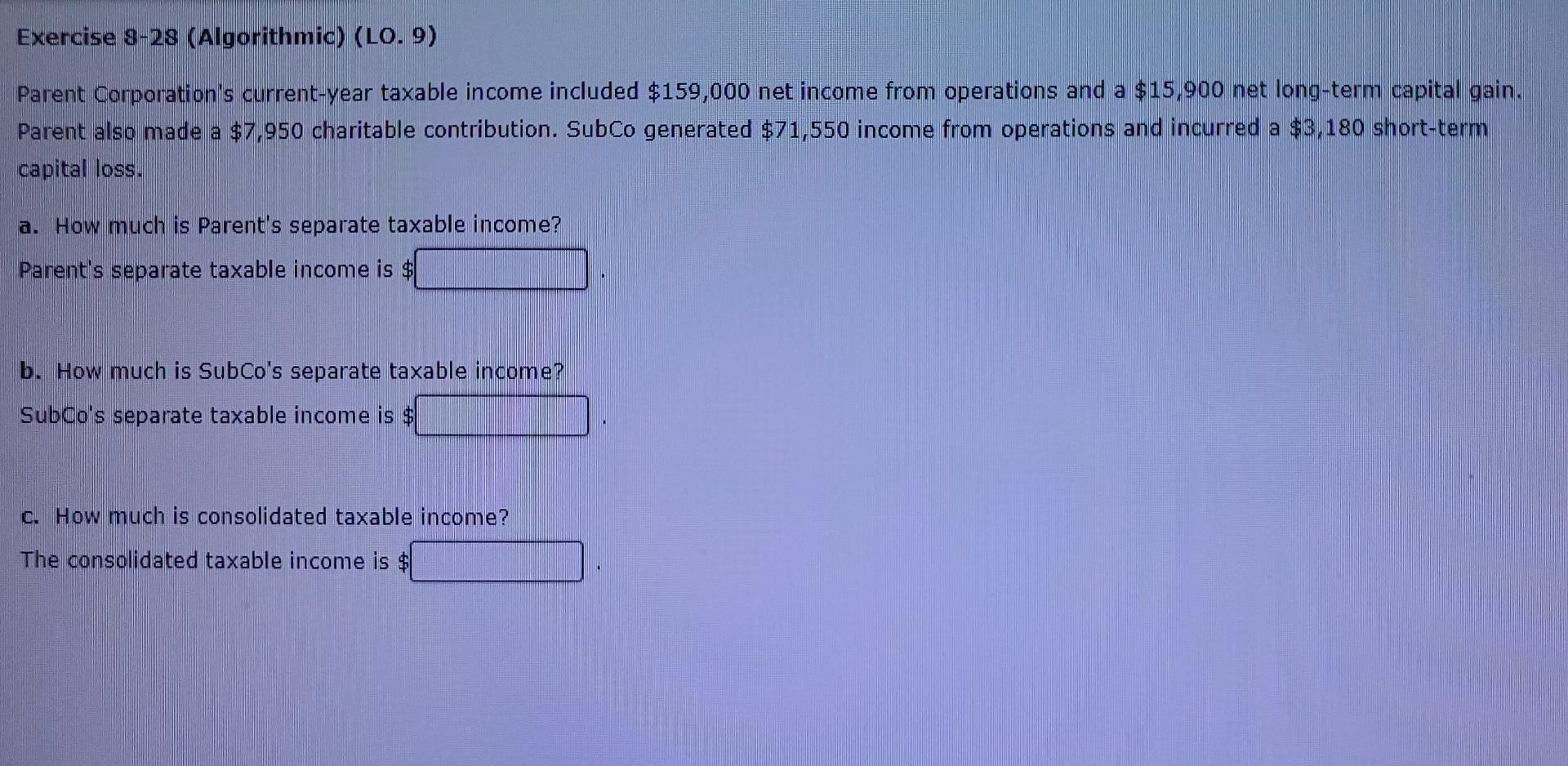

Solved Parent Corporation s Current year Taxable Income Chegg

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

Is Ltc Reimbursement Taxable Income - Form 1099 LTC Long Term Care and Accelerated Death Benefits is the IRS form that enables individual taxpayers to report long term care LTC benefits including accelerated death