Is Second Home Mortgage Tax Deductible If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married filing

The short answer is yes Fortunately for taxpayers you can still deduct second mortgage interest but only under certain terms Factors affecting your ability to qualify can include the type and current amount of mortgage debt you have and the date your loan was originated You can deduct mortgage interest on a second home but there are some requirements to capitalize on this tax benefit You first have to determine if your property is considered a second home or an investment property

Is Second Home Mortgage Tax Deductible

Is Second Home Mortgage Tax Deductible

https://cdn.ramseysolutions.net/daveramsey.com/media/blog/home-buying/mortgages/second-mortgage.jpg

What Is A Mortgage Origination Fee Are They Tax Deductible

https://www.homebuyinginstitute.com/images/irs-flowchart.gif

Making Your Home Mortgage Tax Deductible Purtzki Johansen Associates

https://www.purtzki.com/2015/wp-content/uploads/2019/12/make-mortgage-tax-deductible-photo.jpg

We ll take an in depth look at the tax implications of taking on a second mortgage showing you how to go about calculating your deduction on your taxes as well as highlighting various The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business investment or other deductible purposes Otherwise it is considered personal interest and isn t deductible

When it comes to owning a second home the interest on your mortgage is deductible The same rules that come with writing off mortgage interest for your first home apply to your second Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a primary residence

Download Is Second Home Mortgage Tax Deductible

More picture related to Is Second Home Mortgage Tax Deductible

Best Second Mortgage Rates In 2023

https://moneynerd.co.uk/wp-content/uploads/2021/11/Second-Mortgage-Tax-Benefits-700x394.jpg

Buying A Second Home Tax Tips For Homeowners TurboTax Tax Tips Videos

https://digitalasset.intuit.com/IMAGE/A47u72MsH/unpacking-boxes-new-home-INF12015.jpg

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

http://4.bp.blogspot.com/-1n-pssIhuMA/UBhfE1xILOI/AAAAAAAAC9Q/SQjPSp6h2fc/s1600/HIExample.png

What mortgage interest is tax deductible To take the mortgage interest deduction the interest paid must be on a qualified home Your first and second home may be considered qualified homes If your second house was purchased before December 15 2017 is used primarily for personal use and isn t a rental or business property then the answer is yes you can deduct the mortgage interest on the second home just as you would with your first home

You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest If you rent out your second home you must also use it as a home during the year You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

Are Mortgage Payments Tax Deductible Potential Deductions Explained

https://media.marketrealist.com/brand-img/-9v28ncFX/2160x1131/mortgage-tax-deductible-1666964000846.jpg

Mortgage Interest Tax Deductible 2023

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/shutterstock_1613352049-1280x720.jpg

https://www.investopedia.com/articles/personal...

If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married filing

https://www.rocketmortgage.com/learn/can-you...

The short answer is yes Fortunately for taxpayers you can still deduct second mortgage interest but only under certain terms Factors affecting your ability to qualify can include the type and current amount of mortgage debt you have and the date your loan was originated

The Rise Of The Second Mortgage

Are Mortgage Payments Tax Deductible Potential Deductions Explained

How Many Home Loans Are Eligible For Tax Exemption Leia Aqui How Many

Making Your Home Mortgage Tax Deductible Purtzki Johansen Associates

Second Home Mortgage Guidelines On Home Purchases

Second Home Mortgage All You Need To Know About In 2021

Second Home Mortgage All You Need To Know About In 2021

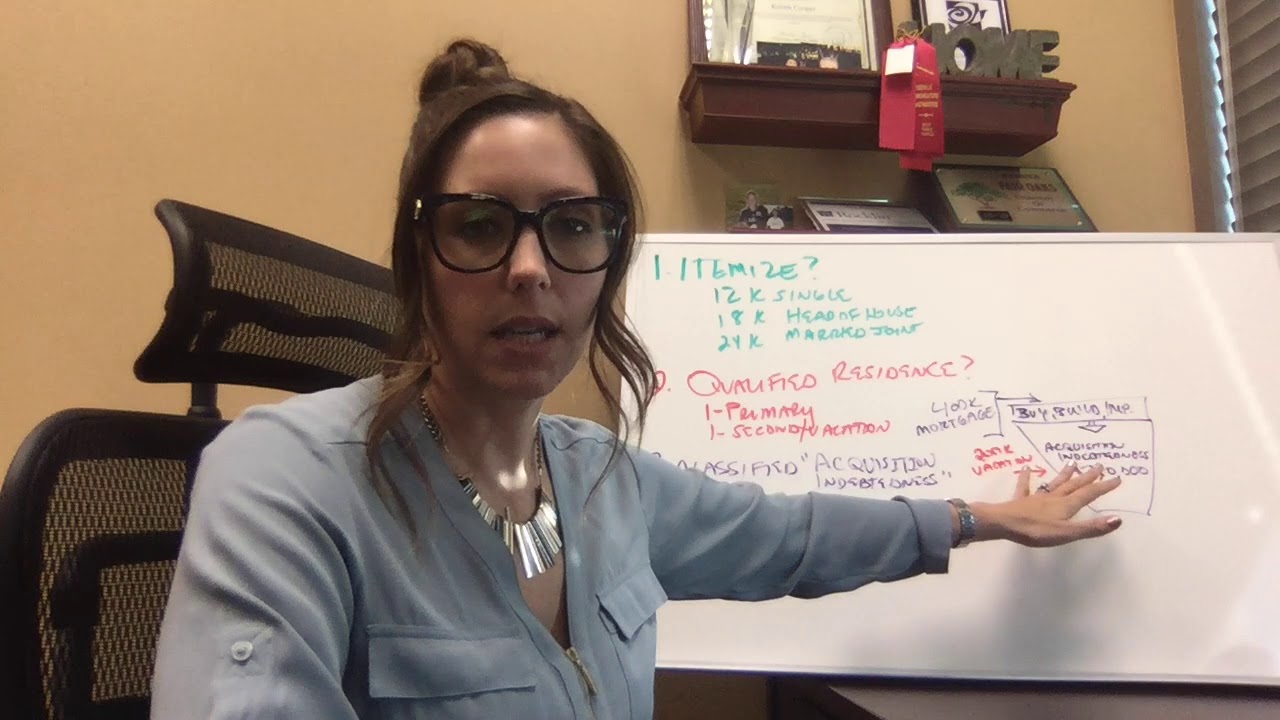

When Is Mortgage Interest Tax Deductible YouTube

How To Get A Second Home Loan For Rental Income

Mortgage Rates For Second Homes Vs Investment Property The Mortgage

Is Second Home Mortgage Tax Deductible - If you itemize deductions you can deduct real estate taxes and points you pay over the life of a mortgage to buy a second home You might refinance or sell the home before you pay off the mortgage If so you can deduct points in the year of sale or refinance points you didn t previously deduct