Is Sales Tax Calculated Before Or After Discounts Web 30 Nov 2023 nbsp 0183 32 In the majority of US states discounts and promotions must be applied to the price of an item or order before sales tax is calculated While a minority of states allow certain flexibility applying discounts prior to tax is

Web 5 Dez 2018 nbsp 0183 32 Retailers in certain states are supposed to recalculate the total amount of sales tax due after any of these discounts have been applied These coupon and sales tax discounts apply only to items that are taxable Many grocery items are not taxable in most states but other items purchased at locations such as a Massachusetts Walmart Web 30 Juni 2022 nbsp 0183 32 Do you calculate sales tax before or after discount Because discounts are generally offered directly by the retailer store and reduce the amount of the sales price and the cash received by the retailer the sales tax

Is Sales Tax Calculated Before Or After Discounts

Is Sales Tax Calculated Before Or After Discounts

https://i.ytimg.com/vi/e3fBMuZFFcs/maxresdefault.jpg

Sales Tax Landing Help

https://cdn.imweb.me/thumbnail/20201110/52a53382d2f36.png

Setting Up A Sales Tax Compliant Ecommerce Tech Stack

https://taxcloud.com/wp-content/uploads/2023/04/TC_0406_featured-1260x1260.jpg

Web 27 Dez 2021 nbsp 0183 32 Answer ID 3988 Published 12 27 2021 01 50 PM Updated 06 29 2023 06 30 PM Sales tax is charged on each taxable item however amounts representing on the spot cash discounts employee discounts volume discounts store discounts such as buy one get one free wholesaler s or trade discounts rebates and store or Web Calculating the VAT on a prompt payment discount is more complicated than the calculation for a trade discount With a prompt payment discount the VAT is based on the actual amount received but you the supplier will need to account for the VAT and prepare the invoice before the amount is received

Web In the UK the sales tax is called VAT value added tax The amount of the sales before the tax is added is called the net amount and after tax is added is called the gross amount Similarly most purchases will include an amount of Web So the discount should be applied before the tax is calculated If VAT works differently my apologies Also and here it s entirely possible that VAT is different sales tax applies only to goods not to services So Gross price discount net price plus tax plus service charge equals final amount AKA quot grand total quot

Download Is Sales Tax Calculated Before Or After Discounts

More picture related to Is Sales Tax Calculated Before Or After Discounts

How To Calculate Sales Tax On Calculator Easy Way YouTube

https://i.ytimg.com/vi/4nEvG0uyTK0/maxresdefault.jpg

Do You Have To Pay Sales Tax On A Semi Truck In Florida RCTruckStop

https://rctruckstop.com/wp-content/uploads/2023/01/sales-tax-2.jpg

Clearing The Confusion Is Tip Calculated Before Or After Tax January

https://mytipcalc.com/wp-content/uploads/2023/05/38b41f95-00f3-4ad5-8975-ebaf377abf5c.jpeg

Web 25 Mai 2011 nbsp 0183 32 Should I calculate sales tax before or after a coupon discount is applied I assume this will vary by state I m currently dealing with NY We deal with three types of coupons discount discount and free shipping I know that for discounts tax is calculated after the discount is taken Web 2 Original price 27 50 percent discount is 10 Sometimes the original price and the sale price of an item is known From this the percent discount can be computed using the formula discount percent discount 215 original price by solving for the percent discount

Web 28 Okt 2020 nbsp 0183 32 Discounts are applied before taxes so any discount that you ve created will be applied before the Sales Tax you ve created How do you calculate tax on a discount You can also convert the discounted percentage to a decimal and multiply that by the original price Web 28 Dez 2023 nbsp 0183 32 GST Treatment of Discount under GST What is Taxable Value Updated on 28 Dec 2023 03 15 PM TREATMENT OF DISCOUNTS UNDER GST Discount is the sharpest weapon for promoting a product or a brand The main purpose of discounts is to increase sales

The Difference Between Sales Tax And Use Tax A Guide For E commerce

https://thetaxvalet.com/wp-content/uploads/2023/04/Jurence11938_blog_post_header_receipts_bright_colors_cubic_styl_e35d9bff-bb41-4d84-a105-4243f79d4141.png

Sales Tax Sales Tax Calculator My Finance Bot

https://myfinancebot.com/wp-content/uploads/2023/05/certificate-of-_1_.webp

https://salestaxcalculator.online/are-discounts-applied-before-or-…

Web 30 Nov 2023 nbsp 0183 32 In the majority of US states discounts and promotions must be applied to the price of an item or order before sales tax is calculated While a minority of states allow certain flexibility applying discounts prior to tax is

https://topclassactions.com/lawsuit-settlements/consumer-products/is...

Web 5 Dez 2018 nbsp 0183 32 Retailers in certain states are supposed to recalculate the total amount of sales tax due after any of these discounts have been applied These coupon and sales tax discounts apply only to items that are taxable Many grocery items are not taxable in most states but other items purchased at locations such as a Massachusetts Walmart

Where Can I See The Sales Tax Amount Printify

The Difference Between Sales Tax And Use Tax A Guide For E commerce

How Is Sales Tax Calculated For Online Purchases The Tech Edvocate

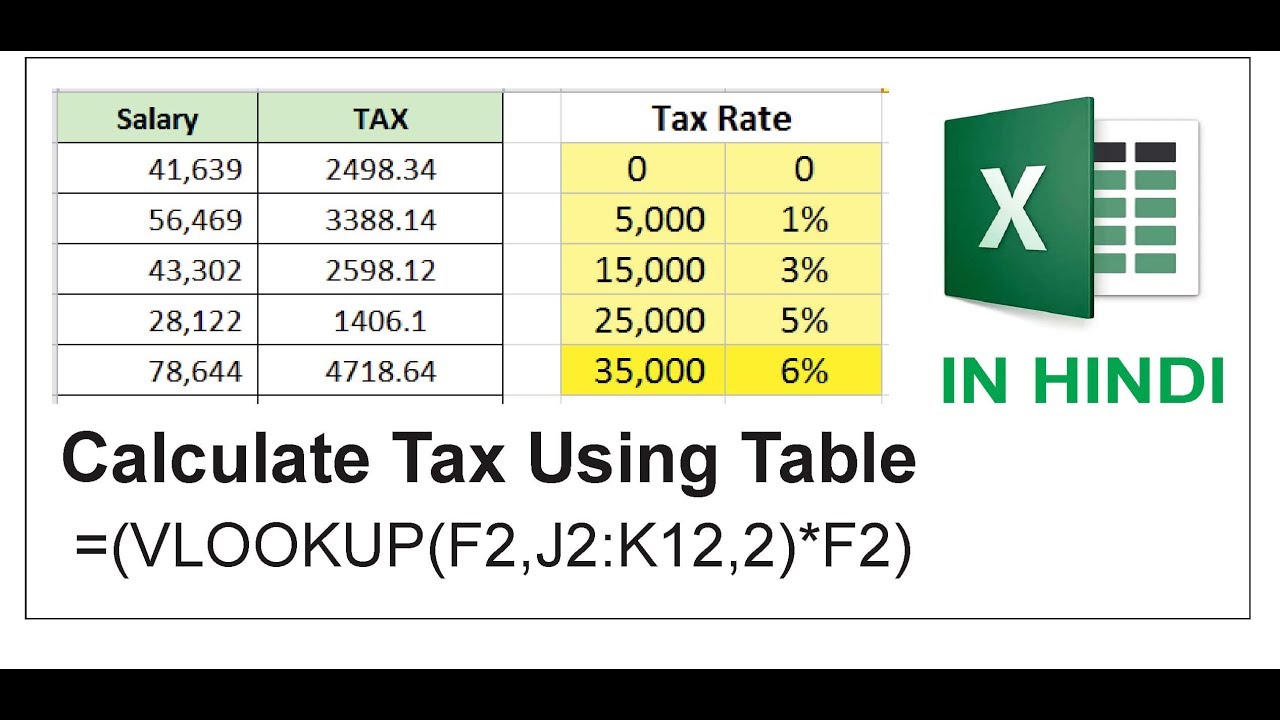

Calculate Sales Tax In Excel Using Vlookup Formula YouTube

Sales Tax Guide For Artists TaxJar Tax Guide Sales Tax Tax Questions

Easy Sales Tax Guide For Dealers File In Quarter Easily

Easy Sales Tax Guide For Dealers File In Quarter Easily

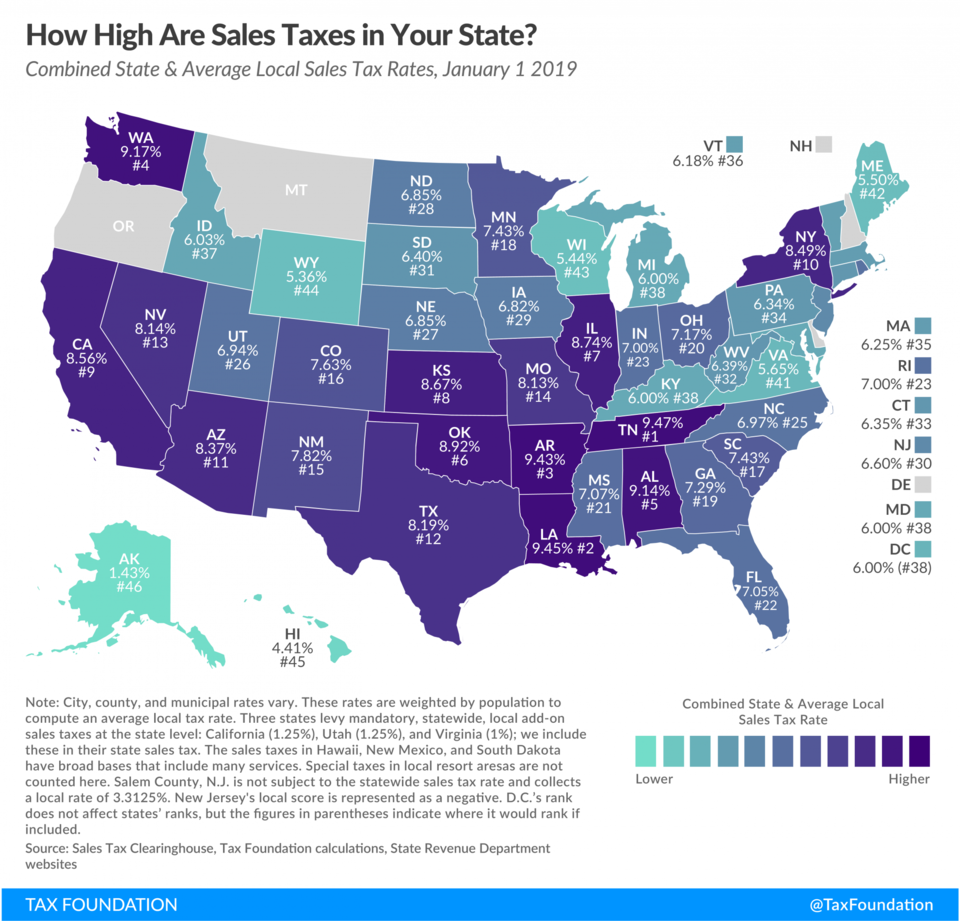

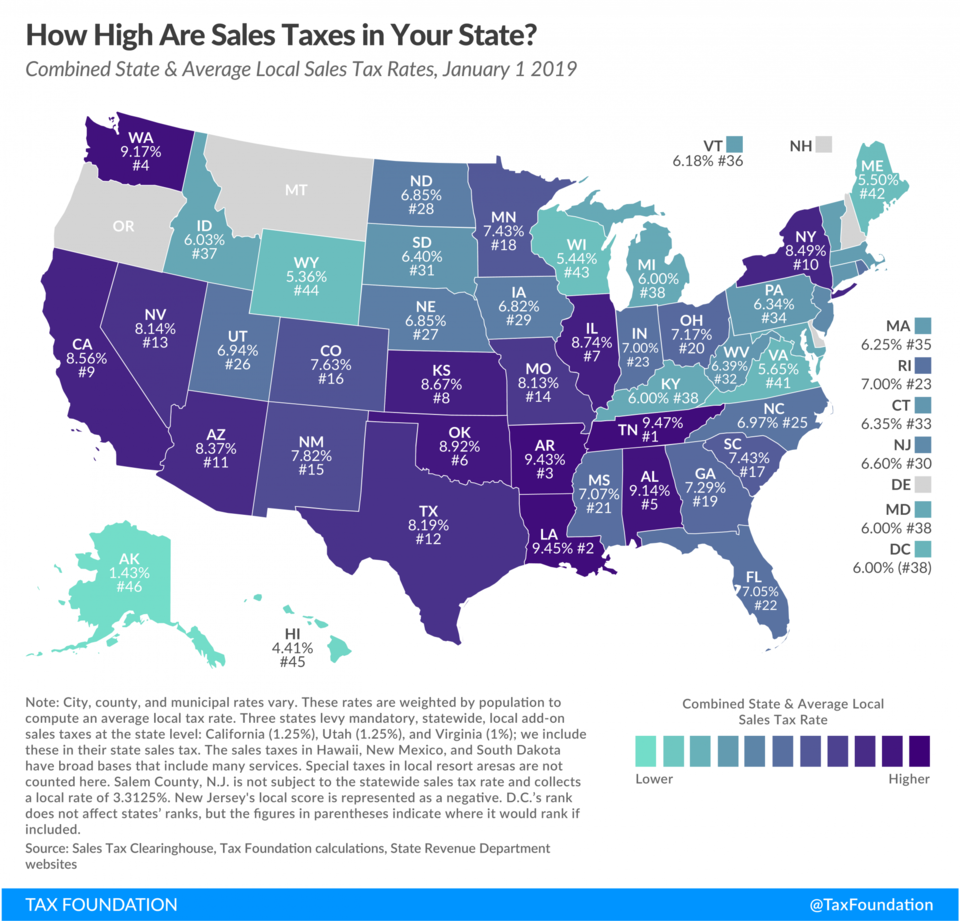

Sales Tax Rates Descubre Conecta Triunfa

What Is Sales Tax Financial Literacy Yippee Faith Filled Shows

Calculate My Income Tax SuellenGiorgio

Is Sales Tax Calculated Before Or After Discounts - Web Tax is always calculated on the item s final selling price after considering discounts if available on the item There are two major categories of taxes and they are direct tax and indirect tax Tax is a real life application of the percentage concept