Is There A Tax Deduction For Health Insurance Premiums Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or

While you can typically deduct health insurance premiums other types of related insurance like disability insurance or medical costs that were reimbursed by your health savings account Tax Deduction for Qualifying Premiums Paid under the Voluntary Health Insurance Scheme VHIS Policy

Is There A Tax Deduction For Health Insurance Premiums

Is There A Tax Deduction For Health Insurance Premiums

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

To provide an incentive for citizens to purchase Certified Plans under VHIS the Government will amend the Inland Revenue Ordinance Cap 112 to allow tax deduction for relevant premiums A taxpayer can claim a tax deduction for the qualifying premiums paid by the taxpayer or the taxpayer s spouse for an insured person under a VHIS policy To qualify for the deduction the

You can purchase a VHIS certified plan for yourself or your family members and claim a tax deduction on the qualifying premiums paid Each policy holder can claim a tax deduction on Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care

Download Is There A Tax Deduction For Health Insurance Premiums

More picture related to Is There A Tax Deduction For Health Insurance Premiums

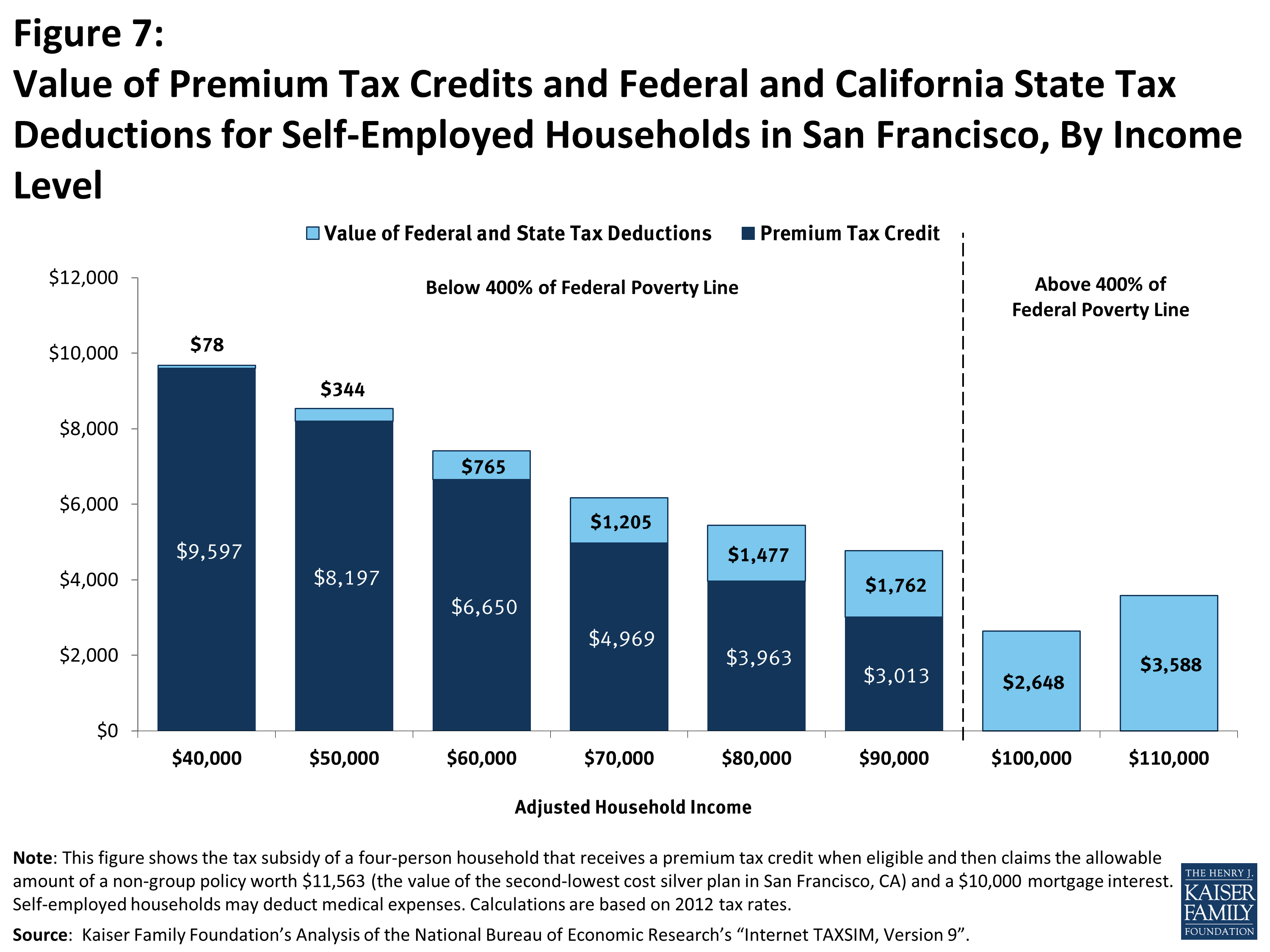

Tax Subsidies For Private Health Insurance III Special Tax Deduction

https://www.kff.org/wp-content/uploads/2014/10/7779-02-figure-7.png?resize=698

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Q12 If a personal income taxpayer is already subject to the standard tax rate of 15 can he she save taxes by claiming tax deduction for qualifying premium of VHIS policies Whether tax deduction is allowable for the qualified premiums paid under this Certified Plan are subject to the prevailing tax laws of Hong Kong as well as the individual circumstances of the

[desc-10] [desc-11]

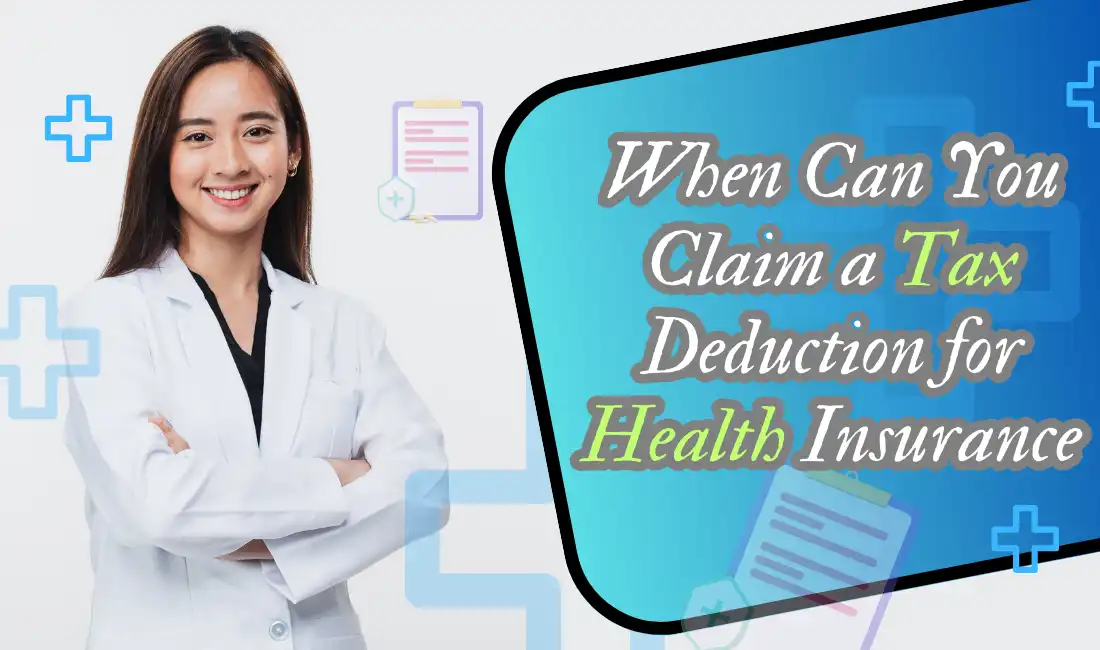

Tax Deduction For Health Insurance When Can You Claim It Business News

https://i3.wp.com/ic-cdn.flipboard.com/thestreet.com/68fad7457e0ef3ddf6a0f261418e485cb5d16e9c/_xlarge.jpeg

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

https://www.mohindrainvestments.com/wp-content/uploads/2022/06/Deduction-for-Health-Insurance-us-80D-of-Income-Tax-.png

https://blog.turbotax.intuit.com › health-care › when...

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or

https://teaching.hk › money › insurance › are-health...

While you can typically deduct health insurance premiums other types of related insurance like disability insurance or medical costs that were reimbursed by your health savings account

When Can You Claim A Tax Deduction For Health Insurance

Tax Deduction For Health Insurance When Can You Claim It Business News

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

The 6 Best Tax Deductions For 2020 The Motley Fool

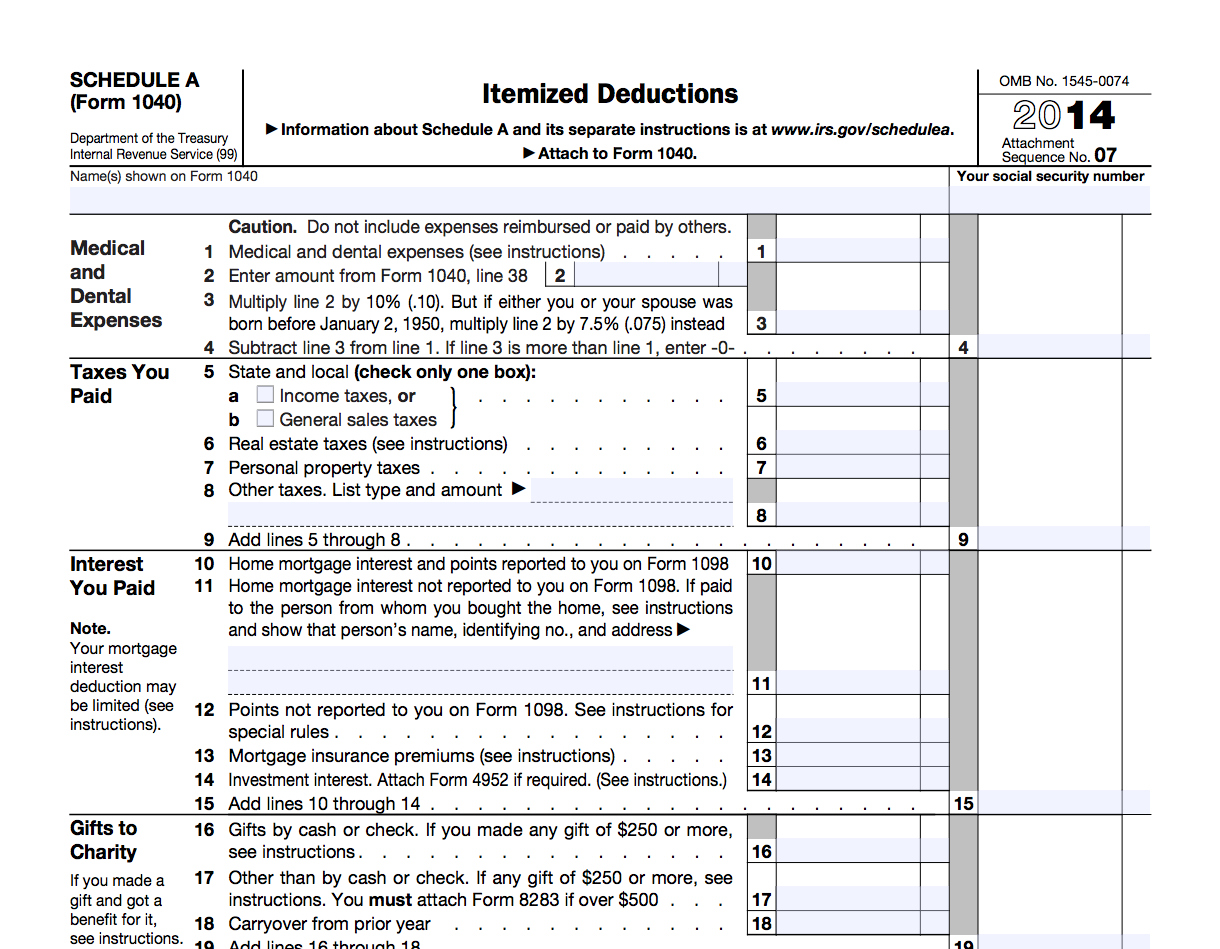

8 Tax Itemized Deduction Worksheet Worksheeto

Tax Deductions Write Offs To Save You Money Financial Gym

Tax Deductions Write Offs To Save You Money Financial Gym

When Can You Claim A Tax Deduction For Health Insurance Yulianna FTP

Income Tax Deductions For The FY 2019 20 ComparePolicy

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable

Is There A Tax Deduction For Health Insurance Premiums - [desc-14]