Is Nj Disability Taxable Did you receive ONLY Temporary Disability Insurance benefits You will NOT have a 1099 G in your online account Click here to learn how Temporary Disability benefits are taxed

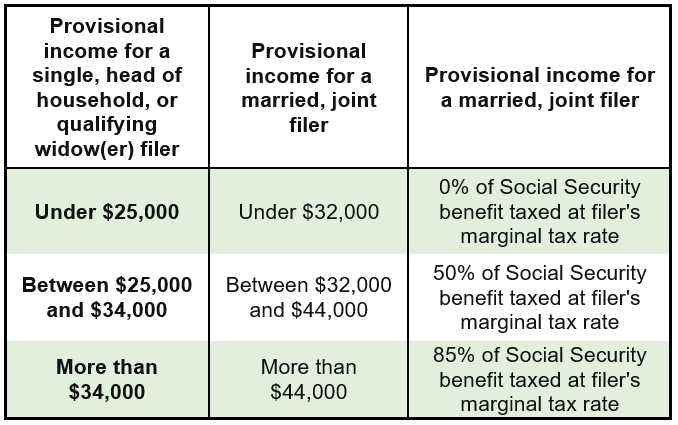

The following benefits are not taxable and should not be reported as pension income Social Security and Railroad Retirement benefits Pension payments received because of permanent and total disability before age 65 If you re single and file an individual return you d pay taxes on Up to 50 of your benefits if your income is between 25 000 and 34 000 Up to 85 of your benefits if your income is

Is Nj Disability Taxable

Is Nj Disability Taxable

https://www.gannett-cdn.com/presto/2021/03/27/PNJM/7f972222-9ad2-4172-9e78-b69d5f331e60-032621_Clifton_0329.JPG?crop=3749,2109,x0,y190&width=3200&height=1801&format=pjpg&auto=webp

Tips For A Successful Social Security Disability Claim Disability Law

https://disabilitylawgroup.com/wp-content/uploads/2019/06/iStock-183295330.jpg

Is Long Term Disability Taxable J Price McNamara ERISA Insurance

https://jpricemcnamara.com/wp-content/uploads/2022/03/Long-Term-Disability-Taxable.jpg

California New Jersey and Rhode Island do not tax state paid short term disability benefits but New York and Hawaii partially tax these benefits depending on how much your employer contributed to the cost of the insurance and how much you contributed to the cost of insurance New Jersey disability income and unemployment benefits are not taxed on the state level However Social Security disability benefits may be taxable depending on whether or not you received

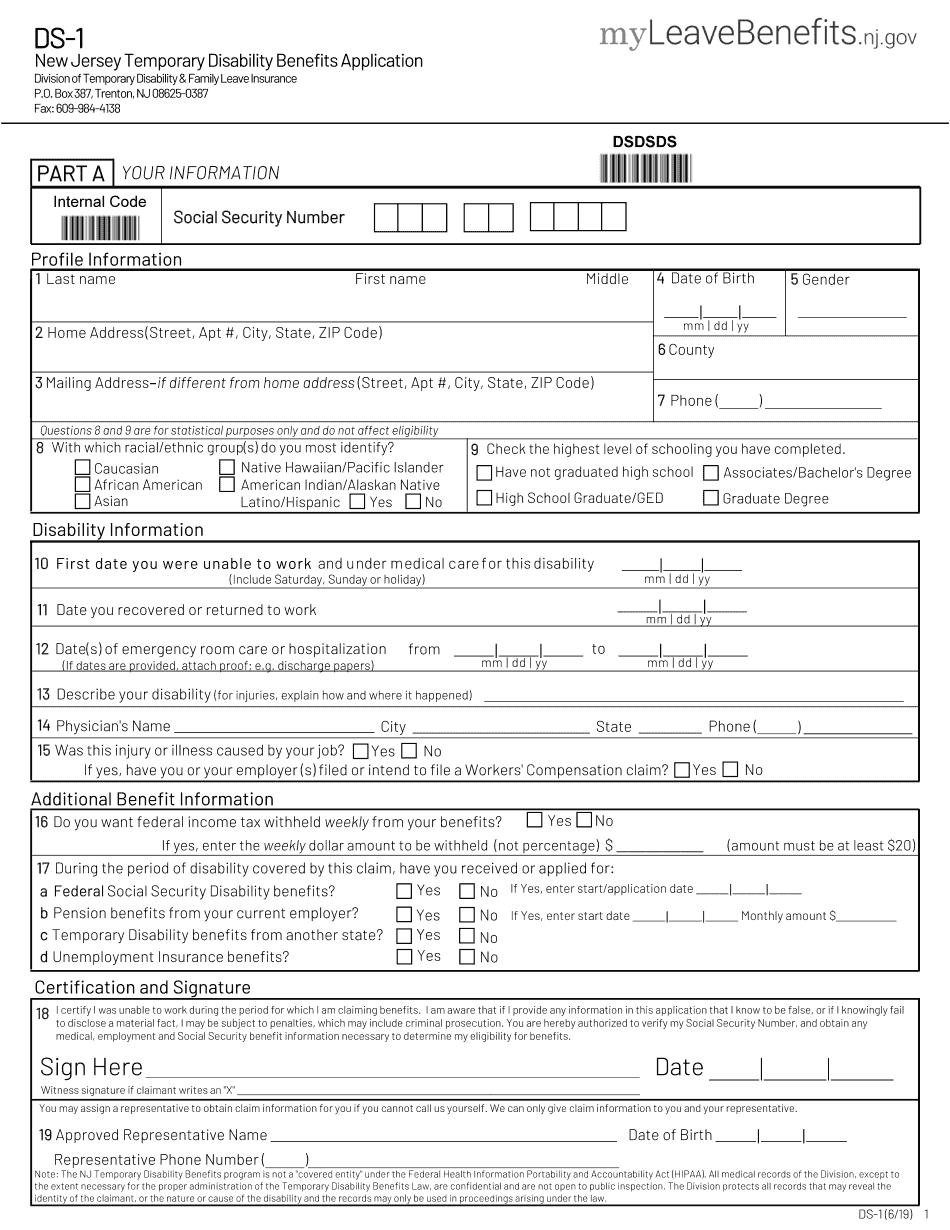

Temporary Disability Insurance benefits are not taxed by the State of New Jersey The amount of your benefits that is taxable will be reported to your employer in January of the year following the receipt of your benefits Is NJ state disability taxable If you received temporary disability insurance benefits in 2022 your employer will report the taxable portion of your benefits on your 2022 Form W 2 If you haven t received your Form W 2 you should contact your employer immediately to get a copy

Download Is Nj Disability Taxable

More picture related to Is Nj Disability Taxable

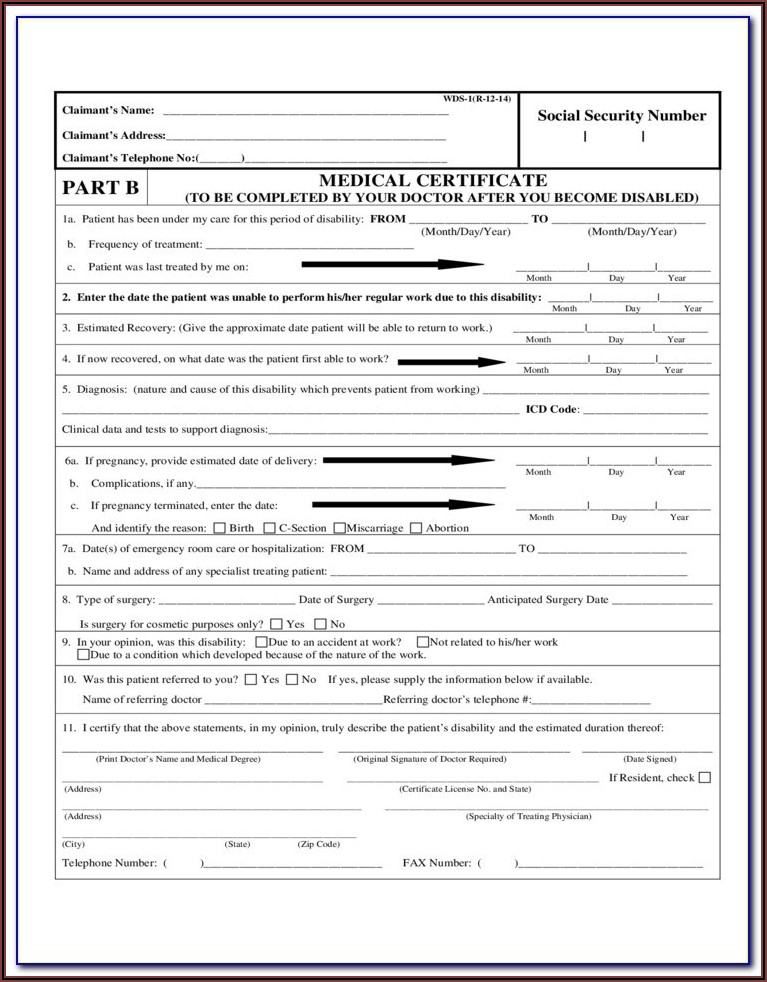

Apply For Temporary Disability Nj Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/478/748/478748167/big.png

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Is Social Security Disability Income Taxable How To Know For Sure

https://moneybliss.org/wp-content/uploads/2023/03/is-social-security-disability-taxable-683x1024.jpg

Your weekly benefit rate WBR in New Jersey is calculated by dividing your base year earnings by the number of base weeks any week in which you earned more than 283 Your WBR is 85 of this average For 2024 the most you can get is 1 055 per week and part of the payment is taxable Here s an example 3 New Jersey Legislation A 3975 effective January 1 2020 separated the computation of the temporary disability and family leave insurance taxable wage base from that of the state unemployment insurance taxable wage base

[desc-10] [desc-11]

Are Social Security Disability Benefits Taxable Direct Express Card Help

https://directexpresshelp.com/wp-content/uploads/2023/04/Is-Social-Security-Disability-Income-Taxable.png

Is Long Term Disability Taxable In Arizona Ronstadt Law

https://ronstadtlaw.com/wp-content/uploads/2021/02/is-long-term-disability-taxable-1024x707.jpg

https://www.nj.gov/labor/myleavebenefits/help/taxforms.shtml

Did you receive ONLY Temporary Disability Insurance benefits You will NOT have a 1099 G in your online account Click here to learn how Temporary Disability benefits are taxed

https://www.nj.gov/treasury/taxation/njit6.shtml

The following benefits are not taxable and should not be reported as pension income Social Security and Railroad Retirement benefits Pension payments received because of permanent and total disability before age 65

Disabilities Replay Health

Are Social Security Disability Benefits Taxable Direct Express Card Help

Is Long Term Disability Taxable What You Need To Know

Disability Rights Pennsylvania

Nj Permanent Disability Chart

Are Disability Insurance Benefits Taxable

Are Disability Insurance Benefits Taxable

Disability Support Disability Support Squad

Business Leaders It s Time To Get Serious About Disability Inclusion

How Long Can You Collect Temporary Disability In Nj Disability Talk

Is Nj Disability Taxable - Is NJ state disability taxable If you received temporary disability insurance benefits in 2022 your employer will report the taxable portion of your benefits on your 2022 Form W 2 If you haven t received your Form W 2 you should contact your employer immediately to get a copy