Malaysia Corporate Tax Return Due Date Under the self assessment system companies are required to submit a return of income within seven months from the date of closing of accounts Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company

The due date for the CIT return is the end of February or if filled electronically 15 March following the calendar year The due date for the CIT return on distributed profit arising from FY 2009 to FY 2013 is the date of profit distribution General submission deadline 29 February 2024 E filing submission deadline 15 May 2024 Form EA Important Notes Employer must issue form EA to employee Failure to prepare and render Form EA to employees before last day of February will be fined RM200 RM20 000 or imprisonment for a term not exceeding 6 months or both

Malaysia Corporate Tax Return Due Date

Malaysia Corporate Tax Return Due Date

https://static.wixstatic.com/media/34b1e8_fc87743491494405aeb614e8c07d4f5f~mv2.png/v1/fill/w_980,h_980,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/34b1e8_fc87743491494405aeb614e8c07d4f5f~mv2.png

Corporate Tax Malaysia All You Need To Know

https://www.yhtanmy.com/wp-content/uploads/2020/11/corporate-tax-malaysia.jpg

Corporate Tax Return Due Date 2019 King Financial Services

https://kingfinancialsvcs.com/wp-content/uploads/2019/04/Corporate-Tax-Return-Due-Date-2019.jpg

Upcoming Malaysia Tax Filing Deadlines for the Year of Assessment YA 2023 Individuals business owners company directors and employers should take note of the new tax filing deadlines and file the tax return before the due date Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja Hantar anggaran cukai secara e Filing e CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual Mulai Tahun Taksiran 2018 anggaran cukai perlu dihantar secara e Filing e CP204

The balance of tax payable by a company based on the return submitted is due to be paid by the due date for submission of the return In general tax of a non resident company on all income other than income from a business source is collected by means of withholding tax 2023 Malaysia Tax Submission Important Timeline Remember to prepare your tax forms on time File your companies employers individuals partnership or association tax hassle free with Cheng Co Tax agents

Download Malaysia Corporate Tax Return Due Date

More picture related to Malaysia Corporate Tax Return Due Date

Income Tax Malaysia 2022 Deadline Latest News Update

https://i.pinimg.com/originals/7a/04/b5/7a04b54ac47a10cec5c9840af96dff8b.png

Malaysian Corporate Tax System Malaysia Taxation

https://www.sfconsulting.com.my/wp-content/uploads/2020/05/Malaysian-Corporate-Tax-System.jpg

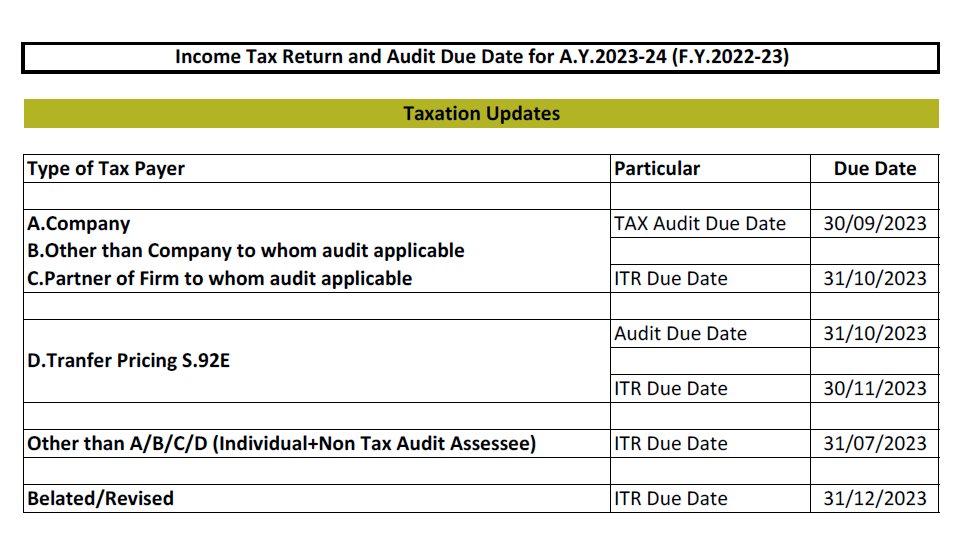

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

https://pbs.twimg.com/media/Ftfrk2DagAECRKs.jpg

What are the deadlines for corporate tax filing and payment in Malaysia Corporations in Malaysia must file their tax returns and pay the estimated taxes in monthly instalments starting from the second month of their financial year with final tax settlement upon year end tax return submission Return Form RF Filing Programme For The Year 2024 Return Form RF Filing Programme For The Year 2023 Corporate Tax Home en EduZone Tax Brochure Tax Brochure 2023 Corporate Tax Headquarters Location Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor

[desc-10] [desc-11]

Malaysia Corporate Income Tax Rate Tax In Malaysia

https://www.3ecpa.com.my/wp-content/uploads/2022/03/photo-malaysia-corporate-income-tax-rate-1200x630-1.jpg

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

https://taxsummaries.pwc.com/malaysia/corporate/tax-administration

Under the self assessment system companies are required to submit a return of income within seven months from the date of closing of accounts Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company

https://taxsummaries.pwc.com/quick-charts/...

The due date for the CIT return is the end of February or if filled electronically 15 March following the calendar year The due date for the CIT return on distributed profit arising from FY 2009 to FY 2013 is the date of profit distribution

Latest Budget 2023 Malaysia Summary Cheng Co Group

Malaysia Corporate Income Tax Rate Tax In Malaysia

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

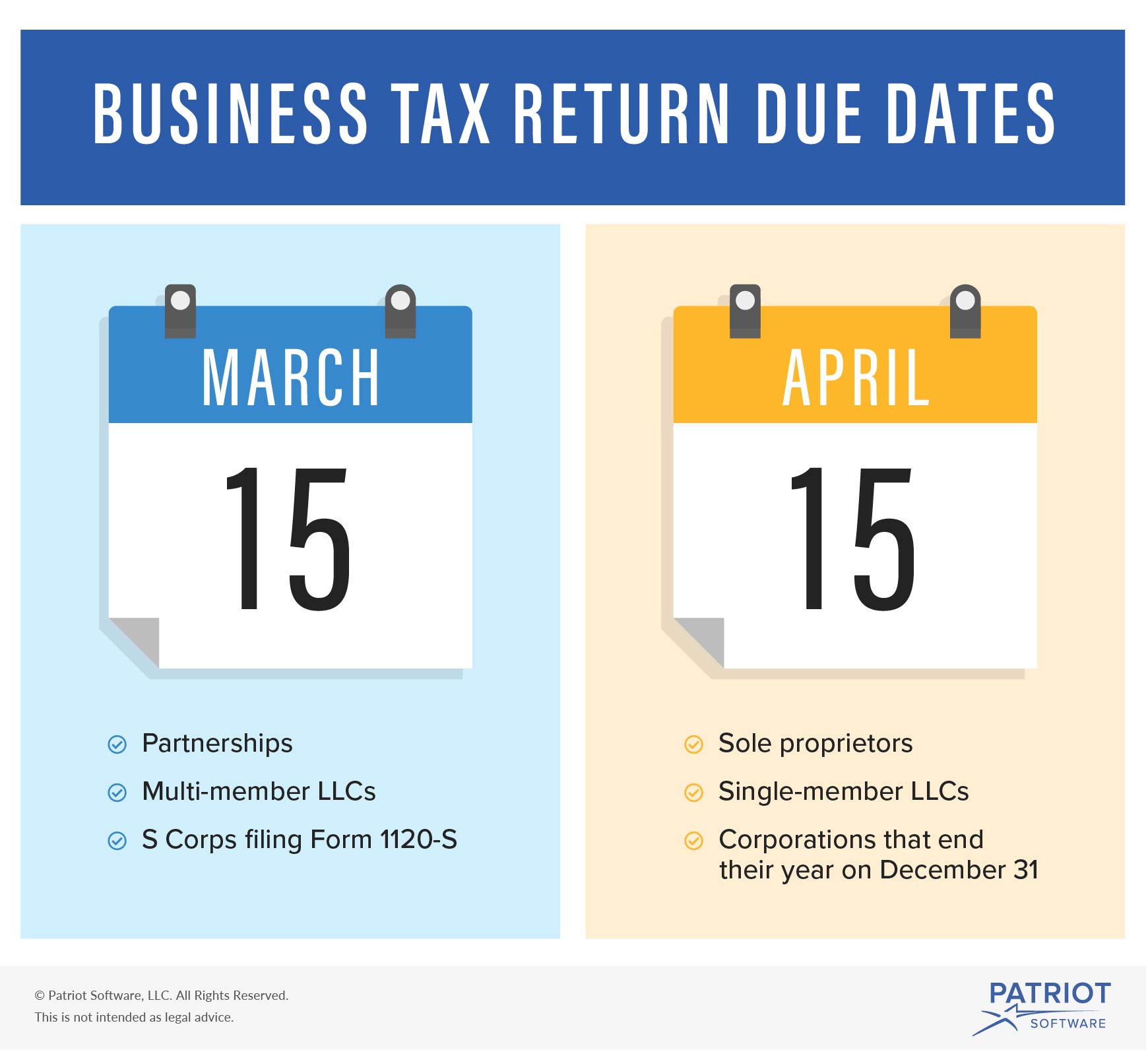

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

When Are 2019 Tax Returns Due Every Date You Need To File Business

Income Tax Returns Filing Due Dates Extended Ebizfiling

Income Tax Returns Filing Due Dates Extended Ebizfiling

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

Income Tax Malaysia Fareez Shah And Partners

Borang C Company Felicity Black

Malaysia Corporate Tax Return Due Date - Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja Hantar anggaran cukai secara e Filing e CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual Mulai Tahun Taksiran 2018 anggaran cukai perlu dihantar secara e Filing e CP204