Is There Employer Contribution In Nps Employers typically contribute up to 10 of an employee s Basic Dearness Allowance DA to the NPS with an overall limit of Rs 7 50 000 including Employer s contributions to Provident Fund PF Superannuation and NPS

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling of Rs 1 50 lakh under Sec 80 CCE What is the deduction limit under section 80CCD for an employer s contribution to an NPS account Employer s contribution to NPS is allowed as a deduction under section 80CCD 2 while computing the employee s total income

Is There Employer Contribution In Nps

Is There Employer Contribution In Nps

https://newstogov.com/wp-content/uploads/2023/02/SSS-Contribution-Regular-Employers-Employees.jpg

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh

https://certicom.in/wp-content/uploads/2020/09/Employee-Provident-Fund.png

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://cdn.freefincal.com/wp-content/uploads/2015/12/Online-contribution-NPS.jpg

Your employer also contributes to your NPS account Let s see how the tax liability will be attracted in both cases If employee contributes only and if both employer and employee contribute The maximum employer contribution in the government sector is 14 of the salary Basic DA contributed by the Central Government and State Government to the employee s NPS account

Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available up to 10 of the basic salary Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such contribution is made by the Central Government under Section 80CCD 2 beyond the Rs 1 5 lakh limit provided under Section 80CCE

Download Is There Employer Contribution In Nps

More picture related to Is There Employer Contribution In Nps

Whether Deduction On Employer s Contribution In NPS Can Be Claimed

https://i.ytimg.com/vi/NxDRI4DRr5I/maxresdefault.jpg

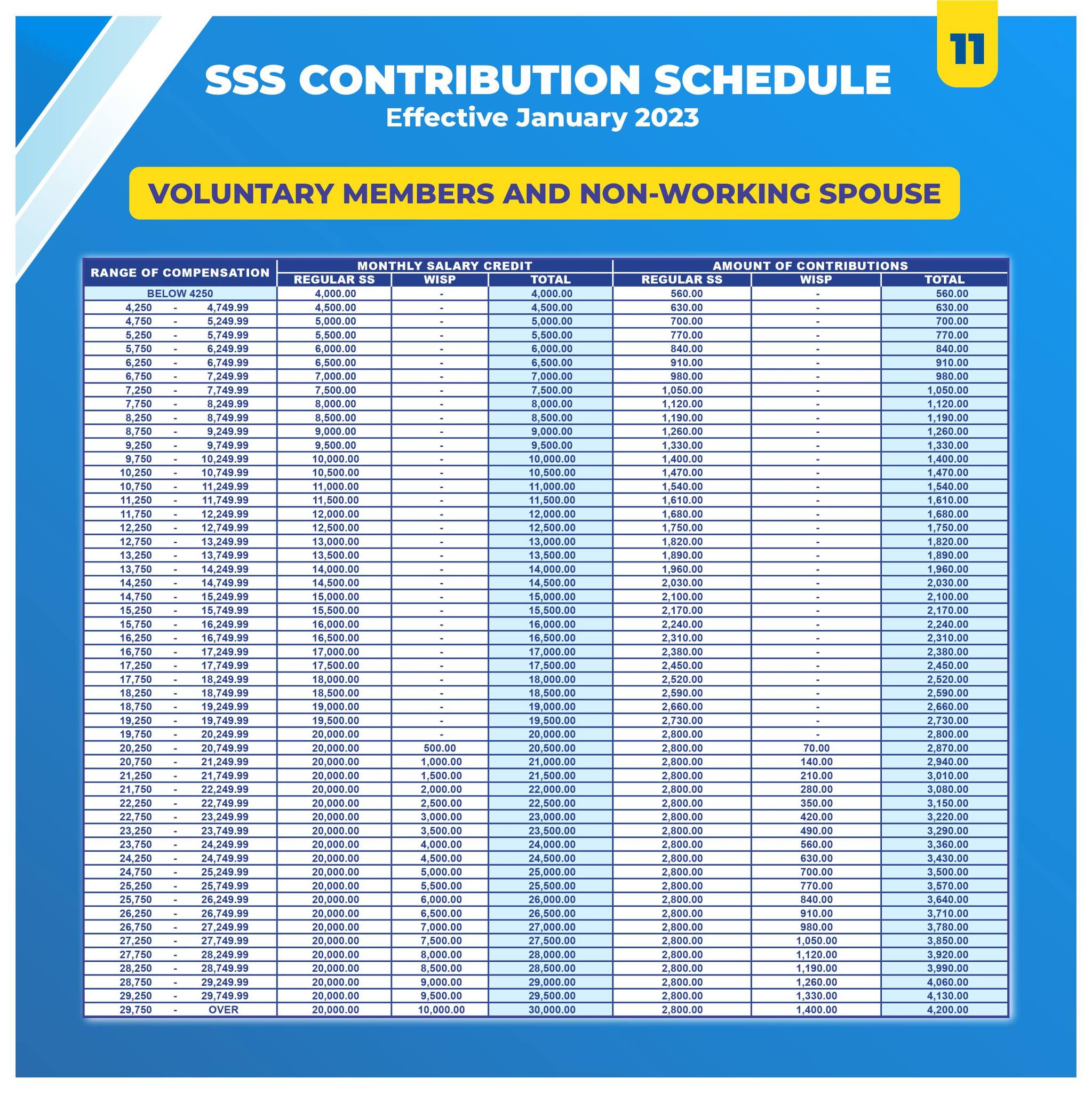

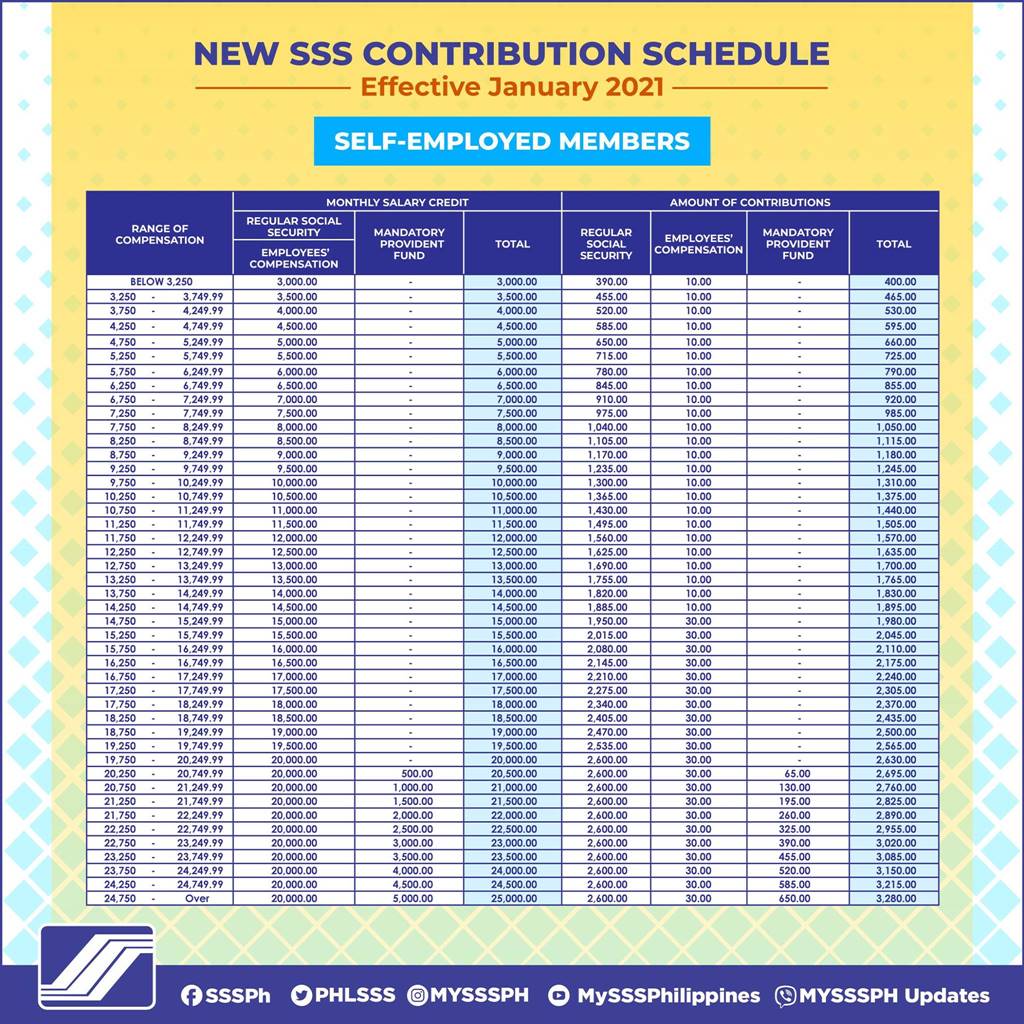

New Sss Contribution Table 2023 Schedule Effective January Porn Sex

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhcKolUL1kpAxXoCNCrDttBik73Re-z9lnh7mw7AUQKtqYbLR1y0b-ZSkTMPZtBlKp7sN4yvkj08aTrWxRfeU7ftKmZb18BbZEauHbKrlFM0P6o043P9aTJsNzPhfRjTIVlSJEn07N9npcJflph2nyUioerxfnsex3vZ8xKfu3-a-_HJpHtkk8Q-ANhjQ/s2048/SSS Contribution Table - Voluntary and Non-Working Spouse.jpg

Creating NPS Contribution Pay Head For Employers Payroll

https://help.tallysolutions.com/docs/te9rel63/Payroll/Images1/5_NPS_Employer_contribution.gif

Able retirement savings account Under the NPS the individual contributes to his retirement account and also his employer can also co contribute for the social se On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD 1 of Income Tax Act up to 10 of salary Basic DA

The employer s contribution up to a limit of 10 percent of the salary 14 percent for government employees which includes the basic salary and dearness allowance is eligible National Pension Scheme NPS NPS contribution limit for employer in private sector raised from 10 to 14 of the employees basic salary For both private and public sector employees the deduction limit has been raised from 10 to 14 All these benefits are available on the new tax regime only

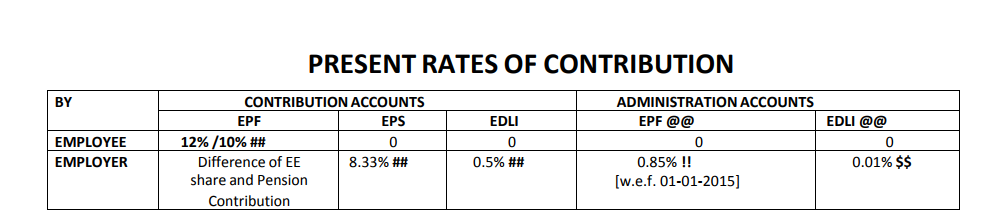

What Are EPF Contribution Categories Digi X Master

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/2043419249397/original/ia_CN1nDr2WbSD5KLsNgQD0GLUO2kwbSmg.png?1675844132

All You Need To Know About The Premium PhilHealth Contribution The

https://i0.wp.com/thefrenchadobo.com/wp-content/uploads/2020/04/Philhealth-Contribution.jpg?resize=700%2C698&ssl=1

https://www.kotak.com/en/stories-in-focus/national...

Employers typically contribute up to 10 of an employee s Basic Dearness Allowance DA to the NPS with an overall limit of Rs 7 50 000 including Employer s contributions to Provident Fund PF Superannuation and NPS

https://npstrust.org.in/benefits-of-nps

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling of Rs 1 50 lakh under Sec 80 CCE

NPS National Pension System Contribution Online Deduction Charges

What Are EPF Contribution Categories Digi X Master

How To Compute For SSS Contribution E PINOYGUIDE

Your Employer s Contribution To NPS Can Make A Huge Difference

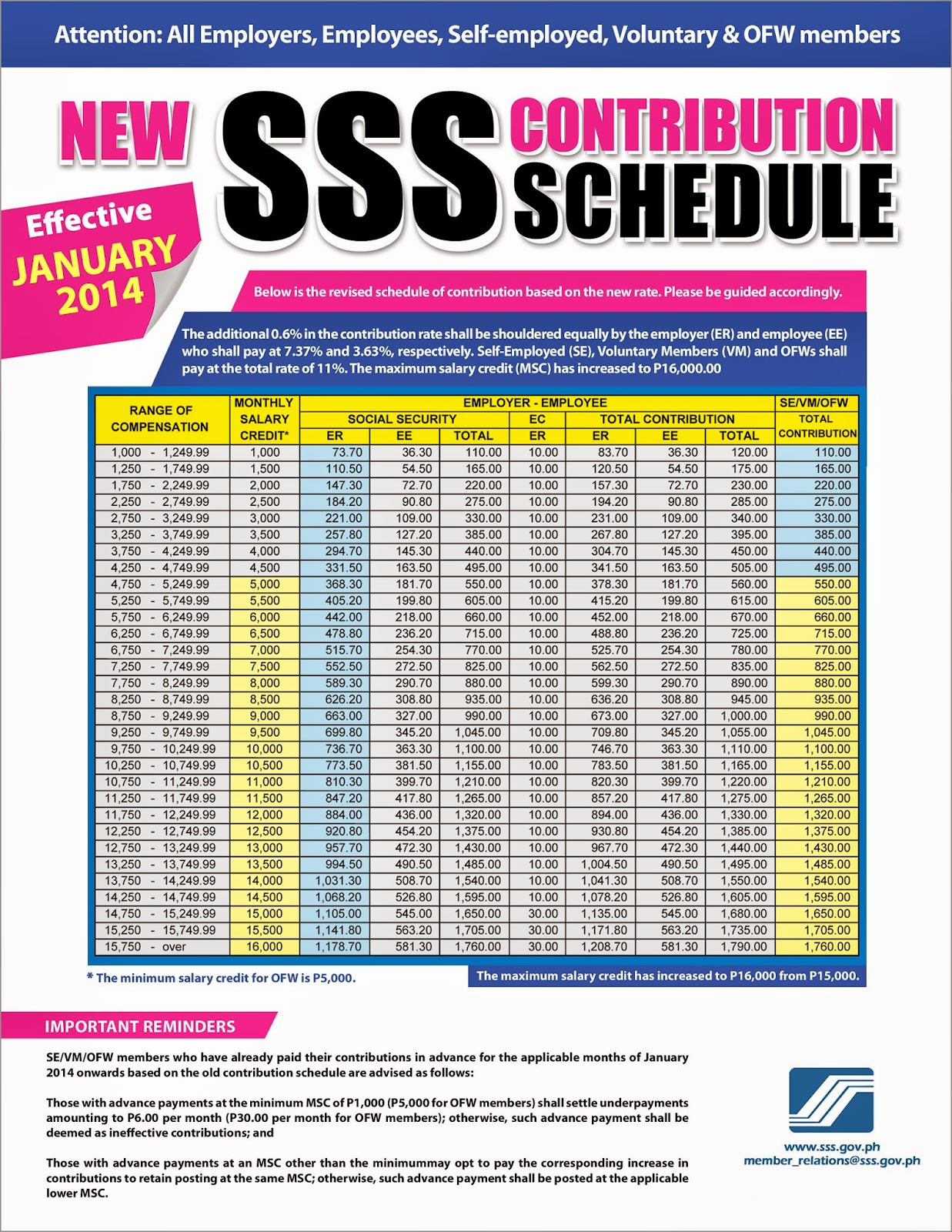

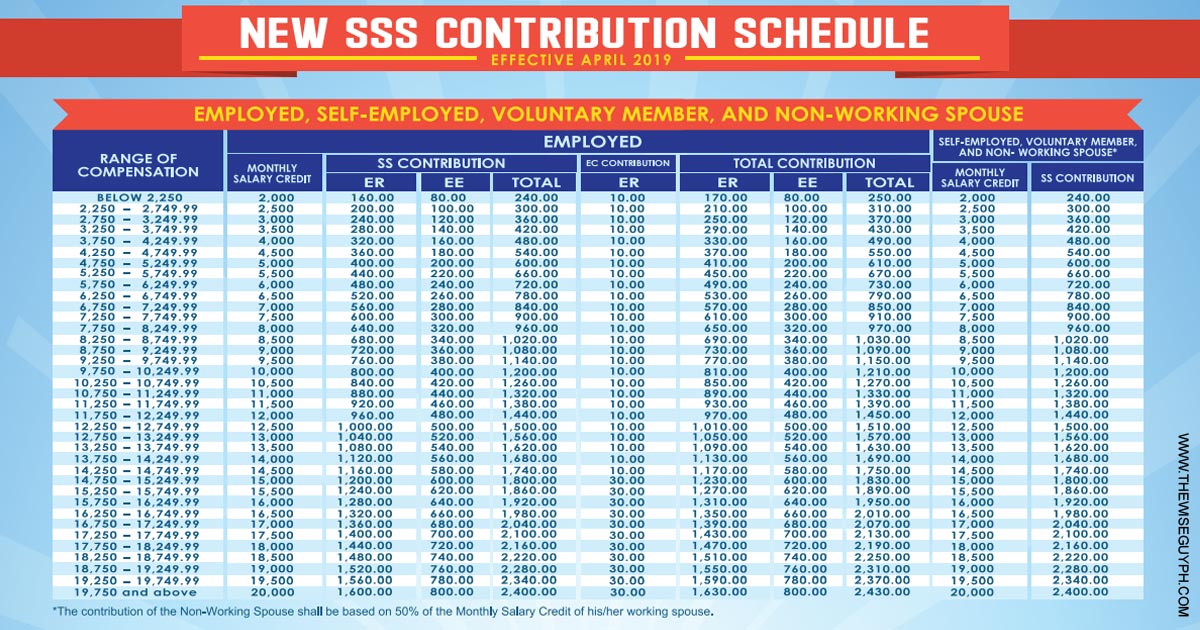

Sss Contribution Table 2019 Employer Employee Sss Contribution Table

NPS Contribution Online And Offline Procedure And Charges Scripbox

NPS Contribution Online And Offline Procedure And Charges Scripbox

PF Contribution Rate Employer Employee Share

Pin On SHAMEEM

SSS Monthly Contribution Table Schedule Of Payment 2023 The Pinoy OFW

Is There Employer Contribution In Nps - Your employer also contributes to your NPS account Let s see how the tax liability will be attracted in both cases If employee contributes only and if both employer and employee contribute