Low Income Comprehensive Tax Rebate Web 5 mai 2020 nbsp 0183 32 The Non Filers tool is for married couples with incomes below 24 400 or single people with income below 12 200 This includes couples and individuals who are

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web The rebate is going to taxpayers who claim the Working Families Tax Credit on their 2020 Personal Income Tax return and have an adjusted gross income of 31 200 or less

Low Income Comprehensive Tax Rebate

Low Income Comprehensive Tax Rebate

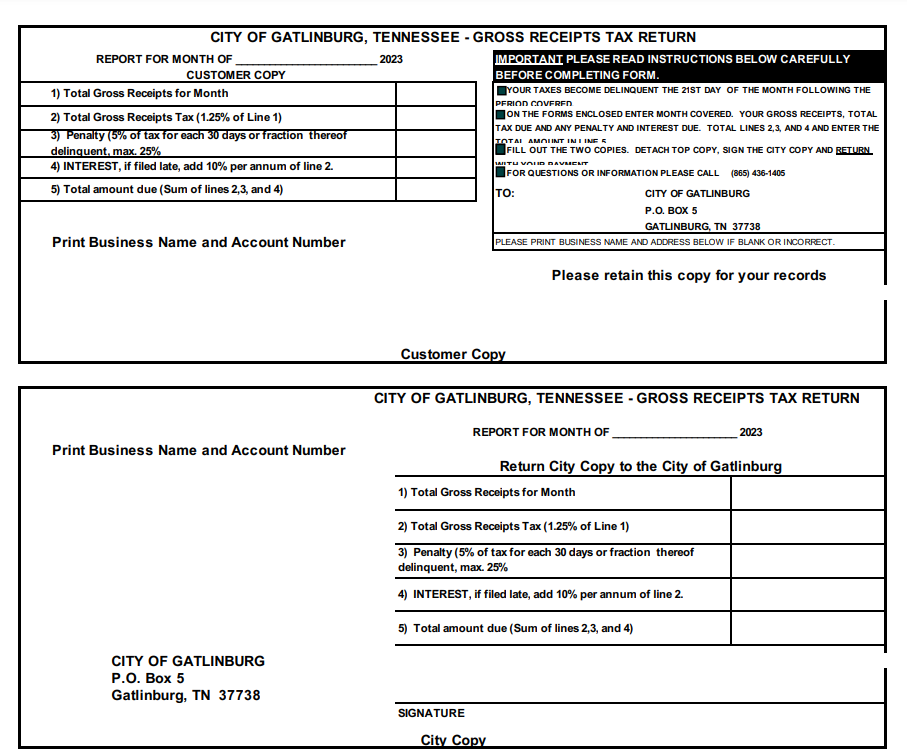

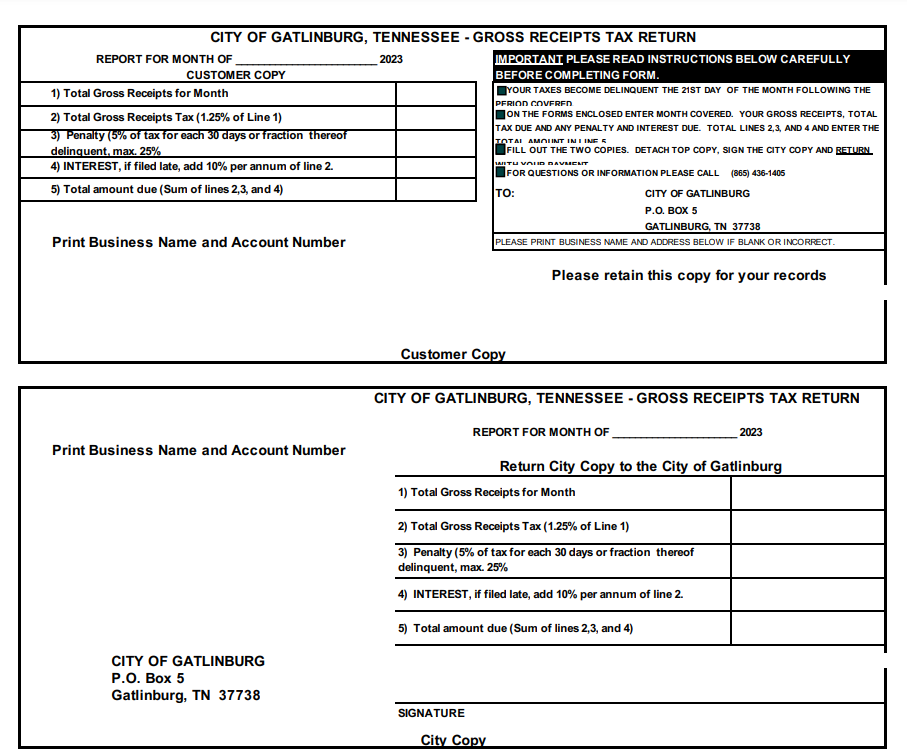

https://printablerebateform.net/wp-content/uploads/2023/05/Tennessee-Tax-Rebate-2023.png

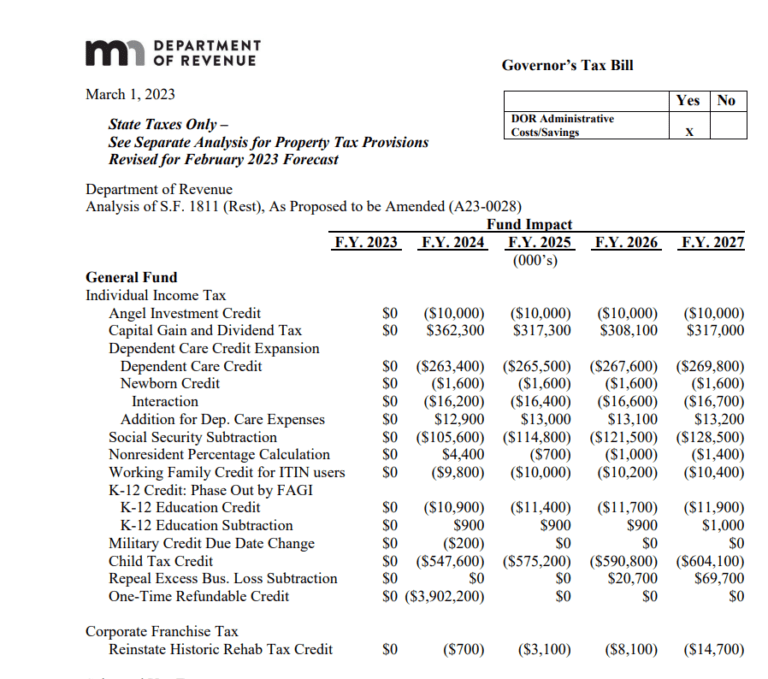

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

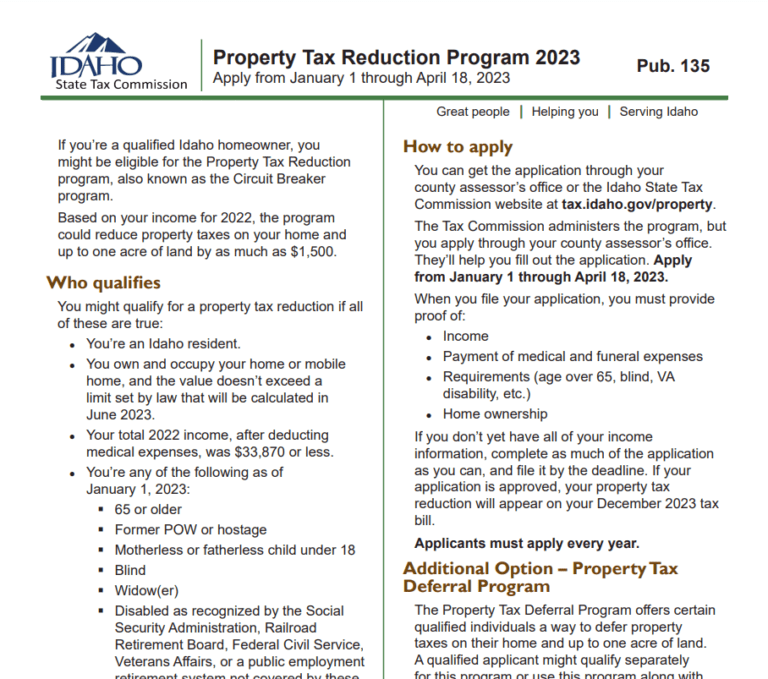

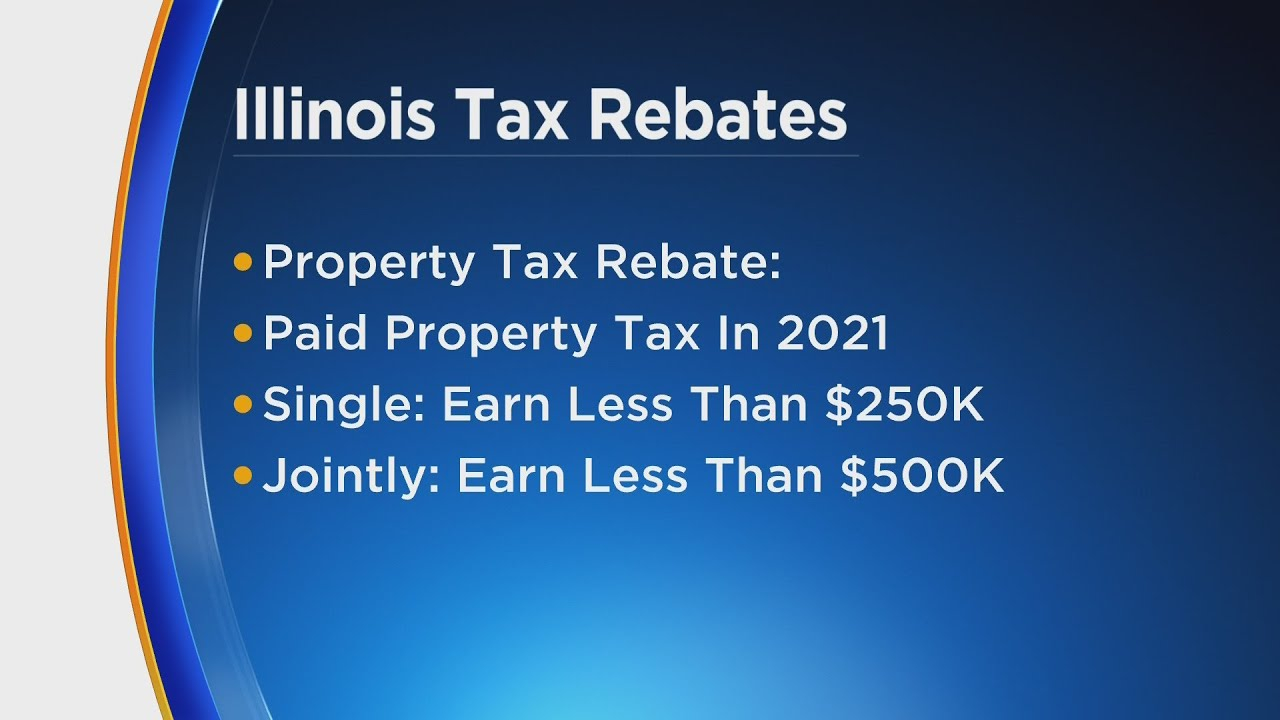

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money

https://printablerebateform.net/wp-content/uploads/2023/03/Idaho-Tax-Rebate-2023-768x679.png

Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay Web 2 juil 2014 nbsp 0183 32 Low income comprehensive tax rebate A Except as otherwise provided in Subsection B of this section any resident who files an individual New Mexico income

Web 2 juil 2014 nbsp 0183 32 The 2021 amendment effective June 18 2021 increased and indexed the low income comprehensive tax rebate and defined quot consumer price index quot for purposes of Web 3 ao 251 t 2023 nbsp 0183 32 If you are looking for Low Income Comprehensive Tax Rebate you ve come to the right place We have 33 rebates about Low Income Comprehensive Tax Rebate

Download Low Income Comprehensive Tax Rebate

More picture related to Low Income Comprehensive Tax Rebate

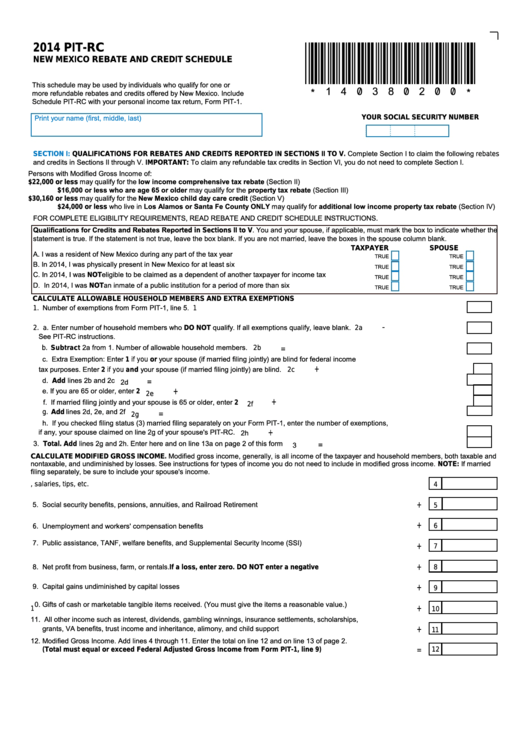

Form Pit Rc New Mexico Rebate And Credit Schedule 2014 Printable

https://data.formsbank.com/pdf_docs_html/373/3738/373875/page_1_thumb_big.png

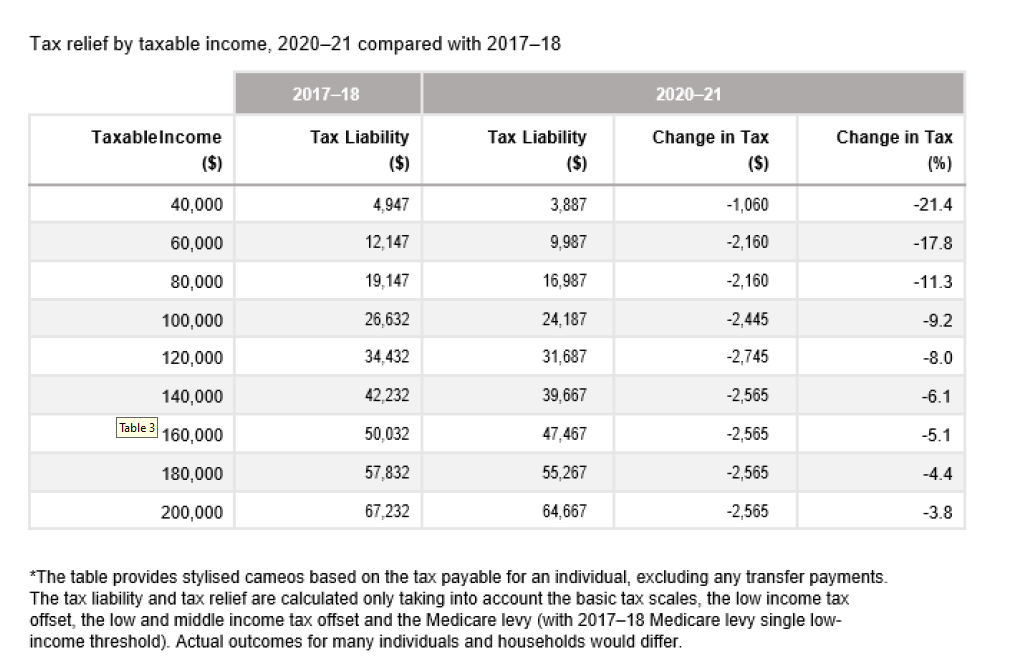

Budget 2020 Individuals Tax Accounting Adelaide

https://www.taxaccountingadelaide.com/wp-content/uploads/2020/10/00.png

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

Web Increase the Low Income Comprehensive Tax Rebate The Low Income Comprehensive Tax Rebate LICTR is another tax policy tool to help improve equity and invest in our families LICTR puts money back into Web 2 juil 2014 nbsp 0183 32 Low income comprehensive tax rebate A Except as otherwise provided in Subsection B of this section any resident who files an individual New Mexico income

Web A refundable income tax rebate of 1000 for married couples filing joint returns heads of household and surviving spouses and 500 for single filers and married individuals filing Web 9 f 233 vr 2021 nbsp 0183 32 Low income Comprehensive Tax Rebate Tracking Information Register now for our free OneVote public service or GAITS Pro trial account and you can begin

What To Know About Montana s New Income And Property Tax Rebates

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18ZJcd.img?w=1280&h=720&m=4&q=50

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

https://www.irs.gov/newsroom/low-income-people-are-eligible-to-get-an...

Web 5 mai 2020 nbsp 0183 32 The Non Filers tool is for married couples with incomes below 24 400 or single people with income below 12 200 This includes couples and individuals who are

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

What To Know About Montana s New Income And Property Tax Rebates

Nj Property Tax Rebates 2023 PropertyRebate

Retirement Income Tax Rebate Calculator Greater Good SA

Carbon Tax Rebate 2022 Printable Rebate Form

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Govt Increases Income Tax Rebate To 7 Lakh Under New Tax Regime Tax

A Comprehensive Guide To Income Tax Returns Cornerstone Financial

Increase The Threshold For Qualifying For Tax Forgiveness PennLive

Low Income Comprehensive Tax Rebate - Web 2 juil 2014 nbsp 0183 32 Low income comprehensive tax rebate A Except as otherwise provided in Subsection B of this section any resident who files an individual New Mexico income