Is The State Of Minnesota 2021 Tax Rebate Taxable Income On your Minnesota income tax return This payment is not taxable and will not be taken to pay any unpaid tax or debts we collect for other agencies On your U S income tax return This

On your Minnesota income tax return This payment is not taxable and will not be taken to pay any unpaid tax or debts we collect for other agencies On your U S income tax Eligible families could have received 260 per dependent for a total of up to 1 300 That gratitude however was met with disappointment upon the news that recipients would have to pay federal

Is The State Of Minnesota 2021 Tax Rebate Taxable Income

Is The State Of Minnesota 2021 Tax Rebate Taxable Income

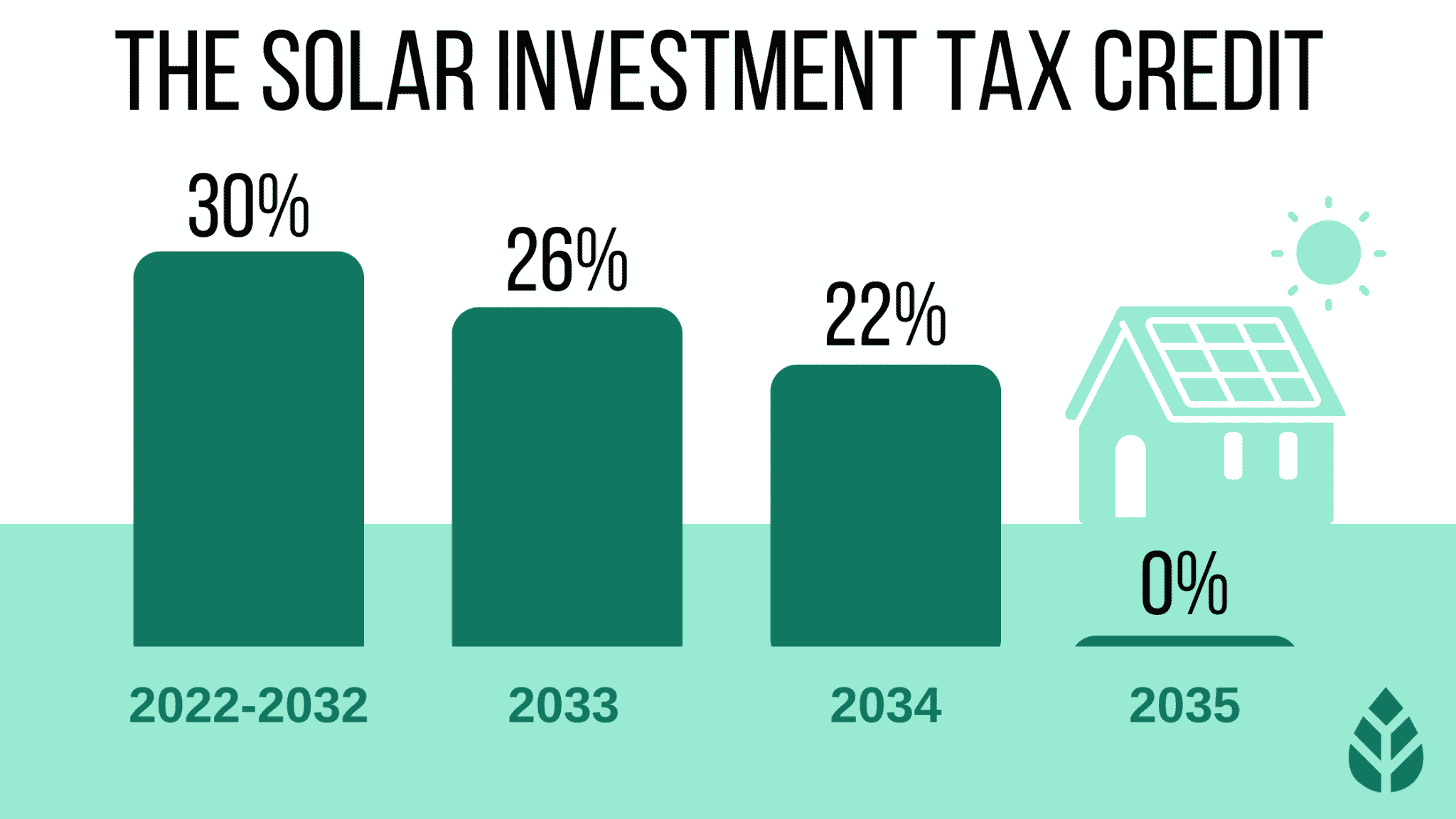

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

How To Reduce Virginia Income Tax

https://static.wixstatic.com/media/753bc4_54233880b95140b6b722381f7064e880~mv2.jpg/v1/fill/w_1000,h_843,al_c,q_90,usm_0.66_1.00_0.01/753bc4_54233880b95140b6b722381f7064e880~mv2.jpg

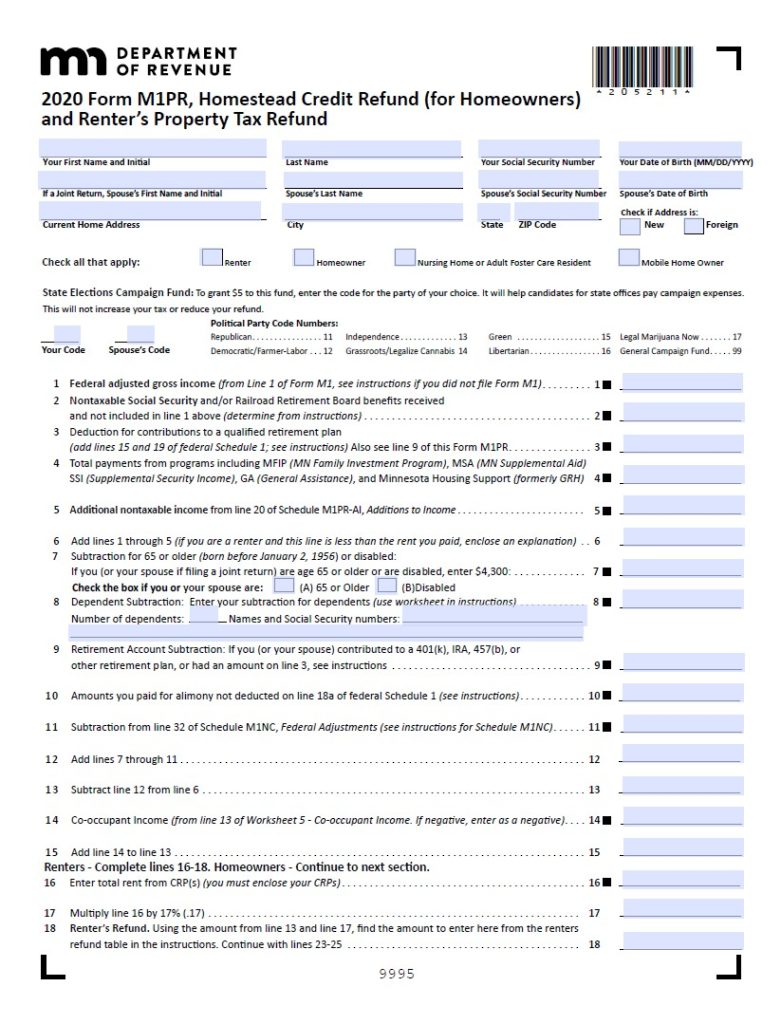

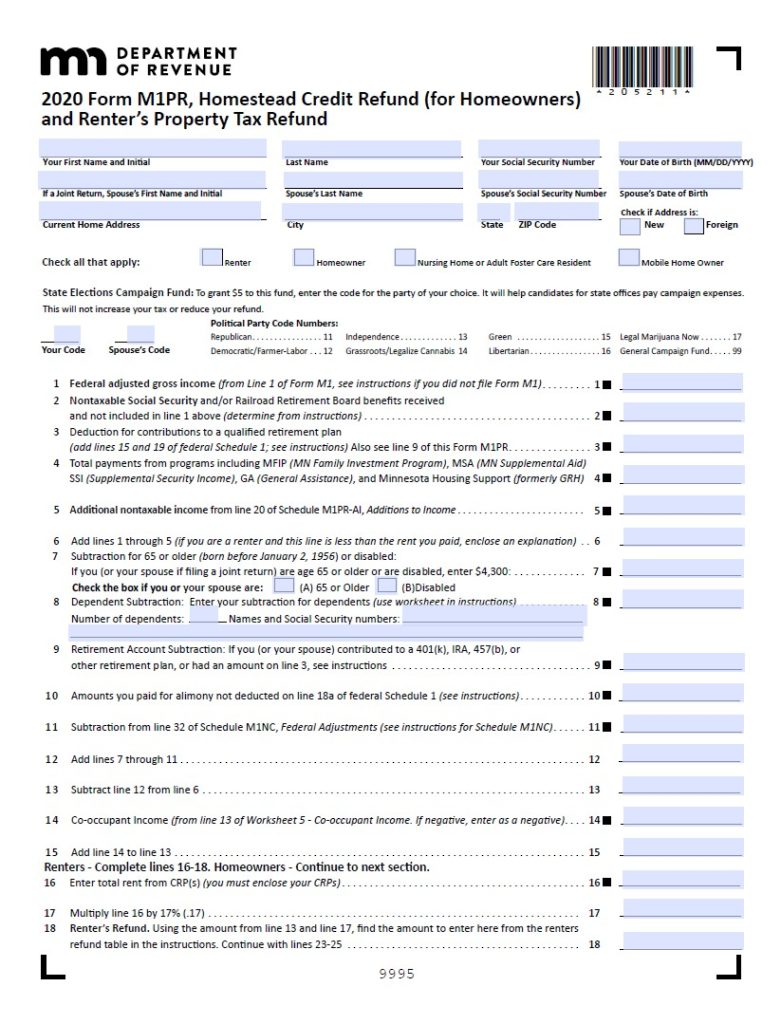

Minnesota Property Tax Refund 2019 2023 Form Fill Out And Sign

https://www.signnow.com/preview/513/825/513825734/large.png

In May the Minnesota State Legislature approved a one time tax rebate of 260 for individuals whose adjusted gross income was 75 000 or less 520 for married couples filing a joint Minnesotans who lived in the state for at least part of 2021 filed a Minnesota tax return or property tax refund and are below a certain income threshold will receive a check Here are the check totals 260 for individuals

ST PAUL Minn Governor Tim Walz recently signed legislation that directs the Minnesota Department of Revenue to distribute direct tax rebate payments to eligible While Minnesota isn t taxing the payments the IRS has now determined that the payments will be taxed federally Depending on Minnesotans income and the size of their rebate check the federal tax

Download Is The State Of Minnesota 2021 Tax Rebate Taxable Income

More picture related to Is The State Of Minnesota 2021 Tax Rebate Taxable Income

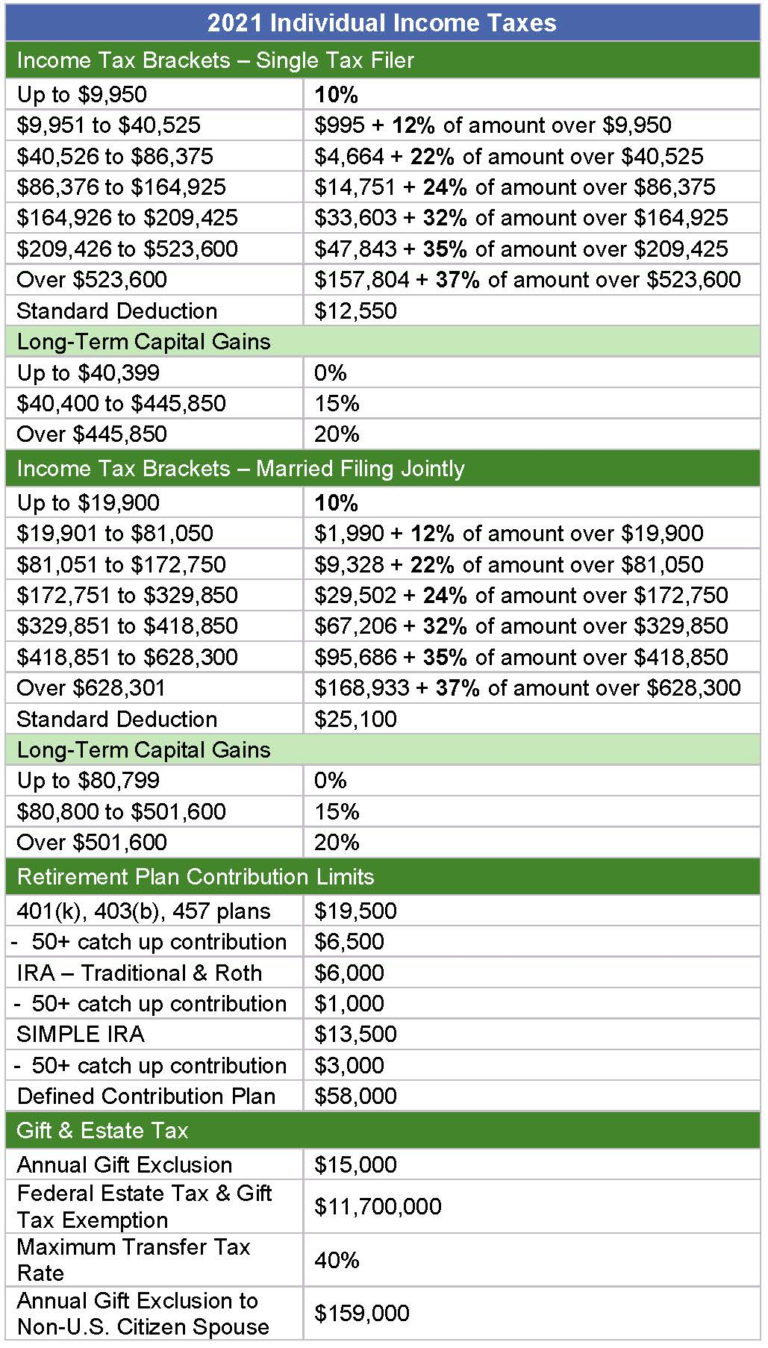

2021 Federal Income Tax Brackets Chart Federal Withholding Tables 2021

https://federalwithholdingtables.net/wp-content/uploads/2021/07/2021-tax-chart-cmh-11-768x1348.jpg

Minnesota Revenue Form ST3 for Tax Exempt Orders

https://img.yumpu.com/30093140/1/500x640/minnesota-revenue-form-st3-for-tax-exempt-orders.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

California State Income Tax Rate Table 2021 Brokeasshome

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

At the state level Minnesota generally excludes the rebate from taxable income Taxpayers should review Minnesota Department of Revenue publications for confirmation You will see the subtraction of your MN rebate from your income on line 7 of your MN M1 form since your rebate is not taxable in MN For more information review MN

The Minnesota tax rebate is not taxable on your Minnesota state tax return If you include this payment in your federal adjusted gross income subtract it from Minnesota taxable People who made 75 000 or less in 2021 or up to 150 000 as a married couple could receive 520 for a couple or 260 for an individual Higher rebates could go to parents

Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021-781x1024.jpg

Cukai Pendapatan How To File Income Tax In Malaysia JobStreet Malaysia

https://media.graphassets.com/j9n1ArmpRreKvI9fooEq

https://www.revenue.state.mn.us

On your Minnesota income tax return This payment is not taxable and will not be taken to pay any unpaid tax or debts we collect for other agencies On your U S income tax return This

https://www.revenue.state.mn.us › mndor-pp

On your Minnesota income tax return This payment is not taxable and will not be taken to pay any unpaid tax or debts we collect for other agencies On your U S income tax

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Renters Rebate Form Printable Rebate Form

How To Reduce Your Taxable Income

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Key Highlights Of The 2021 Budget Form 10E For F Y 2021 22 With

8 2023 Social Security Tax Limit Ideas 2023 GDS

Is The State Of Minnesota 2021 Tax Rebate Taxable Income - In May the Minnesota State Legislature approved a one time tax rebate of 260 for individuals whose adjusted gross income was 75 000 or less 520 for married couples filing a joint