Is There Income Tax Rebate On Car Loan Claiming Car Loan tax benefits is easy as long as you are actually using the car for legitimate business purposes For claiming the benefit at the time of filing tax returns include the loan interest paid in a year in the business expenses column

Checkout how you can claim car loan tax benefits including deductions and exemptions Learn about depreciation claims car facilities in income tax and more Yes a Car Loan can help you save on tax if you are a self employed professional or business owner and use the car for business purposes But a salaried employee cannot claim tax deductions on Car Loan interest repayments like with a Home Loan

Is There Income Tax Rebate On Car Loan

Is There Income Tax Rebate On Car Loan

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

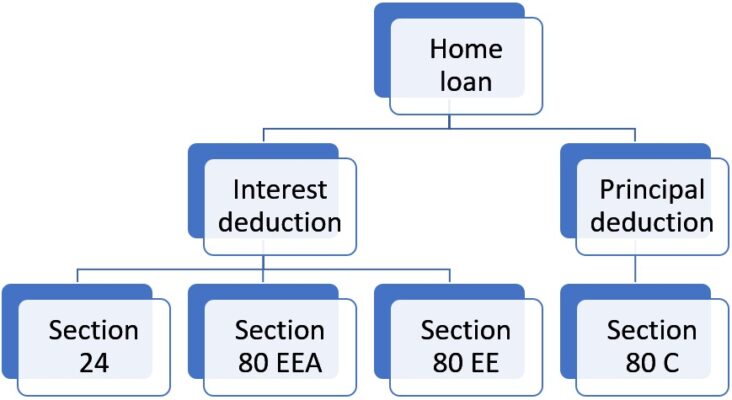

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-768x524.jpg

2022 South Carolina Tax Rebate What You Need To Know Wltx

https://media.wltx.com/assets/WLTX/images/537945567/537945567_1920x1080.jpg

Section 80EEB has been introduced allowing a deduction for interest paid on loan taken for the purchase of electric vehicles A deduction for interest payments up to Rs 1 50 000 is available under Section 80EEB Read to know more For cars used for business purposes self employed people may be eligible for auto loans under section 80C of the Income Tax Act This reduces your taxable income lowering your overall tax liability

Car loans availed by individual customers do not offer any tax benefit Car loans availed by self employed individuals for vehicles that are used for commercial purposes are eligible for tax deduction under section 80C of the Income Tax Act Tax Benefit on Personal Loan No there are no specific tax benefits on a personal loan However we have identified a few scenarios where you can claim tax benefits on a personal loan in India The key factor in determining whether you can claim these benefits is the intended use of the loan amount

Download Is There Income Tax Rebate On Car Loan

More picture related to Is There Income Tax Rebate On Car Loan

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

https://feeds.abplive.com/onecms/images/uploaded-images/2022/04/02/f76f68da854ba91279b6eb80f97615cb_original.jpg?impolicy=abp_cdn&imwidth=1200&imheight=628

Income Tax Rebate Astonishingceiyrs

https://i.ytimg.com/vi/mw-erFuYboM/maxresdefault.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Do you get any tax benefits for repayment of car loans This question will interest several buyers since the cars are expensive and many buyers borrow to fund such purchases The answer is Yes and No Who can claim car loan income tax benefits Salaried employees cannot claim tax benefits on a car loan However self employed individuals or business owners can avail of tax benefits on the interest payment of the car loan if

So when you are claiming tax rebate on car loan deduct the interest you have paid towards your in that year from your taxable income The interest paid can be added as a business expenditure There are other ways to save taxes on car purchase even if you have not sought a loan to buy the car Tax Exemption on Car Loan Tax benefits are available on the interest paid on a car loan and can be claimed as an expense if the car is purchased for business purposes under section 80C of the Income Tax Act However if the car is purchased for personal use the tax benefit cannot be claimed because a car is a luxury item in India Who Can

The Self care Prime Day Deals You Actually Won t Regret Buying GoodTo

https://cdn.mos.cms.futurecdn.net/75PgJj8f2aF6LLuzagky8m.jpg

5 Home Loan Tax Exemptions Businesszag

https://businesszag.com/wp-content/uploads/2022/11/Income-tax-rebate-on-home-loan-FB-1200x700-compressed-1170x683.jpg

https://www.icicibank.com/blogs/car-loan/car-loan...

Claiming Car Loan tax benefits is easy as long as you are actually using the car for legitimate business purposes For claiming the benefit at the time of filing tax returns include the loan interest paid in a year in the business expenses column

https://www.tatacapital.com/blog/loan-for-vehicle/...

Checkout how you can claim car loan tax benefits including deductions and exemptions Learn about depreciation claims car facilities in income tax and more

Income Tax Rebate On Home Loan Tmdl edu vn

The Self care Prime Day Deals You Actually Won t Regret Buying GoodTo

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Deferred Tax And Temporary Differences The Footnotes Analyst

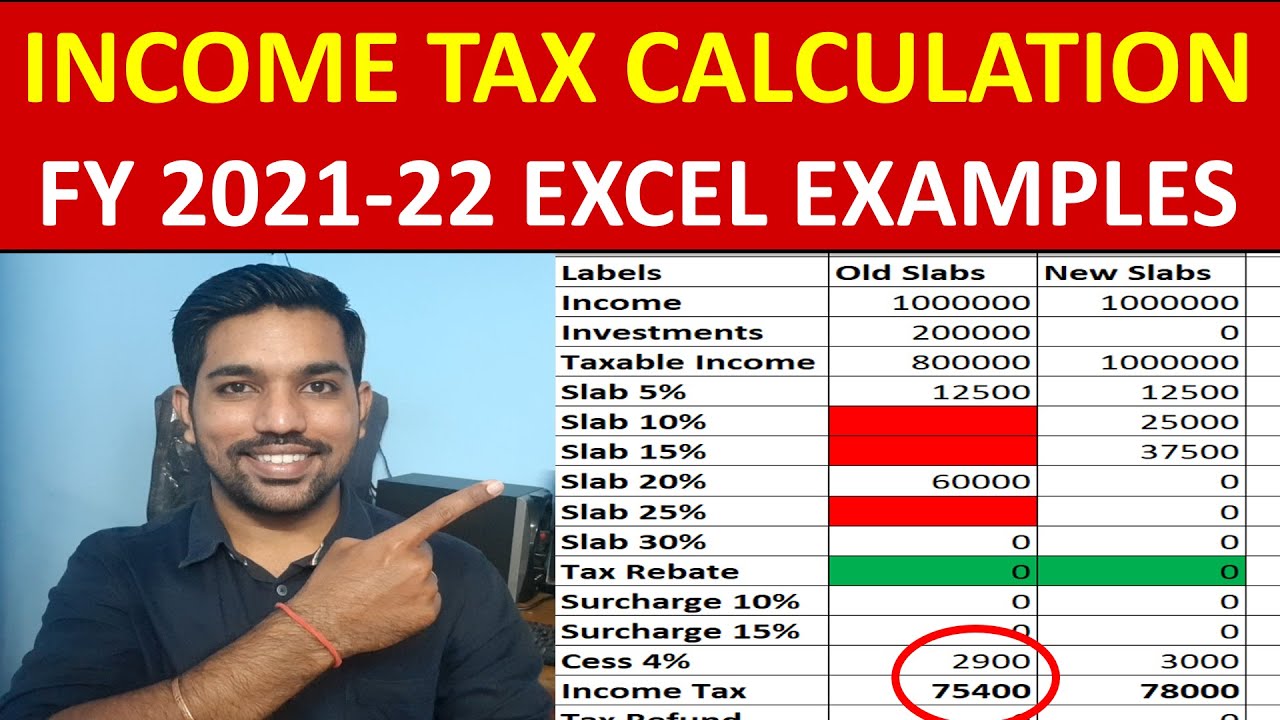

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

ITR Filing Income Tax Exemptions And Deductions That Home Loan

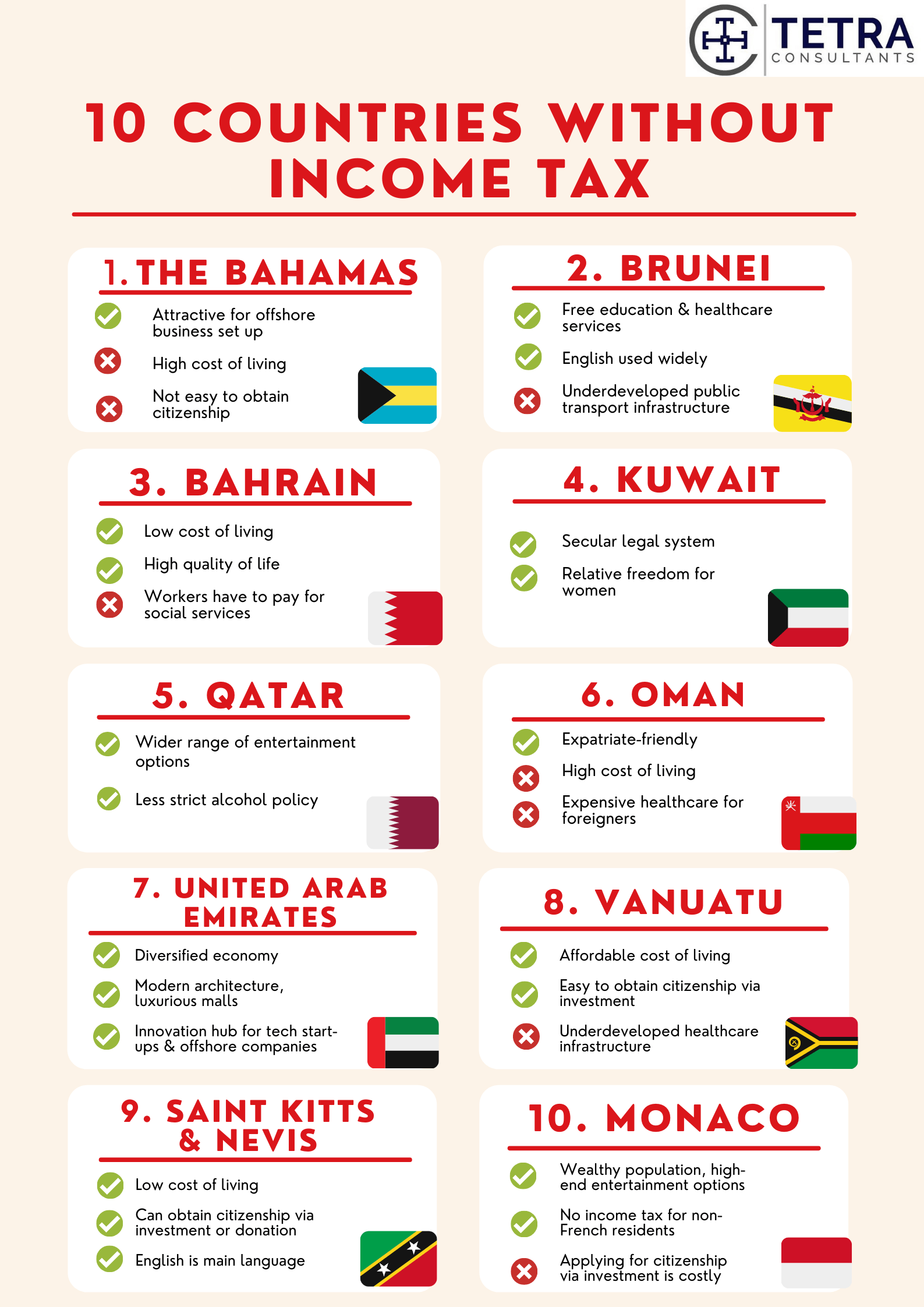

10 Countries With No Personal Income Tax 2023 Glitchtraders

Section 87A Income Tax Rebate

Is There Income Tax Rebate On Car Loan - Car loans availed by individual customers do not offer any tax benefit Car loans availed by self employed individuals for vehicles that are used for commercial purposes are eligible for tax deduction under section 80C of the Income Tax Act